We Are

Orion Engineered Carbons S.A. (NYSE:OEC) delivered a very ambitious outlook for the years 2024 and 2025. Further improvements in mobility and sustainability are expected to enhance the demand for OEC’s products. I do see some risks coming from lack of innovation or concentration of clients. However, the current price mark appears too low. I believe that the stock is undervalued.

Orion Engineered Carbons

Orion Engineered Carbons supplies carbon black, which is a solid form of carbon sold as powder or pellets. With 14 plants worldwide, the company’s products are used to tint and colorize, conduct electricity, or even increase durability.

Presentation

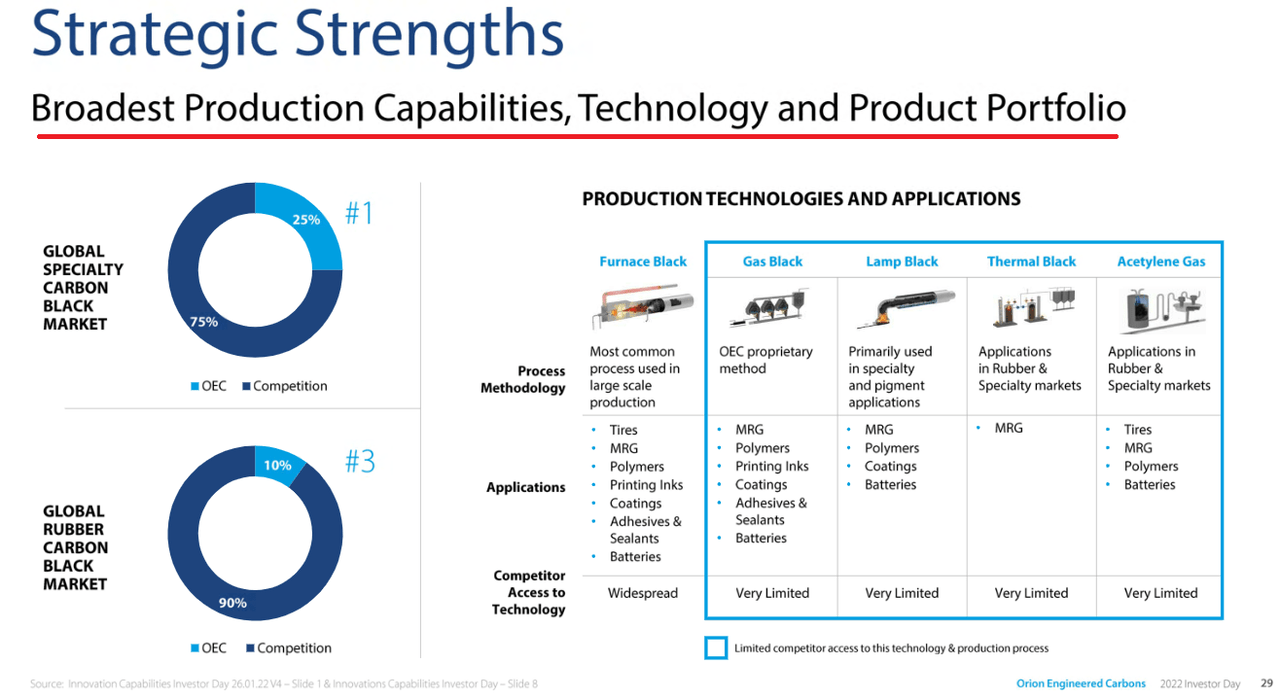

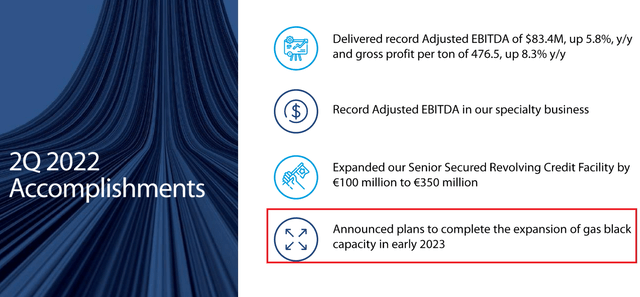

I took a good amount of time studying Orion Engineered after noting some of its competitive advantages over peers. First, the company appears to have one of the broadest portfolios in the carbon black market and the rubber carbon black market. Besides, management intends to increase the company’s capacity in 2023.

OEC Q2 2022 Earnings Call Slides

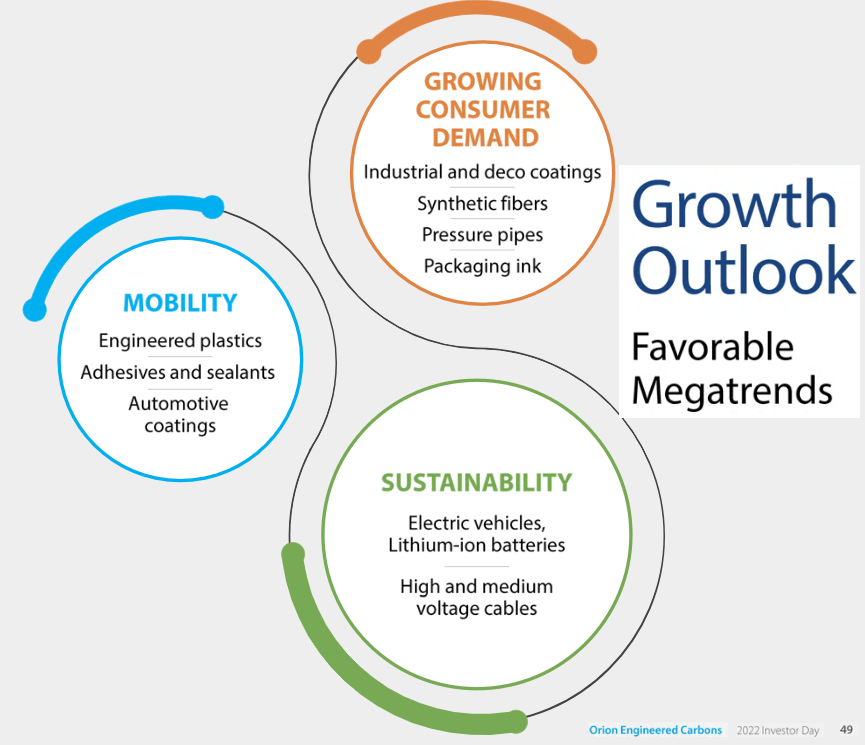

The company’s net revenue is also geographically diversified. The company sells in Europe, the Americas, and Asia. It expects significant growth thanks to several mega trends. Improvements in mobility, the electric vehicle revolution, and growing consumer demand are revenue growth drivers for Orion.

Presentation

OEC Q2 2022 Earnings Call Slides

Growth, Market Demand, And Beneficial EBITDA Along with Free Cash Flow Expectations

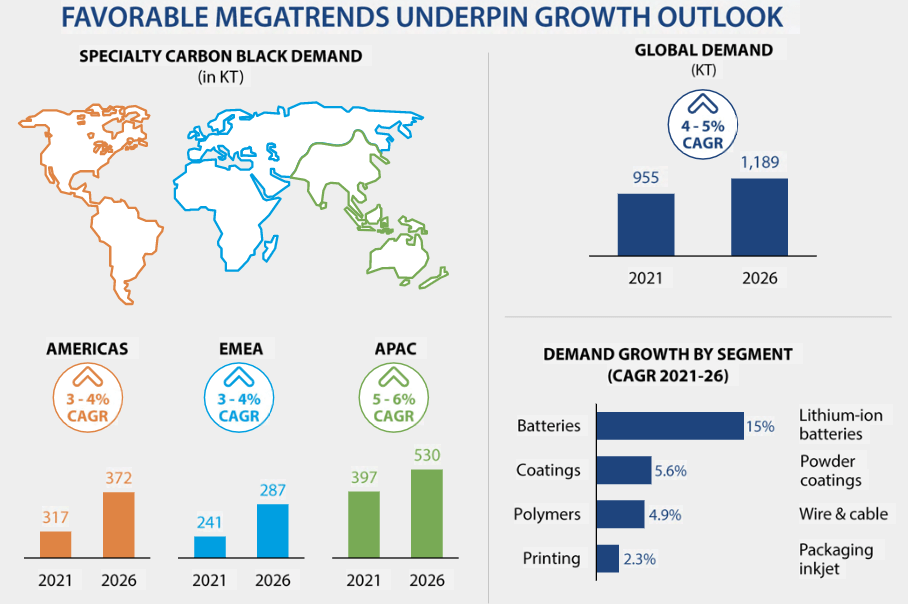

Orion Engineered believes that the company will benefit from an increase in the demand for specialty carbon black. Orion envisions sales growth of 3%-4% CAGR in the Americas, 3%-4% CAGR in the EMEA, and 5%-6% CAGR in APAC. The demand will most likely be driven by more battery usage, coating polymers, and printing.

Presentation

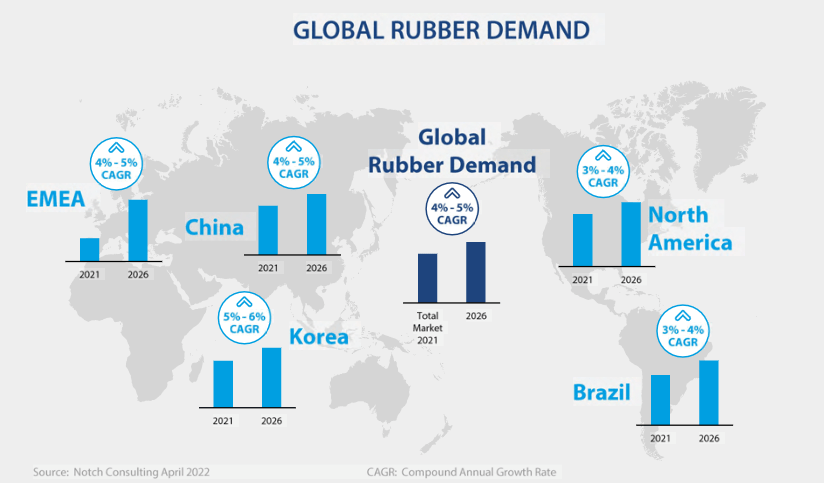

With respect to global rubber demand, Orion also expects to find meaningful demand in Brazil, North America, Korea, and China. In my view, Orion’s sales growth will likely increase close to the growth of the market.

Presentation

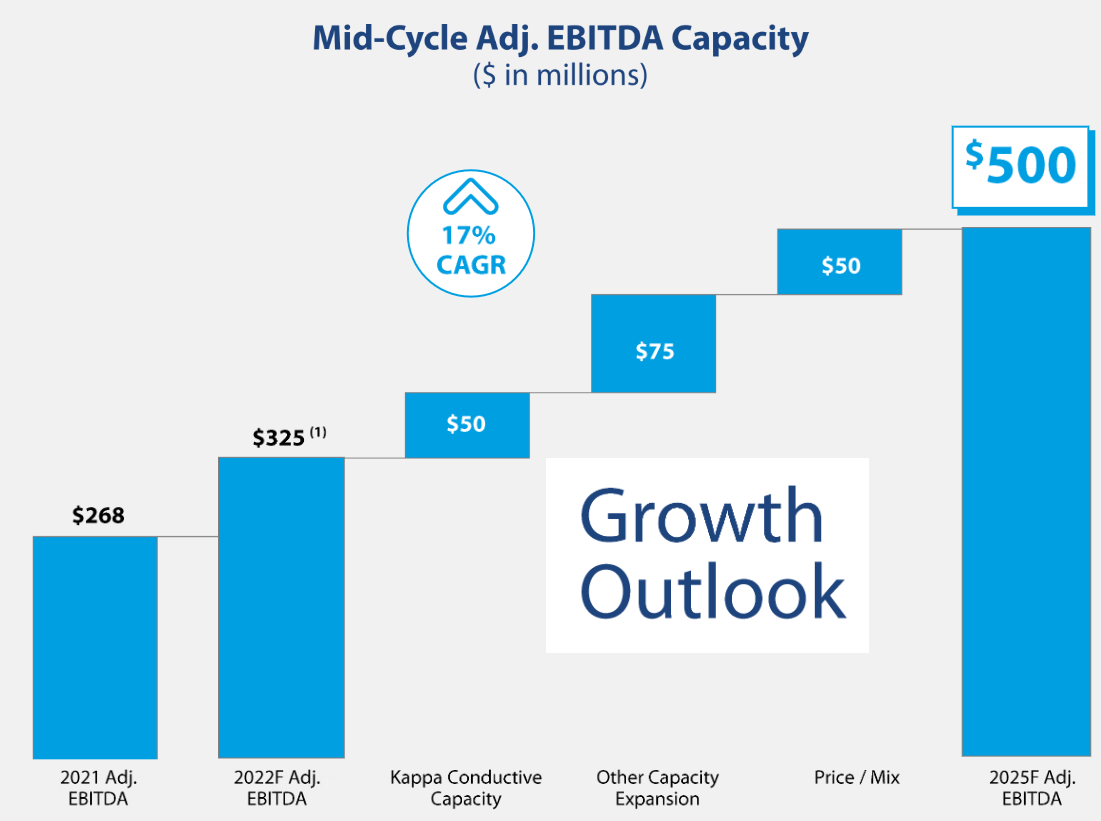

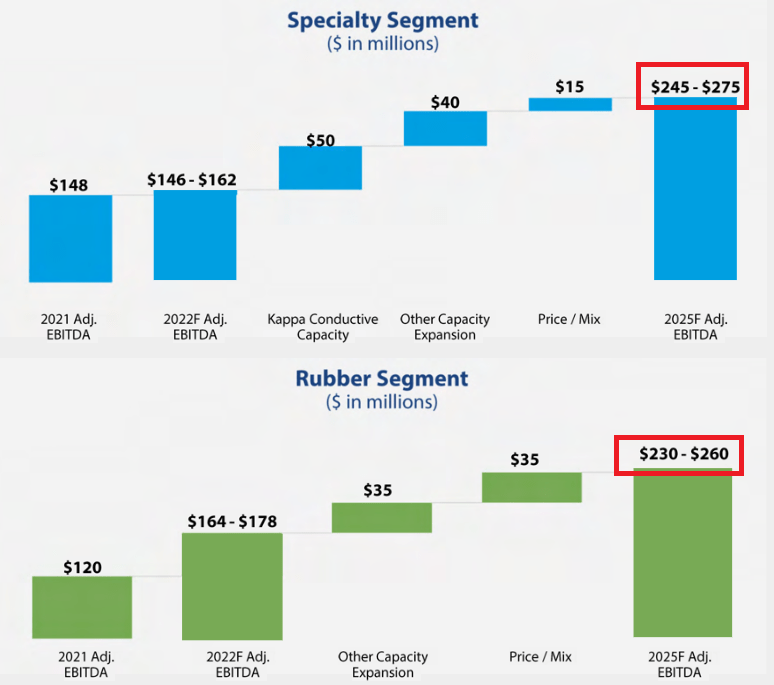

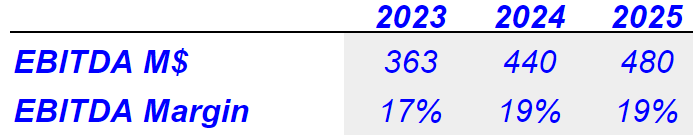

Orion provided valuable information about its EBITDA expectations for the year 2025. Management believes that with two business segments combined, the total EBITDA could reach a total of $500 million.

Presentation

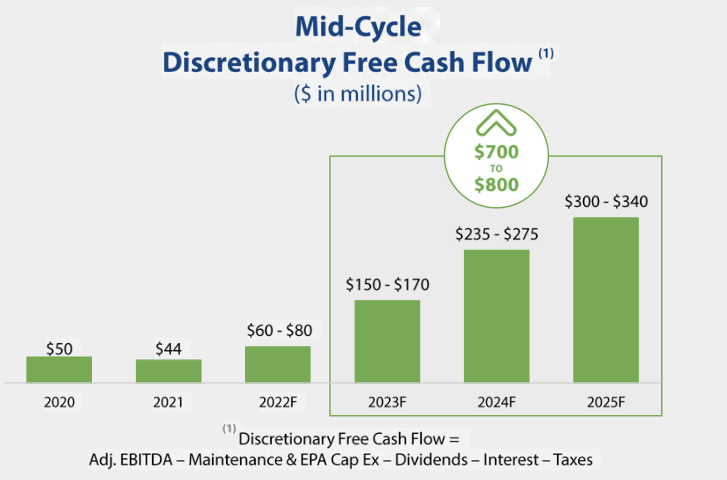

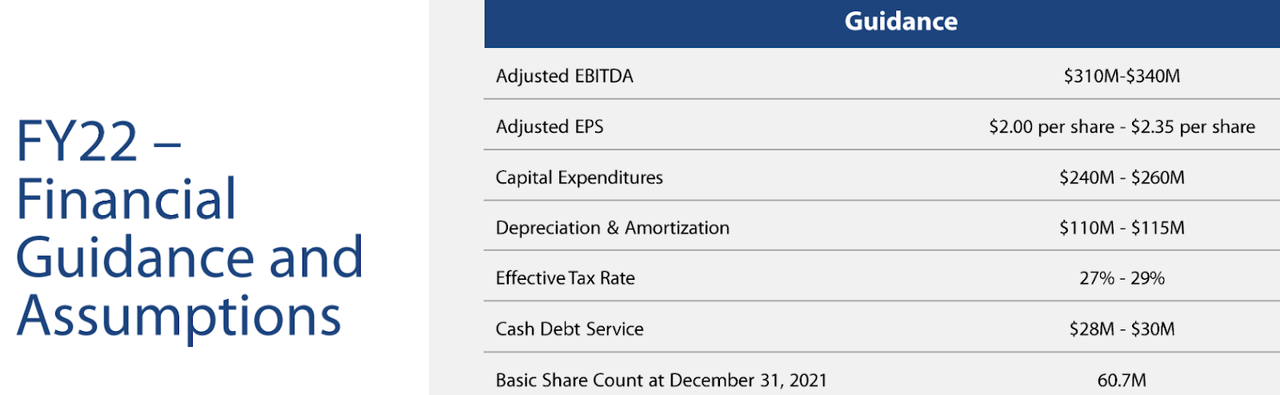

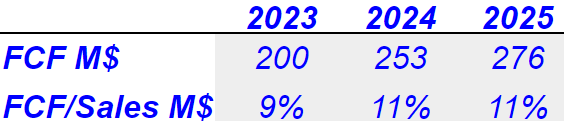

Besides, Orion expects that free cash flow will grow from $60-$80 million in 2023 to $300-$340 million in 2025. 2022 Adjusted EBITDA would stay at $310-$340 million, and 2022 capex would be close to $240-$260 million. I used some of these numbers for my financial models.

Presentation

OEC Q2 2022 Earnings Call Slides

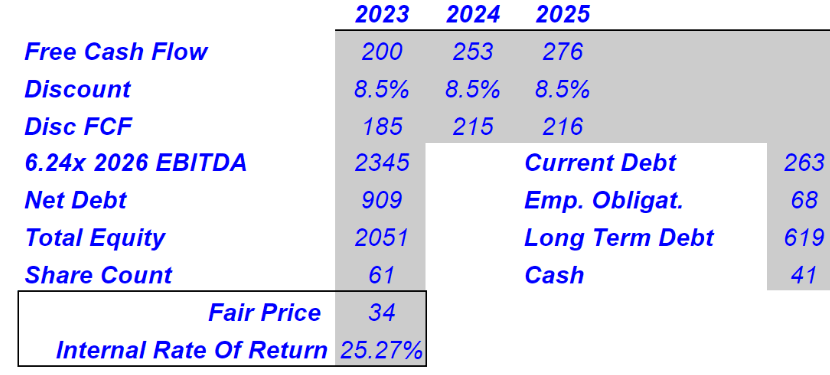

Balance Sheet

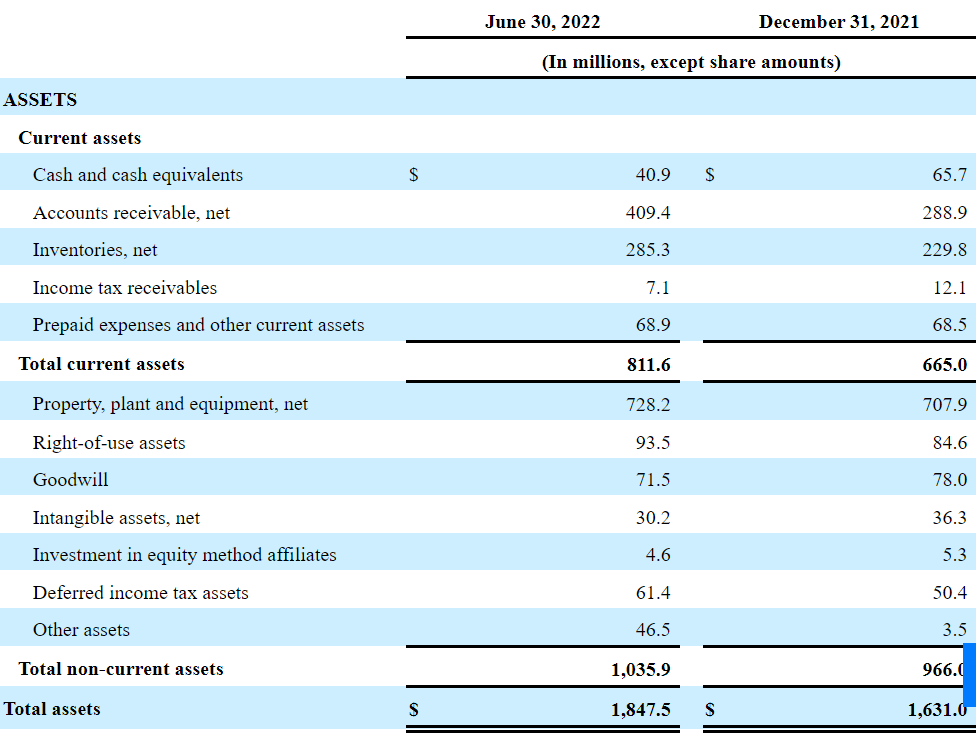

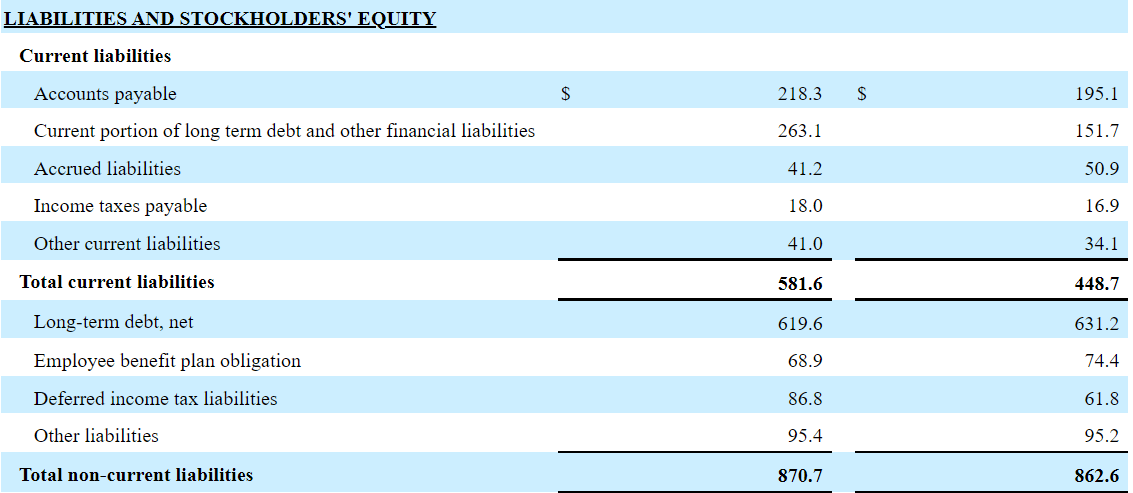

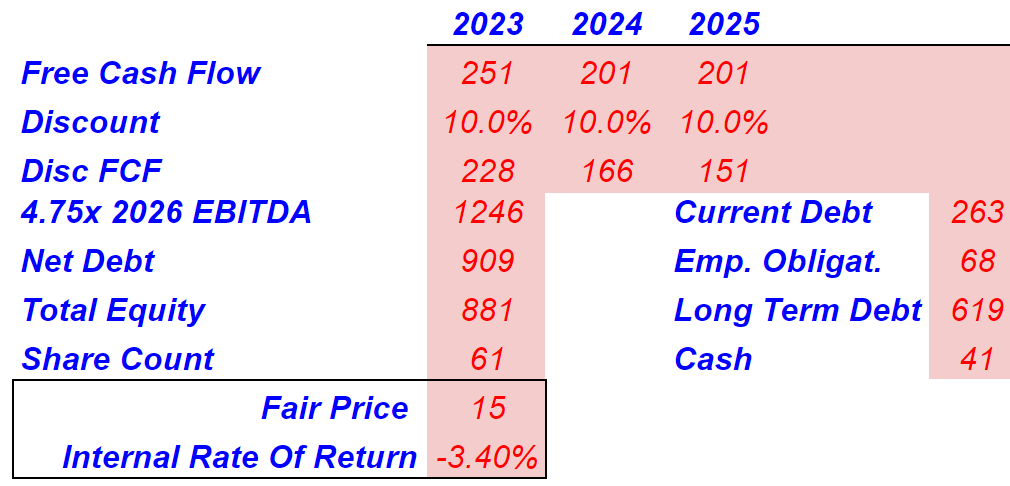

As of June 30, 2022, Orion reported cash worth $41 million and total assets of $1.8 billion. I believe that the balance sheet appears stable. In my view, most financial advisors will not be afraid of the company’s financial obligations. With growing EBITDA and free cash flow, Orion does not seem to have too much liabilities or debt.

10-Q

With long-term debt worth $619 million, current portion of long term debt and other financial liabilities worth $263 million, and employee benefit plan obligation of $68 million, net debt stands at $860 million. Orion reports net debt close to 2x-2.2x 2025 EBITDA.

10-Q

Orion Engineered Could Be Worth $33-$34

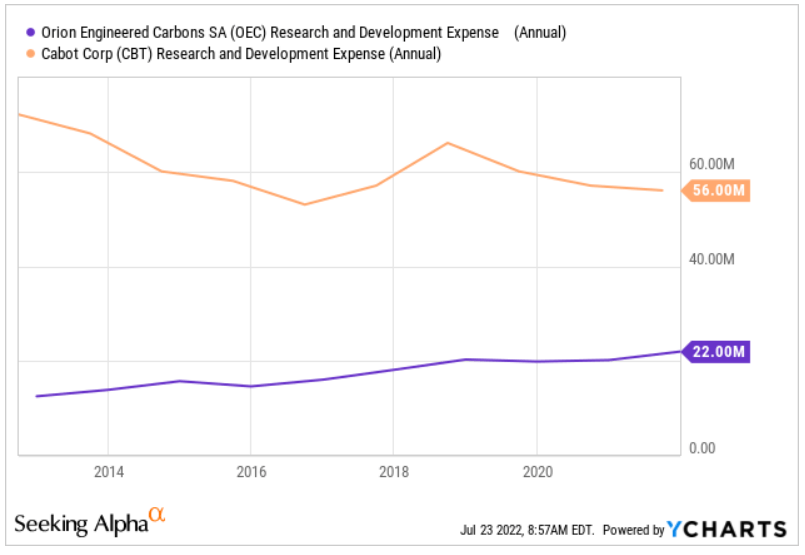

The company competes with Cabot Corporation (CBT) and Birla Carbon. These companies are not significantly larger than Orion. I don’t believe that their R&D expenses are much larger than that of Orion. In my view, if management is sufficiently smart, Orion’s products could be better than that of peers.

Cabot Corporation and Birla Carbon are the other two large global producers of specialty carbon black. Each of the top three producers of specialty carbon black leverages R&D and applications technology platforms to tailor products to customer needs and to introduce its products into new application niches. Source: 10-k

Ycharts

Orion Engineered signs long-term contracts with clients, which allows the company to have a lot of visibility about future streams of net sales. With that, let’s note that management didn’t confirm whether it has a lot of recurrent revenue.

Most of our long-term contracts contain formula-driven price adjustment mechanisms.

These contracts have enabled us to reduce the impact of fluctuations in oil prices on our margins; however, rapid and significant oil price fluctuations have had and are likely to continue to have significant effects on our earnings and results of operations given not all contracts contain price adjustment mechanisms and the value of our productivity improvements rises and falls with oil price movements. Source: 10-k

Finally, I believe that the company’s collaborations with customers will likely help offer beneficial products. Let’s keep in mind that Orion uses tests in its laboratories that are also performed by clients. Management provided a certain explanation in its annual report.

Our applications technology team brings together a deep knowledge of carbon black technology with an understanding of the key applications practiced by our customers. This team has access to extensive laboratory and testing facilities using similar formulations, processing and test methods employed by our customers. Customer collaborations often include cooperative testing with customers’ staff in our facilities. Applications technology provides a key customer and market interface and translates specific customer needs into carbon black product attributes. Source: 10-k

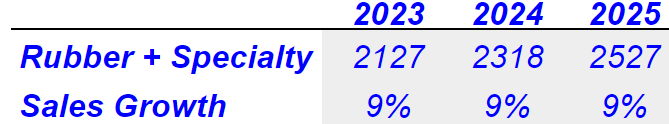

The global specialty carbon black market is expected to grow at a CAGR of 9% from now until 2030. Under normal conditions, I believe that the company’s revenue growth would stay close to the growth of the target market.

The global specialty carbon black market is expected to value at USD 2.34 billion in 2021 and is expected to grow at a CAGR of 9.0% during the forecast period. Increased product demand as reinforcing agents in hoses, belts, tyres, and moulding plastic components is likely to boost the market. One of the most common uses for speciality carbon black compounds is conductive polymers, which have better conducting characteristics than rubbers and polymers. Source: Global Specialty Carbon Black Market is Expected to Grow

With a sales growth of 9% from 2023 to 2025, I obtained 2025 net revenue of $2.52 billion. Besides, with an EBITDA margin of 17% to 19%, 2025 EBITDA would stay at $480 million.

Author’s Expectations

Author’s Expectations

With conservative changes in working capital and capex close to the estimates given by Orion, I obtained attractive free cash flow. 2025 FCF would stay close to $276 million, and the free cash flow margin would touch the 11% mark. Let’s note that my free cash flow expectations are a bit more conservative than those given by management, but they are quite beneficial.

Author’s Expectations

By assuming a CAPM model with a discount of 8.5% and a conservative exit EV/EBITDA multiple of 6.24x, I obtained an equity valuation of $2.05 billion. Finally, the implied equity valuation per share stays at $33-$34. The internal rate of return is attractive at more than 24%.

Author’s Expectations

A Decline In Sales Would Lead To A Valuation Of $15 Per Share

With many analysts claiming that an economic recession could occur, let’s note that Orion is connected to the cyclical automotive industry. If drivers buy less cars, car manufacturers may reduce their acquisition of products from Orion. As a result, a decline in Orion’s net revenue would lead to less stock price.

In particular, a large part of our sales has direct exposure to the cyclical automotive industry and, to a lesser extent, the construction industry. As a result, our business experiences a level of inherent cyclicality. The nature of our business and our large fixed asset base make it difficult to rapidly adjust our fixed costs downward when demand for our products declines, which could materially affect our profitability. A global or regional economic downturn may reduce demand for our products. Source: 10-k

Orion also reports a significant concentration of clients, which could represent serious risks in the future. If one of the customers decides to work less with Orion, revenue growth may decline. Besides, clients may try to renegotiate prices with management, which would lead to less free cash flow margin and lower implied equity valuation:

In 2021, our top ten customers accounted for approximately 41% of our volume measured in thousand metric tons. Our success in strengthening relationships and growing business with our largest customers and retaining their business over extended time periods could affect our future results. Source: 10-k

Orion invests a significant amount of dollars in research and development to offer new innovative products. The competitors could offer better products than Orion. Management may also fail to profit from its investments as clients may not be willing to pay a lot for new products. As a result, I believe that shareholders would suffer a decrease in profitability.

Although carbon black continues to offer opportunities for product and process innovation, we cannot be certain that the investments we make in our Innovation function will result in proportional increases in revenue or profits. Source: 10-k

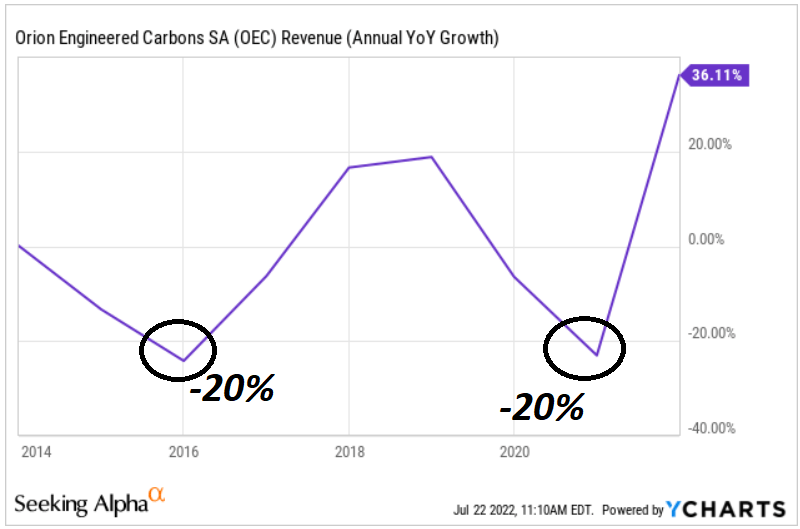

I took into account the declines in sales growth in 2016 and 2021. I believe that future sales growth of -20% could occur. In this particular case, I assumed a decline in 2023 and some recovery in 2024 and 2025.

Ycharts

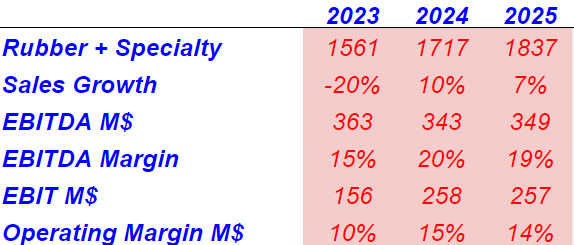

My results include 2023 sales of $1.56 billion and 2025 sales of $1.8 billion. With an EBITDA margin around 20% and 15%, 2025 EBITDA would stay at $349 million. I also included operating margin around 10% and 15% as well as 2025 EBIT of $257 million. I believe that my numbers are not at all catastrophic. They could become a reality under certain market conditions.

Author’s Expectations

With a WACC of 10%, net debt of $909 million, and an exit of 4.75x EBITDA, the fair price would be $15 per share. The internal rate of return would be close to -3%.

Author’s Expectations

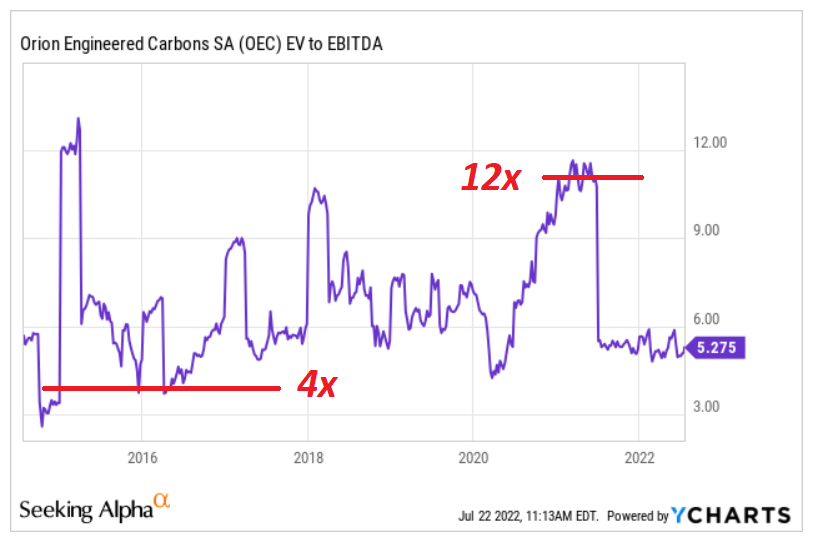

Taking into account previous EV/EBITDA multiples, I believe that an exit multiple of 4.75x could happen. In the past, the company traded at 12x EBITDA and 4x EBITDA.

Ycharts

Conclusion

Orion reported a beneficial outlook from now until 2025 and many revenue drivers from growing industries. If the world continues to target improvements in mobility and sustainability, management believes that EBITDA and FCF will trend north. While there are certain risks from client concentration, lack of innovation, or economic downturn, the current price mark is too low. In my view, as more and more analysts learn about the expectations given by management, demand for the stock will increase. As a result, I believe that the share price will likely trend higher.

Be the first to comment