Jean-Luc Ichard

Introduction

Telecom is indispensable nowadays, almost everyone has a mobile phone and internet. Customers pay monthly subscription fees. These telecom companies thus have guaranteed cash flows and are therefore considered defensive. They can therefore be interesting to invest in. Especially in times of high inflation, because they can pass on these costs in their subscriptions.

Orange (NYSE:ORAN) is a telecom company and has its origins in France, here it is the leading telecom provider. Outside France, the company is growing strongly in Africa. Orange also owns tower companies (towercos). In the United States, for example, we know American Tower (AMT) and Crown Castle (CCI) as towercos. TOTEM, owned by Orange, provides infrastructure for other telecoms. The article by SA Contributor Chetan Woodun describes this structure in great detail.

Orange stocks have recently fallen and now offer a high dividend yield of 7.6%. Like other telecom providers, Orange is a defensive stock. In this article I describe that Orange is worth buying and that investors can enjoy a high dividend yield in the coming years.

Recent Developments

The largest part of the revenue comes from France (41%), revenue fell slightly in the first half of the year by 1.7%. This was primarily attributable to lower revenues from their wholesale segment, with sales down 9.4%. Retail services grew by 1.6%. EBITDAal of their segment France decreased slightly by 0.9%. Orange mainly saw growth in fiber connections, with 263k net gains in the second quarter, of which 55% were FTTH new customer gains. Mobile contracts also grew strongly, with net adds of 173k in the second quarter.

Retail service performed strongly in Europe with a sales increase of 0.6%, but due to the decline in wholesale sales, consolidated sales for Europe decreased by 1.5%. 75k new mobile contracts were added, showing that customers are satisfied and are happy to opt for an Orange subscription.

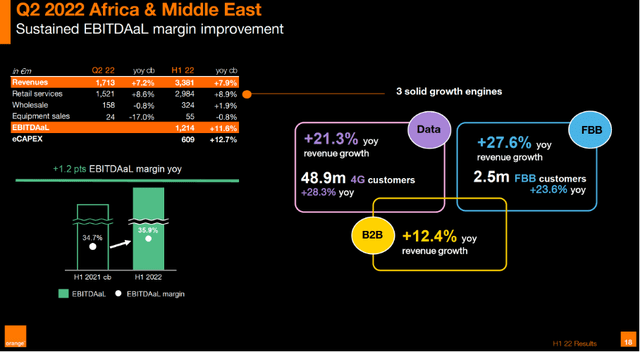

The strongest growth was noticeable in Africa and the Middle East. Revenue grew strongly by almost 8% year-on-year. The EBITDAal grew by almost 12% in the same period. Africa and the Middle East represent 16% of consolidated sales, this is a strong growth market for Orange.

Africa and Middle East Revenue and EBITDAal Growth ( Orange 2Q22 Investor Presentation)

Recently, Orange and Telecom Egypt announced a strategic partnership to create a highly reliable terrestrial system connecting Iraq to Europe through Jordanian and Egyptian territories. The new system is the Cairo Amman Baghdad System” or “CAB System”. As a result, they are expanding their presence in the Middle East to offer state-of-the-art telecommunications and connectivity solutions. This will provide reliable low-latency internet connectivity services to meet Iraq’s growing demand.

To gain market share, Orange offers new promotions in a variety of countries. Orange Poland has started a new promo for students using their Orange Flex service. They will receive a bonus of 50 GB of mobile data per month for the next six months. Orange also offers promos in Spain for their Infinity premium pack. Certain current customers can upgrade from 1 Gbps broadband to 10 Gbps for an additional $5 per month. This promotion is valid until 3 October, after which the package costs €13 per month. These promos will contribute to Orange’s growth and provide a win-win situation for both customers and Orange itself.

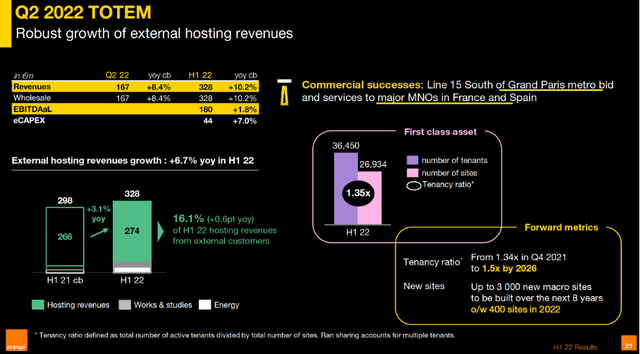

TOTEM Revenue Is Growing Strong

Orange owns tower company TOTEM, and as the article by SA contributor Chetan Woodun describes (see introduction), the EBITDA margin of tower companies is much higher than that of telecom companies. American Tower’s EBITDA margin is 63% versus Orange’s 27%.

TOTEM revenue for the first half of 2022 was €326 million, a 10% year-over-year growth. Orange’s first-half consolidated revenue was €21.3 billion, so TOTEM’s revenue contribution is still small compared to the whole but growing steadily.

TOTEM Revenue and EBITDAal Growth (Orange 2Q22 Investor Presentation)

Orange Valuation

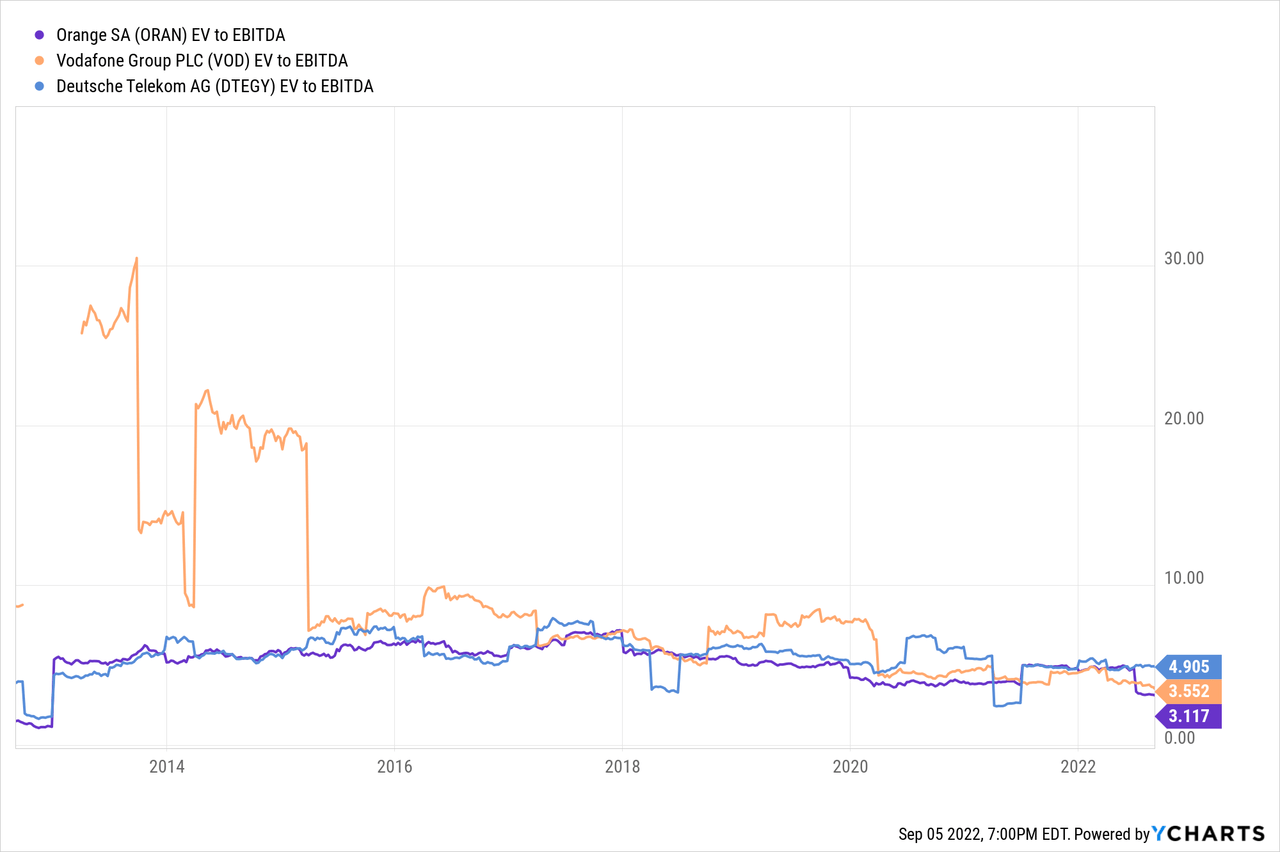

To map the valuation, I take the enterprise value/EBITDA. This ratio includes cash and debt. Tower businesses are generally capital intensive, so this is an appropriate ratio. I compare Orange with Vodafone (VOD) and Deutsche Telekom (OTCQX:DTEGY).

Orange is the cheapest valued of the three, while a premium is paid for Deutsche Telekom. The reason Orange is undervalued may be that Orange’s sales have fallen slightly. However, Orange is doing everything it can to gain market share, as I described in the previous chapter. Orange’s dividend yield is 7.6% and the dividend can be considered safe due to their defensive character of the business.

A risk is that the company currently has high energy costs, Orange Belgium noted. While I expect high energy prices to be temporary, this will impact operating income for the foreseeable future. Perhaps this offers a good opportunity to buy the shares cheaply.

Conclusion

The telecom sector can be an interesting sector to invest in in times of high inflation. These companies can pass on their higher costs in the subscriptions. It’s a defensive business because customers pay their monthly subscription fees. Besides telecom, Orange also has a tower company called TOTEM. Tower companies are generally much more profitable, but incur higher infrastructure costs. TOTEM’s revenue is growing steadily by 10%. Orange is also growing strongly in Africa and the Middle East (year-on-year sales growth of 8%). This compensates for the small drop in revenue from Spain. Orange is doing everything it can to gain market share. Orange and Telecom Egypt have announced a strategic partnership. Orange offers promotions for students in Poland and there are also promotions in Spain for current Orange customers. The valuation of the stock is very attractive compared to three competitors. The dividend yield is currently 7.6% and can be seen as a stable dividend for the coming years, given the defensive character of the business. The stock is therefore a ‘buy’.

Be the first to comment