Eugene Nekrasov/iStock via Getty Images

A Quick Take On OptMed

OptMed (OMED) has filed to raise $24 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is developing surgical adhesives for use in treating external and internal wounds.

When we learn more about the IPO from management, I’ll provide an update.

OptMed Overview

New York, NY-based OptMed was founded to develop surgical adhesives that bond to tissues in wet environments and have compatibility with human tissues.

Management is headed by Chief Executive Officer Dr. Ervin Braun, who has been with the firm since October 2012 and was previously a director and consultant for companies in various industries and has more than 28 years of clinical expertise in prosthodontics.

The company’s initial product candidates are:

-

BondEase Topical Skin Adhesive – closure of incision and laceration wounds

-

TearRepair Liquid Skin Protectant – topical skin protectant for fragile skin

OptMed has booked fair market value investment of $39.2 million in equity and debt as of March 31, 2022 from investors including H.B. Fuller Company, IMP Partners Fund II, Hong Kong Tigermed, Pidilite USA, McKim Stat Ventures and individuals.

OptMed’s Market & Competition

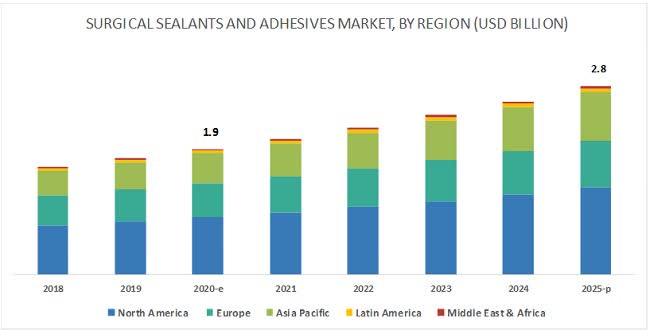

According to a 2020 market research report by MarketsAndMarkets, the global market for surgical sealants and adhesives was an estimated $1.9 billion in 2020 and is forecast to reach $2.8 billion by 2025.

This represents a forecast CAGR (Compound Annual Growth Rate) of 8.4% from 2021 to 2025.

Key elements driving this expected growth are an increase in the number of accidents, sports-related injuries and surgical procedures worldwide.

Also, the natural/biological sealants segment was the largest part of the market in 2019 versus the synthetic and semisynthetic segment.

The North America region accounts for the largest market share but the Asia Pacific region is expected to grow at the fastest rate of growth through 2025, as the chart shows below:

Surgical Sealants Markets (MarketsAndMarkets)

Major competitive vendors that provide or are developing related treatments include:

-

Johnson & Johnson (Ethican)

-

Advanced Medical Solutions Group PLC

-

Chemence Medical

-

Adhezion Biomedical

-

Cryolife

-

Aesculap

-

Glustitch

-

Medline Industries

-

3M Health Care

-

Baxter

-

Becton, Dickinson

-

Covidien

-

Medtronic

OptMed Financial Status

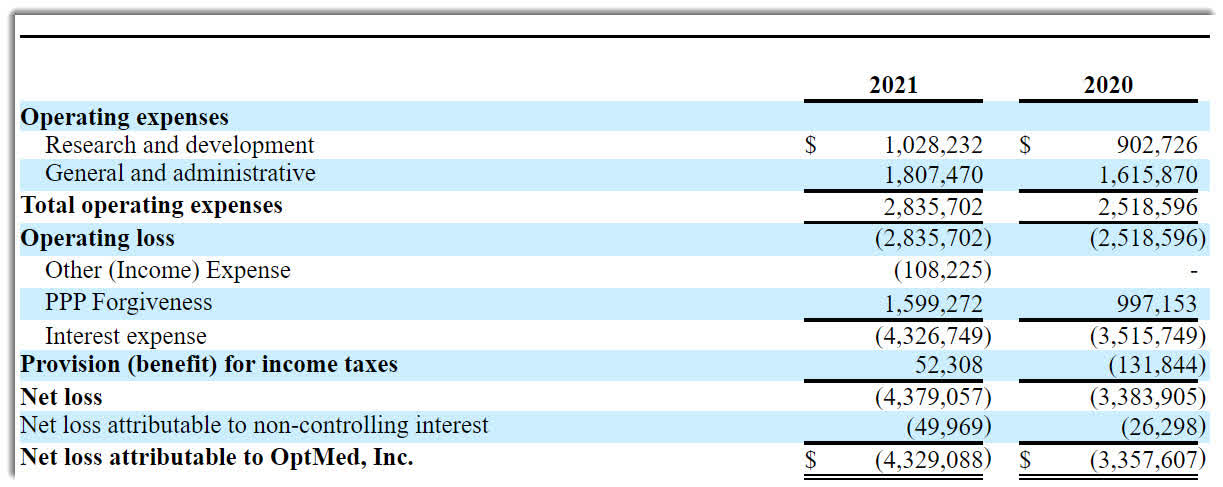

The firm’s recent financial results are typical of a development stage life science company in that they feature no revenue and significant R&D and G&A expenses associated with its pre-marketing efforts.

Below are the company’s financial results for the past two calendar years:

Company Operating Statement (SEC EDGAR)

As of March 31, 2022, the company had $168,199 in cash and $13.8 million in total liabilities.

OptMed IPO Details

OptMed intends to raise $24 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price, although this element may become a feature of the IPO if disclosed in a future filing.

Management says it will use the net proceeds from the IPO as follows:

to fund our product development and marketing activities, fund the repayment of our senior secured indebtedness and certain other indebtedness, and for general corporate and working capital purposes.

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says there are no ‘material pending legal proceedings’ against the company or its subsidiary, Synkotech.

The sole listed bookrunner of the IPO is EF Hutton.

Commentary About OptMed’s IPO

OMED is seeking U.S. public capital market funding to advance its surgical adhesive and skin care products into commercialization stage.

The firm’s lead candidate, BondEase Topical Skin Adhesive, for closure of incision and laceration wounds, was approved for marketing by the FDA in 2015, but the firm has made changes to facilitate manufacturing so will submit a new clearance application to the FDA within 3 months after the IPO.

The market opportunity for surgical sealants and adhesives is relatively large and expected to grow at a moderate rate of growth over the coming years, but it also features large incumbents with established distribution capabilities, so the company faces strong competition.

Management hasn’t disclosed any major pharma firm or medical device firm collaboration relationships.

The company’s investor syndicate does not include any widely known institutional medical device venture capital firms.

EF Hutton is the sole underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (56.2%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

While management believes that its resubmission application for its lead product will be approved by the FDA, we don’t know if that is the case, so commercialization for its BondEase product is dependent upon that FDA decision.

When we learn more about management’s assumption on IPO pricing and valuation, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment