FG Trade/E+ via Getty Images

OptimizeRx (NASDAQ:OPRX) is another small market capitalization company that screens favorably for its potential to be a great investment.

Investment thesis

There are many reasons to like OptimizeRx even though it is currently only a $500 million company:

- Large and growing TAM with industry tailwinds like digitalization supporting growth in demand for OptimizeRx’s solutions

- Highly scalable operating model with more than sufficient network capacity to facilitate growth in the near term.

- OptimizeRx has a strong network of large customers that provides a differentiating factor and competitive advantage to compete against other competitors in the space.

- The quality of the current large customer base is also testament to the strong execution ability and competitive moat of the company.

- The company has a solid balance sheet and has been growing revenue at a rapid pace, setting the stage for near term inflection in profitability.

Overview

OptimizeRx is a digital health technology company that focuses on solving the complex needs of the healthcare industry to improve engagement and quality of care. The company connects more than 60% of the healthcare providers in the US with millions of patients, thereby providing engagement between healthcare providers, life science companies and patients. All these is done through OptimizeRx’s intelligent technology platform.

Initially, the main bulk of the company’s revenues came from financial messaging, where OptimizeRx serves as a patient support center that helps doctors and healthcare staff eliminate the need to manage and store physical drug samples, thereby allowing a more convenient way to allocate, deliver and track samples and co-pay savings for their patients. Over the years, OptimizeRx has benefited from the increased demand for communication for a wider variety of health information between different parties. As such, the platform has grown and expanded to include a growing list of solutions for the healthcare industry to be able to access information for patients at the point of care. Some of these solutions are generating decent revenues for OptimizeRx at the moment and include brand and therapeutic support messaging, brand support, patient engagement, therapy initiation workflow, amongst others.

The business model focuses on growing its customer base, with a current focus on large ones, and thereafter, continue to leverage on the wide range of innovative solutions on the platform to continue to drive greater upselling and cross-selling to increase the wallet share. This land and expand model aims to generate recurring as well as increasing revenue streams while the company continues to grow its platform by introducing new solutions. Management’s strategy for the company also includes acquisitions like that of RMDY Health, a Software-as-a-Service platform for digital therapeutics products, and EvinceMed, a specialty drug prescription initiation platform. Along with its focus on revenue growth, management is mindful of the need to improve margins and profitability for sustainable future growth.

Large TAM and scalable operating model

There is a current total addressable market of $9 billion for OptimizeRx and the company is currently operating as the largest point of care communications network in the US. The company can continue to grow in the industry and apart from its focus on the top 20 pharmaceutical manufacturers, start to move down to the middle and smaller sized customers to increase penetration in this market.

Furthermore, I think it is more important that the market is growing. As digitalization becomes of increasing importance for healthcare providers and the industry, as well as adoption of electronic prescription and increasing consumer demand for more streamlined and digital processes, I think we will likely see this market grow over the coming years.

More importantly, the company has the ability to scale up to a run rate of $100 million at the current network capacity and with the current team. This implies that we will likely see large scale effects compound to the bottom line in the years to come as operating expenses needed to generate the incremental revenues will likely decrease.

Quality customer network brings a competitive advantage

I have to commend the management team at OptimizeRx for the excellent disclosures provided for its customer mix and the transparency certainly helps investors grasp the quality customer base that the company has.

Firstly, a large majority of the top 20 pharmaceutical manufacturers are its customers. As of December 2020, 85% of the top 20 pharmaceutical manufacturers were its customers. This translates to 17 of the top 20 pharmaceutical manufacturers that are part of OptimizeRx’s customer base. By 1Q22, the company managed to acquire 2 more of these large customers, resulting in having 95% of the top 20 pharmaceutical manufacturers as its customers. The fact that so many of the largest companies are customers of OptimizeRx goes to show the value add that it brings to these pharmaceutical manufacturers. These are some of the large customers that the company serves.

OptimizeRx customer base (1Q22 slides)

Secondly, the average revenue for each of these pharmaceutical manufacturers are growing year on year. In December 2020, the average revenue was $1.9 million, and this grew to $2.5 million by 1Q22, representing an increase of 32% over the period. This shows the ability of management to land and expand on these large deals and increase the average spend by these large customers.

Thirdly, the company’s revenues that come from these top 20 pharmaceutical manufacturers are rather stable over the years. In December 2020, these large customers made up 76% of total revenues and the figure has maintained in 1Q22.

While OptimizeRx has captured a large number of the top 20 largest pharmaceutical manufacturers as customers, I think that the next phase of growth will come from continuing to expand wallet share in these very large customers with billions in revenues. I think that it’s important to note that these relationships with the large customers can also form a valuable competitive advantage against smaller companies that wish to compete in the space.

Exponential growth and solid financials

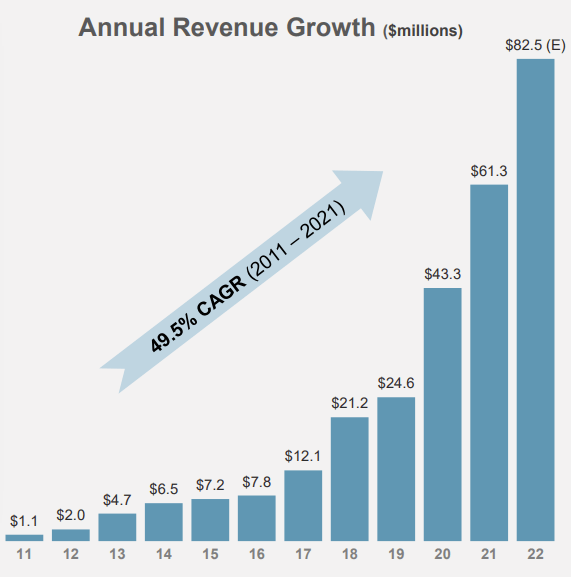

OptimizeRx revenues has growth by a CAGR of close to 50% over the past 10 years, showing really solid exponential growth as demand for its products and services see accelerating demand. In addition, for the year of 2022, management is guiding 31% to 39% revenue growth and gross margins of 57% to 60%.

A decade of high revenue growth (1Q22 slides)

I think what is worth highlighting is that OptimizeRx is in a tipping point in terms of profitability, which I think will grow much faster than revenue in the years to come. Its operating margins grew from -5% in 2020 to 1% in 2021, and it turned positive net income in 2021, with 1% of net income margin in 2021 compared to -5% net income margins in 2020.

Furthermore, the company has a very clean balance sheet. With $89 million in cash and zero debt, OptimizeRx has a strong balance sheet needed to ride through the current turbulent environment. In addition, this translates to 18% of the $500 million market capitalization of the company.

Valuation

As OptimizeRx has a low EPS base at $0.02 2021 EPS, its 2022F P/E which is currently at 50x may appear to be high. That said, I expect the company to continue to post strong EPS growth in the near term. I expect a 70% increase in EPS in 2023F and assume a 50x 2023F P/E. With that, my price target for OptimizeRx is $48.50, implying 74% upside from current levels.

Risks

Competitive threats

Firstly, in the key financial messaging solution space, OptimizeRx has competitors that may threaten its growth and compete for customers. One of the most direct competitors is ConnectiveRx. While OptimizeRx differentiates itself with the size of its network, service quality, and ability to meet specific needs, as well as the platform’s unique ability to reach prescribers directly through their EHR, there are other large, well known companies in the pharmaceutical digital marketing industry with solid market niches and wide range of products that may compete for pharmaceutical budgets and thus impact OptimizeRx.

Secondly, OptimizeRx may have to compete with other competitors in attracting new users and increasing revenues from advertisers. There are other commercial sites that may compete for users and revenues in this regard.

Concentration risk

There are 3 customers that each makes up more than 10% of the company’s revenue mix in 2020 and 2021, with 1 customer that makes up more than 10% of the company’s mix in both years. This would bring concentration risk as the customer may terminate the services of OptimizeRx and thereby bringing negative risk to the company. That said, I am of the opinion that the revenues are highly recurring and rather sticky type of revenue that is unlikely to cause a huge revenue miss.

Conclusion

I think that OptimizeRx is on track to great outperformance in the future and initiate the stock with a buy rating. The company has a large TAM that is growing with strong industry tailwinds like digitalization helping to push demand for its solutions. In addition, the company has a highly scalable operating model with more than sufficient network capacity to facilitate growth in the near term. In addition, the strong network of large customers provides a differentiating factor and competitive advantage to compete against other competitors in the space. The quality of the current large customer base is also testament to the strong execution ability and competitive moat of the company. Lastly, the company has a solid balance sheet and has been growing revenue at a rapid pace, setting the stage for near term inflection in profitability. I initiate OptimizeRx with a price target of $48.50 , implying 74% upside from current levels.

Be the first to comment