slexp880/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members as part of the CEF Weekly Roundup on September 29, 2022. Please check latest data before investing.

OPP rights offering results

The results for the rights offering for RiverNorth/DoubleLine Strategic Opportunity Fund’s (OPP) are in (see preliminary and final press releases). We discussed the offering when it was announced in a previous CEF Weekly Roundup (public link), and again in another CEF Weekly Roundup when it was about to expire. From the final press release:

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. Announces Final Results of Rights Offering

September 27, 2022 06:30 PM Eastern Daylight Time

WEST PALM BEACH, Fla.–(BUSINESS WIRE)–RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. (the “Fund”) (NYSE: OPP) today announced the final results of its transferable rights offering (the “Offering”). The Fund will issue a total of 3,508,633 new shares of common stock as a result of the Offering, which closed on September 23, 2022 (the “Expiration Date”). The subscription price of $9.70 per share in the Offering was established on the Expiration Date based on a formula equal to 92.5% of the reported net asset value. Gross proceeds received by the Fund, before any expenses of the Offering, are expected to total approximately $34.0 million.

The offering expired on September 23, 2022. To recap, this was a transferable 1-for-3 rights offering with the subscription price being the higher of 92.5% of NAV or 95% of the average closing market price in the final five days of the offering. This meant that there was a floor to the subscription price at a -7.5% discount, limiting the maximum extent of dilution (–1.88% assuming full subscription).

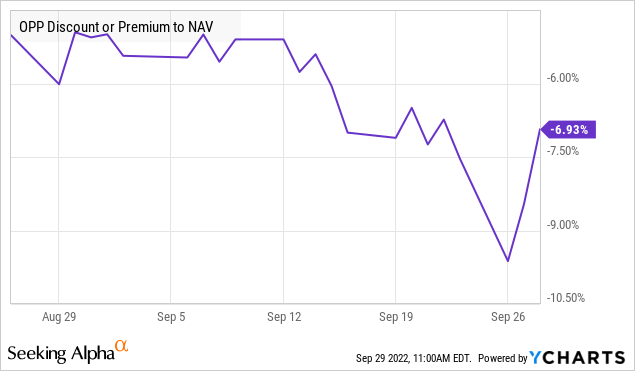

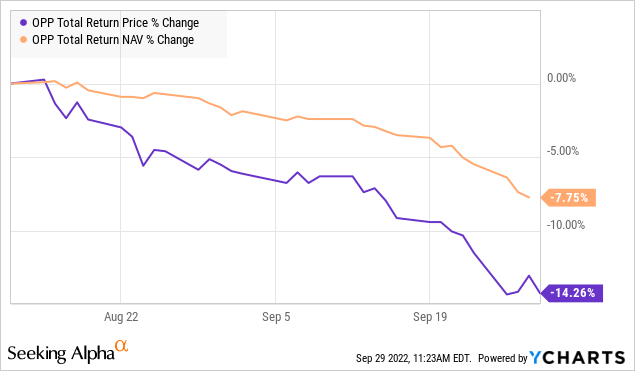

It turned out that OPP closed at exactly the -7.5% discount floor on the expiry date of September 23. As a result, the subscription price of $9.70 was identical to the closing price of that day, meaning that there was no benefit to subscribing. It could have been worse though; had OPP dropped below a -7.5% discount, subscribers to the offering would have gotten a worse price than simply buying the fund on the open market at the close.

Income Lab

(As an aside, the markets crashed the next day after expiry of the offering and OPP closed at $9.39, even lower than the subscription price. However this isn’t something that can be predicted in advance, hence it is not actionable).

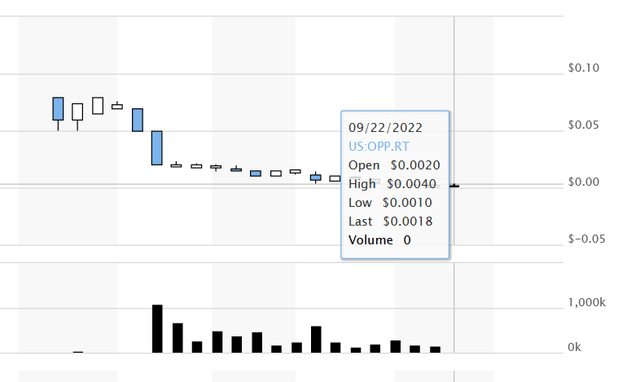

Consistent with the price of OPP moving towards the floor of the offering, the rights became nearly worthless as the expiry date approached. This is why we suggest members to sell their rights as soon as they get them if they do not intend to subscribe for new shares. For one reason or another, the rights gradually lose value as the expiry date approaches.

As the offering was not very attractive, it was not fully subscribed. The fund will issue around 3.51 million new shares in this rights offering, increasing its share count by +18%, instead of the maximum +33% increase that was possible. On the positive side, less subscription means less NAV/share dilution for this dilutive offering. Based on the number of new shares issued, I calculate the NAV/share hit to be -1.2%.

Overall, this offering again supports the “sell and rebuy” strategy for CEFs that undergo rights offering (tax issues not considered). Moreover, our prediction that the price would move towards the discount floor as the expiry date approaches turned out to be largely correct as well.

Income Lab

Don’t know what to do about CEF corporate actions?

Closed-end fund corporate actions such as rights offerings and tender offers present both significant opportunities and risks. We cover these regularly for members of CEF/ETF Income Laboratory, allowing them to profit or avoid losses.

Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

Be the first to comment