JHVEPhoto/iStock Editorial via Getty Images

Intro

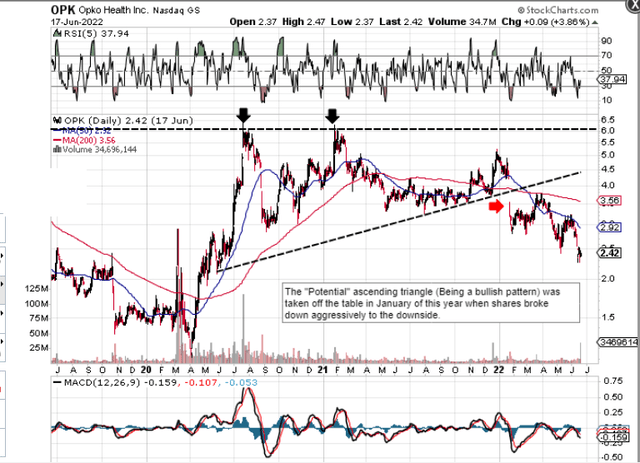

We wrote about OPKO Health, Inc. (NASDAQ:OPK) back in December of 2021 when we stated that the bullish case for the company was still intact. The company had just come off an earnings beat in its fiscal third quarter and earnings were growing (compared to Q3-2020) which was encouraging. Furthermore, free cash flow was projected to grow on strong margin growth. Suffice it to say, we assumed the ascending triangle (which we had alluded to in the previous commentary) was continuing to play itself out and that over time, shares would continue their upward trajectory. How wrong we were.

Technical Chart Of OPKO Health (Stockcharts.com)

The issue bulls have to deal with now is that the gap that presented itself in early 2022 has the potential of being a breakaway gap which is worrying. We state this because these gaps usually present themselves at the outset of a significant market move. As we can see from the chart above, the gap has yet to be filled and took place after months of consolidation. Suffice it to say, the breaking of the upward trendline most likely signaled a reversal of the former bullish trend which can be confirmed by how the 200-day moving average has acted as strong resistance since the breakdown. In fact, given the underlying trend, shares could easily test their 2020 lows in this latest down move. Trends in the areas discussed below give some credence to this possibility.

Profitability

Although there is plenty of positivity surrounding OPKO Health at present due to what the recent ModeX & Sema4 transactions will bring to the table in terms of unlocking value, investors need to remember that the ramifications of both these deals have been completely absorbed by the share-price action on the technical chart at this stage. Furthermore, the financials of these respective deals, as well as the $85 million Pfizer (PFE) milestone (which are both destined to hit the income statement in Q2), have already been accounted for.

Higher labor costs on substantially lower testing in the diagnostics segment adversely affected margins in the first quarter. Operating costs actually grew in Q1 despite the fact that overall sales dropped by close to 40% in the quarter. Furthermore, although OPKO’s net profit tally of -$55 million in the company’s fiscal first quarter was an actual improvement over Q4 (-$74 million), negative earnings are expected for quite some time in OPKO and are being exacerbated by recent earnings revisions. Although the pharmaceutical segment grew over a rolling quarter basis in the first quarter, its gains cannot make up for the losses in the diagnostic segment when testing slows down sharply. If indeed new variants of COVID-19 are around the corner which will increase testing numbers, the company simply has to do better on the costs side with respect to hiring and letting go of staff. There remains plenty of scope in the pharmaceutical segment, especially after the recently announced deals, but ongoing trials will need vital cash flow to ensure these candidates have the maximum opportunity to get to market.

Valuation

Followers of our work will be fully aware of the importance of profitability in beaten-down value plays. Positive earnings usually lead to positive-free cash flow generation over time which essentially buys the company time to get its drugs to market. Although OPKO’s book multiple and sales multiple of 1.02 & 1.01 look compelling at this juncture, OPKO as mentioned is not profitable (-$117 million over the past four quarters), and its book multiple in particular needs to be looked at more closely. Why? Because balance sheet assets and especially line-items like goodwill and intangibles invariably see their values written down if a negative earnings trend becomes the norm. At the end of the first quarter, OPKO’s intangible assets as well as goodwill made up over 60% of the value of the company’s assets ($2.31 billion). As mentioned, when times are good and earnings are increasing, large amounts of intangible assets are no big deal on a balance sheet. This is why earnings growth and those associated revisions are so important as earnings are derived from assets in that the longer profits remain subdued, the higher the likelihood that the company’s assets have to be re-valued to reflect the new earnings trend.

Conclusion

Suffice it to say, given OPKO Health’s growing short-interest, bearish technicals, and struggling profitability, things may indeed get worse in here before getting better. We look forward to continued coverage.

Be the first to comment