BrianAJackson/iStock via Getty Images

Here’s a knock-knock joke for you.

Knock-knock!

Who’s there?

Opportunity.

Opportunity who?

You fool. Opportunity only knocks once.

I believe this joke reflects Opendoor Technologies Inc.’s (NASDAQ:OPEN) current share price. It is a golden opportunity, and it may not come knocking at your door the second time!

With that out of the way, here’s a deep dive on Opendoor. Enjoy!

Investment Thesis

Opendoor, the iBuying juggernaut, is disrupting the residential real estate industry. The company dominates the iBuying space, supported by its technology, scale, network effects, and brand moats.

While Opendoor has a long growth runway ahead, the company faces a challenging macro environment characterized by rising interest rates and volatile home prices. However, the company has a highly liquid balance sheet, strong value proposition, and dynamic pricing model that should protect the business during the dark days ahead.

That said, the selloff presents an incredible opportunity for investors. Opendoor is a Strong Buy.

Value Proposition

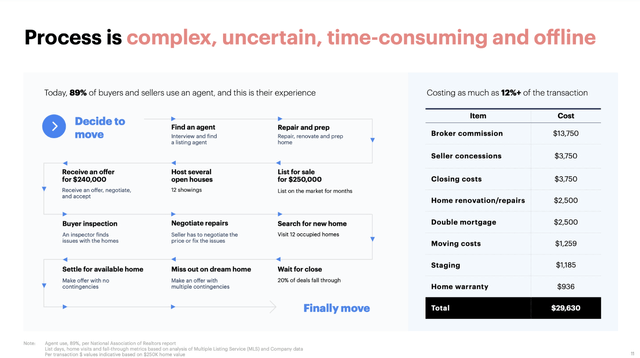

Traditionally, the process of buying or selling a home is complex, uncertain, time-consuming, stressful, and offline. When selling a home, for example, owners have to go through an emotionally draining process including finding a listing agent, getting the home “sale ready,” hosting open houses, negotiating offers and concessions, and conducting inspections. Not to mention, home sellers need to coordinate with the different parties – including the seller agent, buyer agent, mortgage broker, escrow officer, movers, and more – constantly communicating back and forth with them. All these could take months before the transaction closes, which by the way, has a 20% chance of falling through between signing and closing, forcing the seller to go back to square one if that were to happen.

Furthermore, home sellers need to find a new home as well upon selling their old homes. As such, they need to deal with the challenges associated with home buying, including qualifying for mortgages, gathering cash for down payments (which rely on their previous homes being sold), and a whole new round of negotiating back and forth. There’s also a high likelihood of the “double move” where they need to settle at a temporary dwelling before they move into the new home.

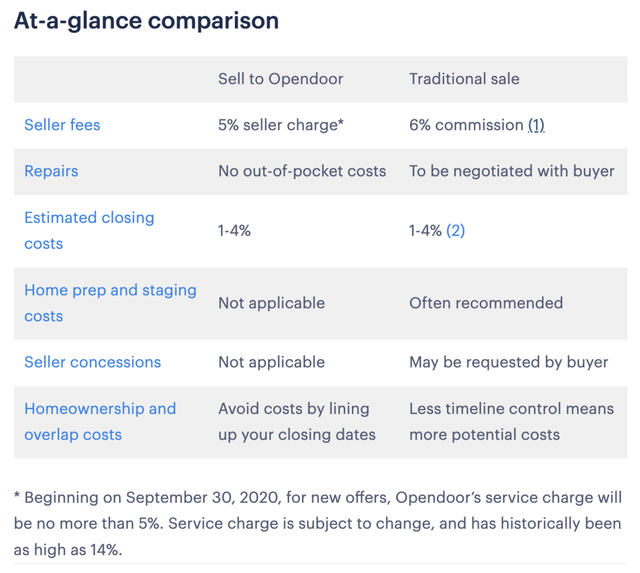

The slide below shows what the average person has to deal with when moving homes, incurring as much as 12%+ of the transaction value. It is no surprise that moving is dubbed as one of, if not, the most stressful event in one’s life.

Opendoor aims to remove the pain of moving for good.

Source: Opendoor November 2020 Analyst Presentation

Founded in 2014, Opendoor is an end-to-end platform that gives consumers the power to buy and sell homes online through the Opendoor app or website, digitizing the traditional moving experience.

Mission: To empower everyone with the freedom to move.

Opendoor offers an all-in-one platform that unifies and simplifies the consumer’s entire home buying and home selling journey:

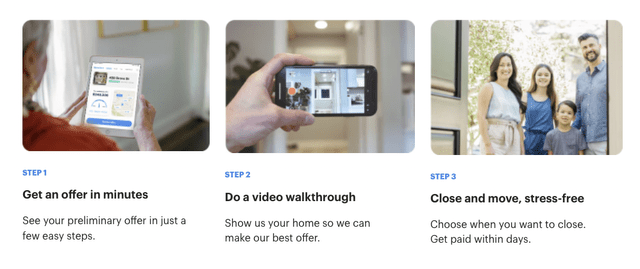

Sell to Opendoor

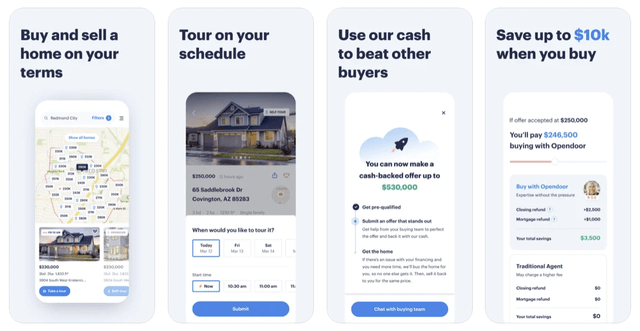

Homeowners can sell their homes directly to Opendoor. The process is very simple. A customer can request an offer by entering her address at Opendoor’s website or app (requesting an offer is free). Through Opendoor’s AI-enabled pricing algorithm, the customer will then receive an offer including the offer price, service charge, and estimated closing costs.

If the customer is satisfied with the offer, Opendoor will then conduct a virtual interior and exterior home assessment to verify the condition of the home and finalize the offer. If repairs are needed, the customer will be charged a repair credit, which will be deducted from the net proceeds of selling the home – customers don’t have to deal with repairs. Once the customer is happy with the price, she can then select her preferred closing date.

Compared to the traditional process, selling to Opendoor is entirely digital and all prices and fees are laid out clearly upfront. In addition, there are no agents, no negotiations, no visits, no repairs, no hidden costs, and no fall-through risk. Just a simple, certain, and transparent transaction experience.

As of year-end 2021, Sell to Opendoor is available in 44 markets.

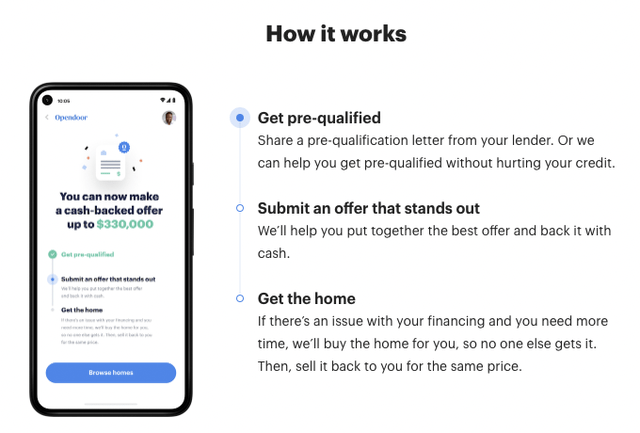

Buy with Opendoor

Home seekers can self-tour or virtually tour homes listed on the Opendoor platform, at their convenience. Customers can then submit an offer to buy a home they’re interested in. Unlike the traditional process, customers can submit an offer backed by Opendoor’s cash. Launched in early 2021, Opendoor Backed Offers enables qualified buyers to make an offer backed by Opendoor’s cash. This will not only increase their likelihood of winning the bid but also give sellers absolute certainty in terms of payment. It’s a win-win-win situation.

In my opinion, the Opendoor Backed Offers is a game-changing feature as it gives average customers the purchasing power and ultimately, a level-playing field for them to compete with other buyers, particularly the wealthy.

Once the customer has obtained financing, the transaction can be completed. If for some reason, the customer faces some financing issues, Opendoor can buy the home first so no other buyer gets it. Once ready, the customer can purchase the home back at the same price paid by Opendoor. In addition, if the customer is unsatisfied with her new home, she can sell it back to Opendoor within 90 days.

Buy with Opendoor is currently offered in 16 markets.

Opendoor Home Loans

Customers can work with any licensed mortgage lender or use Opendoor Home Loans to obtain the financing that they need. In November 2021, Opendoor acquired RedDoor, a digital-first mortgage broker, to strengthen its finance offering. The acquisition also enables customers to quickly apply for a home loan with a 60-second pre-approval process.

Opendoor Home Loans is currently available in 26 markets.

Title and Escrow

In 2019, Opendoor also acquired OS National to offer customers a “fully digital, integrated and self-serve closing process”. OS National had been a partner of Opendoor since 2016 and the acquisition meant that Opendoor can embed title insurance and escrow services under one platform.

Opendoor Exclusives

Homes recently acquired by Opendoor are also exclusively offered to customers through Opendoor Exclusives. These homes are offered to customers for 14 days before they are listed to the public, often at cheaper off-market, no-haggle prices.

Opendoor Complete

Opendoor Complete brings all of the previously mentioned products and services into a single, streamlined experience. The service was launched in August 2021 and it provides customers with an all-in-one moving solution, helping them manage their move throughout the entire home selling and buying value chain. It’s that easy.

In summary, Opendoor’s platform aims to help people move quickly, seamlessly, and freely with peace of mind. Although Opendoor pioneered the concept of iBuying, the company aspires to be much bigger than its core offering. As the Q4 Shareholder Letter states:

Opendoor’s ecosystem is a two-sided local marketplace between home sellers and home buyers with Opendoor homes and services at the center of the transaction.

…

We will be creating an e-commerce-like checkout experience for home buyers. This means we will be integrating both the RedDoor and Pro.com products into our buyer experience and enabling customers to shop for a home, tour it, prequalify for a mortgage, make an offer, select upgrades and repairs, and buy the home of their dreams with just their mobile device.

Market Opportunity

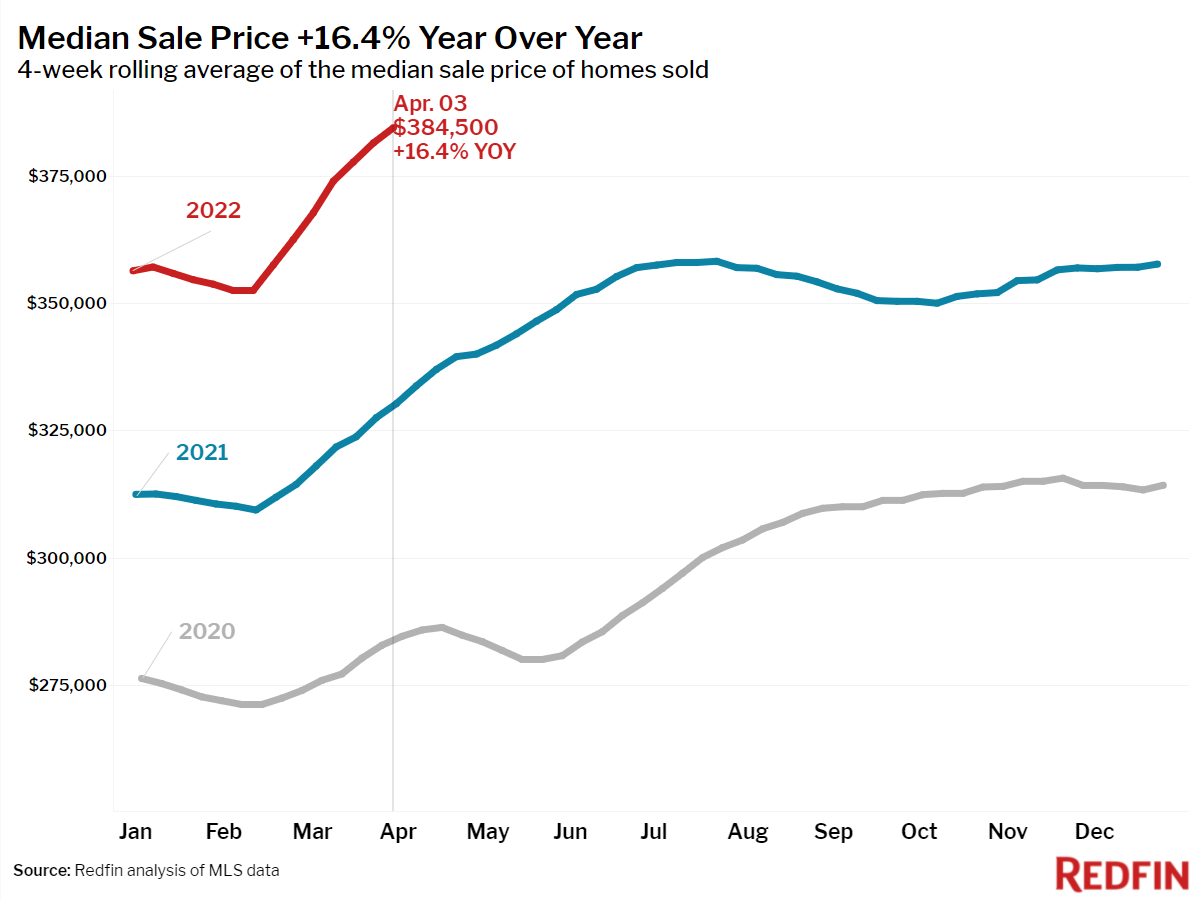

In terms of the macroeconomic environment, the housing market is still red hot as buyers are pounding the table to buy homes at record-high prices, at record-low inventory. According to Redfin (RDFN), the 4-week period ending April 3 saw median home sale prices reaching yet another record high, up 16% YoY from last year. As you can see, house prices are also way higher than 2020 levels. Do note that Home Price Appreciation (HPA) is a tailwind for Opendoor, to a certain extent.

Source: Redfin

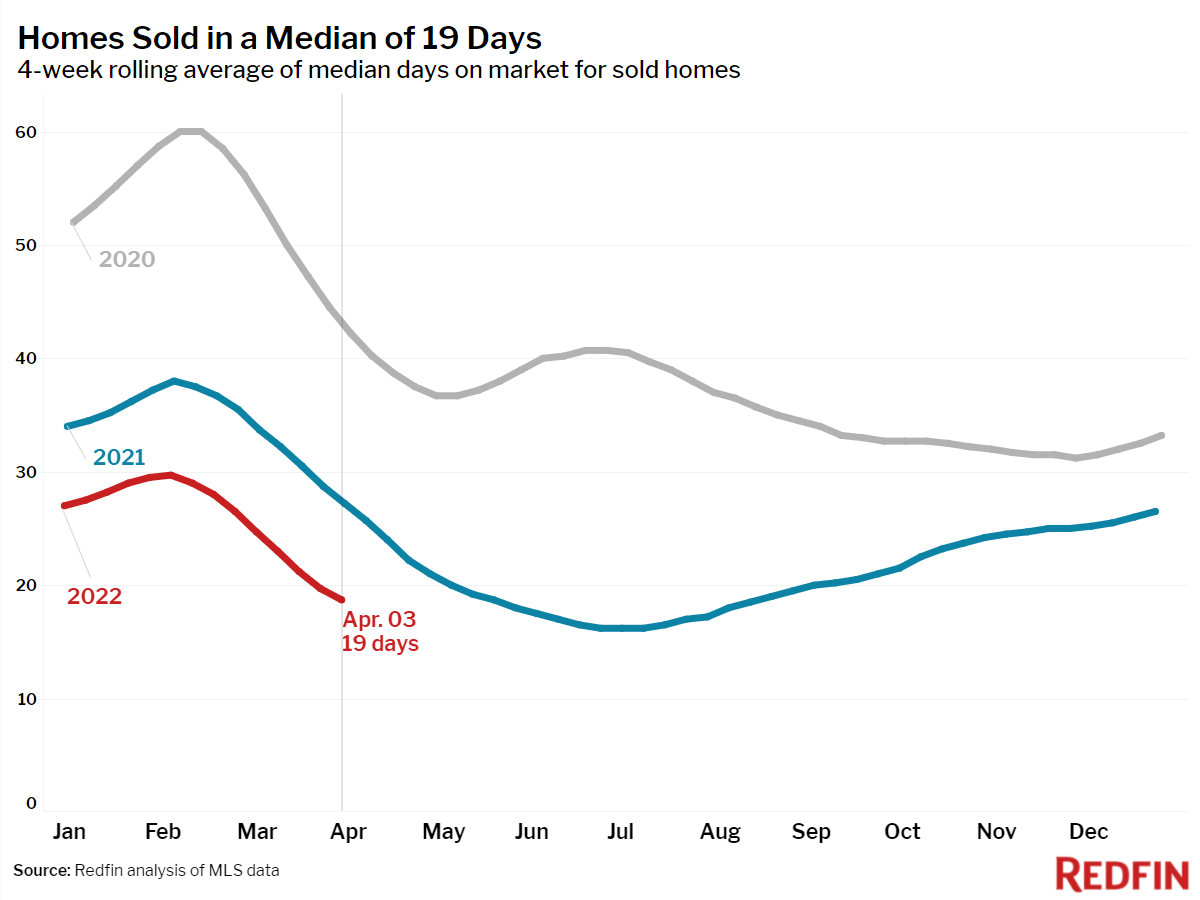

Ever since the pandemic hit, housing inventory has been very low while the market deal with high inventory turnover rates. The graph below shows the median number of days that houses are on the market. As you can see, the median days on the market are lower than usual, showing that demand is still hot. According to Redfin, the median days on the market were 19 days, compared to 27 days a year ago. Lower median days on the market are a tailwind for Opendoor as it can unload inventory faster, decreasing holding costs as well.

Source: Redfin

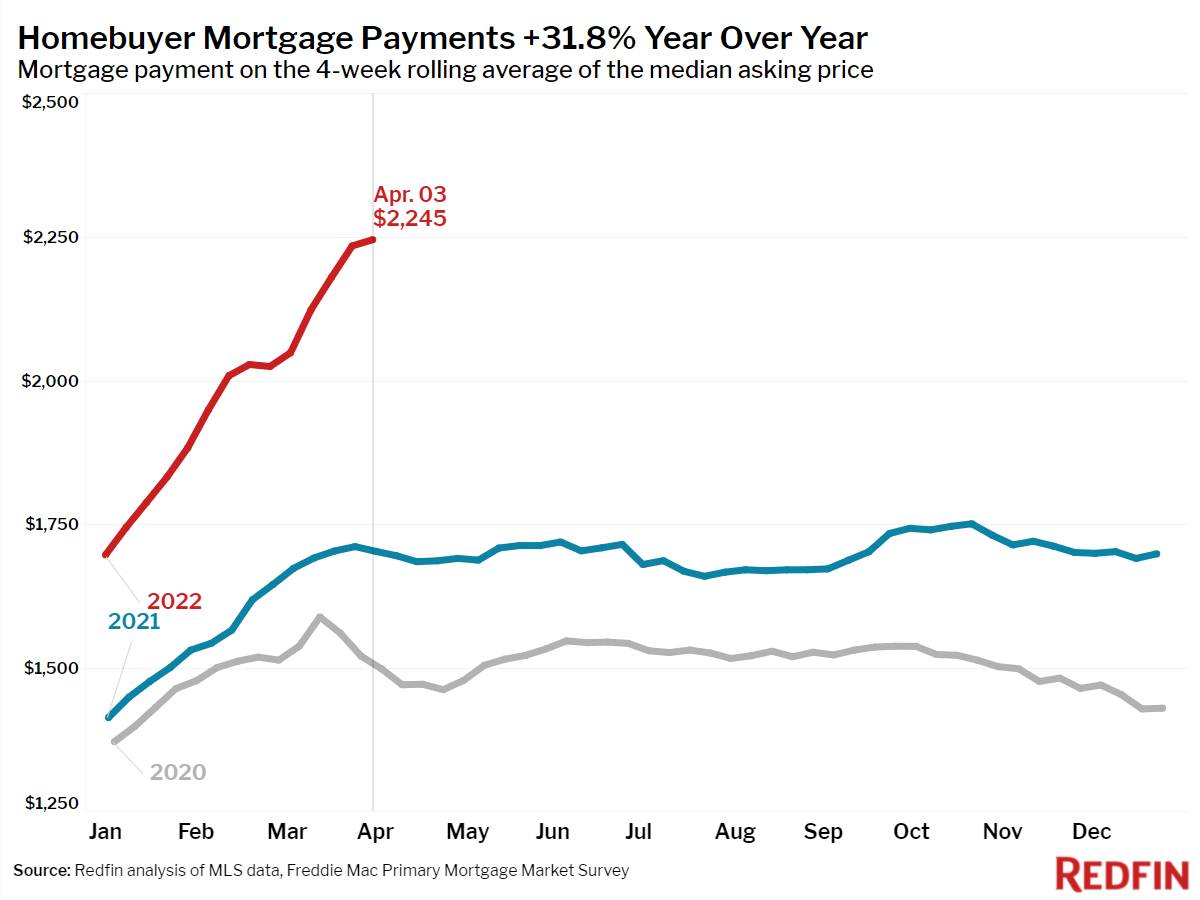

This buying frenzy, of course, was fueled by ultra-low interest rates and mortgage rates. However, experts expect the housing market to cool off as the Fed hikes interest rates and mortgage rates. As you can see, Homebuyer Mortgage Payments rose 31.8% YoY as mortgage rates spiked from 3.13% a year ago, to 4.72%. As such, demand should cool off, allowing inventory and house prices to stabilize. In fact, Redfin reported that 12% of homes had price drops in the past four weeks.

Source: Redfin

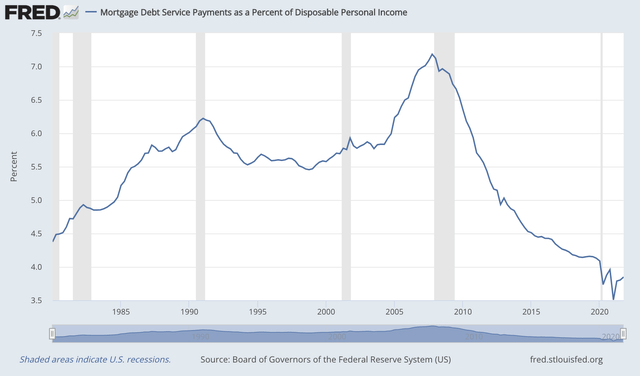

While higher interest rates are expected to slow down the housing market, they shouldn’t curb demand significantly. As shown below, Mortgage Debt Service Payments as a Percentage of Disposable Personal Income is the lowest it has ever been, which means that buyers can still afford a moderate rise in interest rates.

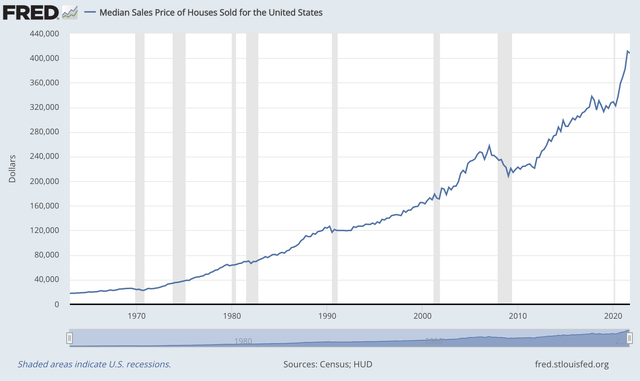

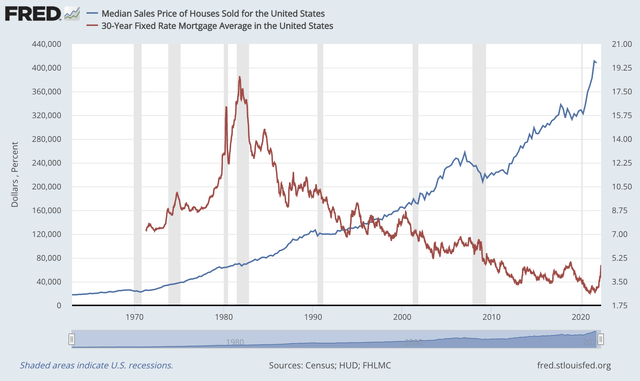

Without a doubt, Opendoor faces a challenging and volatile macro environment. But I believe that fears of a housing crash and Opendoor bankruptcy are overblown. Just look at the chart below. During the 2008 Financial Crisis, the Median Sales Price of Houses Sold dropped by only 20% from peak to trough. As we’ll discuss further later, Opendoor’s technology should be able to withstand such drawdowns.

It is also important to note that the long-term trajectory of residential properties has always been up and to the right. This is a long-term tailwind for Opendoor.

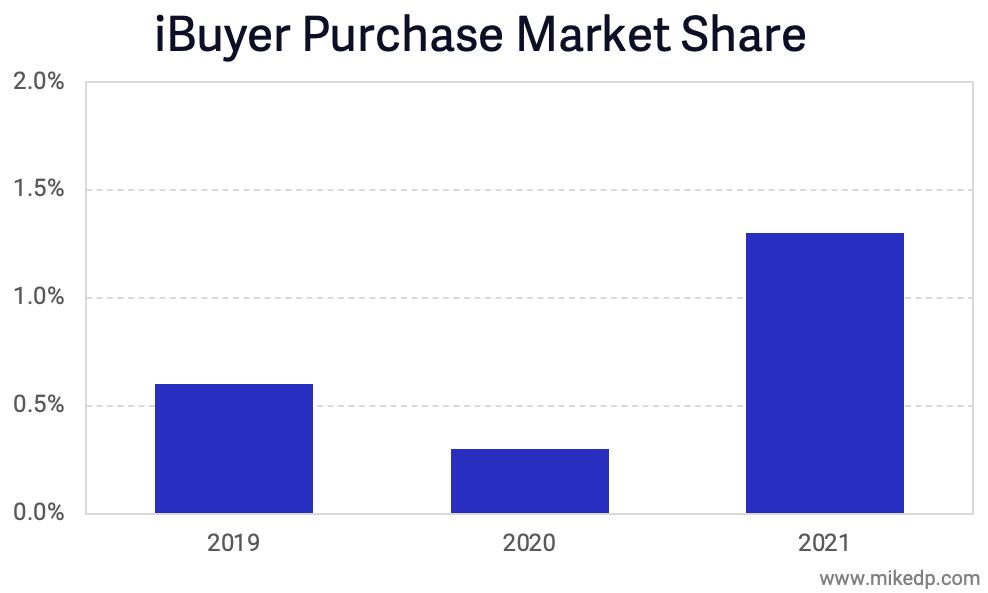

Macro concerns aside, the future has never been brighter for Opendoor. Real estate is the largest asset class in the world and yet, we have not seen major technological adoption or disruption in the industry. According to Opendoor, the residential real estate market saw $2.3 trillion in transaction volume in 2021. iBuyers purchased close to 70,000 homes, which leads to a market share of about 1.3%. If we remove the 24,000 homes acquired by Zillow (Z), the penetration rate is only 0.9%. This shows that there’s still substantial room for growth for Opendoor.

Furthermore, iBuyer market share is growing rapidly annually, and now is more than double from 2019 levels. This shows that although 99% of residential real estate transactions still happen offline, there’s a rapid shift towards digital transactions, which should benefit Opendoor in the long run.

Source: Mike DelPetre

As CEO Eric Wu noted in the Q4 earnings call:

Competition has not impeded our growth, and we do define our competition as the 99% of transactions that are offline.

Business Model

One of the most common misconceptions about Opendoor is that the company is a home flipper. This is a mistake of the highest order.

Home flippers have a “buy low, sell high” mentality, purchasing distressed properties, renovating them, and selling them at higher values.

On the other hand, Opendoor buys homes that are in good condition, renovates them, and offers buyers competitive prices. Opendoor does not intend to make money from “flipping” houses. Instead, the company runs a fee-based business model, collecting service fees much like how agents earn commissions. Currently, Opendoor has a flat service charge fee of 5%.

Sure, Opendoor stands to benefit from HPA. However, Opendoor intends to keep this service fee as low as possible, allowing the company to facilitate more transactions on the platform. In fact, the company has dropped this rate from a historical high of 14% to just 5%.

Furthermore, Opendoor’s pricing structure is much more straightforward compared to traditional agents, which are notorious for charging hidden fees. Not only are Opendoor’s fees lower, but Opendoor also offers more speed, convenience, and transparency.

On top of the flat 5% service fee, Opendoor also charges closing costs, which cover items like title insurance, escrow fees, and Homeowners’ Association fee. This is part of every home sale and it typically ranges from 1% to 4%.

As mentioned earlier, Opendoor also charges repair costs, if needed. This cost will be netted out of the proceeds from the home sale.

In addition, Opendoor also offers ancillary services such as Opendoor Home Loans, Opendoor Complete, and Title and Escrow Services, which are accretive to the company’s overall margin profile.

Costs of Revenue mainly consist of the property purchase price, repair costs, and inventory valuation adjustments. Inventory holding costs and financing costs are also major costs but they are not included in Costs of Revenue.

Put simply, Opendoor is not a home flipper, but rather, a market maker, a “two-sided local marketplace.”

Growth

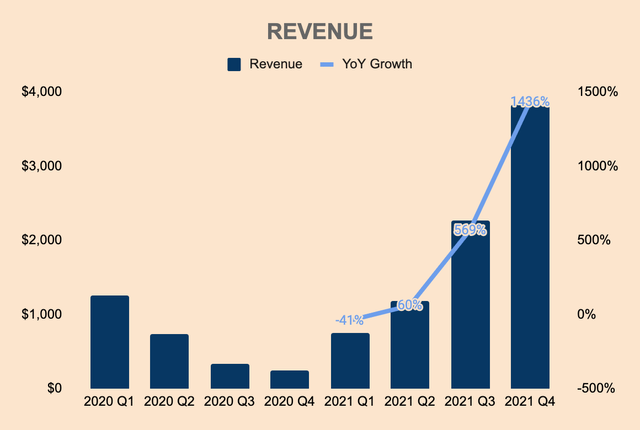

In FY2021, Revenue grew by 211% to $8.0 billion. In Q4 alone, Revenue accelerated to $3.8 billion, up a whopping 1,436% YoY. This massive growth figure is due to much lower inventory levels in FY2020 as the company paused home purchases in the wake of the pandemic. Nonetheless, it is still a 69% increase from FY2019 Revenue of $4.7 billion.

Source: Opendoor Investor Relations and Author’s Analysis

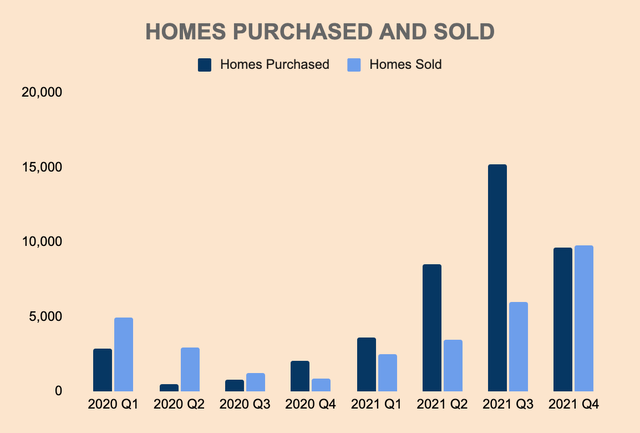

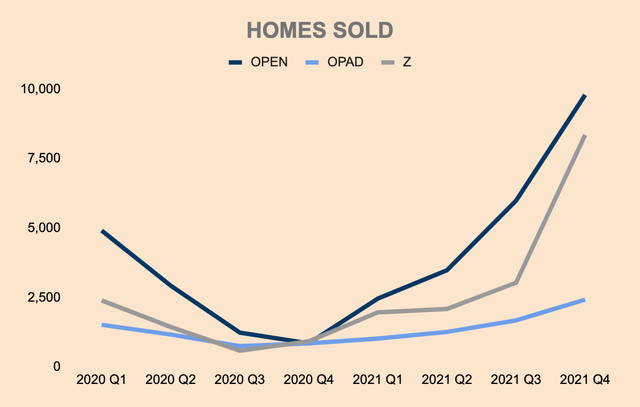

The surge in Revenue was primarily due to a higher number of Homes Sold and higher Revenue per home. In FY2021, Opendoor sold a total of 21,725 homes with Revenue per home sold 42% higher than the previous year. Opendoor is able to sell more homes as iBuyers continue to capture market share in an increasingly digital world, as well as expanding into new markets, increasing its market count from 21 to 44 markets, YoY.

Source: Opendoor Investor Relations and Author’s Analysis

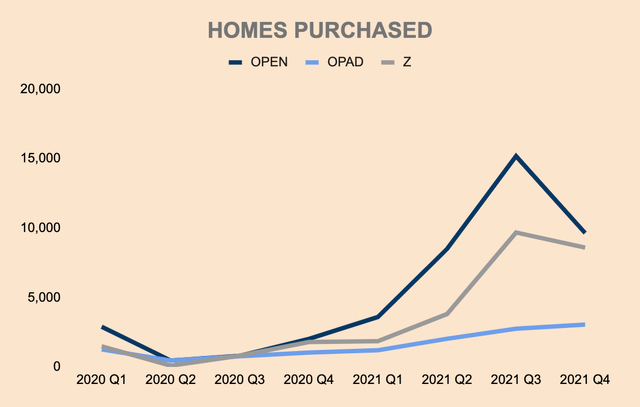

In Q3, Opendoor went on a shopping spree, purchasing a record 15,181 homes. The company dialed back on home acquisitions, purchasing only 9,639 homes in Q4. The record home buying in Q3 was followed by record home selling of 9,794 units in Q4, displaying strong market demand.

In my previous Opendoor article, I addressed my concerns regarding Opendoor’s aggressive iBuying but lagging iSelling in Q3. However, Q4 proved to me that Opendoor put a lot of thought into inventory management, as well as the strength of its iSelling system.

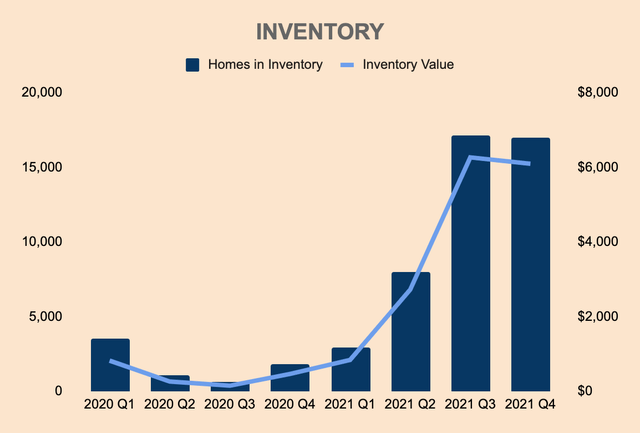

As a result, Homes in Inventory remained flat QoQ as management proceeded into the new year with extra caution. As of Q4, Opendoor had 17,009 Homes in Inventory with a total value of $6.1 billion, a 1,208% increase from last year.

Source: Opendoor Investor Relations and Author’s Analysis

Profitability

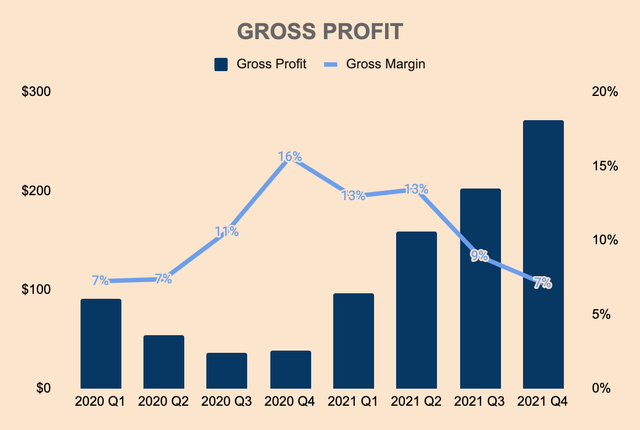

While business growth has been spectacular, profitability remains a concern. FY2021 Gross Profit grew 232% to $730 million. However, as we’ll see for other profitability metrics, margins have been in a downward trend over the last few quarters.

Source: Opendoor Investor Relations and Author’s Analysis

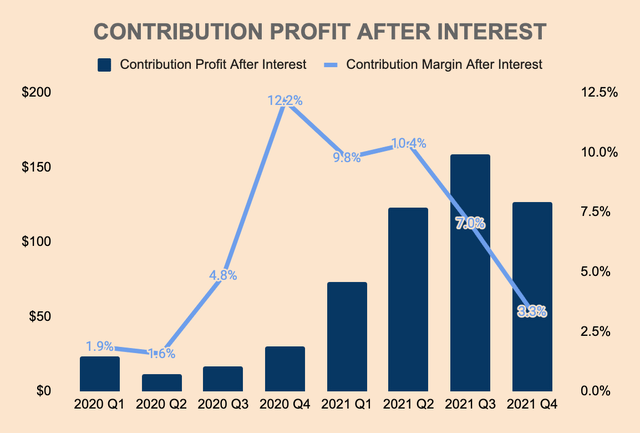

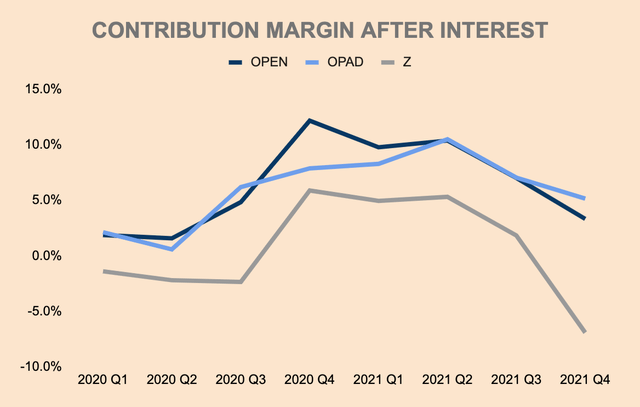

Contribution Margin After Interest – which accounts for direct selling costs, holding costs, and interest expense – dipped to just 3.3%, down from the highs of 12.2%. This metric highlights how much Opendoor makes per home sold. As highlighted by management, the drop in margins is due to two temporary trends: inventory mix and HPA. Here’s CFO Carrie Wheeler to explain (emphasis added):

When you think about the margin trajectory for 2021 and kind of what drove the trajectory, we’ve been very explicit that we had 2 large but temporary factors that were driving excess margin in the first half of the year.

One was we came into the year with essentially no inventory, having kind of sold the inventory during COVID and rebuilding that back up. That was really good for margins and we knew would dissipate on the course of the 1.5 years or kind of back to normal given a $6 billion inventory balance.

And the second part of that was the fact that as we came–turn around our market, we came into the first part of the year, we deliberately made some conservative underwriting decisions relative to what was that time very, very high HPA and that flowed through into resales, into realized margins. Again, that was relatively excessive, relative to our 4% to 6% with the guardrail. So it wasn’t that we missed on gross margin is like that we disclosed the trajectory we call for all year long.

Source: Opendoor Investor Relations and Author’s Analysis

iBuying is already a low-margin business and the falling margins make investors uneasy. However, investors shouldn’t be scared as management has anticipated this normalization. Furthermore, real money comes when Opendoor gains economies of scale. The company eats “BPs (basis points) for breakfast,” building the lowest cost platform in an attempt to delight customers.

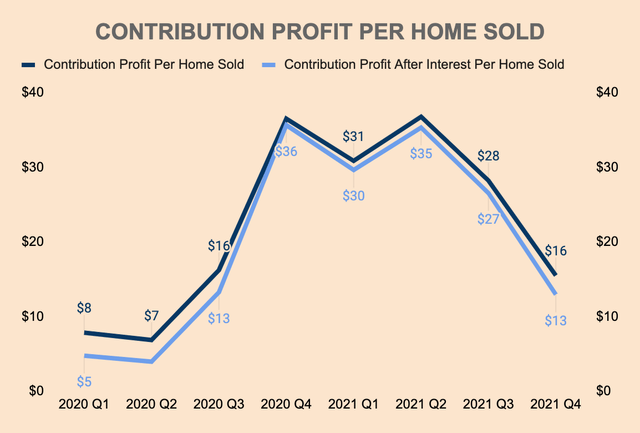

As more and more customers buy and sell through Opendoor, the numbers can stack up very quickly, both in absolute and marginal terms, especially with the addition of high-margin ancillary products and services. Opendoor currently makes $13k per home sold. This happens to be its 20th consecutive quarter of positive contribution profit, which speaks volumes about the company’s ability in weathering through a volatile housing market.

Source: Opendoor Investor Relations and Author’s Analysis

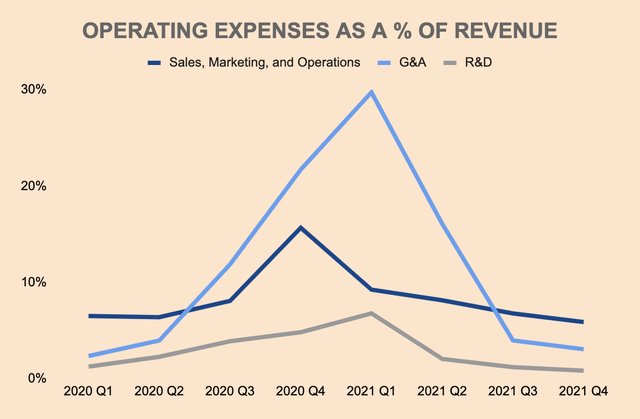

Moving down the income statement, we can see that Sales, Marketing, and Operations Expenses make up the majority of Operating Expenses. This includes resale transaction costs, broker commissions, advertising costs, holding costs, and personnel expenses. G&A Expenses spiked due to high SBC expenses as a result of going public. It is also worth noting that Opendoor laid off 600 employees in April 2020, a cost-cutting measure early during the pandemic. R&D remains the lowest component.

Source: Opendoor Investor Relations and Author’s Analysis

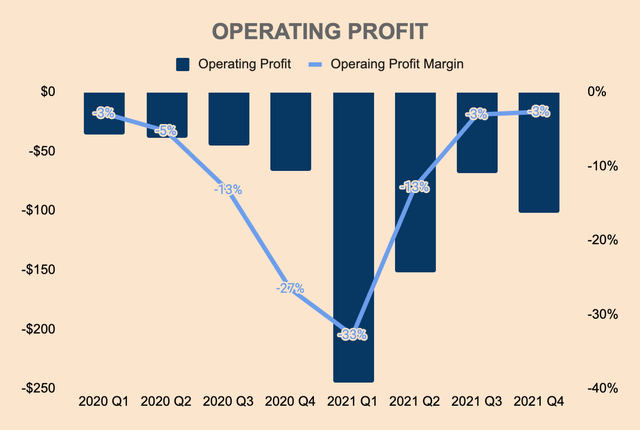

As shown below, Operating Profit Margin is very close to positive, at (3)%. It is improving each quarter despite investing in lots of new initiatives such as Opendoor-Backed Offers, Opendoor Complete, and launching in 23 new markets. In Q4, Opendoor increased Operating Expenses by 256% while Revenue grew by 1,436%, showing strong operating leverage.

Source: Opendoor Investor Relations and Author’s Analysis

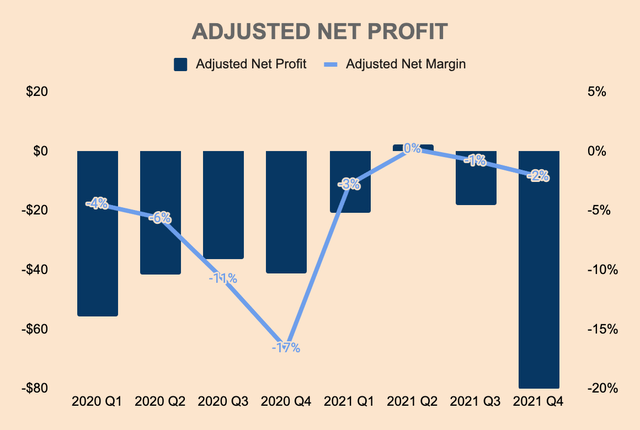

Similarly, Adjusted Net Profit is close to profitability. The recent plunge in Q4 is due to higher interest expenses as a result of a higher debt balance in order to fund home acquisitions over the last few quarters.

Source: Opendoor Investor Relations and Author’s Analysis

All in all, Opendoor is showing rapid topline growth as well as potential profitability for the new year as the company gains economies of scale.

Financial Health

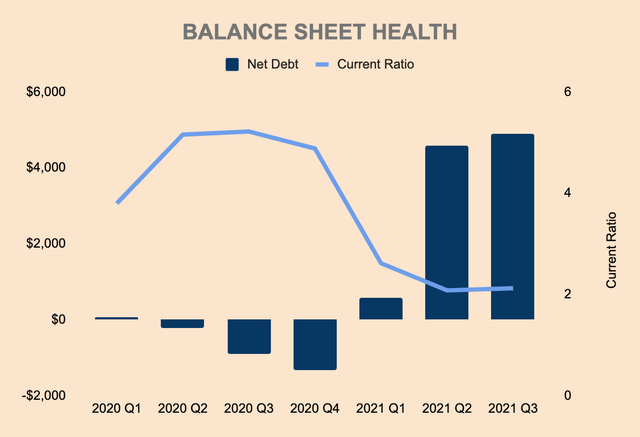

As of year-end FY2021, Opendoor has $2.2 billion of Cash and Short-term Investments. In FY2020, Opendoor has a negative Net Debt position as the company reduced home buying significantly in the wake of the pandemic. However, Opendoor began ramping up home purchases over the last few quarters, which is why its Net Debt position has turned positive, at $4.9 billion as of the latest quarter.

Source: Opendoor Investor Relations and Author’s Analysis

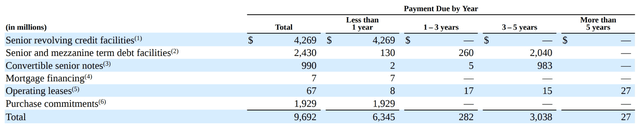

Total Debt stands at $7.1 billion but Opendoor still has $4.7 billion of undrawn borrowing capacity under its non-recourse asset-backed debt facilities. As such, Opendoor can fund up to $10 billion of Inventory, which would imply about $30 billion of home acquisition volumes based on typical inventory turnover rates.

With that said, Opendoor’s business model is considered capital intensive as the company needs to tap into the debt markets to fund growth and facilitate transactions. Furthermore, debt funds are collateralized by Opendoor’s real estate inventory. However, I do not see any substantial default risks as Opendoor’s balance sheet is highly liquid with a Current Ratio of 2x and the company has shown that it can turn inventory quickly:

As of December 31, 2021, only 8% of our homes had been listed on the market for more than 120 days. Our inventory was healthier than the overall market where 24% of homes had been listed for more than 120 days, adjusted for our buybox.

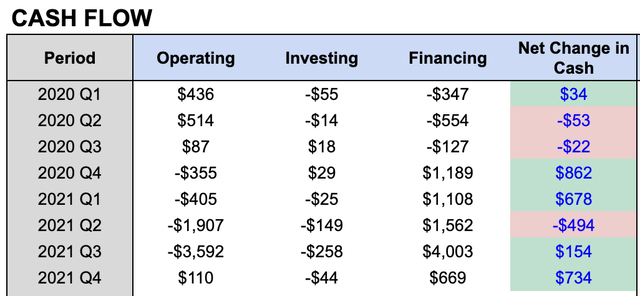

Opendoor’s cash flow statement has a close resemblance to REITs where there are large cash movements, particularly with borrowing debt, using it to acquire properties, and then repaying debt using the proceeds from property sales or leases. This is called capital recycling.

As shown below, the majority of cash flow happens in Operating and Financing activities. Cash from Operations activities has been negative as the company builds up inventory. The company uses cash from Financing activities to fund these transactions. However, we can see that cash flow from Operating and Financing activities is starting to converge as Opendoor pares back on home acquisitions.

Source: Opendoor Investor Relations and Author’s Analysis

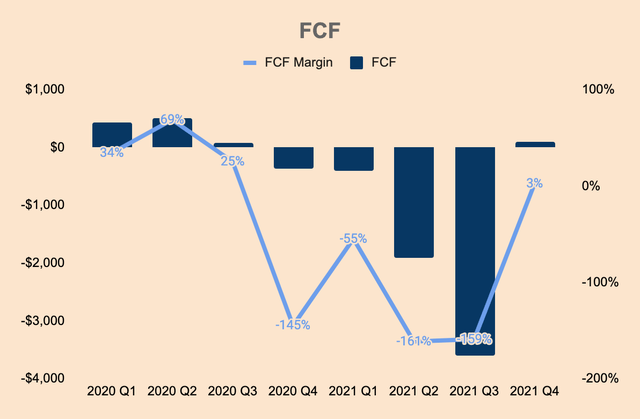

When there’s a healthy balance between iBuying and iSelling, we can expect healthy cash flow activities. That is what we’re actually seeing in the latest quarter as the company purchased and sold 9,639 and 9,794 homes, respectively. As a result, Free Cash Flow turned positive during the latest quarter. Over the long run, I’d expect to see this iBuying/iSelling balance as Opendoor acts as a marketplace for both buyers and sellers, not just sellers.

Source: Opendoor Investor Relations and Author’s Analysis

It is also worth noting that most of Opendoor’s financing activities consist of short-term borrowings, so investors need to keep an eye out for Opendoor’s major debt obligation (first line).

Guidance

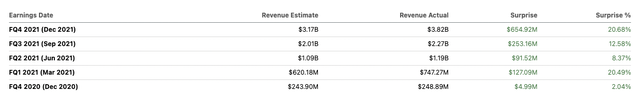

Turning to guidance, management expects Q1 Revenue to grow 462% to $4.2 billion, which is an annual run rate of $16.8 billion. I believe this is too conservative given Opendoor’s track record of beating expectations.

AEBITDA is expected to be about $35 million, a 0.8% margin. Contribution Margins are also expected to improve sequentially QoQ. Again, I believe we are going to see much-better-than-expected profitability metrics in Q1.

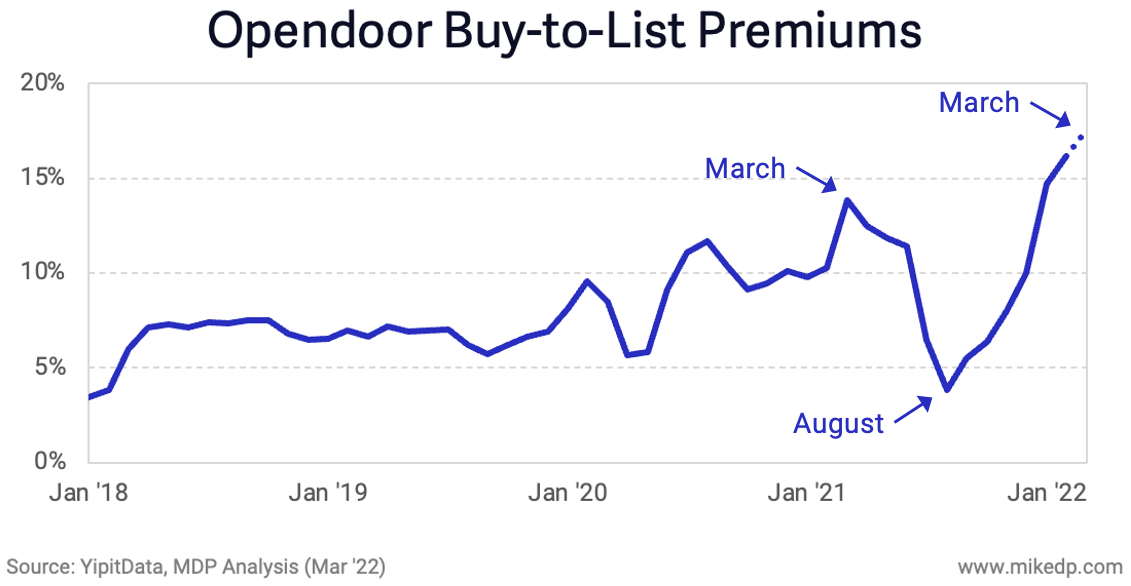

According to Mike DelPetre, Opendoor’s buy-to-list premium is at record highs, which will flow through Opendoor’s top and bottom lines. Opendoor’s lagging Contribution Margins in Q4 were due to low buy-to-list premiums. As of March this year, Opendoor’s premium is at 17% or $60k per home! Expect a blockbuster quarter in Q1!

In the long term, however, management expects long-term Contribution Margins of 7% to 9%, which includes high margin services.

Source: Mike DelPetre

Competitive Moats

Based on my research and analysis, I identified five competitive moats for Opendoor: technology, scale, network effects, brand, and monopoly.

Technology

Opendoor leverages AI and ML to power its pricing algorithm and risk management models, automating the preliminary offers that the company sends to prospective sellers.

Offers are dynamically priced based on multiple factors including macro conditions, home conditions, comparable homes, location, demand forecasts, inventory, and so on. Through its experience assessing 375,000+ homes, Opendoor utilizes 100+ data points to make approximately 1.4 billion adjustments to MLS data, offering customers competitive prices. The speed, flexibility, and adaptability of Opendoor’s pricing model are what sets it apart from traditional competitors.

In addition, Opendoor’s risk management technology serves as a durable raincoat during stormy seasons.

- First, the company focuses on high-velocity, short-duration transactions thereby limiting high holding periods and costs.

- Second, its pricing models adapt to changing market conditions on a daily basis, down to an individual home level.

- Third, experience from operating across 44 markets enables Opendoor to leverage data in a diversified portfolio.

- Fourth, homes are in sale-and-move-in-ready conditions for Buy with Opendoor customers, thus increasing the likelihood of a conversion.

Source: Opendoor November 2020 Analyst Presentation

Scale

Opendoor is by far the largest player in the iBuying industry. Compared to competitors Zillow (Z) and Offerpad (OPAD), Opendoor is king. With Zillow exiting the industry, Offerpad is the next major competition, which only bought 9,023 homes in 2021, compared to Opendoor’s 36,908 homes.

Source: Opendoor Investor Relations and Author’s Analysis

The same goes for the number of homes sold. Offerpad sold 6,373 homes versus Opendoor’s 21,725 units sold.

Source: Opendoor Investor Relations and Author’s Analysis

Opendoor is available in 44 markets and has processed 140,000+ customer transactions since inception.

Many thought that Opendoor’s rapid growth is unsustainable and that it would come at the cost of widening losses. Instead, the company is gaining economies of scale as fixed costs are spread among a larger number of homes.

In pricing, we were able to simultaneously reduce our pricing uncertainty, while increasing our buybox by 50% year-over-year, enabling us to provide offers on more than 60% of all transactions in our active markets. Operationally, our investments in technology drove significant efficiencies, resulting in our ability to deliver nearly six times the home assessments and repairs and nearly 110 basis points of operational cost structure improvements over last year. These investments have also allowed us to efficiently scale the number of customers we service by over 250% from the prior year and efficiently expand our market footprint, doubling the number of our markets in 2021.

Network Effects

Opendoor is a partner with over 70 homebuilders, including eight of the top ten homebuilders. The company also has over 700 trade partners and local service providers for home repairs and maintenance. It has also partnered with Realtor.com which has over 100 million monthly active consumers, agents, and brokers. More recently, Opendoor acquired Pro.com and Skylight, to enhance its home renovation process, expanding its network of contractors for construction and renovation. In addition, Opendoor also acquired RedDoor to boost its digital mortgage financing offering.

As a vertically-integrated platform with a growing network, Opendoor is able to attach additional services as customers are willing to pay for convenience. For example, Title and Escrow Services have an 80% attach rate, with Revenue for the category growing 140% YoY. This is just the beginning and each new customer, product, and partner added to the ecosystem will lead to powerful network effects.

Brand

Opendoor has a Net Promoter Score of 80+, which is unheard of in the real estate industry. The company has the following ratings:

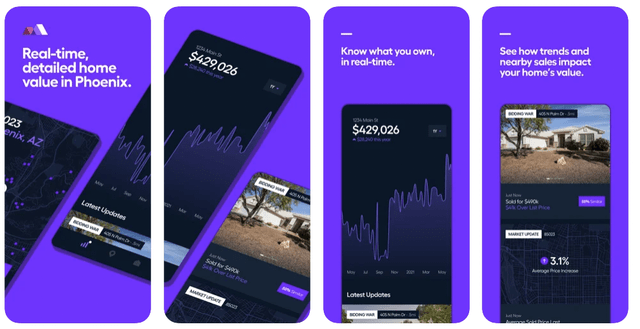

- Apple App Store: 4.7/5.0 with 4,479 reviews

- Reviews.io: 4.4/5.0 with 2,377 reviews

On the other hand, Offerpad’s reviews are depressing:

- Apple App Store: 3.4/5.0 with 74 reviews

- Reviews.io: 2.5/5.0 with 10 reviews

When dealing with the most stressful events in their lives, customers will want to work with the most trustworthy brand out there, that is, Opendoor.

Virtual Monopoly

In his book Zero To One, Peter Thiel highlighted four characteristics that make up a monopoly:

- Proprietary technology

- Economies of Scale

- Network effects

- Brand

Opendoor holds all four characteristics of a monopolistic business.

Previously, the introduction of Zillow Offers was a major threat to Opendoor’s existence, as Zillow is the “king of online real estate” and its vast amount of data could overthrow Opendoor. Well, let’s take a look at Contribution Margin After Interest for all three iBuyers. You can see why Zillow exited the iBuying business. Zillow is a much more profitable business than Opendoor and yet, the company calls it quits as Opendoor eats Zillow’s basis points for breakfast.

Source: Opendoor Investor Relations and Author’s Analysis

Zillow’s departure means two things:

- Opendoor has superior pricing and risk management technology.

- The iBuying space has very high barriers to entry.

With Zillow out of the picture, Opendoor has roughly 80% market share in the iBuying space. As such, Opendoor is virtually a monopoly.

Valuation

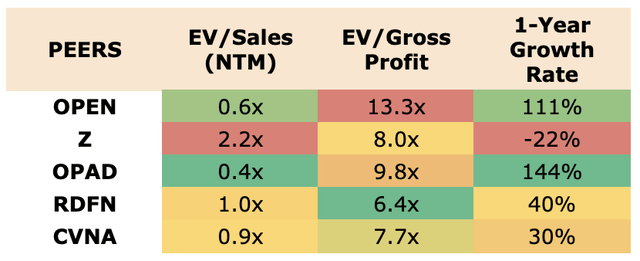

It is tough to value Opendoor as the company has just recently gone public. To make matters worse, there’s only one other comparable company, Offerpad. Nonetheless, here’s what valuation multiples look like.

Source: Seeking Alpha, Koyfin, and Author’s Analysis

Opendoor is valued at an EV/Sales multiple of 0.6x. While this may look cheap, Opendoor trades relatively expensively in terms of EV/Gross Profit. However, Opendoor is growing at a rapid pace, so a higher multiple is reasonable. I have also included Carvana (CVNA) as it has a similar business model to Opendoor (but for cars). Given its monopoly status and high growth rate, I believe Opendoor is trading cheaply at $8 a share.

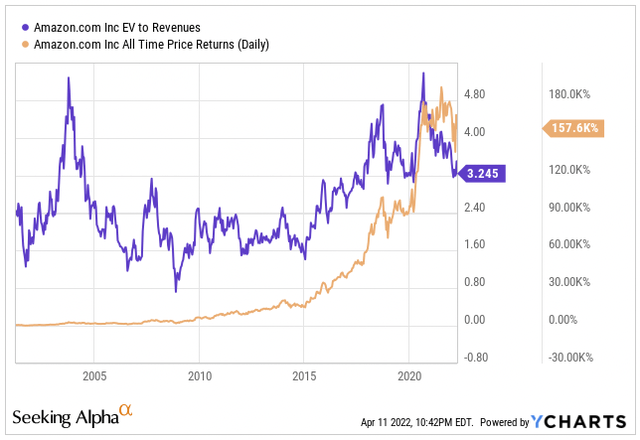

Some may also compare Opendoor to Amazon (AMZN), as it is also a low-margin business, first-mover, and is virtually a monopoly as well (40% market share in the e-commerce industry). Not including the Tech Bubble of 2000, Amazon has traded at an EV/Sales multiple of less than 5.0x over the past two decades. The lowest point was 0.8x, close to where Opendoor is trading today. Despite minimal multiple expansion, Amazon’s share price has returned more than 1,500x for shareholders.

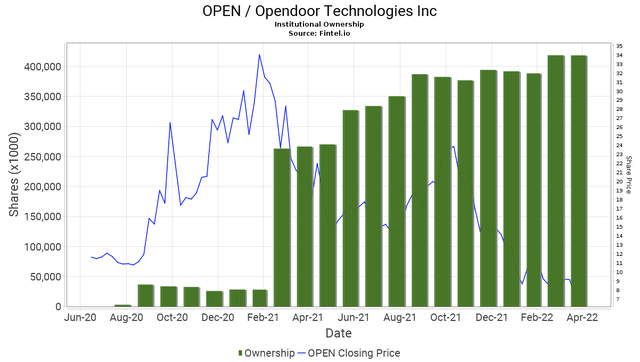

While the stock is selling off, many institutional investors are piling onto Opendoor. While retail investors are dumping shares, smart money is accumulating at these levels.

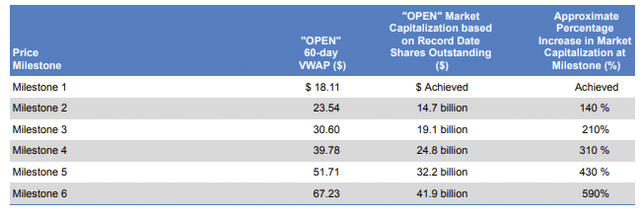

Management also released its proxy statement a few days ago, highlighting CEO Eric Wu’s compensation package. As shown below, Wu’s equity awards are divided into 6 milestones which vest upon reaching a certain price hurdle. The highest milestone is $67, which is almost 10x from today’s price. This not only shows that management is aligned with shareholders, but they are also in it for the long game.

Source: Opendoor FY2021 Proxy Statement

Catalysts

Expand Ancillary Services

Opendoor aims to provide an end-to-end experience for all things home-related. That means integrating ancillary services on top of its core home buying and selling services. Not only for their moving journey but also for their living journey. That is, providing services after the customer moves in, such as regular maintenance and upgrades. As we’ve seen with Title and Escrow, incremental attach of new services will not only bring higher-margin revenue for Opendoor but also solidify its position as the go-to, end-to-end home services provider.

Source: Opendoor November 2020 Analyst Presentation

More Partnerships

This includes home builders, REITs, banks, etc. Furthermore, Opendoor could partner with internet service providers, smart home providers, furniture companies, and utility companies (water, electric, solar) so customers can just move in and have everything all set up for them.

Market Expansion

Opendoor recently announced its expansion into San Francisco, New Jersey, and New York. These are some of the busiest housing markets on the planet, so this is a positive development for the company. Opendoor also has eyes on international expansion as it readies for its Canada launch.

Opendoor Max

Not much information has been released about the Opendoor Max, which provides real-time home value. In the future, I see Opendoor Max as a SaaS offering for individuals, agents, and financial institutions. This feature is currently available in Phoenix, Arizona.

Risks

Regulation

Opendoor recently ran into regulatory trouble with the North Carolina Real Estate Commission. Although regulatory pushbacks are part and parcel of running a disruptive business, Opendoor may, from time to time, face risks of suspension in certain markets.

Higher Interest Rates

Let’s face it. A high-interest rate environment is not good for any business, let alone a capital-intensive unprofitable real estate business. For consumers, mortgage payment costs will be higher, thus decreasing demand. For Opendoor, it means a higher cost of capital to fund home acquisitions. As the cost of debt rises, margins are likely to be compressed as well.

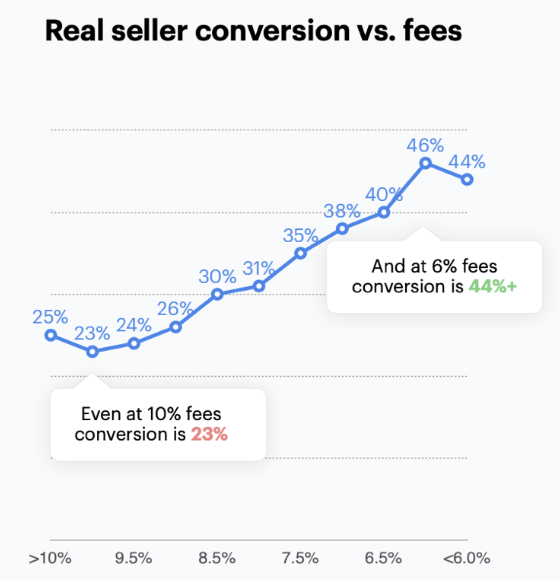

To combat rising interest rates Opendoor can “embed those costs in our offers” and “pass it on to the consumer.” In other words, Opendoor is likely to raise Service Charge fees. In 2021, Opendoor has a seller conversion rate of over 35% when charging a 5% fee. Raising fees will definitely drop conversion rates but historically, Opendoor is able to achieve conversion rates of 23% even at 10% fees.

Source: Opendoor November 2020 Analyst Presentation

Housing Market Crash

This is probably the biggest bear thesis against Opendoor given the current red-hot real estate market and its diminishing likelihood to sustain its trend in a high-interest rate environment. With 17,009 Homes in Inventory, a housing crash would mean a large inventory write-off as well as the potential to force the company to sell them at a loss.

During the Morgan Stanley TMT Broker Conference Call, an analyst asked about how Opendoor will grow and manage through a slowing housing market. This is Eric Wu’s response (emphasis added):

There’s 4 key points I want to make.

One is that our homes are liquid listed assets, which is very different than a homebuilder or a REIT. And we hold homes for about 100 days, of which 50 days of that is under resell contract. That means we have a buyer, a deposit and a contract in place, right? So 50 days of that is on a resale contract. The other half is what you might call a listing exposure, right?

And the second thing is that if you study the worst U.S. housing recession in history, which is the GFC or subprime crisis, the market moved much slower than people perceive. And so nationwide in the worst part of the recession, the prices moved a negative 2.8%. And obviously, our exposure is 50 days, but that’s well within our margin of error vis-a-vis our contribution margin of 4% to 6%. And so if you run the business model through the worst recession in U.S. history, we would still have positive contribution margin.

The third piece of that–that’s assuming we don’t know that there’s a recession. So the third piece of that we’ve invested heavily in the data collection here. So we’re tracking in real-time demand signals, both of our homes, visits, as well as market homes, clearance rates and what’s happening in market, mortgage applications, all of the demand signals, then the form of pricing. So there’s never a disconnect between what we view with supply side pricing and demand side. And so we’re tracking the data very closely, and we’re updating prices in real time.

And then the fourth is really the debt structure. We have $11 billion of borrowing capacity, committed nonrecourse. If there’s a dislocation, this gives us a tremendous amount of dry powder to actually capitalize on a dislocation.

On liquidity, Opendoor focuses on high-velocity, short-duration, and sale-ready assets, thereby limiting long periods of holding inventory. Opendoor is a market maker that provides liquidity for customers, and the company is likely to do well regardless of the market environment, whether it’s an up market, flat market, or down market.

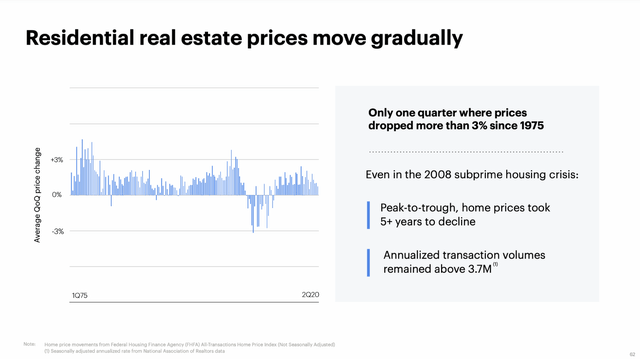

On price movement, the residential real estate market moves gradually, rather than sharply, as shown below. As such, Opendoor will not be heavily affected by market drawdowns. If Opendoor has an average inventory holding period of more than a year, then that’s a different story.

Source: Opendoor November 2020 Analyst Presentation

On data, Opendoor’s vast amount of data and AI-powered pricing model provides dynamic, real-time offers. Speed. Flexibility. Accuracy.

On debt structure, Opendoor has access to more funds, which enables the company to buy homes at low prices when people are panic selling. Opendoor is not a home-flipper, but contrary to popular belief, a housing crash is a net benefit for Opendoor.

Conclusion

In summary, Opendoor aims to empower everyone with the freedom to move by building a two-sided marketplace for home buyers and sellers. Through its dynamic, AI-powered pricing model, Opendoor offers convenience, simplicity, and certainty which consumers have grown to love. It is operating as a virtual iBuying monopoly in a massive industry with low technology adoption, and the company is rapidly taking market share.

Opendoor’s share price has sold off by more than 70% from its November highs. The price is knocking on the doors of every investor and this kind of opportunity may not come knocking twice. The markets are probably too scared of the fact that a housing crash will most likely dissolve Opendoor’s business.

Well, for that matter, I will end with one last chart. As you can see, house prices continue to march forward and upward, regardless of how low or how high interest rates have gone. The resiliency of residential real estate will be an automatic tailwind for Opendoor.

Thank you for reading my Opendoor deep dive. If you enjoyed the article, please let me know in the comment section down below. If there’s a company that you would like me to do a deep dive on, don’t hesitate to share your thoughts as well.

Be the first to comment