Feverpitched

(Note: This research report was originally published at my marketplace service, “The Quantamental Investor,” on 15th November 2022. The report has been updated to reflect changes since this report was published.)

Introduction

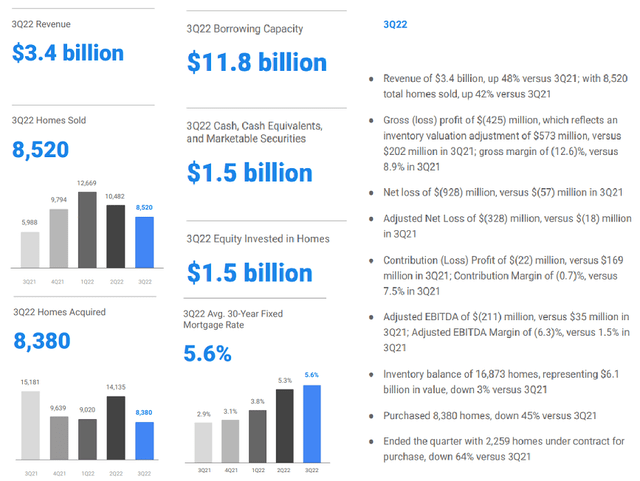

On 3rd November, Opendoor (NASDAQ:OPEN) published a disappointing earnings report, with the iBuying pioneer recording net losses of $928M for Q3. As we know, the US housing market has been cooling off since May 2022 as higher mortgage rates and low affordability have sapped demand out of a supply-constrained market. Due to the rapid velocity of this reversal in housing markets, Opendoor is hurting.

While investor confidence in the “iBuying” business model is hitting new lows after Redfin exited iBuying last week, Opendoor’s well-capitalized balance sheet should be enough for it to ride out the downturn in housing and emerge as a dominant, monopolistic platform business on the other side. To this end, Opendoor recently announced the official launch of Exclusives – a marketplace where consumers can directly buy and sell a home without any of the hassles of the traditional real estate model. Furthermore, Opendoor’s visionary founder – Eric Wu – has already set a big hairy goal for Exclusives:

Opendoor Q3 2022 Shareholder Letter

For those following my work on Opendoor, you already know that my investment thesis has always been based upon Opendoor shifting from a low-margin, 1P marketplace model to a high-margin, 3P marketplace model. And Opendoor Exclusives is precisely what I wanted from Opendoor as a long-term shareholder. In my view, Opendoor Exclusives will be additive on volumes and accretive to margins [5% seller fee, no selling or financing costs], whilst it would also reduce capital risk. Now, I understand that Opendoor is currently losing a lot of money; however, the stock is already priced for bankruptcy in my view. With ~$3.3B in total cash (restricted [$1.8B] + unrestricted cash & short-term investments [$1.5B]) and ~$11.8B in borrowing capacity (70% committed), I think Opendoor has adequate liquidity to get through this tumultuous period, despite the fact that we may see one more big write-off in Q4 2022 as contribution margins bottom out. As Opendoor refreshes its inventory, I expect the company to return to positive contribution margins by H1 2023 and start delivering on management’s guardrails of 4-6% contribution margins in H2 2023. Overall, I am thrilled with how Opendoor is navigating through the current macroeconomic environment, and I remain convinced of Opendoor’s ability to digitally transform the archaic real estate transaction process.

My detailed coverage of Opendoor is available in the following research notes:

As a long-term investor, I am looking beyond the near-term business volatility, and in Opendoor, I see a generational company in the making. In this note, we will review Opendoor’s Q3 results and assess the company’s outlook for Q4. Further, we shall analyze Opendoor’s liquidity situation and revisit Opendoor’s valuation in light of its latest earnings report.

Without further ado, let’s get started!

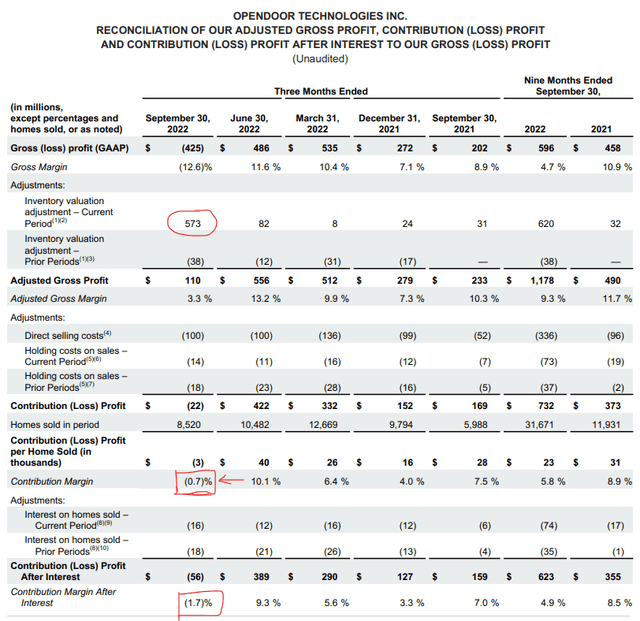

Digging Deeper Into Opendoor’s Q3 Numbers

For Q3, Opendoor’s revenue came in well ahead of expectations at $3.4B (est. $2.3B) as the iBuyer accelerated inventory sell-through. However, this additional revenue came at the cost of margins, and this impact can be noticed in the higher-than-expected adj. EBITDA loss of -$211M (est. $175M). During Q3, Opendoor ended up being a “net seller” of homes, as it sold 8,520 homes whilst acquiring 8,380 homes. After recording positive contribution margins (unit economics), Opendoor’s contribution margins turned negative in Q3 and came in at -0.7%, well below management’s guidance range.

Opendoor Q3 2022 Shareholder Letter

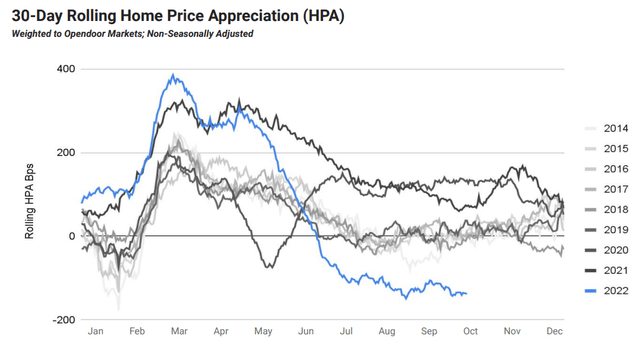

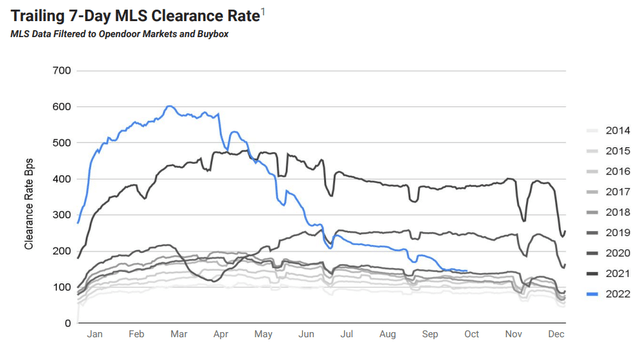

As you may know, a surge in mortgage rates has led to a drastic drop in home affordability throughout 2022. This rising interest rate environment has resulted in a drop in consumer demand and, consequently, in home prices and clearance rates. Most metropolitan areas have experienced ~10-20%+ declines in home prices since summer, and the HPA environment is currently running at -100 to -150 bps per month, according to Opendoor!

Opendoor Q3 2022 Shareholder Letter Opendoor Q3 2022 Shareholder Letter

Considering the poor macro backdrop, I think Opendoor’s management made the right call in terms of accelerating inventory sell-through; however, I wish they had made a lower number of acquisitions in Q3 and sold (a lot) more than 40% of those Q2 Offer Cohort homes [even at the cost of realizing a bigger cash flow burn in Q3]. Well, what’s done is done, and I hope that Opendoor’s management will get through more of these homes in Q4 [management guided for ~65% Q2 Offer Cohort inventory resale by the end of this year].

Much has been said about Opendoor’s Q3 net loss of -$928M; however, this loss figure included a massive inventory valuation adjustment of -$573M (including expected selling costs of $142M). Now, Opendoor’s management told us on call that newer inventory (purchases made since the end of Q2) have much higher spreads built into their offers and are performing in line with management guardrails of 4-6%. And since a big chunk of losses on older inventory has been realized in this quarter, I believe that the net loss figure for Q4 will be far lower than what we saw in Q3. That said, the resultant cash burn will be realized in Q4 and the first half of 2023 as Opendoor sells through this inventory. In my view, Opendoor’s cash burn will peak in Q4 at ~$400-500M, and the inventory valuation adjustment next quarter will moderate rapidly going forward.

Opendoor Q3 2022 Shareholder Letter

The headline loss figure is scary, and there’s a lot of FUD in the media about future inventory writedowns; however, I think the fear is unwarranted. If you have followed my work on Opendoor, you know that we have already known about a big net loss and inventory writedowns for Opendoor in Q3 for months and discussed potential ranges in these notes:

- Opendoor Q2 Review: Decent Earnings, Weak Guidance, Killer News (Zillow Partnership) [11th August 2022]

- Opendoor: A Generational Buy For Bold, Contrarian, Long-Term Investors [26th September 2022]

Here are some statements from the above-linked note:

A big headline net loss is coming for Q3, along with massive inventory markdowns (~$0.5-1B). And this is why Opendoor is trading at less than its net cash balance of $2.2B.

Opendoor’s business model is built to survive and thrive across market cycles, and this notion is being put to the test as we speak due to an unprecedented decline in the housing market. Now, I understand and agree with the bearish argument/premise – “Opendoor is set to record big transactional losses in the upcoming quarter[s] accompanied with inventory markdowns”.

With “median existing home sales prices in the US” declining by ~6% in the last two months (~10-20%+ declines in metros), Opendoor is set to face inventory markdowns, and I think this figure could be as high as 8-10% ( ~$500-650M) of inventory ($6.6B).

The net loss and inventory write-down figures came in well within my projected range, and Opendoor got rid of more inventory than I thought it would in Q3. Hence, I see no reason to panic. In fact, the panic sell-off in Opendoor is a buying opportunity! (despite weak near-term business outlook). Alright, now let’s analyze Opendoor’s Q4 revenue guide and contextualize it within the current macro environment.

What’s In Store For Q4 And 2023?

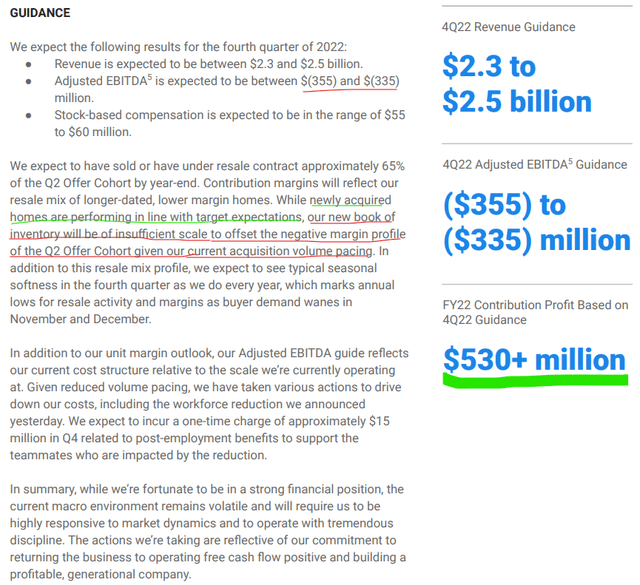

For Q4, Opendoor guided for revenue and adj. EBITDA to be in the range of $2.3 to 2.5B and -$355 to -335M, respectively. While Opendoor’s margins are set to remain under pressure in the near term as the iBuyer works through a bloated inventory, I think achieving $500M+ of contribution profit in FY22 is an amazing feat considering the macro environment we find ourselves in today.

Opendoor Q3 2022 Shareholder Letter

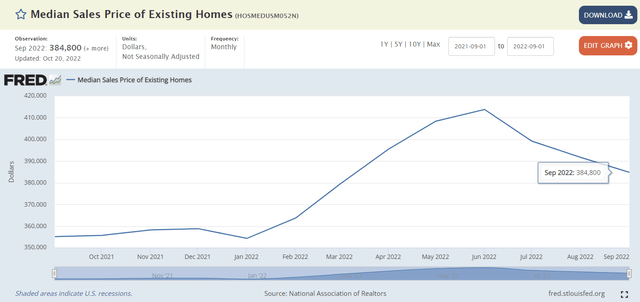

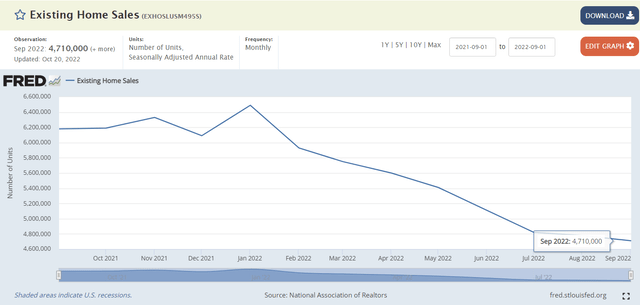

In the aftermath of COVID, global central banks ushered in an era of free money, which led to a significant jump in risk asset prices, and the residential real estate market has experienced an incredible bounce since 2020. As mortgage rates have soared this year, buyer affordability has eroded, and naturally, consumer demand for homes has sunk lower. The housing supply remains constrained, but the sheer lack of buyers could force the value of homes lower. On top of price contraction in the housing market, we are also seeing a decline in the number of “Existing Home Sales”.

The trend for home prices and existing home sales are very much negative, and I think more pain lies ahead for Opendoor from a macro perspective.

Assessing Opendoor’s Liquidity Situation

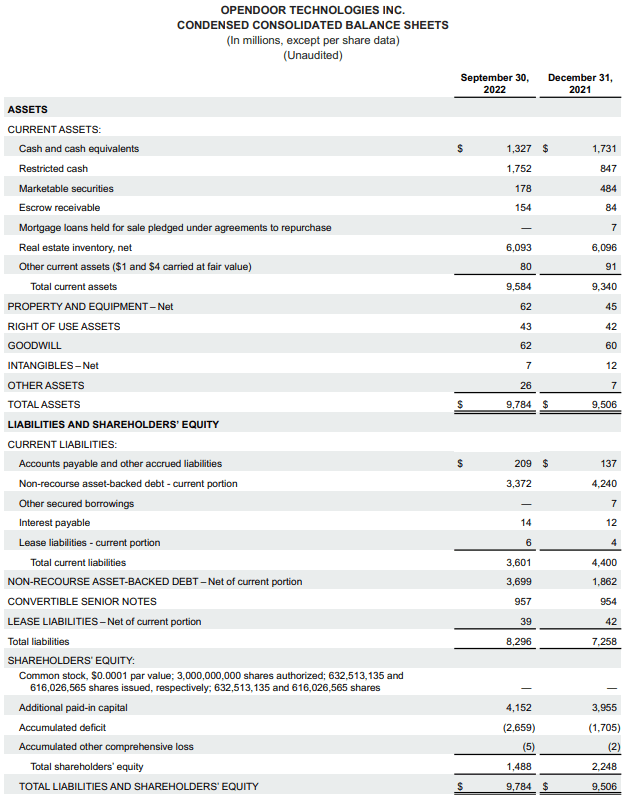

In Q3, Opendoor burned through a big chunk of its cash reserves as transactional losses mounted, and as of now, Opendoor holds roughly ~$1.5B in cash and marketable securities. Some critics have pointed to Opendoor’s Q2 cash position of $2.5B to highlight how quickly Opendoor could lose the remaining capital. However, I see a big step up in “restricted cash” as Opendoor is now carrying $1.5B of equity in homes ($349M of which is in unlevered homes). As per management’s commentary on the earnings call, the unlevered homes will soon be securitized under new financing arrangements, and this should free up more cash for the business.

Opendoor Q3 2022 Shareholder Letter

With a total cash (unrestricted + restricted) position of ~$3B, I continue to believe that Opendoor has ample liquidity to ride through this housing downturn. The business outlook for Opendoor remains uncertain; however, the cash burn should top out in Q4 at ~$400-500M and get smaller in H1 2023. In the case of Opendoor, I think the book value (assets -liabilities) may have another hit or two coming up in the next two to three quarters, but it is hard to imagine book value falling much lower than $500-700M. Overall, I am a little concerned about the impact of future home price declines on Opendoor’s balance sheet, but I think there’s ample liquidity (and committed financing) to get Opendoor to the other end of this vicious downturn in one piece.

Opendoor’s Fair Value And Expected Return

For 2022, I am still projecting Opendoor to achieve ~$15B in revenue, with housing demand likely to moderate further in Q4 as consumers adjust to elevated mortgage rates (~6-8%) and reduced home prices. With housing supply still being constrained, I expect home price declines from here to be a slow burn lower (similar to what we saw during the Great Financial Crisis). Although Opendoor’s contribution margins are likely to stay under pressure in Q4 through to the first half of 2023 (as the iBuyer resets its inventory), I now expect the cash burn to peak in Q4 at ~$400-500M. In a bear market, Opendoor’s value proposition improves significantly for sellers, and Opendoor could realistically charge a higher spread in a buyer’s market (bear market). We saw evidence of this business model feature in Opendoor’s Q3 results, where real-seller conversion rates came in at 10-15% (down from 30%+) despite Opendoor raising spreads very significantly.

Over the long run, Opendoor’s transaction spread (difference between buy and sell price) should stabilize in the ~3-5% range. As we know, Opendoor charges a service fee of 5% to sellers. Furthermore, I believe that Opendoor could generate another ~3-5% margins from the sale of ancillary services (financing, moving, insurance, warranty, renovations, etc.) to buyers. Overall, Opendoor can end up generating ~10-15% in gross margins at the unit level in its 1P business. At scale, Opendoor aims to get its Operating Expenses down to ~3% and Interest, D&A, and Tax expenses down to ~2%. I believe these targets are achievable.

The unit economics and volume outlook for Opendoor’s 3P marketplace (Exclusives) are not yet clear, but we do know that sellers fee will still be ~5%. In my opinion, Opendoor can also generate additional fees of ~3-5% from buyers in the long run. And if Opendoor can build an advertising & discovery business on top of its platform (like Zillow), then margins could go even higher. If Opendoor Exclusives succeeds, the sky is the limit for Opendoor in terms of scalability; after all, residential real estate in the US alone is a $1.9T addressable market opportunity.

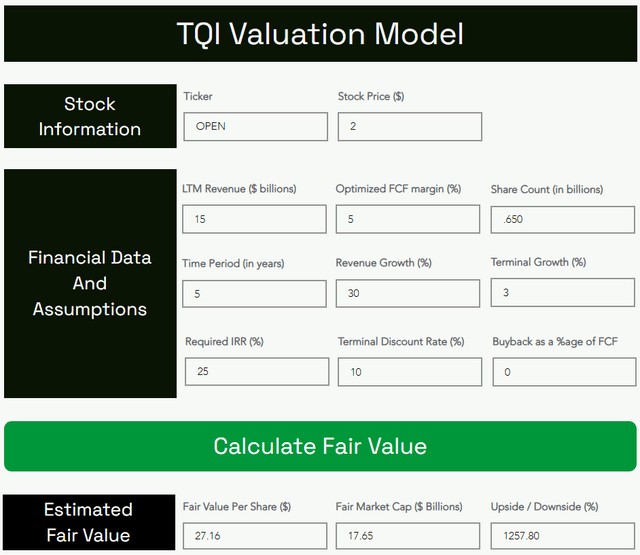

In a nutshell, I continue to believe that Opendoor’s free cash flow margins could reach ~6-10% at maturity. To implement a margin of safety, I chose an optimized FCF margin of ~5% in my valuation model for the company. Despite a downturn in housing, I think Opendoor (and iBuying) is still at a nascent stage, and this means Opendoor could grow through this downturn. Therefore, I am maintaining my 5-yr CAGR revenue growth forecast at 30%. Please note that Opendoor Exclusives (3P marketplace) will likely create a significant impact on the bottom line, but little impact on the top line.

Under TQI’s required IRR [discount rate] of 25% (for moonshot growth investments), Opendoor’s fair value came out to be ~$17.7B (i.e., $27.16 per share). With the stock trading at $1.72, it is currently trading at a significant discount to its fair value. Mr. Market has no faith in the iBuying business model, and Opendoor’s depressed valuation is a reflection of widespread FUD.

TQI Valuation Model (TQIG.org)

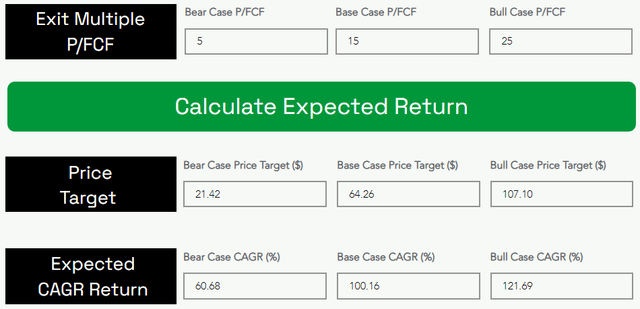

In a base case scenario, I expect Opendoor to trade at ~15x P/FCF (optimized FCF) at the end of 2027, which would be equivalent to ~0.75x 2027 P/S ratio based on my forward revenue projections shared above.

TQI Valuation Model (TQIG.org)

With these assumptions, I see Opendoor trading at ~$42B in market cap ($64 per share) by the end of 2027 [~35-40x current levels], which would translate to an expected CAGR return of ~100%+ over the next five years.

Final Thoughts

Opendoor is building the way future generations will transact real estate 10, 20, and 50 years from now. And the official launch of Opendoor Exclusives is a key milestone for the iBuying pioneer. In the long run, this shift from a 1P to the 1P-3P hybrid model will reduce the capital risk for Opendoor whilst increasing scalability and improving the margin profile. Opendoor’s iBuying rivals are folding up in a hurry, and it could emerge as a monopolistic platform by the end of this ongoing downturn in housing markets.

Due to the rapid reversal in housing markets since May 2022, Opendoor’s top and bottom line performance weakened significantly in Q3. With home prices still in decline, Opendoor’s financial performance is likely to deteriorate further in Q4; however, most of the bad news has already been reported in Q3 (in the form of a massive inventory writedown). While Opendoor’s cash flows are set to bottom out next quarter, I think Opendoor will not return to positive operational cash flows until H2 2023. Given the uncertain macro environment, Opendoor’s stock may continue to remain under pressure in the near to medium term. That said, at less than a $1:$1 valuation (less than book value), Opendoor is a once-in-a-lifetime investment opportunity!

As we saw in this note today, Opendoor has ample liquidity (~$3B) to survive through this downturn. Now, I understand that a rapid 20-30% crash in house prices can wipe out Opendoor’s book value; however, going forward, I expect the reset (or correction) in housing to be a slow burn lower. As a market maker, Opendoor has widened its offer spreads significantly in Q3, and it is still getting sellers (real seller conversion rate of 10-15% in this quarter). Opendoor is currently undergoing an inventory reset, and once that is completed by Q2 2023, I see Opendoor returning to positive contribution margins (and cash flow breakeven). Investors may need to remain patient in this counter over coming months and endure volatility. Opendoor is not a stock for the faint-hearted! Therefore, I suggest accumulation via DCA plans and proactive risk management through option-based hedging strategies.

Key Takeaway: I rate Opendoor a generational buy at ~$1.7 per share.

Thanks for reading, and happy investing. Please share your thoughts, questions, or concerns in the comments section below.

Be the first to comment