PonyWang/E+ via Getty Images

When I came across Onto Innovation (NYSE:ONTO), I liked the setup of this company. Onto Innovation is a company with a market capitalisation of $3 billion, with the ability to generate free cash flows and profits while still growing faster than the market.

Investment thesis

I am of the opinion that Onto Innovation is a hidden gem in the semiconductor space that has a long runway to go. My investment thesis for the company is as follows:

Onto Innovation is a leading player and one of the top 16 wafer fab equipment companies in the world. It has a diversified revenue mix that spans across the entire value chain, providing its customers with an end-to-end solution and the value add that they need. Also, Onto Innovation has a strong customer base with the most established semiconductor companies as its largest customers. In addition, the company is riding on the secular growth tailwinds that is benefiting the wafer fab equipment industry while growing at a faster pace than the industry average. Lastly, the company is generating positive free cash flows and positive earnings, producing sustainable growth for its shareholders.

Overview

Onto Innovation designs and manufactures process control tools that are used by semiconductor wafer fabricators and advanced packaging manufacturers and is regarded as a leader in this market. The company’s products are also used in other high technology markets like the manufacturing of LED, RF filters and modules, as well as other industrial and scientific applications.

The way Onto Innovation provides value add to customers is to reduce the time needed for its customers to bring to market their new products and devices, while also aiming to reduce scrap costs. As such, it is key for Onto Innovation’s products to bring critical yield-enhancing and actionable information that can be used by customers, and also include solutions for customers to enhance productivity and increase cost reductions.

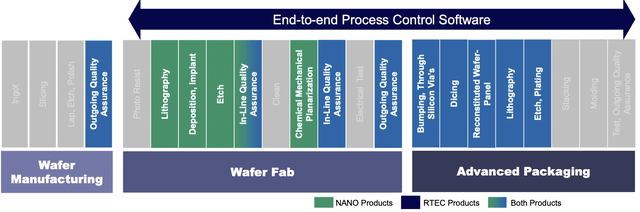

Onto Innovation was the result of a merger in 2019 between Nanometrics and Rudolph Technologies. The merger resulted in the merged entity, Onto Innovation, being in the top 16 wafer fab equipment suppliers and enable the company to benefit from improved scale as well as highly complementary product portfolio. The merged entity had a fuller end to end process control solution ranging from wafer manufacturing, to wafer fab and finally to advanced packaging.

Onto Innovation end to end solutions after merger (Onto Innovation merger slides)

Diversified revenue mix

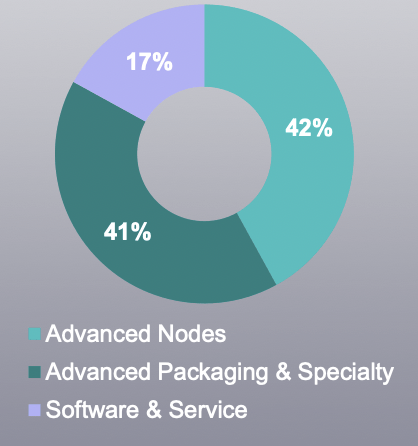

Onto Innovation’s revenue mix comprises of 3 segments: Advanced nodes, Advanced packaging and specialty and software and service.

Advanced nodes makes up 42% of revenues. In the world of integrated circuits, there is a large demand by Onto Innovation’s customers to be able to continue to shrink the size of their transistors and other features. Taiwan Semiconductor Manufacturing Co. (TSM) is the first company able to produce 3 nanometers chips and is expected to begin production later in 2022. As such, Onto Innovation’s products enable its customers to increase the overall performance of their chips without increasing the size, and also considering many other aspects like power efficiency, manufacturing yield, logic processing capability and data storage volume, amongst others. As these customers continue to improve performance through shrinking of nodes, they are using new materials and methods in high volume manufacturing and Onto Innovation’s management believes that this will increase the demand for its own Atlas product line which has the capability to measure these advanced nodes as they continue to shrink from 7nm to 3nm. Furthermore, as new methods like extreme ultra-violet (EUV) lithography are increasingly used, they also have stricter requirements like requiring no contamination. As such, Onto Innovation’s NovusEdge inspection tool is used by major silicon wafer manufacturers to detect any contamination or edge cracking. This provides customers with an assurance as a final quality control procedure before they are then shipped.

Advanced packaging makes up 41% of Onto Innovation’s revenue mix. This segment provides customers with products that enables its customers to pack more functions into a relatively smaller space and essentially to package the chip much better so that there are more functions and better performance in a package. Onto Innovations products in the advanced packaging segment aims to innovate and respond quickly to the fast changing demands of its customers. This includes the JetStep X500 lithography system which is able to process newer packaging methods, as well as the Firefly series, which allows for high resolution inspection.

Lastly, Onto Innovation’s software and service mix makes up 17% of its revenues. This includes process control software as well as yield management software. Process control software is used to detect or predict faults and used to increase the capacity and yield for its customers while attempting to reduce scrap. All in all, this helps to improve the productivity as well as its profitability for its customers. Yield management software is used by customers to retrieve important information on their process yield as well as their productivity of the equipment used. This large amount of data can then also be analysed to attempt to increase productivity across the value chain.

1Q22 Onto Innovation revenue mix (Onto Innovation investor presentation)

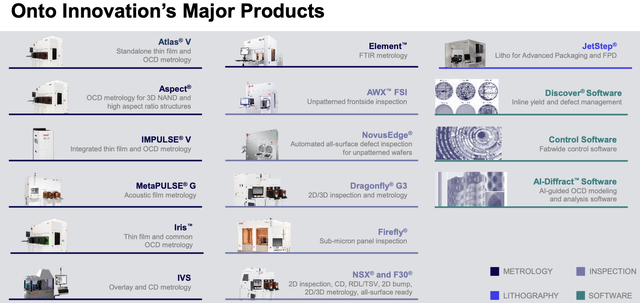

Onto Innovation’s major products are listed below, ranging from metrology, inspection, to lithography and software. These products enable Onto Innovation to provide end to end solutions for its customers, thereby enhancing its value proposition to its customers.

Onto Innovation’s major products (Investor presentation)

Secular growth drivers

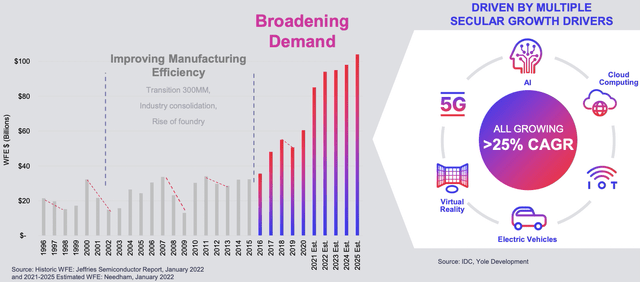

The general wafer fab equipment market is expected to see increasing demand from now till 2025, driven by multiple secular growth drivers that are all expected to grow by more than 25% CAGR. These drivers includes cloud computing, artificial intelligence, electric vehicles and 5G.

Secular growth drivers (Investor day)

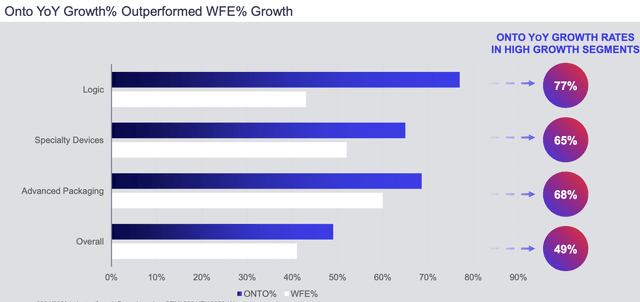

Apart from leveraging on the strong demand for wafer fab equipment in the industry, Onto Innovation is also outperforming the industry growth rate. Looking at multiple high growth segments below, Onto Innovation is growing at a faster pace than the average in the industry and this leads to higher growth overall compared to the industry average.

Onto Innovation’s growth outperformance (Investor day slides)

In fact, in the recent 1Q22 earnings call, the company announced that they saw an increase in the volume purchase agreements with some of its top semiconductor manufacturers that resulted in more than $390 million in agreements closed for 2022 across front and back end applications as well as inspection and metrology segments. This newly announced agreement results in a 40% year on year increase and exceeded management’s expectations for wafer fab equipment growth by 2 times.

Strong customer base

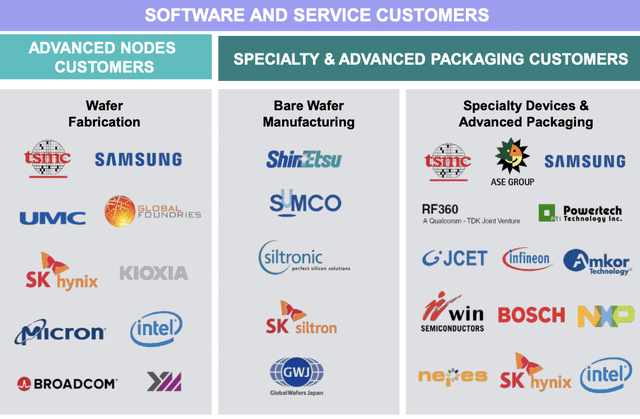

While Onto Innovation has more than 200 customers that purchased its equipment or software, I think that it is interesting to note the quality of its customer base. First, based on the latest end December 2021 annual report, Taiwan Semiconductor Manufacturing Co or TSMC has been its largest customer for some time now, representing more than 10% of revenues. In addition, another large customer is Samsung Electronics (OTC:SSNLF), which has contributed to more than 10% of revenues since 2020. Another major customer is SK Hynix, which accounted for more than 10% of Onto Innovation’s revenues in 2019, but since 2020, it has contributed less than 10% of Onto Innovation’s revenues but likely still significant.

Secondly, apart from its major customers, we can see below that Onto Innovation has a wide range of customers across the value chain. This includes advanced nodes customers like TSMC, Samsung, Micron (MU), and Intel (INTC), amongst others, as well as specialty and advanced packaging customers like Infineon (OTCQX:IFNNY) and Shin-Etsu.

Onto customer mix (Investor presentation)

Solid financials

I think that Onto Innovation’s financials illustrate the management’s capabilities in ensuring sustainable growth.

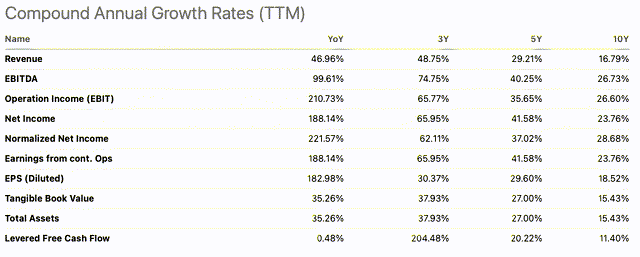

As can be seen below, we have seen revenue growth accelerate in the past 3 years with 49% CAGR over the 3-year period compared to the 10-year CAGR of 17% revenue growth. At the same time, we see EBITDA and EPS growth accelerate as well with their 3-year CAGR at 75% and 30%, respectively.

Onto Innovation financials growth rates (Seeking Alpha)

Onto Innovation also has a strong profitability and cash flow profile. Gross margins improved from 44% in 2019 to 54% in 2021, while EBITDA margins increased from 5% in 2019 to 29% in 2021. Conversely, net income margins also improved from 0.62% in 2019 to 18% in 2021. Returns on equity also improved from 0.24% in 2019 to 11% in 2021. The company is also free cash flow positive, with growth in free cash flows from $11 million in 2019 to $163 million in 2021. This translates to free cash flow yield of 3% in 2021, up from 1% in 2019.

Onto Innovation also has a clean balance sheet. With more than $500 million in cash and marketable securities compared to the $13 million in debt, the company has a net cash position of $497 million and this translates to net cash to equity ratio of 35%.

Valuation

Onto Innovation is currently trading at 14x 2022F P/E while EPS is growing at 34%. The company has a 5-year historical P/E of about 25x. Based on my forecasted 2023F EPS of $5.70 and assuming a P/E of 20x, my price target for Onto Innovation is $114, implying 60% upside from current levels.

Risks

Supply chain issues

Challenges in the supply chain may bring about unexpected downside risks if they remain unresolved in the second half of the year. Due to higher logistics costs as well as global supply chain problems, this brings about 2 kinds of impact to Onto Innovation. Firstly, the disruptions in supply chain results in disruptions in the company’s production schedule, and this in turn leads to lower than expected deliveries for the year. Secondly, it is becoming more expensive to navigate through this current supply chain situation and this has a direct pressure on costs and eventually impacts gross margins.

That said, the company has put in place hedges to ensure that its production remains on track. One of these hedges highlighted in the 1Q22 call was that they have accelerated the deliveries of inventories to ensure that the company is moving ahead of the curve if supply chain disruptions were to persist. In addition, I would add that supply chain issues are faced not only by Onto Innovation but by the entire industry in general.

Inflation and rising cost pressures

If inflation were to continue to persist, the company may face increasing cost pressures. For Onto Innovation, commodity price increases and rising logistics costs as well as freight costs are causing pressure on the company’s margins.

Onto Innovation is looking to address this by lowering their discretionary spending to alleviate some of this cost pressure, but if this high inflation environment persists, there could be additional downside risks for the company.

Industry competition

The semiconductor industry is a very competitive industry and Onto Innovation operates in markets with competitors with deep pockets that are continuously improving their products. As such, there is a risk that these competitors may develop a new product that is superior to that of the company, thereby causing Onto Innovation to lose its market position. It is important for Onto Innovation to continue to innovate and develop new products that adds value to its customers in order to maintain its competitive position.

Cyclicality of the semiconductor industry

In the past, there were periods of cyclicality that impacted Onto Innovation negatively. As a result, if the global economy worsens or if the semiconductor industry experiences a downturn, Onto Innovation could see lowered demand for its products. In addition, the company needs to adapt to changing macro environment as well as changes in the cycle of the industry to continue to operate in both good and bad times.

Conclusion

I think that Onto Innovation is a hidden gem in the semiconductor world that has a long runway to go. As elaborated earlier in the article, the company has a strong customer base with the most established semiconductor companies as its largest customers. In addition, the company is riding on the secular growth tailwinds that is benefiting the wafer fab equipment industry while growing at a faster pace than the industry average. Lastly, the company is generating positive free cash flows and positive earnings, producing sustainable growth for its shareholders. As such, I initiate Onto Innovation with a buy rating and my price target for the company is $114, implying 60% upside from current levels.

Be the first to comment