The Good Brigade/DigitalVision via Getty Images

Acquisition Of Ocean Bio-Chem

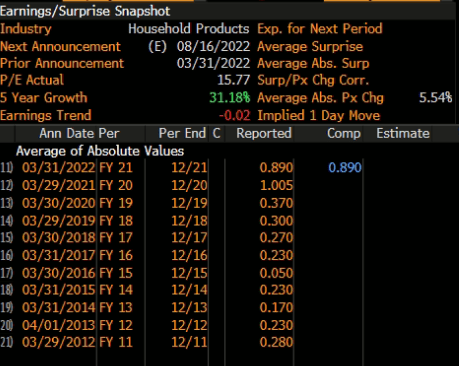

This week, OneWater Marine (NASDAQ:ONEW) announced the acquisition of Ocean Bio-Chem (OBCI), a NASDAQ-listed company that “supplies and distributes appearance, cleaning and maintenance products for the marine, automotive, powersports, recreational vehicles, powersports, and outdoor power equipment markets”. Valuing Ocean Bio-Chem at $13.08/share [121% premium to its closing price the day before the acquisition], this transaction is valued at $125mn, which will be paid in cash. This transaction in our opinion is positive as it builds on the company’s strategy of doing M&A in the space of spare parts. This will help OneWater Marine diversify its revenue stream, mitigate economic cyclicality and generate growth. The company also sees the potential to increase its margins after this transaction. Over the last 5 years, Ocean Bio-Chem has demonstrated strong EPS results, which has demonstrated a CAGR of 31%. Operating margins for Ocean Bio-Chem were similar to that of OneWater in 2021.

Bloomberg

While OneWater Marine’s stock has corrected sharply in the last few months [down about 45% since its December 2021 high] on fears of a recession impacting boat demand, we feel that the current stock price more than discounts this. Trading at just 3.9x 2022 P/E, OneWater’s stock price is extremely cheap. We are also in the process of revising our model following this acquisition. Our target price for the stock is $81, which is based on a 9x FY09/22 P/E. This represents 134% upside potential.

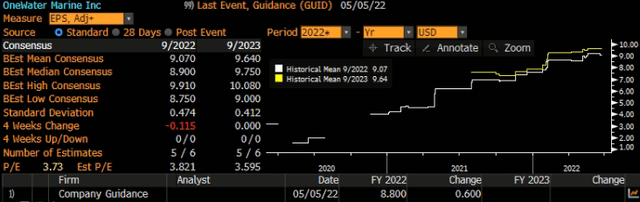

Rising EPS Estimates, Strong Growth

OneWater Marine has seen analyst EPS estimates rise over the last few quarters as demonstrated in the image below. This is on the back of strong EPS growth that the company has been reporting. In addition, management has also been increasing its EPS guidance consecutively for the last 2 quarters. EPS guidance for FY09/2022 now stands at $8.60 – $9.00, up from $7.20 – $7.50 that the company had initially guided for at the end of FY09/2021. Demand growth for boats has been robust in the last few months and isn’t showing any slowdown. In 2Q FY09/2022 OneWater Marine reported a solid set of results with revenue up 34.1% YoY, EBITDA grew 64.1% YoY and net income increased 38.4% YoY. This underscores our point of the company being able to generate strong financial results. In addition, OneWater Marine has also announced that it will repurchase up to $50mn of stock [9% of shares outstanding].

Conclusion

We like OneWater Marine for its ability to grow through acquisitions, diversifying revenue streams, cheap valuations, and stock buyback program. The company’s recent acquisition solidifies its move towards higher margin products that will help the company diversify its revenues and balance cyclicality. Trading at a P/E of just 3.9x on our FY09/22 EPS estimate, the fears over the stock are more than priced in and this looks like an attractive entry point for long-term investors. We estimate that upside for the stock can be 134% to a target price of $81.

Check out our Subscription Service, Unique Value and Dividends, which helps investors invest in unique “deep value” stocks and interact with us directly.

What investors can expect:

- Weekly Articles on unique under-covered stocks

- High dividends, low P/Es, high FCF, high net cash

- 3-year IS/CF/BS forecasts on most of our stocks

- Provide compelling entry points, many U-shaped charts

- Access to our “actionable, new money buy now” ~25 stock portfolio

- Stocks with multiple clear catalysts to unlock value

- Real-time Earnings Analysis

- Regular Newsletters with insights on our stock portfolio

- 12-year track record servicing some of world’s largest HF/MF

Be the first to comment