rarrarorro/iStock via Getty Images

OneSpan (NASDAQ:OSPN) is a software developer concentrated on authentication solutions with worldwide operations.

After a proxy contest, the company got a renovated management team that presented a strategic plan in May 2022. The plan consists in milking its hardware and software license segments (making up about 80% of revenue), in order to finance a cloud-based segment geared towards high-value transactions with corporate clients.

The plan is still in its infancy and it is still too early to judge management effectiveness. However, in my opinion, for that same reason, the company is too expensive. OSPN is not generating operating earnings not even when eliminating restructuring and one time charges. It currently trades at a 25 multiple to EBITDA and a 10 multiple of EBITR&D. Those multiples, for a company that has yet to prove its capacity to grow, seem elevated in the current context.

Note: Unless otherwise stated, all information has been obtained from OSPN’s filings with the SEC.

Company overview

For a more detailed description of the company’s history, operations and industry, please visit my initiation coverage published in June.

As a summary, OSPN is an ex-growth company, in a competitive industry, that announced a change of management and a “new” strategy in May.

OSPN is a developer of authentication solutions. These are either software or hardware pieces that allow companies to authenticate employees and customers. Examples include hardware key-generators, or algorithms for identity verification.

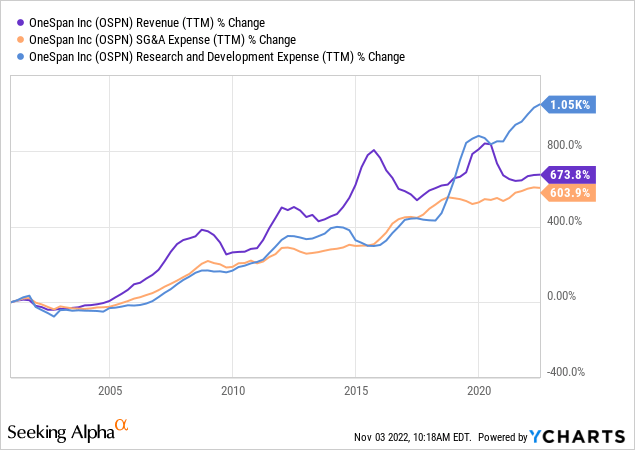

The company had been relatively slow to move from the license-based model in software until about a decade ago into the cloud-based SaaS model that is now prevalent. Maybe for this reason, what was a growing company until the mid 2010s started slowing down, while operating expenses continued to grow.

This loss of efficiency and lack of growth mobilized activist investors into a proxy battle after which they obtained control of the company’s management. In May 2022 they announced a new strategic plan. According to the company, they will use the current license and hardware based segments to finance a cloud based segment. This cloud based segment will concentrate on high-value transactions in the financial, healthcare, government and related industries.

The “new” strategy does not sound too novel. Company’s documents from before the managerial change already recognized the transition towards cloud and recurring revenue models, and that high-value transactions in the corporate and government world could be more profitable than SMB customers. In my opinion however, novelty is not important. A great plan is nothing without implementation, and even if the new management does not have a revolutionary plan, it could succeed by implementing it better than its predecessors.

From a competitive perspective, OSPN is in a complicated position. The company is trying to enter a new market, where competition is fierce. It is trying to sell to corporations that have bargaining power. Finally, its most important resources, developers and salespeople, generally have high compensation. A complicated competitive landscape means that OSPN is by no means guaranteed to succeed in its attempt to generate a new market.

Finally, OSPN counts with interesting cash reserves of $100 million to implement changes, and has no debt whatsoever that could complicate its situation if improvements took longer than estimated. The company has used some of that money to repurchase shares, $6 million in 9M22, but management has also commented that it will have a conservative approach to using those cash reserves.

Latest quarters show no great changes yet

With the new management announcing its strategic plan in May, two quarters have been published already showing the first results of implementation.

Unfortunately, most of those results are actually increased expenses in the form of asset impairment and severance payments. These (hopefully) one-time charges may lead the reader to believe that business fundamentals have deteriorated when they actually have not.

It seems that management has concentrated on reducing R&D expenses, probably in the license based segment, while incrementing selling expenditure, again probably in the cloud based segment. I say probably because OSPN started reporting operating income figures for its segments (something the previous management did not), but does not report detailed expenses by segment. Management has also commented that it plans to double the number of salespeople on the company by the end of 2023.

All in all, when removing one-time charges related to severance and impairment, OSPN generated a $0 operating profit in 3Q22, against a $2 million operating loss one year ago and a $4 million operating loss in 2Q22 (again after adjusting for one-time expenses). However, most of that improvement can be attributed to reductions in R&D, which is the easier but maybe less sustainable way of improving profitability.

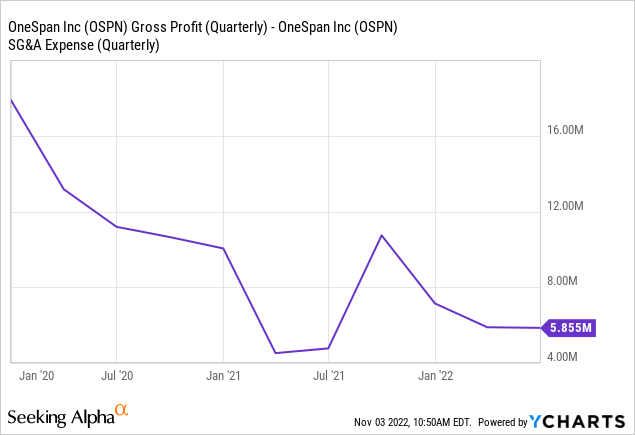

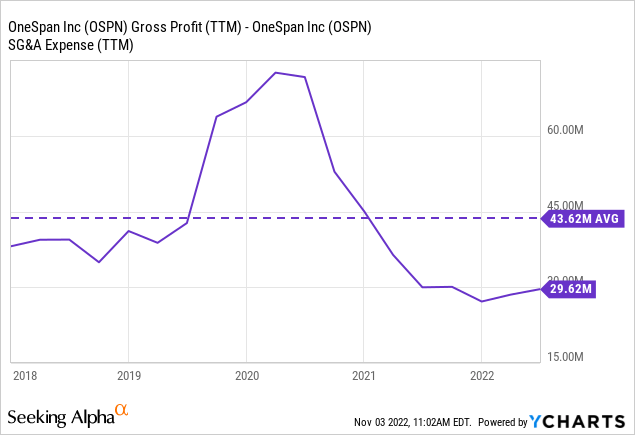

In my previous article, I commented that one way of judging OSPN is its capacity of financing R&D expenditure. I proxy that capacity below as gross profit minus SG&A expenses, given that OSPN has no debts and relatively low depreciation. Readers can observe that it has not improved, albeit it has not deteriorated substantially either. The calculation below does not include one-time charges and therefore is not affected by recent restructuring charges.

The problem is not fundamentals, is valuation

There is not a lot to comment on OSPN yet, but its valuation seems absolutely excessive in the short term. With established technology giants like Meta (META) or Google (GOOG) (GOOGL) trading below a P/E ratio of 20, or even 10, why pay 25 times EBITDA for a company that has not yet proven its business model?

In my previous article I commented that OSPN’s profitability is probably underestimated by its significant investments in R&D. Before the management change, the company spent almost as much in R&D as in general and administrative. If we consider income before R&D, the company’s current valuation makes a lot more sense. While it is true that OSPN could probably not compete if it eliminated all R&D expenses, it is probable that management will continue curtailing in this area to either increase accounting profitability or to finance a bigger sales operation.

But even considering that, OSPN is still expensive. There is no guarantee that the company will be able to grow and then turn that growth into profitability. There is not even inflation-adjusted top-line growth yet, so the investor is paying purely on the basis of promises.

Be the first to comment