PeopleImages

Shares of OneMain Financial (NYSE:OMF) have lost nearly half of their value over the past year as recession fears have continued to build. As a largely unsecured lender to middle and working-class households, OMF has significant exposure to the economic cycle. My analysis suggests OMF has adequate reserves to continue to generate substantial earnings, though earnings are likely to normalize further. However, given other companies like Capital One (COF) are also trading at very low multiples despite more diversified businesses, OMF does not offer the most compelling risk/return payoff.

OneMain operates at the riskier end of the lending spectrum. Unsecured loans account for about 50% of OMF’s originations with an average loan size of $8,000 and an APR of 28%, enabling an 8-10% loss rate and still being a profitable program. When it secures loans against autos, the average size tends to be higher (over $12k) with a lower rate of about 23% but the loss rate is generally below 6%.

These interest rates are obviously quite high, even higher than on many credit cards. Most of its customers are on the cusp between sub-prime and near-prime, and have on average $55-60,000 in income. Suffice it to say, many of these customers turn to OneMain because they are not able to obtain financing elsewhere. This higher-risk lending provides a necessary service to individuals who may have emergency expenses, but it also means OMF has customers more likely to default than other financial firms have. This would be particularly true in a downturn.

That said, for the time being, OMF’s business is immensely profitable. In the company’s second quarter, it earned $1.68. Adjusting for one-time items, earnings were $1.87, which was down $2.66 a year ago. This decline in earnings was primarily due to the fact the company provisioned $338 million for loan losses up from $208 million a year earlier. Additionally, the yield on its portfolio declined from 24.2% to 23.1% as it tightened underwriting standards and saw a rise in delinquencies. OMF has $20 billion in loan receivables, up 10% from last year. Personal loan originations were $3.9 billion, up 2% from a year ago.

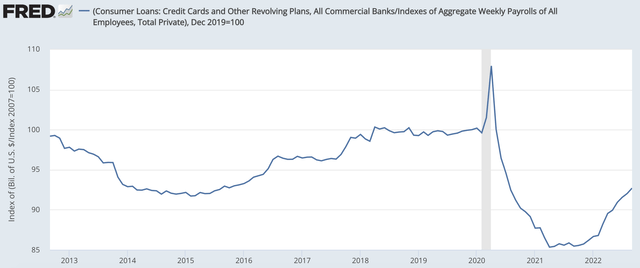

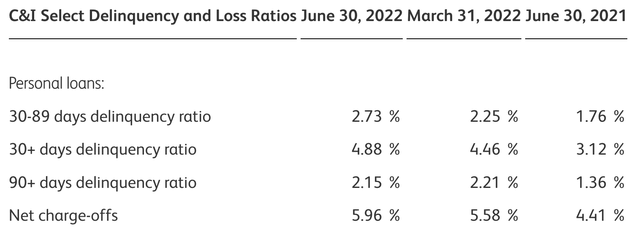

This increase in delinquencies and loan loss reserves are the primary red flags investors are worried about. If we see the economy roll over, there could be a large tick-up in defaults, causing significant losses that erode profits and capital. Indeed, as you can see, delinquencies have been steadily rising over the past year.

I think it is important to have context here. Delinquencies fell significantly in 2020 and 2021 as the government gave out several rounds of checks in the CARES Act and American Rescue Plan. With this cash, consumers were able to pay debt with little issue, but no one expected this to last forever. This is why I like to look at the end of 2019, the 30-89 day delinquency ratio was 2.47%. The 90+ day ratio was 2.11%. The net charge-off ratio was 5.71%. So, delinquencies are now running a bit higher than pre-COVID “normal” levels but not alarmingly so. I would note that other lenders like Capital One and Synchrony (SYF) have delinquencies lower than pre-COVID today. So, stresses are appearing more in OMF’s loan book, which makes sense given their riskier credit quality.

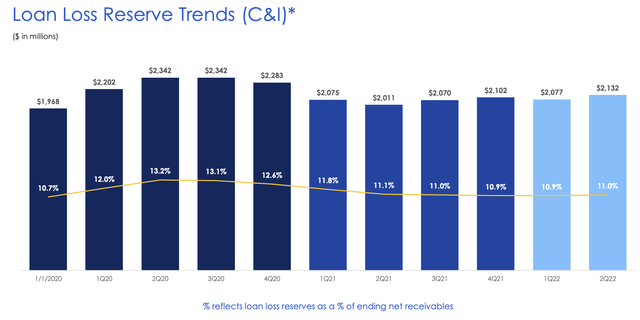

Now, it is important to note that OneMain managed its business always assuming that delinquencies would rise and that 2021 levels were not sustainable-they were essentially a one-time benefit that exaggerated profits. Its loan losses as a share of all reserves are 11%, a bit above the 10.7% it reserved at the end of 2019. This is consistent with delinquencies that are running just slightly above pre-COVID levels. As a consequence, I am less concerned that the $125 million increase in loan provisions is a sign of spiraling higher reserves rather than reflecting this normalization, unless of course we see a significant economic rollover.

Additionally, even as provisions have ticked up, the company’s capital is steady at $3.1 billion as its earnings fully funded the $0.95 dividend and 2.2 million share repurchase. With that capital position, OMF has a 5.6x debt to capital ratio. This compares favorably to the 5.8x at the end of 2019. It also has $375 million of accessible cash and cash equivalents plus $6.5 billion in bank facilities it can tap.

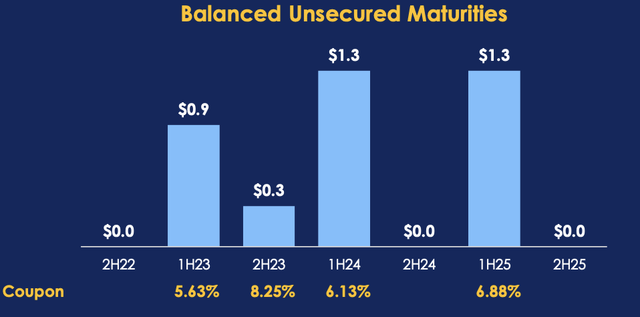

Aside from its higher-risk customer base, there are two additional risks I would highlight. First unlike SYF or COF, OMF does not have a deposit base. It finances itself in financial markets through bank facilities, securitizations, and unsecured bonds. These financing costs rise more quickly than deposits as the Fed raises interest rates, and there are substantial maturities over the next 18 months. Combined with lower asset yields, OMF is at risk of seeing interest margins contract over the next year.

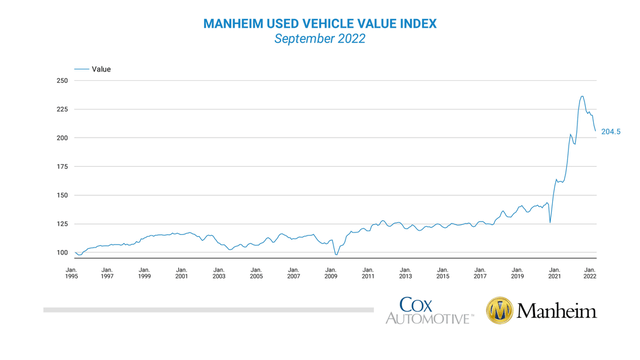

Additionally, when OMF secures its loan against an asset, it typically is a used car, and those prices are now falling. The surge in used car prices in 2020-2021 amid supply chain issues that reduced new car production was another factor that contributed to OMF’s very low loan losses last year. With these prices now falling, this will contribute to further normalization in credit costs. As noted above, I think OMF is reserving for a more normal environment, so this is a manageable risk in my view.

The biggest risk for OMF would be a significant recession. To that end, the fact credit card balances have been rising is often cited as a sign that consumers are feeling stretched and that delinquencies will get worse. In my view, this is not as concerning because it reflects normalization from COVID distortions when fiscal stimulus enabled significant debt paydown. While credit card balances are rising, when you factor in income growth over the past two years, credit card balances actually do not look alarming. They are rising but below pre-COVID levels.

St. Louis Federal Reserve

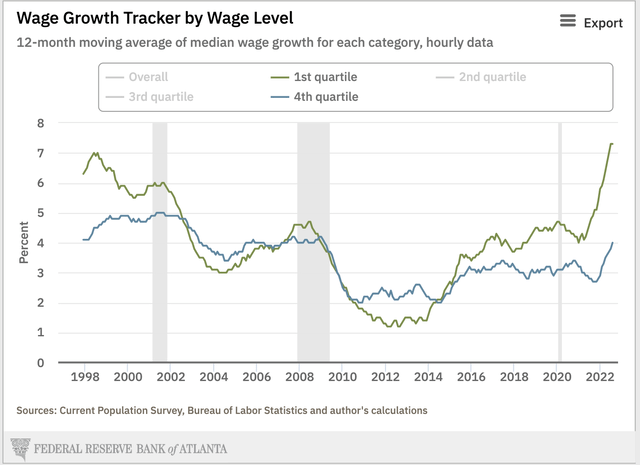

Given OMF tends to service a lower income customer, they may face more pressure from higher inflation. According to the Atlanta Federal Reserve, individuals in the bottom (1st) quartile are seeing the fastest wage growth. This faster income growth should help to offset some of the price pressure and enable consumers to continue servicing their debt.

So, as we think about the company’s earnings power, the most extremely negative outcomes do not seem likely. Arguably though while the stock has fallen a lot, the worst case is not priced in, After all, book value is $24.51, so OMF is still trading at a premium to that, given its elevated earnings. In terms of go forward earnings, for investors who agree with my view we are seeing credit trends normalize rather than steadily deteriorate, I am assuming another 15% increase in run-rate credit provisions, about a $50 million quarterly drag. Given increased financing costs, I am also assuming net interest margins contract another 50bp, a cost of $25 million per quarter.

Holding all else equal, that would give OMF $1.30-$1.45 in quarterly earnings power or about $5.40 for a full year. That gives shares a 5.8x earnings multiple; it also means OMF can sustain its 12% dividend yield. This is a cheap multiple, no doubt, though it is comparable to the 6-6.5x earnings multiple COF and SYF trade at, though both yield less as they direct more of their capital to buybacks rather than dividends.

Given its high cyclicality, OMF will trade at a discount multiple, but if recession fears moderate shares could move to 8x earnings or about $42-45, representing 40% upside. If recession fears worsen, I would expect book value, or about $25, to be a significant level of support. In a vacuum, OMF is a buy, and investors who primarily value dividends or are willing to accept its higher-risk credit profile on OMF’s balance sheet should feel comfortable owning it. I do however think COF and SYF represent better investments as they offer similar earnings multiples, despite higher quality customers and cheaper deposit financing, which is why in my portfolio, I own them over OMF.

Be the first to comment