Kwarkot/iStock via Getty Images

Investment Thesis

One Liberty Properties, Inc. (NYSE:OLP) is a real estate investment trust (REIT) headquartered in New York, United States. In this thesis, I will primarily be analyzing the company’s strong dividend yield and the expansion of its Industrial property portfolio, and its impact on the company’s growth. I will also be analyzing OLP’s performance in the recent quarterly results. I believe that OLP is currently trading at a cheap valuation, and it is a great investment opportunity for investors looking for a stable and high dividend yield.

About OLP

OLP is primarily involved in the purchase, management, and leasing of real estate properties. The company has a diversified property portfolio, including properties from different industries like hospitality, fitness, industrial, entertainment, retail, etc. The company also focuses on the geographical diversification of its property portfolio, with 119 properties spread across 31 states in the United States. The company currently owns 11 million sq ft of real estate spread out across the US. The majority of the company’s properties are leased for a long term, where the tenant is responsible for the real estate taxes, maintenance, repair, and insurance of the properties.

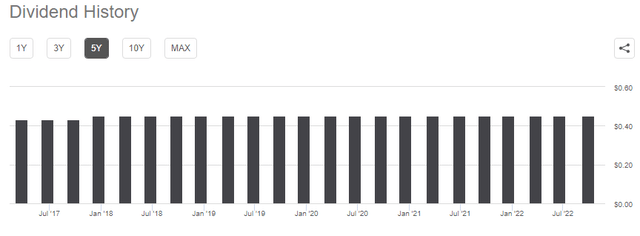

7.5% Dividend Yield

OLP has been consistently paying dividends to its investors, and if we look at the chart above, we will realize that even during the Covid-19 pandemic, the company didn’t cut down on the dividend payout. The company has efficiently maintained its dividend payout growth rate, and the dividend payout has never seen a slump since 2010. OLP is currently paying a quarterly dividend of $0.45, representing an annualized dividend yield of 7.5% at the current share price of $24. Though the company has not seen significant growth in the dividend payout in the past five years, I believe with the current revenue and earnings growth rate that the company is witnessing, we can see an increase in the dividend payout by the end of FY2023.

Now let us have a look at the company’s price history over the past five years. The company saw a significant dip in the share price during the inception of the Covid-19 pandemic, as did most of the companies in the market during that time; however, the company managed to rebound from its five years low of $11.56 and is currently trading at $24, representing around 100% increase. OLP’s stock price has been consolidating in the $30-$22 range since the start of 2022, the speculation in the market in the past six months around the REITs, in general, has resulted in this drop, but I believe this provides a great opportunity for the investors to invest in the stock at a cheaper valuation.

Additional Catalyst

Expanding industrial property portfolio

OLP is focusing on expanding its industrial property portfolio and is continuously acquiring new industrial warehouses and units since the start of 2022. The company recently acquired two industrial warehouses in Northwood, Ohio, for approximately $17.2 million. The two warehouses have an aggregate built-up area of 252,000 sqft built on 18-acre land. To put the purchase in the company’s revenue perspective, let us have a look at the rental income that the company is expecting from this property. The property has a total of seven tenants with 100% occupancy. The current lease agreement provides OLP with an annual base rent of $1.1 million from this property, and the company is expecting it to increase to $1.2 million by 2024. I believe this is a good acquisition by the company with respect to risk exposure and generating positive cash flows. These warehouses are located in the center of the Midwest, where the industrial vacancy rate is below 2%. This provides the company with a risk-averse property generating high rental income. Apart from this acquisition, the company has added two more properties to its industrial property portfolio with an estimated annual base rental income of $1.3 million. I believe the expansion of the industrial property portfolio will help the company in the long term as the industrial properties have higher lease duration compared to other sectors and the higher lease duration provides the companies with a safety cushion during a slowdown in the economy.

Q3 2022 Results

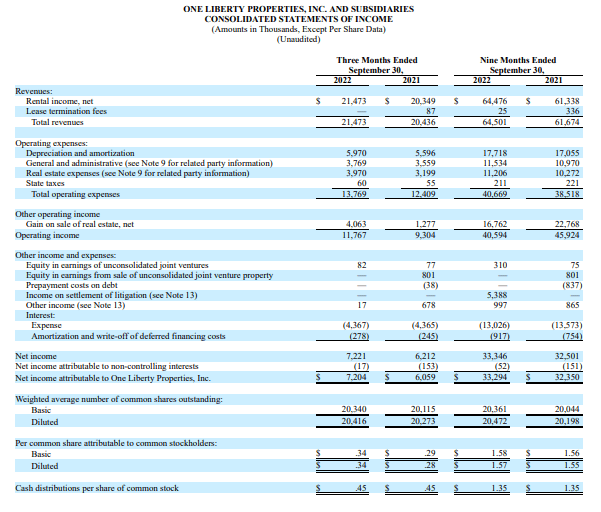

OLP recently announced Q3 2022 results meeting both revenue and earnings expectations. The most interesting part of the results was that the company managed to grow its revenue and net income despite the overall industry facing inflationary headwinds. The company also experienced a 12% increase in the net profit margins. I believe the diversified property portfolio of OLP and strategic sale and purchase of new properties helped it grow despite a slowdown in the economy.

SEC 10-Q OLP

OLP reported total revenue of $21.5 million, a 5% increase compared to $20.5 million in the same quarter last year. As per my analysis, this increase was primarily due to an increase in the rental income from the same store segment of the company. I estimate that the company will maintain this growth rate given the recent acquisitions, which will provide a boost to the revenues. The operating expenses of the company stood at $13.8 million, up 11% compared to $12.4 million in the corresponding quarter last year. I believe the cost related to the acquisition and maintenance of real estate was the main contributor to this increase. OPL reported a net income of $7.2, a significant 20% increase compared to $6 million in the same quarter last year. The gain from real estate sales proved to be a major contributor to this increase. The EPS was reported at $0.34, up 21% compared to Q3 2022.

Patrick J. Callan, Jr., President and Chief Executive Officer, One Liberty, commented,

We are pleased the portfolio demonstrated year-over-year rental income growth, given the challenging economic backdrop of rising interest rates, inflation and volatile markets. In light of these uncertain conditions, we will continue to remain disciplined in acquiring additional properties. While this discipline will slow our ability to grow the business near-term, we believe it is prudent to ensure we are positioned to effectively navigate the evolving landscape.

Key Risk Factor

High dependence on limited tenants: The top five tenants of the company account for 25% of the total rental revenue. Out of these five tenants, only FedEx (FDX) is among the Fortune 500 companies reflecting the operational scale of the tenants. A default by any of the top tenants could have a material impact on the company’s revenues and profit margins. The company is addressing this issue by acquiring new properties and diversifying its portfolio both in terms of geographical as well as tenant diversity.

Quants Rating and Valuation

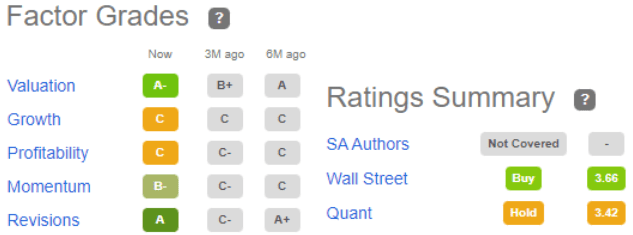

Seeking Alpha

OLP has a Quant rating of Hold, but I believe it can soon change given the increased profit margins of the company coupled with a consistent growth rate. The company has an A- rating in terms of valuation, which I agree with, and this reflects that the company is trading at a cheaper valuation providing a buying opportunity for the investors. The growth and profitability have a C grade which I think will show a considerable improvement in the coming quarters. The Wall Street rating of buy reflects that the analysts are bullish on the stock.

OLP is trading at a share price of $24, a YTD decline of 32%. It has a market cap of $512 million. The company is trading at a forward price/AFFO multiple of 12.40x compared to the industry standard of 15.60x. This reflects the company’s undervaluation in terms of funds from operations in the diversified REITs space. The analysts have an average target price of $26, an 8.4% upside from current price levels. I believe the stock price can witness a 10-15% upside in a 12-month time frame, given its growth factors and undervaluation.

Conclusion

OLP has a strong and steady dividend yield of 7.5% providing investors with a high dividend-yielding stock at a cheap valuation with solid growth prospects. The expansion of the industrial portfolio through recent acquisitions will provide a boost to the company’s earnings and also help the company manage its risks through diversification. I believe OLP provides investors with a favorable risk-reward profile. After considering all the growth and risk factors, I assign a buy recommendation for OLP.

Be the first to comment