JamesBrey

Introduction

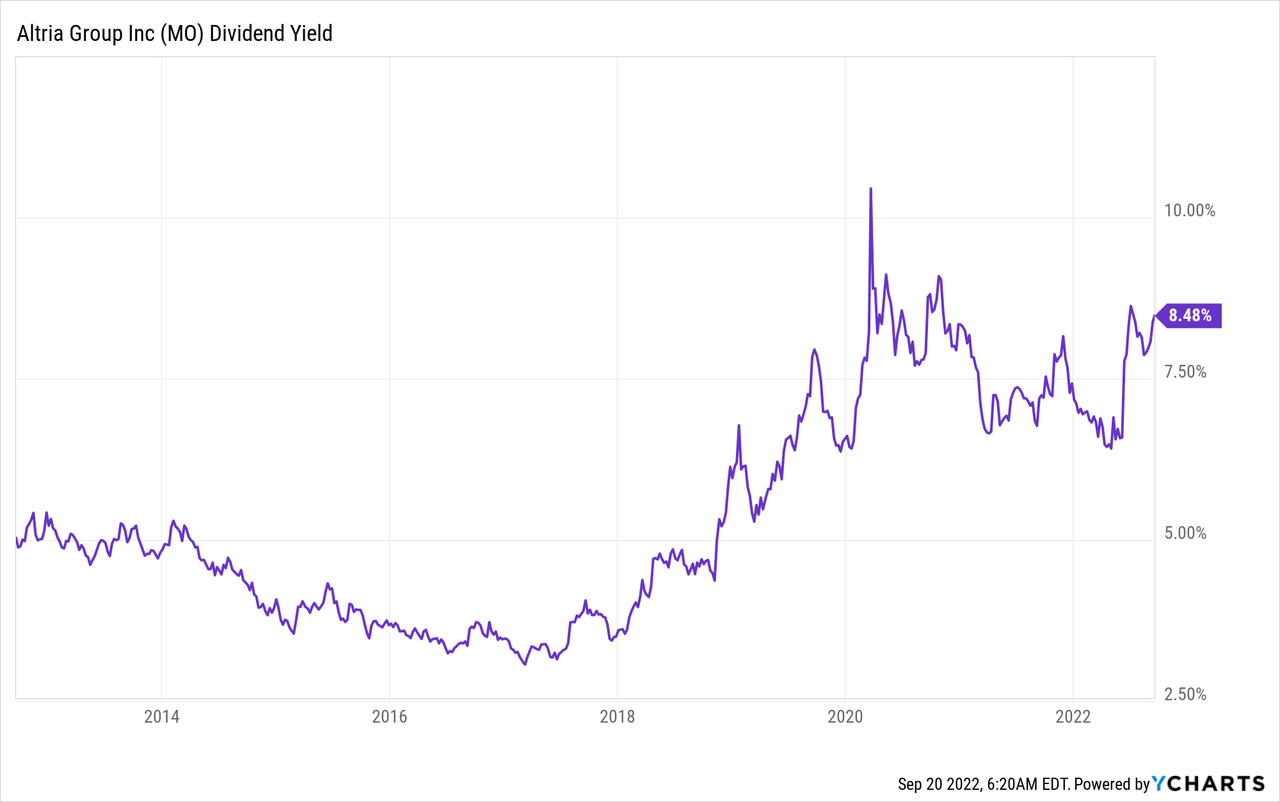

I’m finally going to cover a stock I didn’t expect to cover – probably ever. However, there are good reasons for investors to either own or at least consider buying the cigarette giant Altria Group (NYSE:MO). If we ignore the 2020 pandemic sell-off that caused dividend yields to soar, Altria is by far the highest-yielding stock on my radar. That’s also the reason why I’m covering the company. The market offers opportunities for high-yield investments. Or even more important, it makes investing in high-yield rather important as we’re dealing with a mix of high inflation, increasing economic downside risks, and above-average valuations. This is a call for “equity income”. I believe that Altria is the one to get this job done thanks to its anti-cyclical business model.

In this article, we’re going to take a look beyond the yield and discuss why an investor who’s usually focused on the “growth” part of dividend growth is now interested in high-yielding cigarettes.

So, let’s dive into it, starting with the bigger macro picture!

Buy Me Some Income

While the timing might indicate it, I did not write this article to satisfy the readers I may have made uncomfortable when I wrote that 0.2% yielding Thermo Fisher Scientific (TMO) was one of the best dividend stocks money could buy.

On a side note, I highly recommend you take a look if you want my take on why buying very low dividend growth makes sense.

No, the reason I’m finally covering Altria is that the ongoing market environment does warrant investments in very high-yielding stocks – as long as it’s a quality yield, of course.

The first reason is that income is a great way to benefit from the stock market in times of flat-ish capital returns. A prolonged sideways trend would be bad news for the average low-yielding stock. Hence, while I do invest in a lot of low-yielding dividend growth stocks, I try to keep my average portfolio yield close to 2.5%.

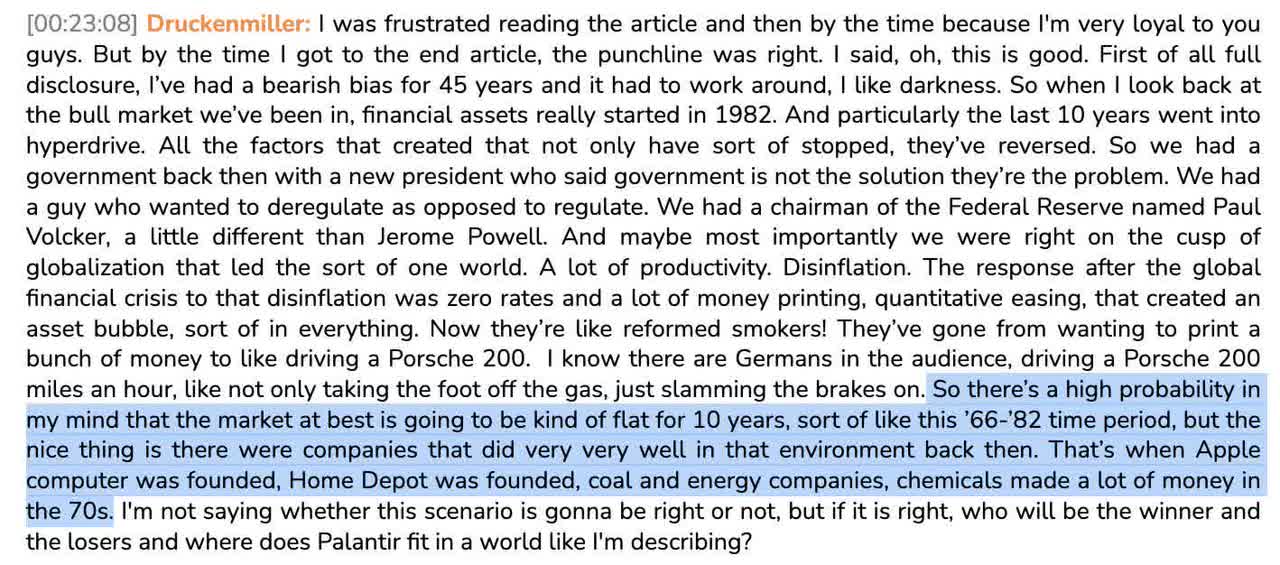

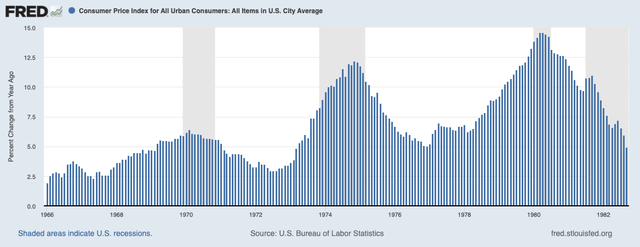

The other day, Stanley Druckenmiller came out saying there’s a high probability that the market remains flat for 10 or more years (see the transcript below, provided by The Transcript on Twitter). Druckenmiller uses the period between 1966 and 1982 as a reference.

The Transcript

This is what that period looked like:

Year-on-year inflation looked like this back then:

In other words, investors were stuck in a prolonged sideways trend with high inflation and high stock market volatility. Needless to say, that’s tough.

What this means is that there are good reasons to emphasize income when making investment decisions in this environment. Especially for income growth-oriented investors like myself.

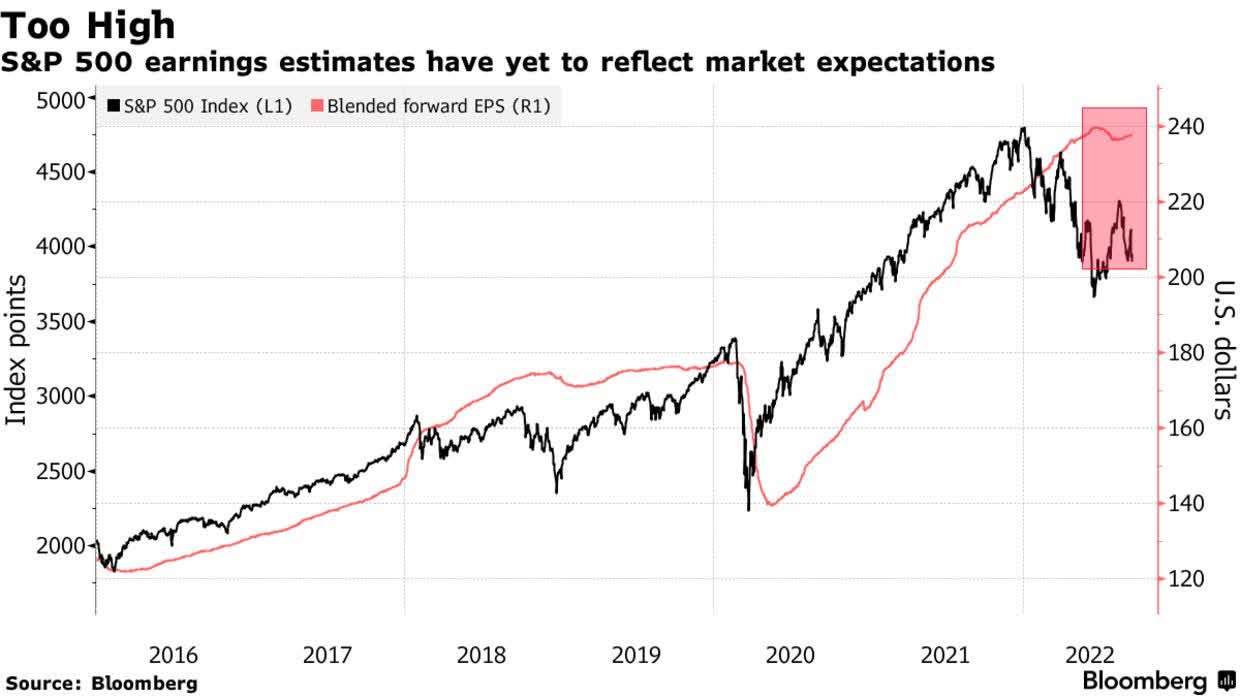

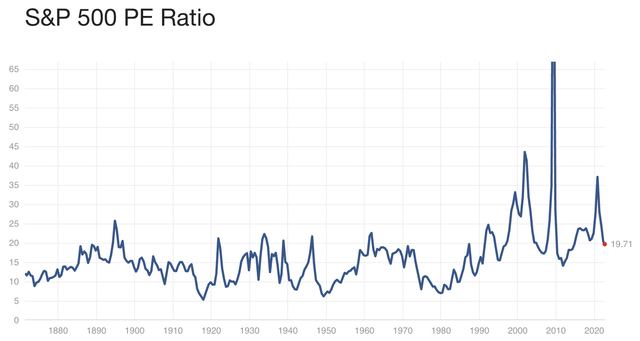

One major reason is a tricky stock market valuation. While the S&P 500 valuation has come down to less than 20x earnings, we’re not necessarily dealing with a “cheap” market.

On the one hand, we have a slowing economy. This is expected to help reduce inflationary risk. On the other hand, it is also expected to hurt the “E” in the P/E ratio – meaning earnings expectations are expected to come down.

The most recent data I have (from September 16, 2022) shows that forward EPS estimates for the S&P 500 are still at all-time highs. If history is any indication, these numbers could come down very soon.

Bloomberg

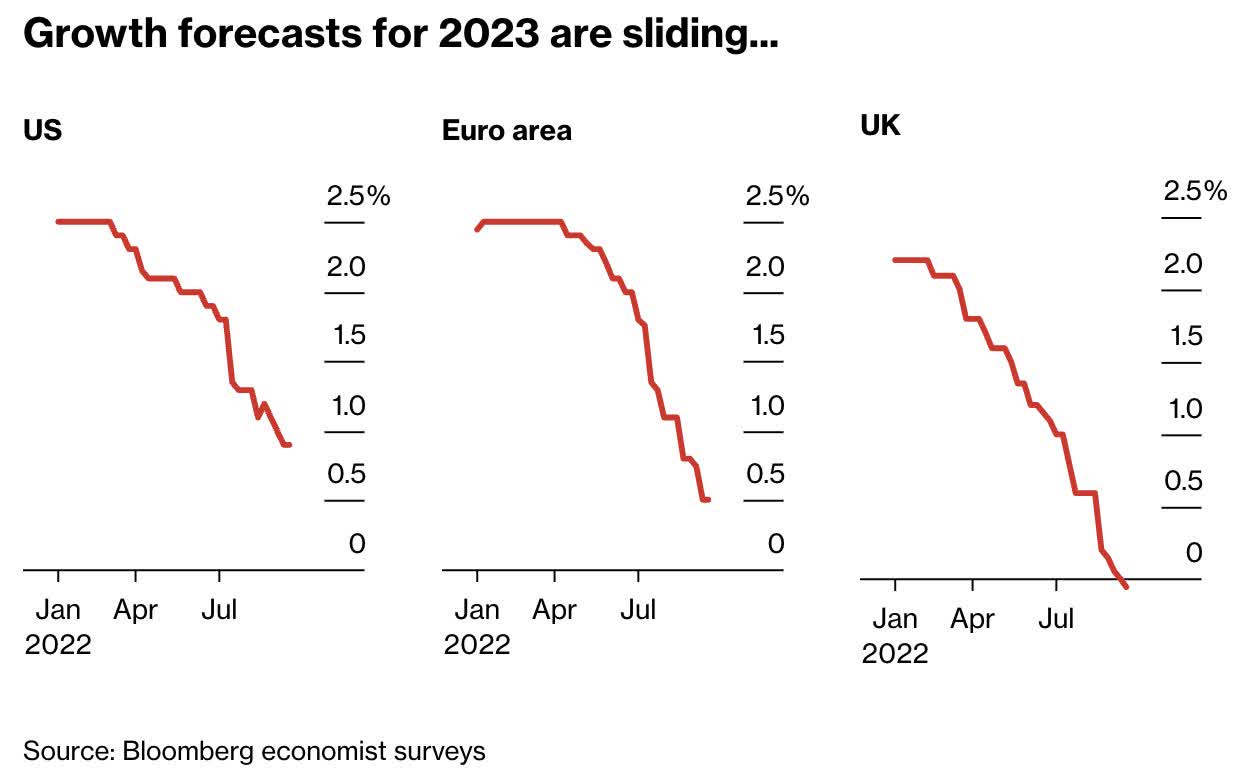

On top of that, we’re dealing with a situation of high inflation, mainly caused by the supply side. In other words, the Fed is now trying to combat high prices in an economic growth-slowing situation. As the Fed cannot impact supply, it is fighting demand. The same goes for major central banks like the European Central Bank, the Bank of England, and the ones in Canada and Australia.

As a result, this is what growth expectations are now looking like for 2023:

Bloomberg

Note that none of the central banks responsible for the regions above are expected to get inflation below 3% at the end of 2023.

That’s the ugly situation we’re in. Slower economic growth, aggressive central banks, and the outlook that it still may not be enough. Let alone the risks of new inflationary waves once demand comes back as I discussed in articles like this one.

In other words, the mix of slower global growth, stubborn inflation, and increasingly tight financial conditions are compelling reasons to allocate money to high-income investments.

Altria Stands For Quality High Income

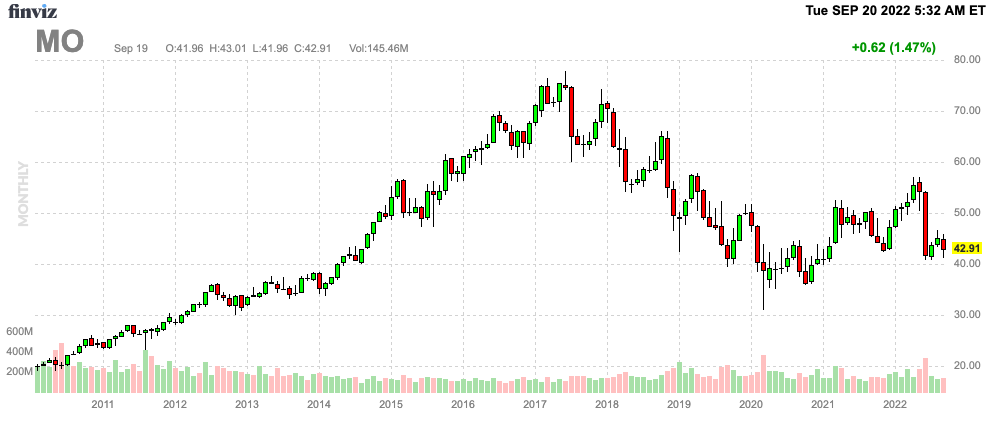

Based on the theoretical framework we just discussed, this is what the Altria stock price did during the high inflationary period between the late 1960s and the early 1980s:

Comparing the chart above to the S&P 500 chart I showed in the first half of this article, we see that Altria not only provided income but also steady (and high) capital gains. It was truly the perfect way to play a similar situation back then.

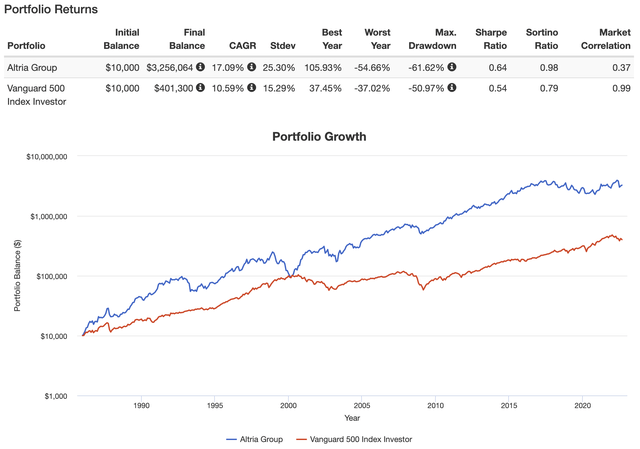

As a matter of fact, going back to 1986 (that’s as far as my data goes back), Altria has returned 17.1% per year, outperforming most tech stocks and high-flying growth stocks, in general. The standard deviation of 25.3% also wasn’t that bad as it allowed the company to beat the market on a volatility-adjusted basis as well (Sharpe/Sortino ratios).

The problem is that this outperformance has ended. Over the past 10 years, the stock has returned 8.7% per year, including dividends. That’s more than 400 basis points below the S&P 500’s return.

Over the past 5 years, the annualized return is negative 0.12% versus 11.7% for the S&P 500.

Year-to-date, the stock is down 9% excluding dividends. This outperforms the S&P 500 by almost 10 points. The outperformance makes sense for the reasons mentioned in the first half of this article. High inflation, economic uncertainty, and aggressive rate hikes favor high-value stocks over stocks that rely more on their future potential instead of what they bring to the table right now (think of your average growth stocks).

FINVIZ

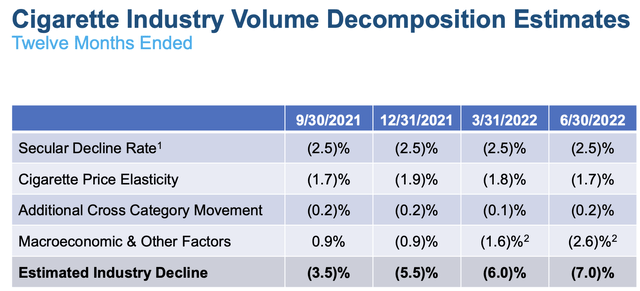

Altria is not immune to these factors. High inflation is hurting its customer. The company is seeing people shift from larger cigarette packages to smaller ones, which is accelerating the industry’s decline in cigarette volumes. During the twelve months that ended June 30, 2022, the industry witnessed a 7.0% decline, led by macroeconomic factors. The secular decline rate remained at 2.5%.

As a pack of Marlboros saw a price increase of roughly 5.6%, the company was unable to offset lower sales. In 2Q22, net revenues fell by 5.7%.

The good news is that the company sees that inflation in certain areas (like energy) is falling, allowing consumers to switch back to (more) cigarettes. It also helps that tobacco brands enjoy the highest brand loyalty on the market, almost double the loyalty grocery brands and household items enjoy (although Altria does not give specific numbers).

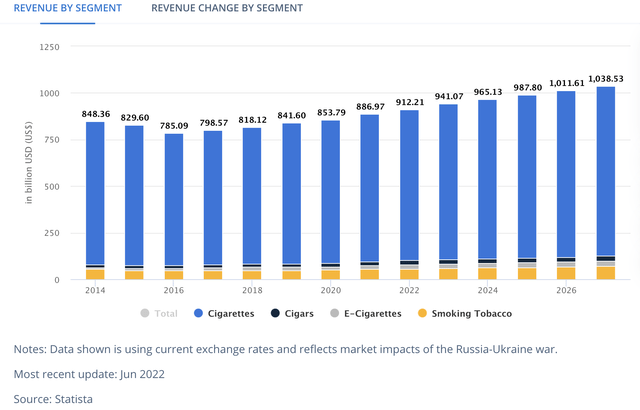

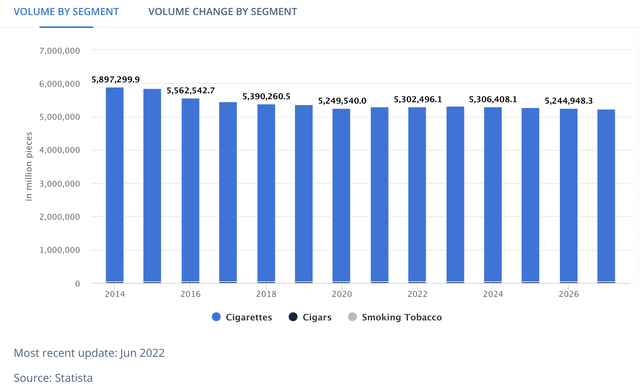

On top of that, global tobacco revenue is not expected to witness a serious decline – or any decline whatsoever.

While global volumes are expected to decline, the decline is expected to slow, allowing better pricing to maintain a steady top line.

The company is also seeing some progress when it comes to dealing with regulatory issues. The FDA received more than 200,000 comments on its proposal to ban menthol in cigarettes. These issues will need to be addressed before taking things to the next step in the rule-making process. Altria (obviously) sees good reasons for the FDA to reconsider the proposal.

Moreover, the proposal to make cigarettes less harmful is not something Altria can fight – nor does it want to. Scrolling through its many presentations, business comments, and related materials, Altria is now a company dedicated to slowly but steadily changing its core business model.

It sees high growth in oral tobacco. According to Altria:

Our approach spans 3 of the most promising smoke-free categories with the potential to reduce harm: oral tobacco, e-vapor and heated tobacco. In oral tobacco, we’re encouraged by the growth of the novel oral products, which comprise more than 1/5 of total industry oral tobacco volume in the second quarter. The category grew 6.8 share points year-over-year, with on! representing more than 40% of this growth. In the second quarter, on! reported shipment volume increased nearly 60% versus the year ago period. And on! retail share of oral tobacco increased 8/10 sequentially, reaching 4.9 share points in the second quarter.

Unfortunately, the company’s investment in JUUL remains a huge issue. In 2Q22, the company recorded a non-cash pretax unrealized loss of $1.2 billion due to a lower estimated fair value of its $12.8 billion investment. The decrease in fair value was driven by several factors including uncertainty created by the FDA’s action related to JUUL and uncertainty relating to JUUL’s ability to maintain adequate liquidity. As of June 30, our estimated valuation is $450 million, which reflects a range of regulatory, liquidity, and market outcomes.

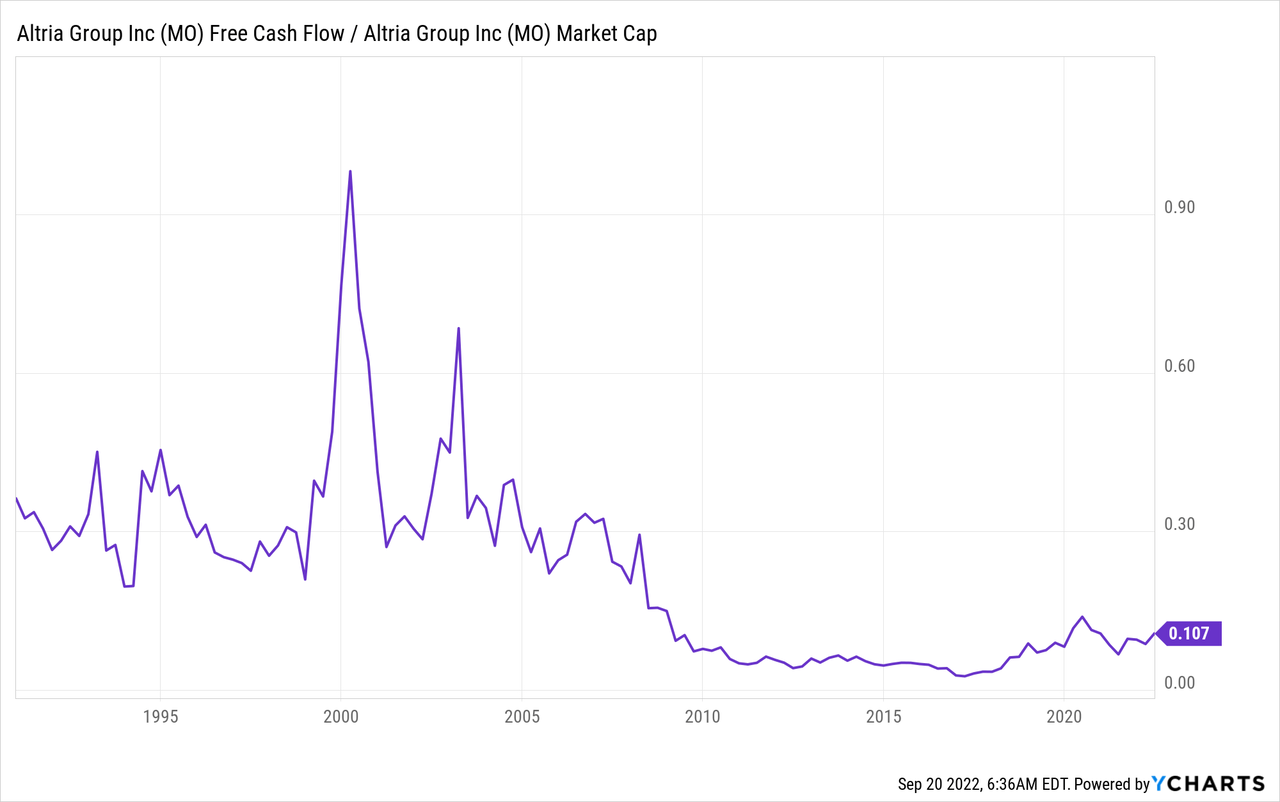

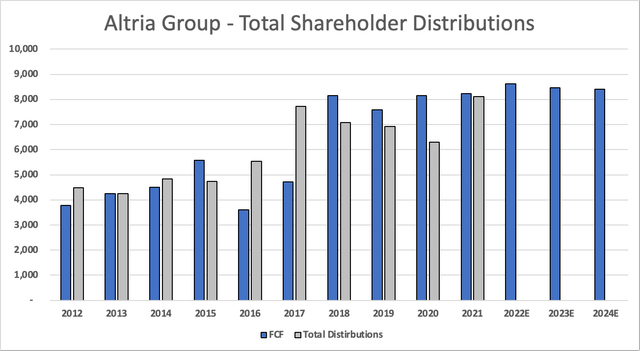

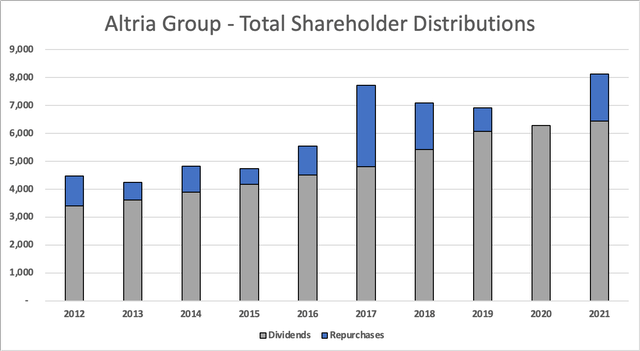

With all of this in mind, Altria is expected to remain the cash cow it is now. In the years ahead, the company is expected to maintain annual free cash flow generation in the low $8 billion range. The chart below also shows that the company is distributing almost all of its free cash to its shareholders.

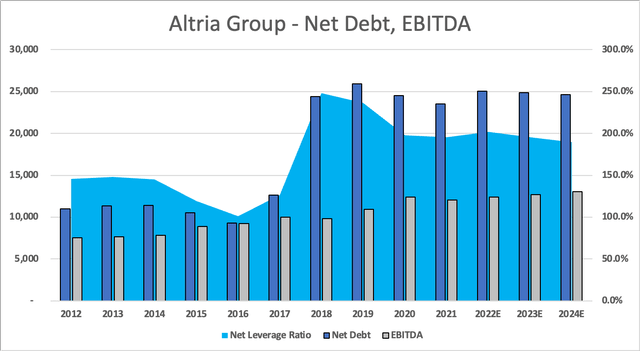

And that’s terrific news for a number of reasons. First of all, $8.5 billion in free cash flow (2023 estimates) is 11.0% of the company’s market cap. As the company has a healthy balance sheet with a net debt ratio of roughly 2.0x EBITDA and a (stable) BBB credit rating, it can (and it does) distribute almost all of its FCF to shareholders.

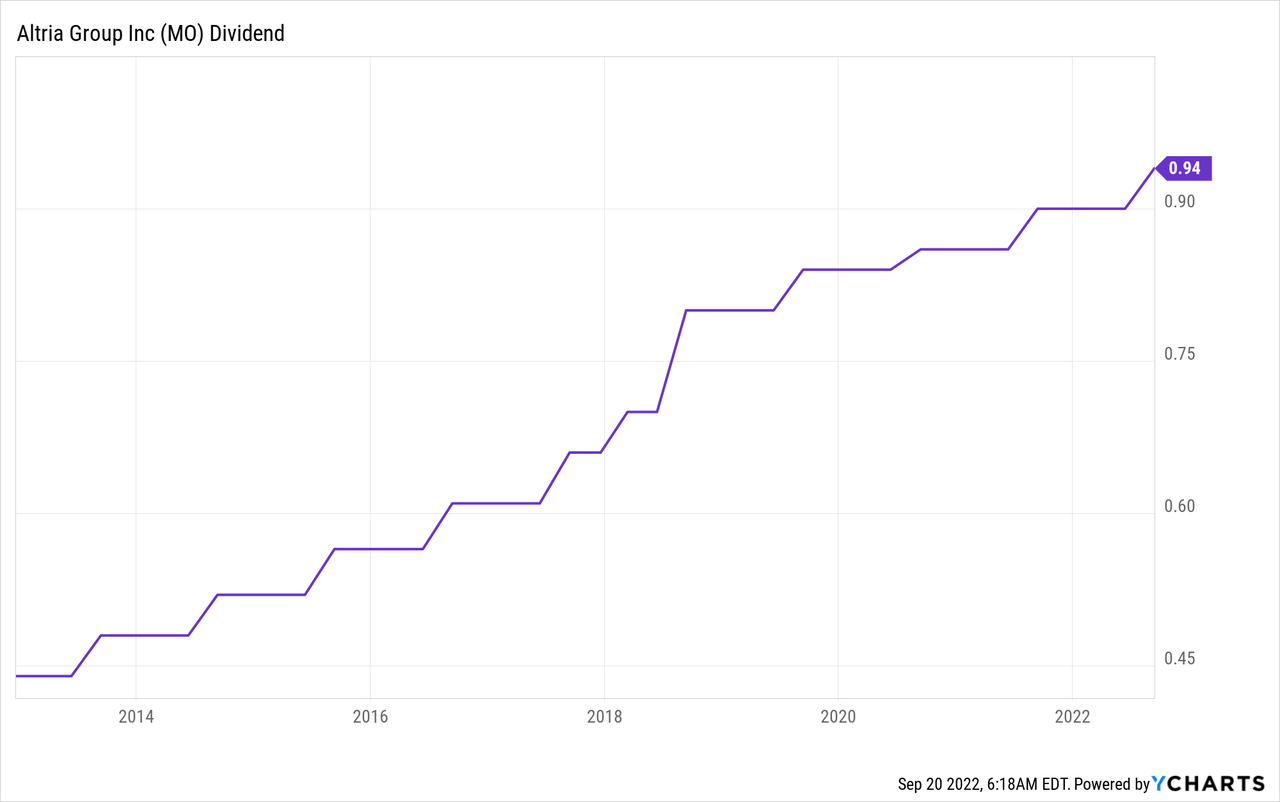

Altria is known for its huge dividend. The company currently pays a $0.94 quarterly dividend. That’s $3.76 per year or 8.8% of the company’s stock price.

That’s truly wild – and fundamentally backed by high FCF and low debt. After all, that’s just as important as the dividend yield as buying a high yield isn’t hard. Buying “quality” high-yield is much harder.

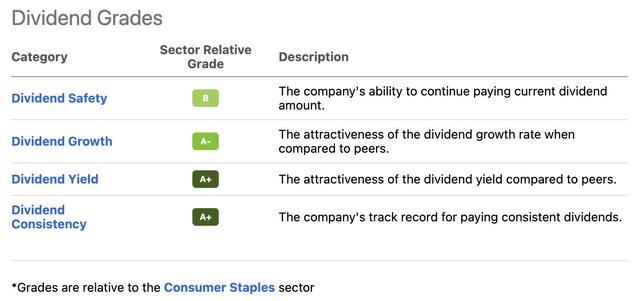

Compared to its consumer staples peers, the company scores high on dividend consistency and its yield. However, dividend growth isn’t bad either.

Over the past 10 years, the average annual dividend growth rate was 8.1%.

The most “recent” hikes were much lower as 8% annual growth isn’t sustainable in Altria’s position:

- August 2022: 4.4%

- August 2021: 4.7%

- July 2020: 2.4%

However, for new investors, that’s OK. Dividend growth is still expected to beat “average” long-term inflation and we’re now dealing with a much better yield.

For example, a 2% hike (to go with a random low number) turns an 8.8% yield into a 9.0% yield on cost. That’s a 20 basis points difference. This really adds up. Especially if people keep reinvesting.

Moreover, additional cash is being distributed via buybacks. Between 2017 and 2021, the company bought back 3.6% of its shares outstanding.

As the dividend yield may suggest, the valuation isn’t half bad either.

Valuation

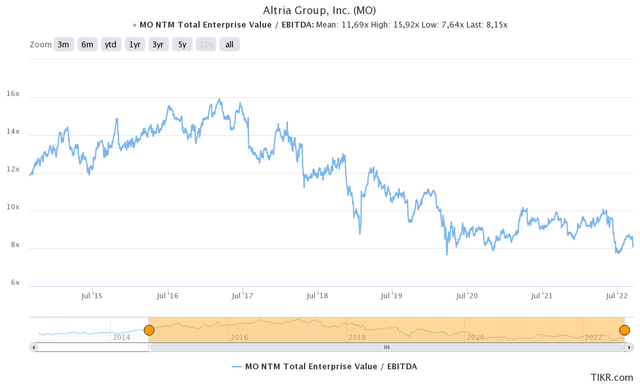

Altria is trading at 8.2x 2023E EBITDA of $12.7 billion. This is based on its $103.8 billion implied enterprise value consisting of $77.3 billion in stock market equity, $24.9 billion in 2023E net debt of $24.9 billion, and $1.6 billion in pension-related liabilities.

I believe that this valuation is attractive as it’s well below the longer-term average, and even below the short-term average of 9.0x NTM EBITDA.

Moreover, I would make the case that EV/EBITDA isn’t key here. What matters more is whether or not investors are overpaying to get “access” to the company’s free cash flow. After all, nobody is buying Altria because of its long-term EBITDA growth potential. Looking at the chart below, we see that free cash flow yield. It is basically price/free cash flow, just the other way around.

The implied FCF yield is 11% as I calculated in this article. This is one of the highest numbers since the early 2000s – ignoring the 2020 COVID sell-off.

That’s a fantastic deal for investors as I believe that MO shares are very undervalued.

I don’t expect this cheap valuation to result in a huge rally. However, I believe that the risk/reward for a stake in Altria is great. Especially in light of the economic developments, I discussed in the first half of this article.

Takeaway

I usually only cover stocks that I am passionate about. In this case, I have to say that I don’t care about cigarettes. However, as I’m not a communist, I won’t tell people what to do. If people want to smoke, Altria is just the place to be as it not only offers high-quality cigarettes but an increasing number of alternatives as well.

While I couldn’t care less for its products, I care a lot about the company’s ability to generate a lot of shareholder value through dividends (and buybacks). The company offers a dividend yield close to 9%, which is fully backed by its free cash flow and sustainable debt load.

Moreover, while global smoking is in a downtrend, the company enjoys high customer loyalty and strong pricing power. So far, JUUL troubles and regulatory issues kept a lid on the stock. Yet, on a mid-term and longer-term basis, I believe that MO is a gem to add to one’s portfolio. The macro environment of high, lasting inflation, slower economic growth, and aggressive central banks is extremely supportive of quality dividend stocks like MO.

Given its very attractive valuation, I believe there is a very strong bull case for Altria and its ability to distribute a high yield.

In other words, in this article, I hope I could establish a macro foundation that warrants investments in high-yield stocks. In this case, I went with Altria as I believe there are a lot of pitfalls in the high-yield space. Altria isn’t one of them. So, if you’re looking for a very high yield, look no further.

On a side note, let me know in the comment section why you own MO shares if you’re long. Is it macro development or just to own high yield, in general?

(Dis)agree? Let me know in the comments!

Be the first to comment