FatCamera

Introduction

Omega Healthcare (NYSE:NYSE:OHI) is a REIT that focuses on skilled nursing and housing for seniors.

Their tenants ran into financial problems during the corona pandemic due to the high mortality among the elderly. And this of course affects Omega Healthcare directly.

Omega Healthcare acted quickly and has already proposed contract amendments that will benefit both parties. Improvements are currently visible in the occupancy rate, while the share price has yet to follow.

Omega Healthcare sees strong growth opportunities in the aging baby boomers. It has a lot of financial leeway in their debt maturity schedule and has therefore announced a $500 million share repurchase program. The COVID vaccinations will cause the elderly to have milder corona symptoms, reducing the death rate. The shares are attractively valued with a high dividend yield of 8.2%. For these reasons, I am giving the stock a strong buy. But beware, new COVID variants remain a huge risk for Omega Healthcare.

Extra Financial Support And No Strike At Guardian

Omega Healthcare showed in their second quarter earnings that several operators are struggling to pay their rent and interest. This has evolved since COVID-19 due to the higher rate of virus transmission and fatality among the elderly.

The state recently provided $600M to bolster caregiving in nursing homes. Less than months later, thousands of nurses, health aides and other support staff threatened to go on strike over how the companies are using the money. They want a higher salary for now and the coming years and enhanced health care benefits.

The union recently entered into an agreement with Guardian, which means that there will be no strike. That’s good news for Guardian and for OHI, because it now has extra support, and the employees can continue their work.

Ambition To Double Market Share In 10 Years

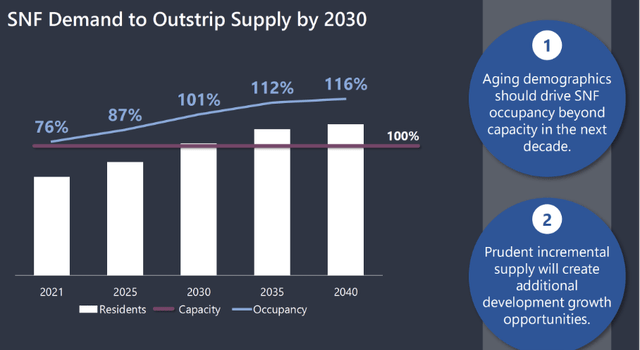

Omega Healthcare expects a bright future as the aging baby boomers represent a decades-long increase in demand for skilled nursing facilities. Currently 17% of the population is 65 years or older and by 2040 22% of the population is expected to be 65 years or older. Omega Healthcare is expected to see their occupancy rates and profits improve as more of the population ages.

COVID reduced the occupancy rate by 13% between February 2020 and January 2021. The occupancy rate was 76% in 2021 and has remained stable until 2022. How quickly will the occupancy rate recover to pre-COVID-19 levels? That’s hard to answer. Vaccines have been developed to reduce the symptoms of COVID and thus extend the lifespan of the elderly. The occupancy rate will therefore improve over the years. Omega Healthcare expects an occupancy rate of 87% in 2025 due to an increasing amount of elderly.

SNF demand to outstrip supply by 2030 (OHI’s 2Q22 Investor Presentation)

From 2009 to 2021, adjusted FFO grew at a CAGR of 17%. Omega Healthcare is the largest owner of skilled nursing facilities and yet they have a market share of only 5%. Omega has the ambition to grow further and will use their experienced management to double over the next 10 years.

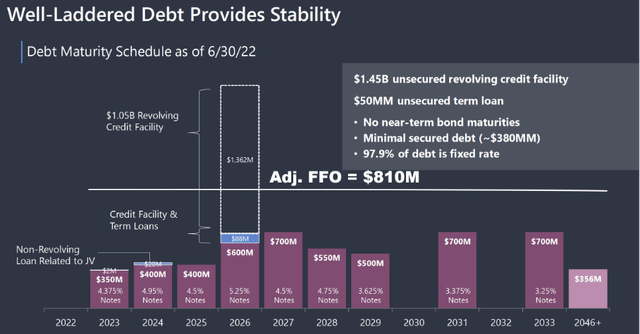

Omega Can Easily Meet Their Debt Obligations

The adjusted FFO for 2021 is $810 million, allowing Omega Healthcare to easily meet their debt obligations in the coming years, and there is even room for growth. The financial picture of Omega Healthcare looks neat.

However, COVID remains a risk to the skilled nursing facilities, Omega’s top priority is to increase their occupancy rate.

Well-laddered debt provides stability (OHI’s 2Q22 Investor Presentation)

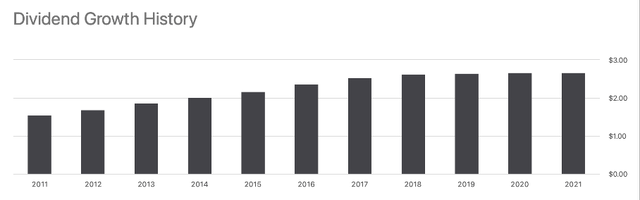

Dividend Remains Stable

REITs like Omega Healthcare are required to pay out 90% of taxed income as dividends. In total, OHI pays a dividend of $638M, the amount of the dividend is well covered by their adjusted funds from operations of $810M.

Since 2020, the dividend per share has remained the same. COVID had a significant negative impact on Omega Healthcare’s tenants. Investors have developed doubts about OHI’s future, leading the dividend yield to a solid 8.2%

From 2011 to 2020, the dividend grew by an average of 6%. And because there is still a lot of leeway in their debt maturity schedule, I see Omega Healthcare growing strongly in the coming years as the occupancy rate is improving. COVID remains a major risk to the business, so I’m considering taking a small buying position.

Dividend Growth History (OHI’s ticker page on Seeking Alpha)

Share Repurchase Program In Full Swing

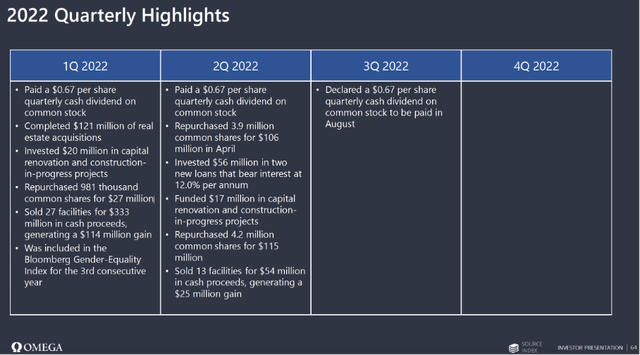

In January, Omega Healthcare announced a $500 million share repurchase program, valid through March 2025. This equates to a three-year average share repurchase opportunity of $167 million.

Omega Healthcare repurchased $27 million in shares in the first quarter and $115 million in the second quarter (year to date: $142 million).

Omega Healthcare repurchases shares when they are undervalued. In April of this year, they bought $106 million worth of shares. Management manages their capital efficiently.

One caveat is that it has made 2 investments in loans worth $56 million, with an interest rate of 12% per annum. These will likely be subordinated loans, which carry a high risk of default.

2022 Quarterly Highlights (OHI’s 2Q22 Investor Presentation)

Conclusion

Several tenants of Omega Healthcare have difficulty paying rent and interest. This is a result of the high elderly mortality due to COVID-19. Omega Healthcare has recently agreed on contract amendments with Guardian, so that Guardian can meet its payment obligations again. Meanwhile, the state has made $600 million available to bolster care delivery in nursing homes.

Omega expects baby boomers to represent a decades-long increase in demand for skilled nursing facilities and expects occupancy rates to improve to 87% by 2025 as the number of older adults increases.

Omega grew their adjusted FFO at a CAGR of 17% from 2009 to 2021. Still, it only has a 5% market share and sees a lot of growth potential here. It has the ambition to double their market share in 10 years.

It has a strong financial position and can easily meet its maturities. As a result, it has initiated a $500 million share repurchase program, of which $142 million shares have already been repurchased. Management manages to spend the capital effectively. In April, when the stock market crashed, it bought back $106 million worth of shares.

When occupancy rates improve, I see a lot of growth opportunities for Omega Healthcare. The aging baby boomers, the leeway in their debt maturity schedule, the positive progress of the COVID vaccinations and the high dividend yield make Omega Healthcare a strong buy.

Be the first to comment