AsiaVision/E+ via Getty Images

Hello Seeking Alpha readers! For the first time, I will cover Olo Inc. (NYSE:OLO), a provider of software and digital service capabilities to the restaurant industry. Tanking 30% after Q’2 earnings due to reduced full-year forecasts and the loss of a huge client might mean it’s time to take a closer look at this small-cap.

Overview

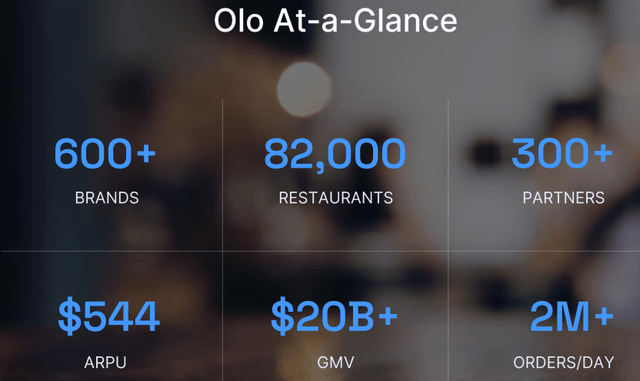

Per its 10-k, Olo’s technology platform powers restaurants’ digital commerce operations including digital ordering, delivery, and payments. The restaurant industry has lagged behind the broader timelines of technology innovation and Olo’s mission is to give customers better, faster, and more personalized service from the restaurants they love.

The above image shows Olo’s basic position in the evolving “food tech” industry. According to its Investor Presentation, a mere 15% of all orders are digital, pointing to a large runway of growth as customers value convenience and efficiency through the digitization of services.

Olo’s services are relied upon by top multi-chain restaurants.

Macro Headwinds & Guidance

Macro headwinds, inaccurate forecasts and Subway losses

It’s fair to say that the restaurant industry was one of the hardest hit during the pandemic. Mass layoffs and closures forced the restaurant industry to adapt quickly and put themselves in survival mode. Hence, Olo, who is meant to help digitize restaurant operations, was a clear beneficiary of COVID-19-related shutdowns during the height of the pandemic. The sales cycle was quick, restaurants adopted the technology, and Olo experienced megagrowth within its customer base.

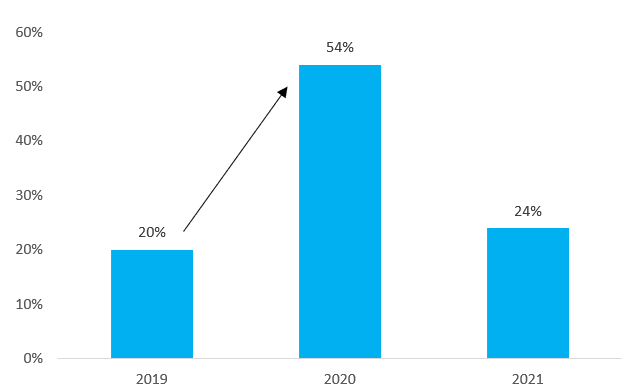

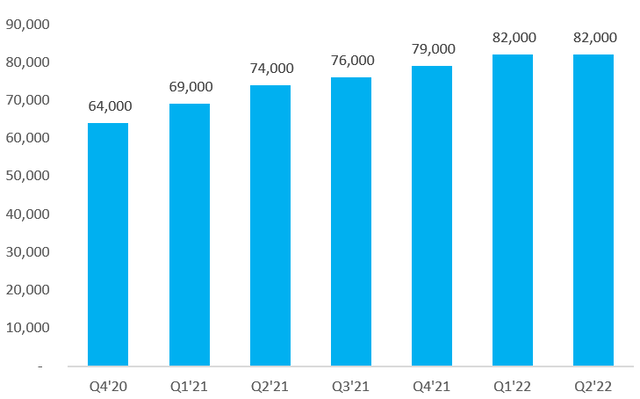

From the period December 2019 – December 2020, Olo’s total restaurant locations increased a whopping 54%. From 2020 – 2021, Olo experienced growth of 24% in total active locations.

Company Filings

Like many SaaS (software as a service) companies, 2020 was an astronomical year of growth with a fast sales cycle as restaurants needed to onboard as quickly as possible. However, in Q2’22 earnings a few days ago, management noted that the sales cycle is significantly slowing down, resulting in the inability to recognize revenue as quickly as Olo thought (emphasis added):

These industry dynamics have impacted our customers and prospects in two ways. At the brand level, these challenges have resulted in elongated sales cycles, as fewer brand resources have lengthened the decision making process. And at the operator level, these challenges have resulted in elongated deployment timelines, as many operators are unable to deploy in a timely manner.

While we continue to actively work to help alleviate these issues at the brand and operator levels through product enhancements, expanding our network of implementation partners and directly managing more of the deployment process. We anticipate both of these dynamics to continue to the balance of the year, and therefore have factored in lower expectations for net new deployments and revenue in the second half of the year.

The quote from management above indicates that the company may face struggles in the near future. Hence, management reduced its revenue forecasts for the fiscal year, causing more downward pressure on the stock reaching all-time lows this morning.

| $ millions | Q1 F22 Guidance | Q2 F22 Guidance |

| Revenue | $194 – $197 | $183 – $184 |

Additionally, macro-economic headwinds such as inflation continue to squeeze restaurant margins, perhaps de-incentivizing any further expenses such as Olo’s services. Nevertheless, Olo’s belief is that in the long-term, restaurants will become extremely reliant on software to enhance their business (emphasis added):

That said, it’s our belief that over time, restaurants will increasingly rely on technology to alleviate macro-economic pressures, improve profitability, ease operational burdens, and enabled digital hospitality to drive repeat business and increase revenues.

Subway Loss

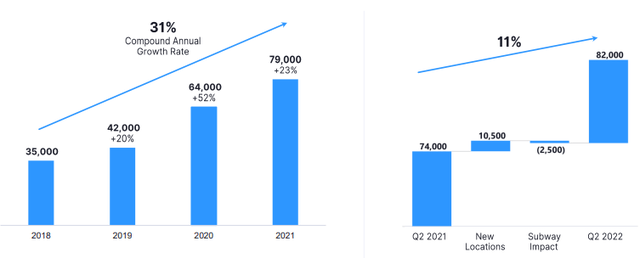

After establishing a relationship with the worlds largest franchise by number of locations, Subway and Olo decided to part ways after a 2-year long relationship. In the second quarter, Olo noted that 2,500 Subway locations halted the use of Olo’s rails service, impacting total active locations.

Despite this, Olo managed to increase total active locations 11% YoY, adding 8,000 net new locations in Q2.

Then, what’s the problem, and why was Olo down 30% after earnings?

The 11% gain was on a YoY basis. However, on a QoQ basis, there was no growth on Olo’s part.

When the Olo signed Subway in February 2020, the deal included 15,000 total locations. So far, 2,500 have left and the other 12,500 are expected to leave (emphasis added):

We expect Subway’s direct marketplace integration to continue with the balance of their locations being removed from our total active location counts in the fourth quarter of this year, or the first quarter of 2023.

Thus, with the losses and declines in total active locations expected to ripple through to Q1’23, the bears continue to push Olo to all-time lows.

Toast Had A Blowout Quarter

Olo has one pure-play public competitor, Toast, Inc. (TOST). The company offers solutions similar to Olo and targets the restaurant industries pain points by offering digital solutions. On a market capitalization basis, the company is now approximately 7 times the size of Olo.

| Data as of Q2’22 | Toast | Olo |

| Market Cap | $9.9B | $1.36B |

| Revenue | $675M | $45.6M |

| Total Locations Q2 | 68,000 | 82,000 |

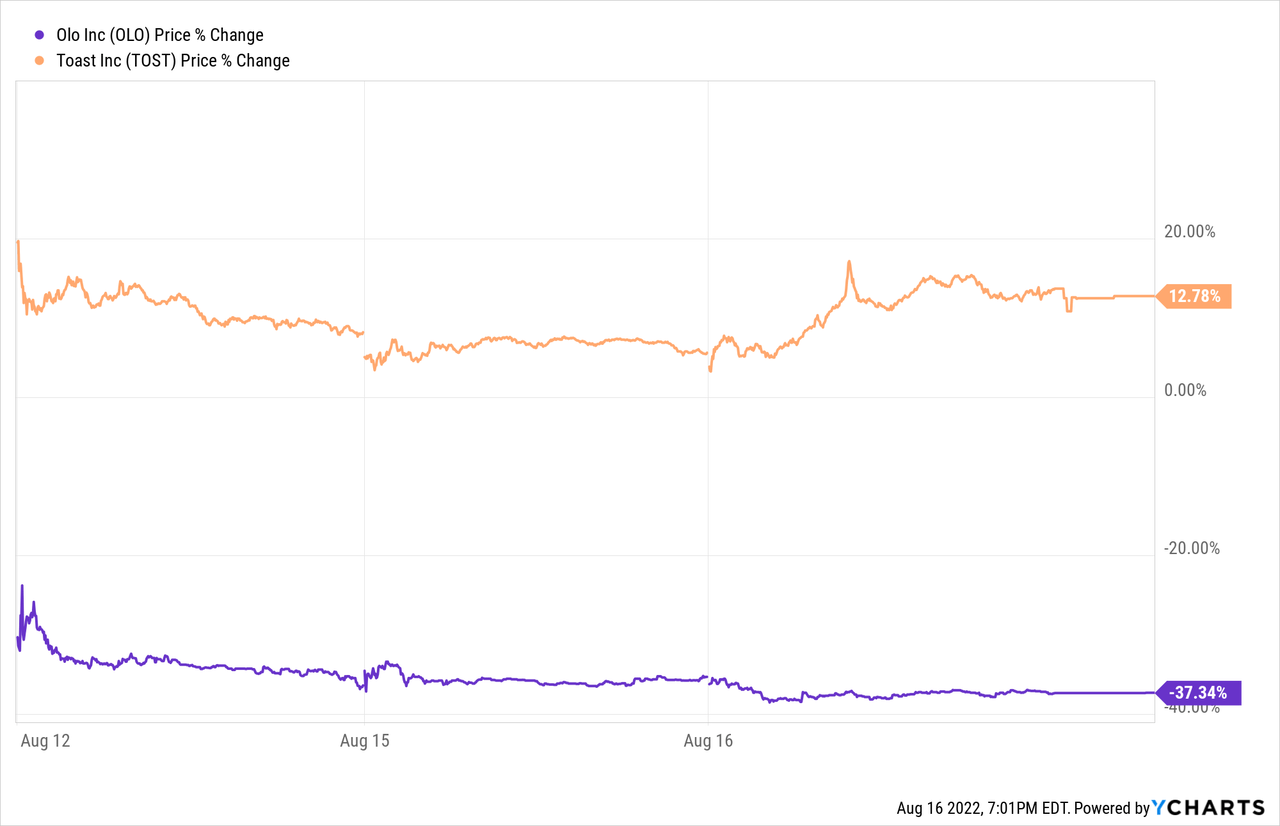

Furthermore, Toast reported earnings on the exact same day as Olo, August 10th. While Olo broke the bad news of the Subway client loss and reduced full-year guidance, Toast shareholders heard about a phenomenal quarter in which the company actually increased full-year guidance by 5%, implying 55% YoY revenue growth.

The image below perfectly depicts the Street’s opinion on Olo and Toast after earnings. The bears unloaded Olo, and the bulls pumped up Toast.

Relative to Olo, Toast’s growth rates appear significantly more promising in the latter half of 2022. Olo’s reduced guidance implies only a 23% YoY revenue growth rate, whereas Toast is set to experience double the growth rate at 55%.

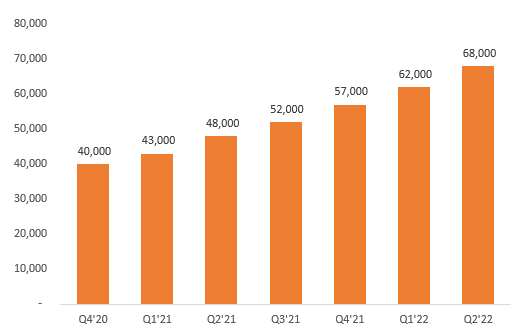

Additionally, Toast exhibits more robust location growth relative to Olo, especially over the last 7 quarters. Olo increased total locations by 23%, while Toast increased active locations by 70% over the same period.

Company Filings

Don’t Bail Yet, But Don’t Buy

With all the negativity surrounding Olo the past 5 days, the headlines are screaming sell – which is exactly what Wall Street did.

Nevertheless, headline negativity is never a reason to sell. On the contrary, many investors have made fortunes when headlines and sentiment are at its worst.

In Olo’s case, there is clearly a demand for digitization in the restaurant industry, and the pre-pandemic growth proves that. While Subway is a large loss, they are also the largest franchise in the world based on the number of global locations. Thus, many restaurants would be reluctant to leave Olo, and I believe management is correct in stating that Subway leaving is not the norm for the restaurant industry.

When CEO Noah Glass was asked about the risk of other restaurants leaving, he responded stating that Subway is an anomaly in the industry:

And we believe that because Subway has this global proprietary point of sale and digital ordering platform all built in house. It’s consistent around the globe. And they were only using Olo for the rails module. So they’re in a unique position to have leverage with marketplaces to have that direct integration — with them, that puts them in a very place in any brand. Typically, we have restaurant brand customers the end of last year on 2.7 product modules Olo, and the more product modules that there are — the more mission critical we believe we are and the more value that we’re generating. So I think you should think of Subway as an anomaly in this case and not just in our restaurants customer population, really in the restaurant industry itself.

As exemplified below, Olo still has strong dollar-net revenue retention, suggestive of low churn and strong product demand. Recent events may just be a blip in the road rather than an insurmountable obstacle.

However, the quarter was quite disastrous for Olo. While I don’t believe the thesis is busted for the long-term, I believe the Street fairly sold off this stock. Nonetheless, Olo has declined significantly in price and its a great time to look at the SaaS company. With a large addressable market and a strong customer base, Olo can still redeem itself and prove to investors it has something to offer.

All in all, I will initiate a “Hold” recommendation for Olo, but urge investors to keep the SaaS company on its watchlist.

Be the first to comment