ipopba

Investment Thesis

Okta’s (NASDAQ:OKTA) Q2 2023 took investors by surprise. The headline here was billings substantially slowed down and this coincided with Okta’s co-founder and Chief Operating Officer Frederic Kerrest looking to take a year out from the company.

However, given that the stock dropped more than 30% post-earnings on a really bad tape, I now look at this stock with a fresh pair of eyes.

I recognize that the stock is now down more than 75% from former highs. However, that bears no indication as to the future value of the company.

Simply put, where the stock was previously is of little importance. What matters is what the stock offers looking ahead. And here, I believe that a lot of the bad news is already factored into the share price.

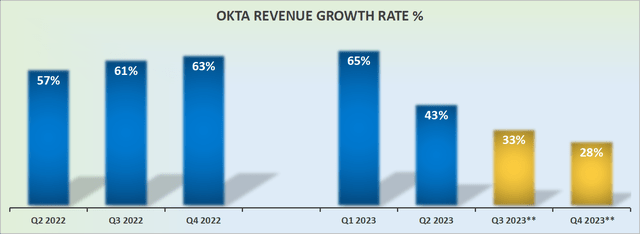

Okta’s Revenue Growth Rates Fizzle Fast

Okta went into Q2 2023 and was expected to report 36% y/y revenue growth. When its revenue growth ultimately got printed, it beat revenue consensus by nearly 500 basis points.

Indeed, this is a company that’s long accustomed to lowballing guidance and then handily beating on its revenue estimates.

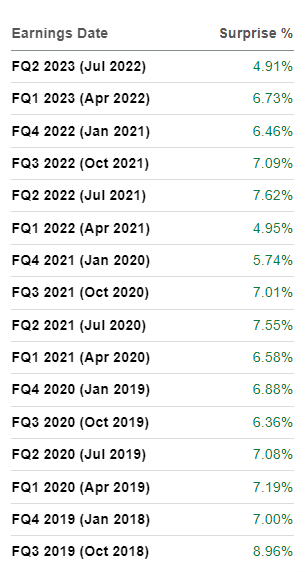

Okta’s revenue beats

As you can see above, Okta has unfailingly beaten analysts’ revenue estimates by mid-single digits going back at least 3 years.

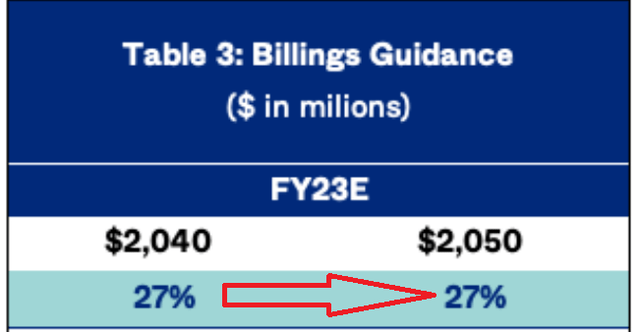

The problem for investors is that Okta has now guided that its calculated billings are only up 27% y/y on a like-for-like basis; this compares with calculated billings expected to finish fiscal 2023 at around 36% y/y just 90 days ago.

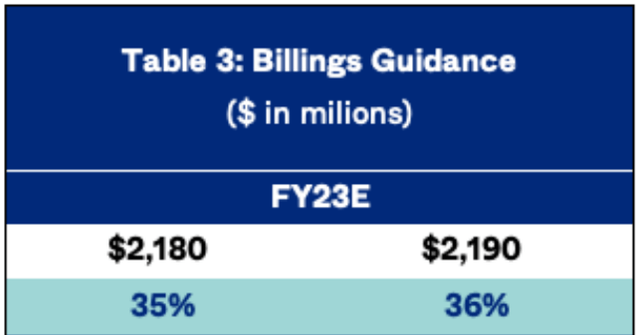

Above we can see that billings previously pointed to 36% y/y growth for fiscal 2023.

Billings are only expected to be around 27% y/y for the year. For a company that many view as non-discretionary, this poses serious questions.

During the earnings call, Okta’s management said,

[…] linearity of the quarter is probably a little more back-end loaded.

And I think that’s a result of some of the things we’ve been talking about with the integration issues, also the attrition issues and then, frankly, the macro, because we started to see the macro towards the end of the quarter. It wasn’t like we saw the macro in May, right?

It was really kind of more toward the end of the quarter where we started seeing the sales cycles elongate.

The paragraph above illustrates some of the issues facing Okta. Longer sales cycle, higher attrition, and a challenging macro environment.

Auth0 Maybe Wasn’t A Great Acquisition?

It feels like blasphemy to even voice this concern, but could it be that Okta’s $6.5 billion acquisition of Auth0 wasn’t as good an acquisition as we were led to believe?

Okta notes post-acquisition that it now has too many reps trying to cross-sell different products to different people within the same organization. That this extra hurdle is adding complexity and slowing down its sales cycle. This is what Okta’s management explicitly said on its earnings call,

I think the headwinds are really about how do you take those hundreds and hundreds of reps and make them productive selling both customer identity cloud and workforce identity cloud and there’s a couple of things that go into that.

The first thing is that, we really have to reach a new buyer for Okta, which is, Okta traditionally was about CIOs and CSOs (edit: Chief Investment and Security Officer).

But for customer identity to be successful, we have to reach VPs of technologies, CTOs, all of the Chief Marketing Officer, Chief Digital Officers, the whole suite of C-suite Executives that will — if we win them all and we have an identity platform for all those use cases, we can better achieve our goal of being the primary cloud and the primary piece of their strategic landscape going forward.

The quote above highlights the hurdles that Okta now faces in righting its ship. These are not insurmountable, but they do make it a challenge.

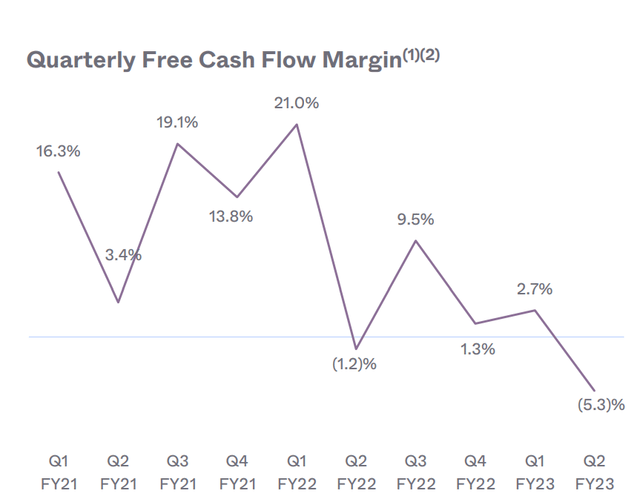

Will Okta Ever be a Free Cash Flow Machine?

This time last year, investors did not care about looking under the hood. Last year investors craved revenues at any cost. And companies were only too keen to oblige.

However, in 2022, everything changed. Today, investors are practically clamoring for businesses that are not only generating robust revenue growth but profits that are backed with cash flows.

Simply put, investors want to know who is swimming naked. And who is being too aggressive with their strategy?

For their part, Okta would point out it carries approximately $2.5 billion of cash and equivalents on its balance sheet. That being said, we should keep in mind that Okta also carries approximately $2.2 billion of convertible debt.

Hence, while Okta can absolutely continue to stomach small losses, the fact remains that right now investors don’t want to get too involved with companies that may or may not have what it takes to deliver premium-growth rates backed by strong cash flows.

That being said, keep in mind that Okta argues on its earnings call that,

We anticipate Q2 free cash flow being the seasonal low point for free cash flow this year.

We are also improving our profitability outlook for the second half of the year. The spend reductions will be achieved by reducing our hiring plans, rationalizing our facilities footprint and applying greater overall financial discipline.

We believe these steps will improve our operating margins and ability to attain our free cash flow targets for the year.

If we were to take Okta’s commentary at face value, investors could now have seen the worst of the company’s near-term prospects. According to Okta, H2 2023 should see a material improvement in its bottom line profitability.

OKTA Stock Valuation – 4x Sales

If we were to presume that Okta grows its revenues by 30% next year, this would put the company on a path to $2.4 billion of revenues.

This means that the stock today is at 4x next year’s revenues. While that’s still some time away, of course, but 4x sales is far from a stretched multiple.

Furthermore, when many of Okta’s peers in cybersecurity, many are priced at higher than 10x forward sales.

For example, CrowdStrike (CRWD) is priced around 14x next year’s sales, while Zscaler (ZS) is perhaps one turn more expensive at 15x next year’s sales.

In that context, even if Okta is growing at a slower rate, I believe that 4x next year’s sales already factors in that slower growth rate as well as a lot more negative news.

The Bottom Line

It is popular to be a pessimist when it comes to Okta’s stock.

That being said, even though Okta’s near-term continues to have some noteworthy unresolved issues facing the company, least of all how will Okta reignite its growth, I am inclined to believe that the risk-reward here is positively skewed.

That’s not to say that investors should expect a quick bounce in the stock. But for investors with a medium-term horizon of 12 months or slightly longer, this now starts to look enticing.

Be the first to comment