Orhan Turan/iStock via Getty Images

Okta, Inc. (NASDAQ:OKTA) is a longtime TechStockPros favorite. Our bullish sentiment is based on our expectation that OKTA is a major player in cloud security. OKTA is down almost 71% YTD, and we believe the weakness of macroeconomic headwinds has finally been factored into the stock. We believe the stock selloff provides an attractive entry point into the cloud security giant.

We like OKTA’s position in the cloud security industry, which is estimated to grow at a CAGR of 18.1% between 2022-2029. We expect the global enterprise adoption of the cloud to serve as a major growth driver for OKTA going forward. We’re specifically constructive on OKTA spearheading the IAM space. We expect the stock price to be volatile in the near term but maintain our buy-rating, as we believe most of the near-term weakness has been priced into OKTA stock.

Cloud identity market ballooning

Our bullish sentiment on OKTA is primarily based on the company’s position within the cloud security industry, specifically identity cloud. OKTA operates in the world of identity security, fulfilling the needs of Workforce and Customer Identity and Access Management solutions. In simpler terms, as OKTA puts it, the company’s products create a world where everyone can safely use any technology. Identity security is not just an excellent concept; it’s also an extremely profitable arena. Gartner predicts organization spending on cloud security will reach $6.69B in 2023, an almost 27% Y/Y growth. We expect OKTA will enjoy three main growth drivers going forward:

1. Increased IT spending on cloud security

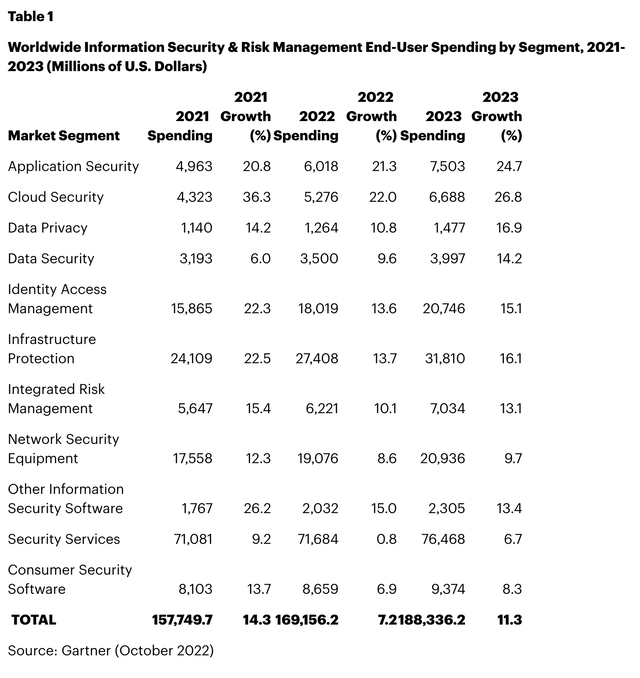

While enterprise cloud adoption has been underway, real growth exists in the cloud security market. Gartner predicts cloud security to be the strongest category of growth in 2023 within the cloud industry. We believe IT cloud security spending will be a major growth driver for OKTA going forward. We’re constructive on this cloud segment as we expect IT spending on cloud security to remain resilient even during stressful financial times.

The following table outlines IT spending forecasts for 2023.

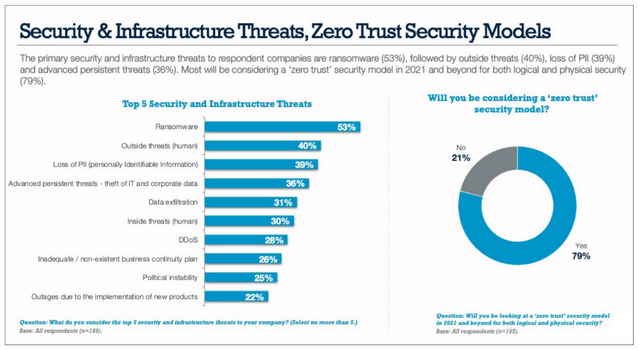

2. The transition from VPNs to zero-trust network access

Identity is at the core around which zero-trust architecture is built. Hence, we expect OKTA to benefit as the transition from Virtual Private Networks (VPNs) to zero-trust network access (ZTNAs) unfolds. Gartner predicts that by 2025 at least 70% of new remote access deployments will rely on ZTNAs rather than VPN services. We believe OKTA is not only in the fastest-growing segment in the cloud industry but also in the fastest-growing segment within cloud security: identity.

The following graph outlines the zero-trust network access adoption.

3. Pandemic-driven hybrid-remote work environment

While the pandemic is mostly in the past, we believe the pandemic’s work-from-home environment created room for hybrid-remote work environments. We believe the pandemic accelerated cloud adoption by kick-starting the hybrid work environment. We believe cloud security is a top priority of IT spending and will drive demand for OKTA’s products.

Weakness is priced into OKTA stock

OKTA stock is down almost 71% over the past year, and we believe this creates a window to invest in OKTA that has not been present for years. We believe OKTA shares were in free-fall due to the cyber incident, struggles to integrate the Auth0 acquisition and macroeconomic headwinds. We believe the weakness has been priced into the stock, for the most part. We believe OKTA’s added customers, even during the current macroeconomic environment, are a good signifier of OKTA’s growth in 2023. OKTA added 600 customers in 1Q23, down from 800 a quarter earlier. We expect OKTA to grow its customer base as macroeconomic headwinds ease, and IT spending to pick up more naturally.

While OKTA operates in a booming industry, it equally operates in a highly competitive space. OKTA competes with Microsoft (MSFT), ForgeRock (FORG), PING, and CyberArk (CYBR). Amazon’s (AMZN) AWS continues to expand into the IAM landscape. While OKTA faces increased competition, we believe the company is headed in the right direction to outperform expectations.

While the stock price remains volatile towards the end of the year, we believe OKTA is better positioned to outperform now. OKTA’s most recent 3Q23 quarter reported revenue growth of 43% Y/Y of $452M, ahead of estimates at $431M. While the company did miss EPS by $0.10, it still outperformed the expectation of an EPS loss of $0.30. We believe the weakness has been priced into OKTA stock and expect to see the company rebound in 2023.

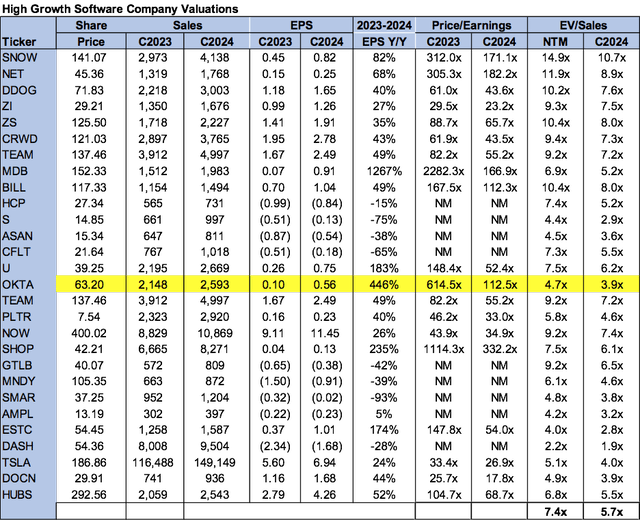

Valuation

OKTA stock is relatively cheap, trading at 112.5x C2024 on a P/E basis EPS $0.56 compared to the peer group average of 88.7x. The stock is trading at 3.9x on EV/C2024 Sales versus the peer group average of 5.7x. We believe OKTA’s valuation is extremely attractive for the company’s position within the cloud security industry. We recommend investors buy OKTA stock at current levels.

The following table outlines OKTA’s valuation versus the peer group.

Word on Wall Street

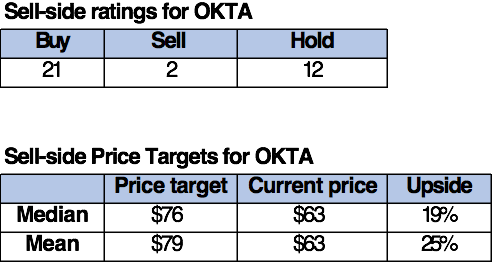

Wall Street is overwhelmingly bullish on the stock. Of 35 analysts covering OKTA stock, 21 are buy-rated, 12 are hold-rated, and two are sell-rated. The stock is currently priced at $63. The median sell-side price target is $76, while the mean is $79, with a potential upside of 19-25%.

The following table outlines the sell-side ratings and price targets.

TechStockPros

What to do with OKTA

We are buy-rated on OKTA despite the stock pullback. We like OKTA’s position within the cloud security industry and expect the company to benefit from the increased IT spending on cloud identity even during market downtrends. We recommend investors buy the pullback as we expect Okta, Inc. stock to rally in 2023.

Be the first to comment