lvcandy

Investment Thesis

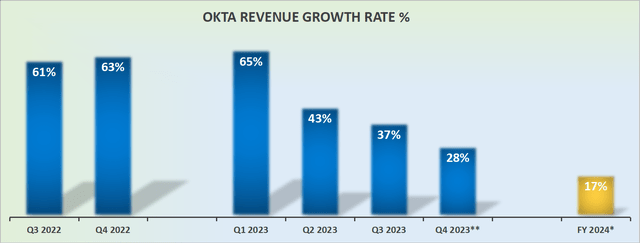

Okta (NASDAQ:OKTA) reports Q3 results that the market positively welcomed. The results were not so impressive on the topline, although there was some good news there. The bad news is that next year, guidance points to about 17% y/y revenue growth rates.

But the bulk of the good news is that now Okta’s profitability profile is pointing in the right direction.

With the stock down +70% from this past twelve months, and down approximately 80% from its peak, investors believe that enough is enough.

What’s more, we have to keep in mind the Fed’s commentary. How it’s now all about slowing down the pace of rate hikes.

There’s a lot to go through here, so let’s get to it.

What’s Happening Right Now?

We are now late into the earnings season. Companies wish to avoid explicitly writing in the press releases showing weakness in the macro. Instead, for their part, Okta points to an ”evolving” macro environment.

That being said, on its earnings call, Okta did state that the ”global macro environment […] we anticipate becoming worse before it improves”.

Separately, we should keep in mind that yesterday, as Okta headed for its earnings results, CrowdStrike (CRWD) reported its earnings results.

Results, which many investors were taken by surprise, as the stock fell about 15%. So it could be said that investors feared the worst from yet another cybersecurity name struggling to live up to expectations. Therefore, anything that wasn’t horrendous from Okta was given a pass.

Revenue Growth Rates Prove Resilient

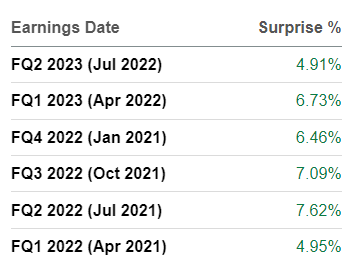

For Q3 2023, analysts were expecting revenue growth rates to come in at 33%. But the topline was actually up 37%. Furthermore, keep in mind the following trend:

Okta revenue beats

Okta consistently beats estimates by approximately 5%. Even if for the quarter ahead they only beat by 2%, it still implies that Okta is still growing by at least 30% CAGR.

The biggest risk here is that next quarter, Q1 2024 will be up against tough comparables against this quarter. But once we get beyond Q1, the rest of fiscal 2024, Okta will be up against much easier comparables.

What’s more, investors will have undoubtedly latched onto Okta’s billings number, accelerating from 36% y/y in fiscal Q2 2023 to 37% y/y for fiscal Q3 2023.

What this demonstrates is that Okta’s growth story isn’t over yet.

Looking ahead, Okta is getting its bad news out, and attempting to derisk its stock, by guiding next year to grow by 17% y/y.

Profitability Profile, Does it Matter?

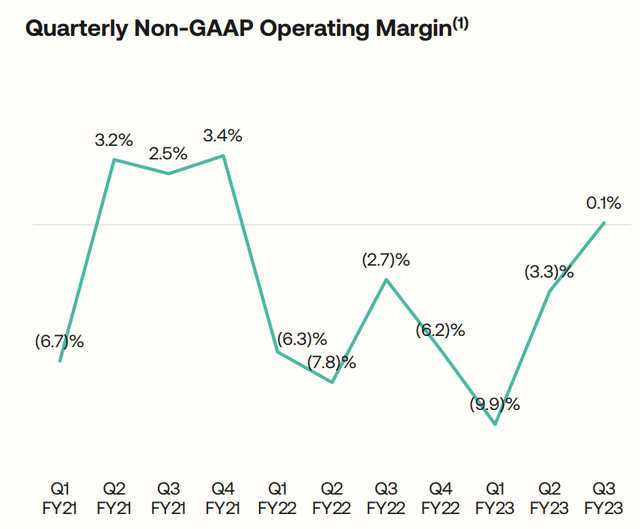

The ol’ ”pretend management works for free”, also known as, non-GAAP operating margin was at breakeven in the quarter. What’s more, within its non-GAAP operating margin, my favorite add-back has to be Okta’s charitable donations.

Management gets all the thanks, plus indirect and intangible benefits, for Okta’s charitable donations, whereas shareholders, the owners of the company, have seen their wealth fall 80% from the highs. Perhaps, this is a moot point? After all, these charitable donations are now substantially smaller than last year.

Meanwhile, on a closer approximation to actual profitability, Okta’s GAAP operating margins, were negative 43%.

On a positive consideration, it appears that Okta’s GAAP operating profits improved from negative 57%, a 1,400 basis point improvement from the same period a year ago.

Furthermore, Okta declares that its Q4 2023 free cash flow margins will reach low double digits. That’s a huge improvement from the 1% free cash flow margin in Q4 of last year.

OKTA Stock Valuation — Difficult to Justify

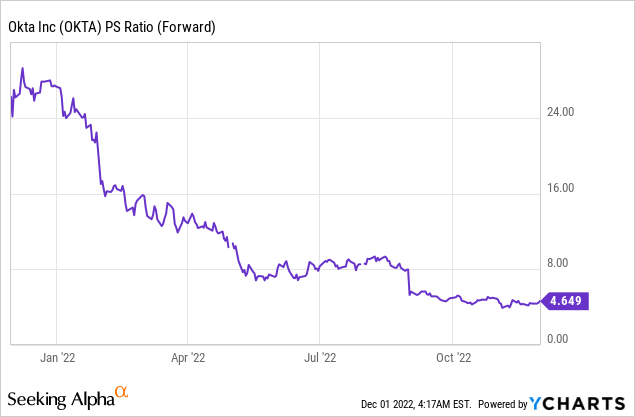

Okta’s multiple has significantly compressed in the past 12 months.

Okta was being priced at 25x forward sales this time last year. It is now priced at less than 5x forward sales. Is that cheap enough for a GAAP unprofitable company? I suppose it depends on where interest rates go from here.

And if this isn’t a clear example of a bet on interest rates, I don’t know what is. Sure, there’s some nuance and interpretation required. But at this point, with the stock down so significantly, the mere mention of a slowing down in the pace of rate hikes, and this stock moves higher.

The Bottom Line

The single best takeaway here, at this point, with the stock down so significantly is that Okta is guiding for positive non-GAAP operating margins starting fiscal Q1 2024.

Furthermore, Okta also guides for positive non-GAAP operating profits in the low-single-digits for fiscal 2024. Even if Okta’s operating margins ended up around 4% for fiscal 2024, that now points to its best profitability profile in several years.

Be the first to comment