Stadtratte/iStock via Getty Images

Oil prices have touched 7 years high with the most-debated target of $100 almost in sight. The recent bullishness, and subsequent high oil prices, seems to be a product of the following: 1) Demand resurgence 2) Inventory depletion 3) Energy crisis 4) Supply concerns 5) Falling spare capacity 6) Geopolitical tensions in the form of Russia-Ukraine 7) Soaring inflation. All of these factors have accumulated and given the momentum for prices to rally towards the triple-digit domain – first time since 2014. These have been successful in shifting the overall sentiment – a factor as strong and important as the other seven combined. However, the overall sentiment will shift soon and there will be a correction in prices.

The recent spike in price of oil can mostly be attributed to the ongoing Russia-Ukraine conflict. Traders expecting a war or at least a military escalation have accumulated long positions. As of today, bullish positions outweigh the bearish ones by 5.6:1. But that seems to be changing, as we will see below.

On 14th February, Russia said that it is ready to revert to diplomacy in order to discuss the Ukrainian issue. Russia’s Foreign Minister hinted towards a peaceful resolution to the security issue by saying “there is always a chance” to reach some agreement with West. A possibility for negotiation was not only expressed in words but also followed up with an action as Russia called some of its troops back from the Ukrainian border where it amassed 100,000 soldiers. Certainly, rising oil prices have made Putin bold, but I opine that he would not get into an all-out war. Why do I say that? History shows that Russia does its cost-benefit analysis. They intervened in Georgia because they knew the enemy encountered wasn’t as strong. In Syria, they mainly played the role of a supporter. The opinion that if Russia wants to really escalate the crisis or pressurize Kyiv, it can do so by providing more support to the separatist movement in Donbass region, which will not require building a huge presence of troops, carries some weight.

As such, it is highly unlikely that Russia is going to invade Ukraine. The realization of this development, which may come after a proper announcement, can significantly reduce the current price of oil.

There is another factor that can lead to a sell-off or reverse the recent bullishness in oil markets. That factor is rising Shale production. Oil production in the biggest basin in the U.S. will increase by 71,000 bpd reaching 5.205 mbpd in the month of March 2022. Other basins such as North Dakota and Montana will register a growth of 6,000 bpd amounting to 1.198 mbpd next month, which is the highest since November 2020. Overall, the U.S. shale production will add 190,000 bpd in March, touching more than 8.7 mbpd. The number of Drilled But Uncompleted (DUC) wells have also started to fall; that now stands at 4,466 in January 2022 versus 7,449 in January 2021. Primary Vision Network’s Frac Spread Count also hit 275 indicating that higher oil prices have started to tempt shale drillers to ramp up production.

Frac Spread Count (Primary Vision Network)

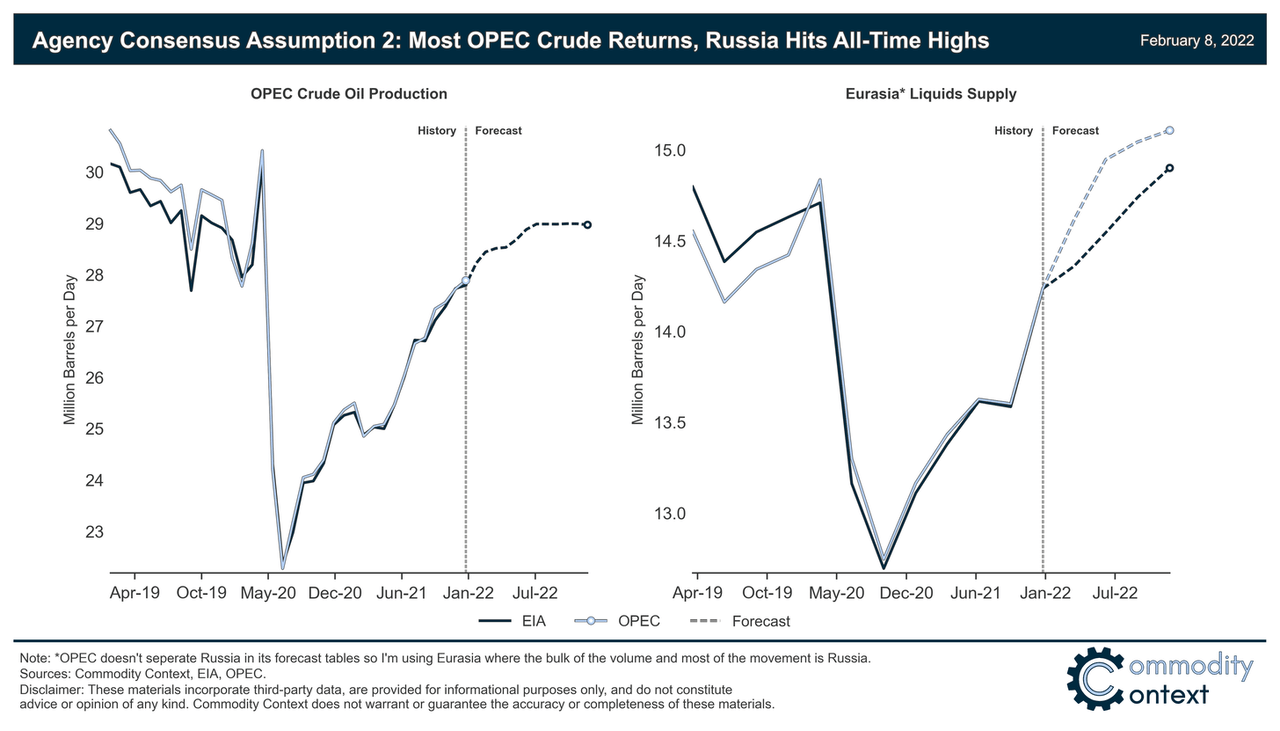

The rising fears of a supply crunch should be seen in comparison to what different monitoring agencies have to say about it. Rory Johnston has done a great job at doing this. EIA says that OPEC production will rise by 1.4 mbpd in 2022 with Russian production reaching an all-time high in 2022. Rory says that an average of all the outlooks by various organizations gives us a 500,000 bpd oversupply (as per EIA) and a balanced market according to OPEC. None of them point towards a supply crunch. Therefore, the concerns vis-a-vis a lack of supply to meet the demand are exaggerated and another reason that oil prices may fall soon.

Oil Production Forecast (Rory Johnston Substack)

Ed Morse, head of Citi’s commodity analysis, also says that a realistic outlook for oil supply shows an increase of 5.5 percent in global oil supply and that U.S. shale producers will add 800,000 bpd in 2022 and a million in 2023, making the total at 13.9 mbpd.

As inflation continues to creep higher, touching a 40-year high in the U.S. at 7.5 percent, the expected rise in interest rates (by the Fed and other central banks) does not augur well for a bullish oil market outlook. As interest rates rise, dollar strengthens; that means it becomes expensive for Emerging Markets and Developing Economies (EMDEs) to buy oil, denting overall demand. The rise in wages has been disappointing to say the least and can be symbolic of an upcoming or protracted slowdown in global economic recovery.

Recently, oil bulls off loaded 14 million barrels of bullish positions and added a same amount of bearish ones! This indicates that the rally might be over soon and that prices will head south in the coming weeks, provided there isn’t a renewed escalation in Russia-Ukraine conflict, or for that matter any other geopolitical flashpoint.

What factors are being ignored?

I mentioned the factors that current price of oil includes in the beginning of the article. For completeness, here are those the factors that markets may be missing: 1) The feedback loop – rising prices, increased U.S. Shale production 2) Higher prices incentivizing OPEC+ to produce more 3) Maybe a new variant of COVID-19 (I hope we never have it) 4) Rising inflation leading to 5) Rising interest rates leading to 6) Strong dollar that will 7) Affect demand of commodities like Oil 8) Rising prices at pump (at $3.4) highest in 7 years.

The key takeaway is to focus on selling rather than expecting higher oil prices and entering the market with a long position. We should focus on the aforesaid 8 factors that can tip the balance towards bears. $95 seems to be a good point that keeps the market in check – there was a break but prices fell back. I believe anywhere above that level should be a good point to short oil with at least $5 on the downside – eventually it will go into lower 80s.

Oil bulls should beware, the sentiment may shift soon!

Be the first to comment