naphtalina/iStock via Getty Images

The first half of 2022 was the worst first half for the U.S. stock market in more than 50 years. The dismal performance was caused by the surge of inflation to a 40-year high and fears that the resultant interest rate hikes of the Fed may cause a recession. It is thus natural that many investors are trying to identify stocks that are resilient to high inflation and recessions.

OGE Energy Corp. (NYSE:OGE) undoubtedly meets these criteria. As a utility, it can easily pass its increased costs to its customers, while it is essentially immune to recessions. As the stock is also offering a nearly 10-year high dividend yield of 4.3%, investors should consider purchasing the stock around its current price.

Business overview

OGE Energy is the parent company of OG&E, a regulated electric utility with nearly 900,000 customers in Oklahoma and western Arkansas. It also owns an approximate 2% stake in Energy Transfer (ET), a Master Limited Partnership (MLP) that owns and operates one of the largest networks of pipelines and storage tanks of natural gas in the U.S.

Thanks to the essential nature of electricity, OGE Energy is resilient to recessions. This has proved to be the case, not only in the Great Recession but also throughout the coronavirus crisis. In 2020, which was marked by a fierce recession due to the pandemic, OGE Energy posted a minor 4% decrease in its earnings per share. Even better, the company has fully recovered from the pandemic, as it grew its earnings per share by 13% in 2021.

Moreover, OGE Energy has had a positive start this year. In the first quarter, its regulated business grew its earnings per share from $0.06 to $0.19, primarily thanks to the absence of a loss in the prior year’s quarter due to storm Uri. In addition, the company benefited from a steep increase in the value of its stake in Energy Transfer, and thus it grew its total earnings per share from $0.26 to $1.39. Due to the sensitivity of the stake in Energy Transfer to the price of natural gas, management provides guidance only for the utility division. OGE Energy expects this division to post earnings per share of $1.87-$1.97 this year, implying 7% growth at the mid-point.

Growth prospects

Utilities are well known for their modest growth, as regulators do not approve of extreme rate hikes in order to keep consumers satisfied. OGE Energy has a somewhat disappointing performance record, as it has grown its adjusted earnings per share by only 3% per year on average over the last decade. However, the company seems to have much brighter growth prospects ahead.

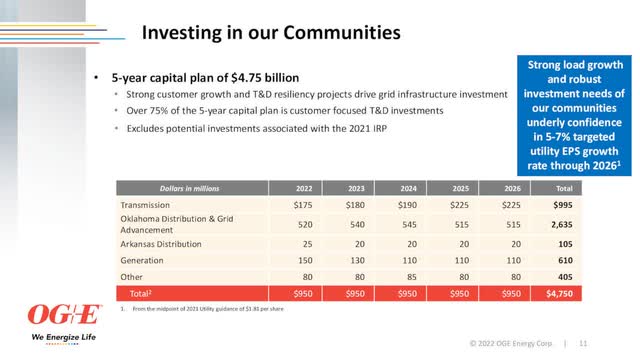

First of all, OGE Energy expects retail load growth of 3.5%-5.0% this year and commercial customer growth to accelerate in the last two quarters of the year. Moreover, the company has a 5-year investment plan of $4.75 billion, which will expand and improve its infrastructure.

OGE Energy Growth Plan (Investor Presentation)

As the amount of the capital plan is 62% of the current market capitalization of the stock, it is evident that OGE Energy is heavily investing in its future growth. It is also important to note that management does not expect to issue any shares to fund its capital plan. Thanks to this capital plan and its expectations for strong load growth, OGE Energy expects its utility business to grow its earnings per share by 5%-7% per year until at least 2026.

Valuation

Analysts expect OGE Energy to earn $2.07 per share this year. Their consensus is in line with the guidance of management for earnings per share of $1.87-$1.97 in the utility business. Based on its expected earnings in 2022, OGE Energy is currently trading at a price-to-earnings ratio of 18.5. This is higher than the 10-year average price-to-earnings ratio of 16.9 of the stock, but it is reasonable given that the growth prospects of the company have greatly improved.

Moreover, given the expected earnings per share of $1.92 of the utility division in 2022 and the guidance for 5%-7% average annual growth of the earnings per share of this division, it is reasonable to expect total earnings per share of approximately $2.57 by 2026 (assuming constant earnings per share of $0.15 for the midstream division). This means that OGE Energy is currently trading at 15.0 times its expected earnings in 2026. Overall, OGE Energy seems to be attractively valued right now.

Resilience to recessions

Due to the sensitivity of its natural gas business to recessions, OGE Energy is not completely immune to recessions, unlike some of its peers. Nevertheless, as mentioned above, the company proved resilient throughout the Great Recession and the coronavirus crisis. It is also worth noting that management has stated that it will divest the natural gas business at an opportune time in order to render the company a pure utility. Whenever that happens, it may provide a catalyst for the stock price of OGE Energy.

Dividend

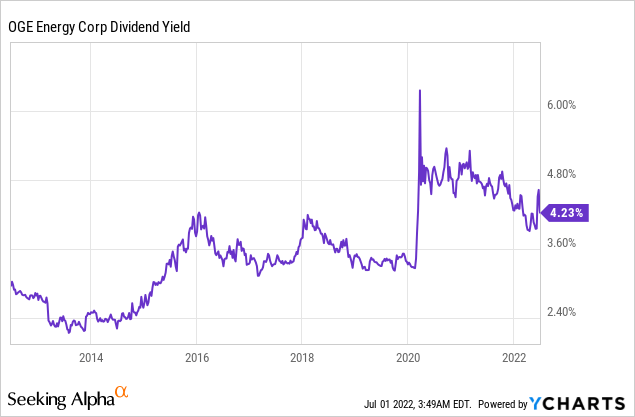

OGE Energy has raised its dividend for 15 consecutive years and is currently offering a nearly 10-year high dividend yield of 4.3%.

As shown in the above chart, the stock offered a higher yield only after the stock market crash in 2020, at the onset of the coronavirus crisis.

Moreover, OGE energy has a payout ratio of 71%, which is only marginally higher than the target payout ratio of 65%-70% of management. Furthermore, the company has a healthy balance sheet, as its net interest expense consumes only 29% of its operating income and its net debt (as per Buffett, net debt = total liabilities – cash – receivables) stands at $8.6 billion. This amount is only 9 times the earnings of the company in the last 12 months, and hence it is manageable, especially given the reliable and resilient earnings of this business.

Given all these facts, OGE Energy is likely to continue raising its dividend at an annual rate close to its 5-year average of 6.7%. Therefore, investors can lock in a nearly 10-year high dividend yield of 4.3% and rest assured that the dividend will keep growing at a mid-single-digit annual rate in the upcoming years.

Final thoughts

Due to the ongoing bear market, most investors are going through a painful period. However, they should realize that such painful periods are ideal for initiating long-term positions in solid dividend-growth stocks at attractive entry points. As a utility, OGE Energy is resilient in the highly inflationary business environment prevailing right now and has also proved essentially immune to recessions. As the stock is offering a nearly 10-year high dividend yield and has promising growth prospects ahead, investors should consider purchasing the stock around its current price.

Be the first to comment