Valentina Shilkina

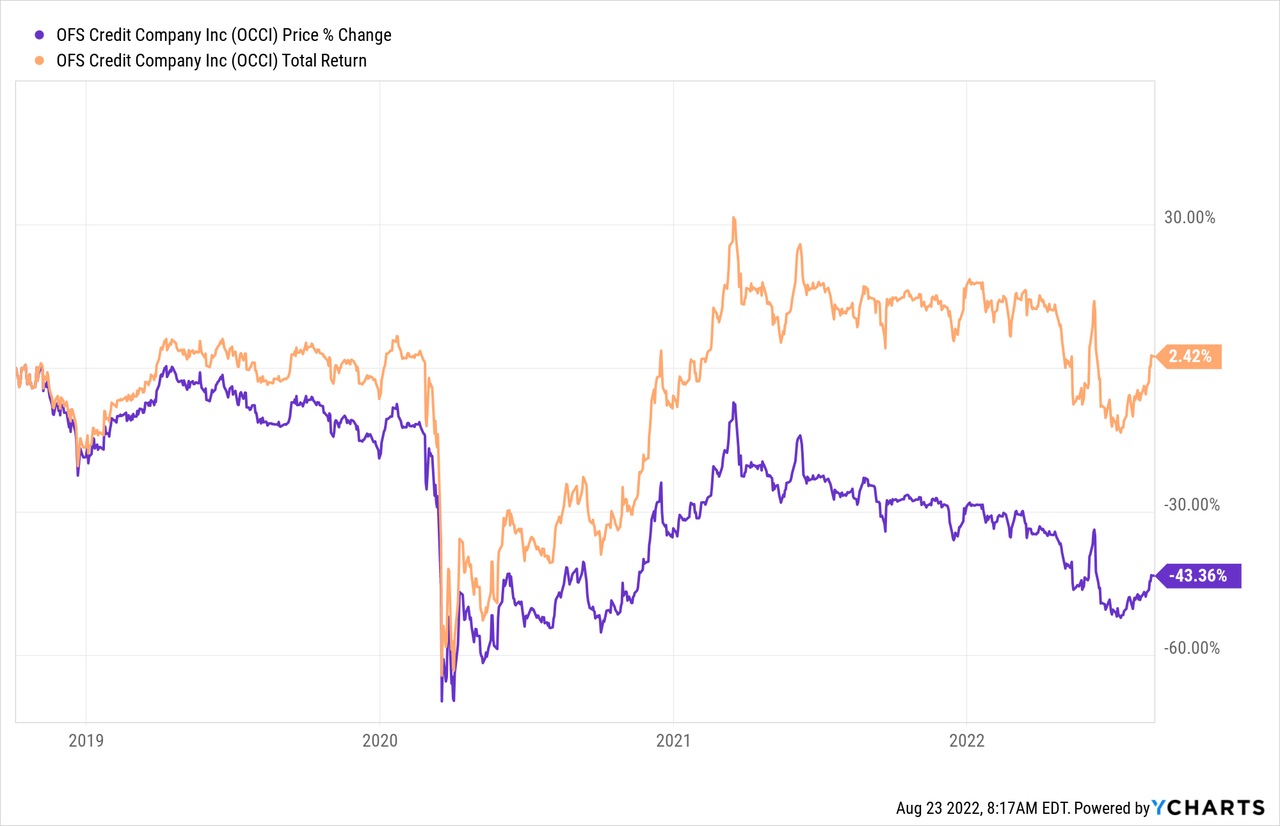

CLO funds have struggled to deliver in the past 3-5 years. None of them have produced competitive returns if you took your distributions in cash. All of them have produced total returns under their average distribution yields. Only one has produced returns that are competitive even with distributions reinvested. Where does OFS Credit Company, Inc. (NASDAQ:OCCI) fall? It is true that we have not covered this previously. In fact, among all the CLO funds, this one receives the least coverage. So let’s look at this one and see if it can be an exception to the rule.

The Fund

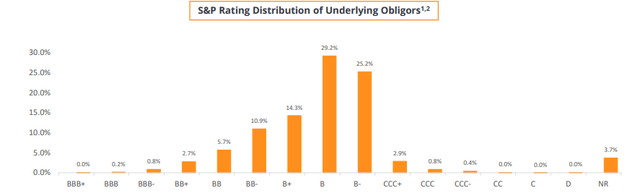

OCCI is a non-diversified, closed-end management investment company. Its investment objective is to generate current income, with a secondary objective of generating capital appreciation, primarily through investment in collateralized loan obligation (“CLO”) equity and debt securities. While these securities have been heralded as the second coming of income, you should start by reading what the fund itself calls them.

The CLO securities in which we primarily invest are unrated or rated below investment grade and are considered speculative with respect to timely payment of interest and repayment of principal. Unrated and below investment grade securities are also sometimes referred to as “junk” securities. In addition, the CLO equity and subordinated debt securities in which we will invest are highly leveraged (with CLO equity securities typically being leveraged 9 to 13 times), which magnifies our risk of loss on such investments.

Source: OCCI Semi-Annual Report

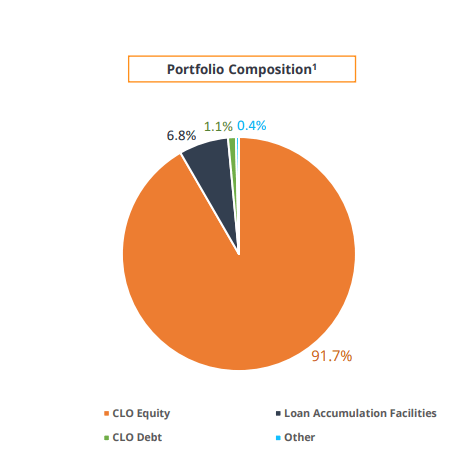

The smarter frogs among you might be right away jumping at the comment and wondering how the CLO equity debt-equity split is being done for this fund. We are glad you asked. It is almost completely CLO equity.

OCCI Presentation

Performance

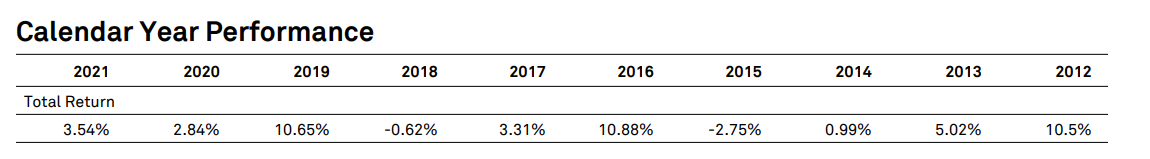

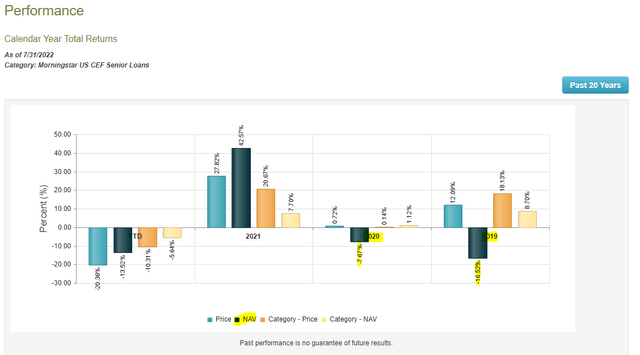

The fund is relatively new and as a result had to get through the challenge of COVID-19, right around its initiation. That said, it actually had a far worse 2019, with a total return including distributions on NAV of negative 16.52%.

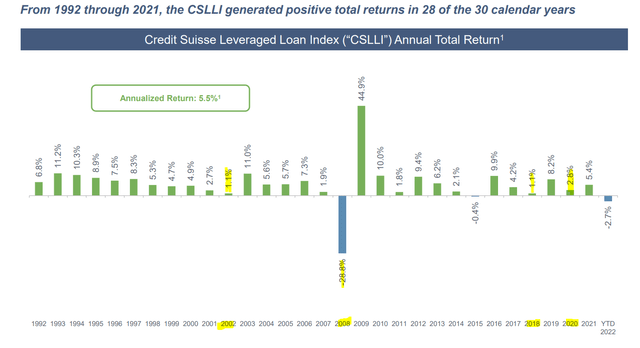

2020 was not as bad but still stung after the bad 2019. An important point to note here is that Leveraged Loan Index absolutely clobbered OCCI in 2019 and 2020.

S&P LL Index

Now, 2021 was strong, with OCCI delivering a rather solid 42% total return on NAV. That outperformance was temporary, and 2022 again saw the fund drop faster than the senior loan category.

Distribution Yield

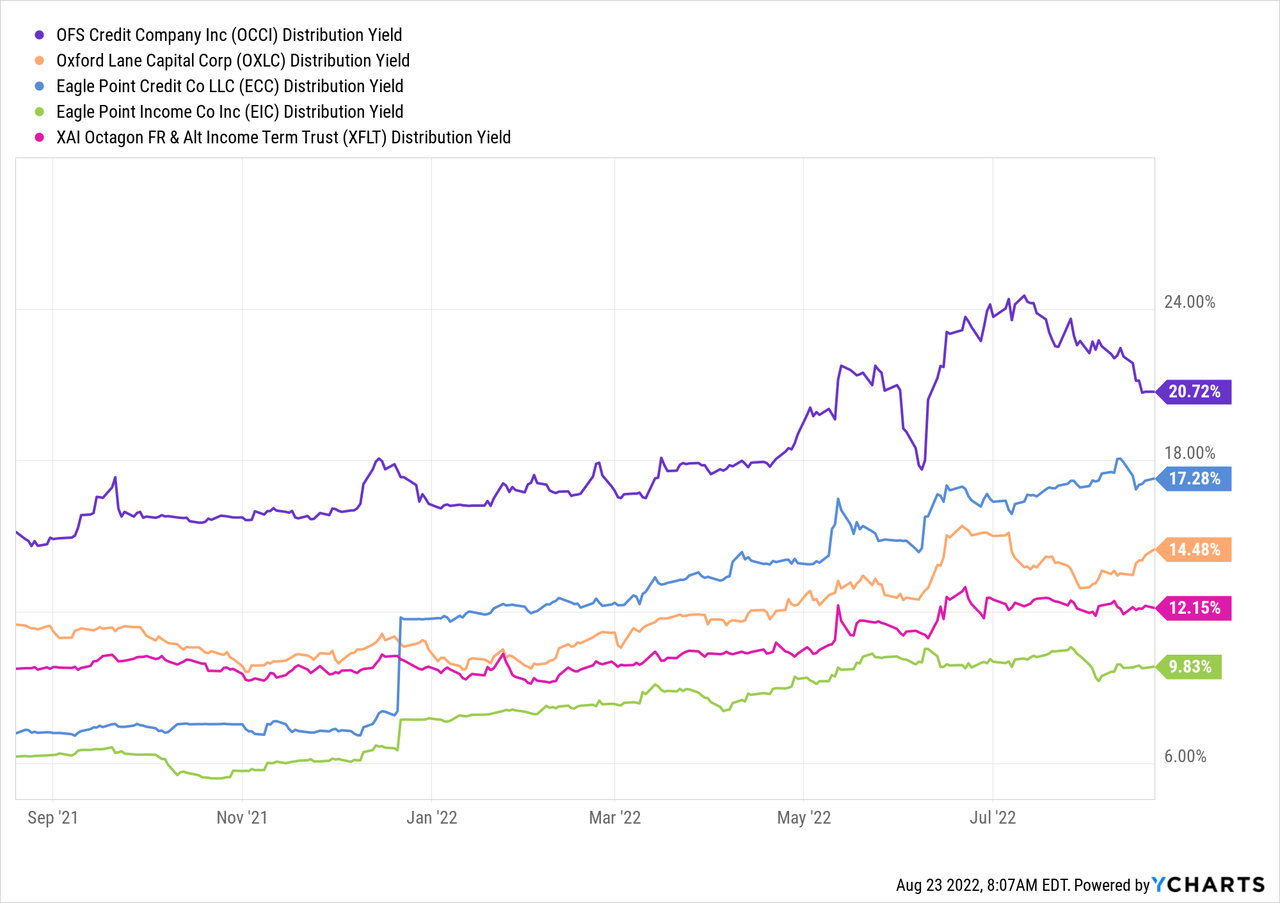

The primary reason you are here (reading this article, not on planet Earth), is for the distribution yield. OCCI gives you 20.72% and that stands apart.

The rest of the space looks bland by comparison.

Eagle Point Credit Co. (ECC) at about 17%.

Eagle Point Income Co. (EIC) at about 10%.

Oxford Lane Capital Corp. (OXLC) at over 14%.

XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) at about 12%.

The plot twist here is that even the 20% stated yield comes with a catch.

Reflects annualized distribution rate on the most recent $0.55 per share distribution declared on the shares of common stock by the Board for the fiscal quarter ending July 31, 2022. The distribution is payable in cash or shares of our common stock on July 29, 2022 at the election of stockholders, to stockholders of record as of June 13, 2022. The total amount of cash distributed to all stockholders will be limited to 20% of the total distribution, excluding any cash paid for fractional shares. The remainder of the distribution (approximately 80%) will be paid in the form of shares of our common stock. The exact distribution of cash and stock to any given stockholder will be dependent upon his/her/its election as well as elections of other stockholders, subject to the pro-rata limitation.

Source: OCCI

Of course, you can sell the shares you get, but this gets back to the core math which investors try very hard to dodge. You cannot make money unless the total returns are positive. OCCI’s total returns with distributions since inception were 2.42%, so if you held a 4-year Treasury bond on the inception of OCCI, you would have done better.

Outlook

There are just two parts to our outlook here that are really relevant. The first being that we are very likely headed into or already in a recession. For all the magic that CLOs allegedly possess, they do pretty poorly in recessions. The leveraged loan index, which we might add has done far better than OCCI since its inception, has pretty weak returns in recessions or near recession environments.

OCCI holds equity in the lower tranches, and we don’t see it doing well at a top level in a hostile environment.

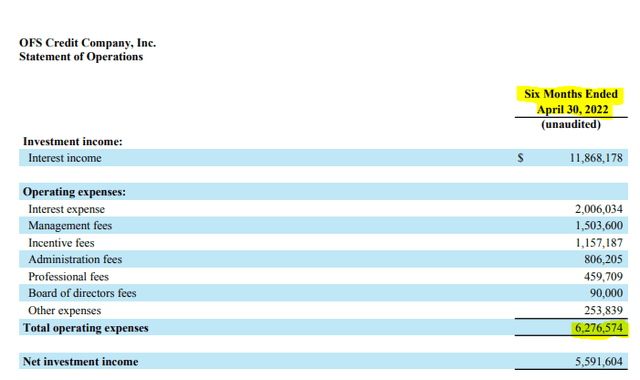

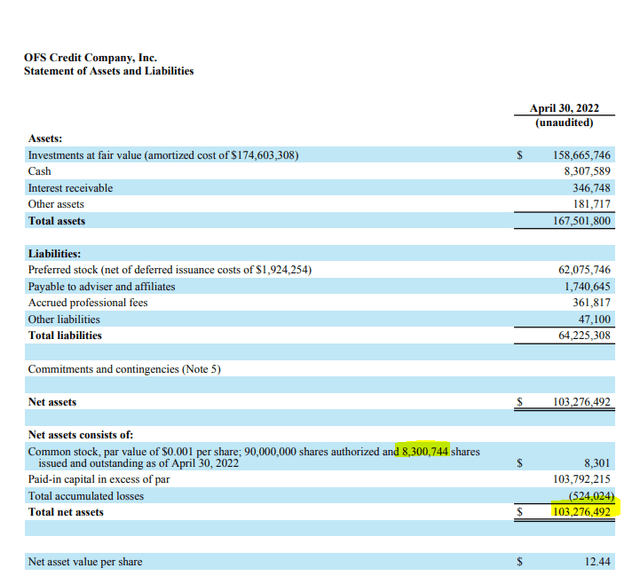

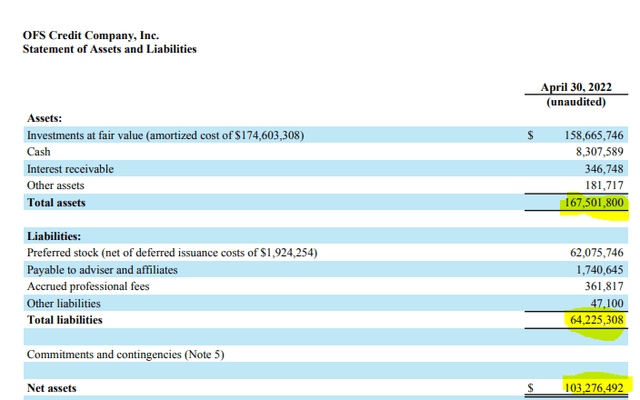

But that is really half the problem. We don’t expect a single CLO fund to earn its distribution yield over the next 12-18 months, so OCCI is hardly unique here. OCCI’s second issue is far more problematic. For the six months ended April 30, 2022, total operating expenses were $6.276 million.

That is on 8.3 million shares at the time and about $100 million in net assets.

So that works out to a 12.5% expense ratio. How do we feel about a 12.5% expense ratio? Well, on XFLT, we had stated this.

5.92% expenses on net assets for an index that will likely not make that total return, is excessive to say the least. At that level, whatever leverage adds, you can rest assured that fees subtract. We would pay 5.92% only if Howard Marks was armed with a time machine and agreed to manage our money.

Source: 2% Annual Returns And We Have Not Had A Proper Recession

For a 12.5% expense ratio, we would need Howard Marks to be armed with at least 5 of the 6 Infinity stones. Needless to say, we don’t think OCCI is going to do well in the next 18 months.

Verdict

CLOs provide good risk-adjusted returns. Those returns tend to be slightly better than junk bonds, and we can expect 5-6% total annual returns over the cycle. In a recession, we would expect that to be lower. OCCI has additional fund-level leverage.

Note that this is from April 30, 2022 and we don’t know what the July 31, 2022 numbers look like. But with the NAV substantially lower, we would expect leverage to be at least in the same ballpark.

With this combination of 20% distributions, 12% expenses and 40% leverage, we are 100% certain this fund is going to have it rough in the next 12 months.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment