Shidlovski

Recently, the stock price of Ocular Therapeutix (NASDAQ:OCUL) has risen due to the potential catalyst event of the company being awarded a late-breaking slot at the American Academy of Ophthalmology to discuss recent data from its Phase 1 trial of OTX-TKI in wet AMD.

This article is a follow up to my existing coverage of the company, but since I haven’t previously discussed OTX-TKI in any detail, today I’d like to provide some background on wet AMD in general, the current standard of care, and what OCUL hopes to be able to bring to the table. I’ll then update DEXTENZA sales data (and my projections for the future), and then will close with a look at the company’s cash runway and the biggest risks that I see for current shareholders.

Wet AMD

The macular society has a succinct definition of wet AMD (note that wet AMD is a progression from the less serious condition of dry AMD):

Wet age-related macular degeneration (AMD) develops when abnormal blood vessels grow into the macula. These leak blood or fluid which leads to scarring of the macula and rapid loss of central vision. Wet AMD can develop very suddenly, but it can now be treated if caught quickly. Fast referral to a hospital specialist is essential.

And Brightfocus highlights both the seriousness and societal cost of wet AMD and AMD generally:

Wet macular degeneration accounts for approximately 10 percent of cases, but results in 90 percent of legal blindness. It is considered advanced macular degeneration (there is no early or intermediate stage of wet macular degeneration). Wet macular degeneration is always preceded by the dry form of the disease.

[…]

Estimates of the global cost of visual impairment due to age-related macular degeneration is $343 billion, including $255 billion in direct health care costs.

Genentech estimates that in 2011 there were about 1.7M cases of wet AMD in the US and that 200,000 new cases are diagnosed annually in North America. It further estimates that by 2020 there would be nearly 3M cases in the US. Research and Markets estimates that there are about 4.4M wet AMD cases spread across the US, EU5 and Japan in 2020.

Thus, any way you look at it, wet AMD is a prevalent and potentially devastating disease, so treatment is a must. Which brings us to the current SOC.

Standard of Care

This NCBI article does a great job of not only explaining the current standard of care (SOC) for wet AMD, it also discusses some of the drawbacks, which, as we’ll see below, is where OCUL is hoping to contribute (with my emphasis).

Research has identified the vascular endothelial growth factor (VEGF) as an important pathophysiological component in neovascular AMD and its intraocular inhibition as one of the most efficient therapies in medicine. The introduction of anti-VEGF as a standard treatment in wet AMD has led to a great improvement in the prognosis of patients, allowing recovery and maintenance of visual function in the vast majority of cases. However, the therapeutic benefit is accompanied by a difficulty in maintaining the treatment schedule due to the increase in the amount of patients, stress of monthly assessments, as well as the associated economic burden. Therefore, treatment strategies have evolved from fixed monthly dosing, to individualized regimens, aiming for comparable results, with fewer injections. One such protocol is called “pro re nata”, or “treat and observe”. Patients are given a loading dose of 3 monthly injections, followed by an as-needed decision to treat, based on the worsening of visual acuity, clinical evidence of the disease activity on fundoscopy, or OCT evidence of retinal thickening in the presence of intra or subretinal fluid. A different regimen is called “treat and extend”, in which the interval between injections is gradually increased, once the disease stabilization is achieved.

This article also discusses the idea of “treat and extend”, but it correctly notes that FDA approvals have generally been based on fixed dose regimens, so by implication, doctors are taking some personal risks in essentially going off of protocol when they engage in “treat and extend” (again with my emphasis).

In wet age-related macular degeneration, the gold standard treatment is intravitreal VEGF inhibitors. Many of these medicines were FDA approved based on positive data from phase 3 clinical trials. In these pivotal clinical trials, many of these medicines were given at fixed dosing regimens, and that provides us with level 1 evidence for the treatment of these diseases. In clinical practice, retina specialists often individualize the therapy for each patient. Because of this individualized and personalized therapy, sometimes patients are on different dosing regimens. The most popular dosing regimen in the United States for the treatment of wet age-related macular degeneration is a treat-and-extend regimen, which allows patients to potentially have fewer injections but with still the same efficacious results.

OTX-TKI for Wet AMD

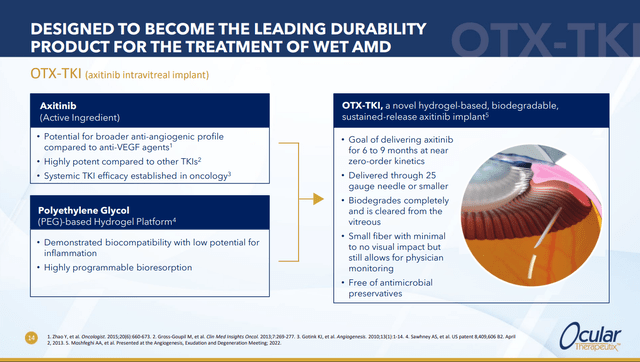

OCUL early stage candidate treatment is an intravitreal implant with a hydrogel that’s intended to deliver a tyrosine kinase inhibitor, Axitinib, whose primary mechanism of action (MOA) is thought to be VEGF inhibition. The hope is that the hydrogel will deliver the drug for at least 6 months which would be a huge improvement over the FDA trials in which current drugs have been approved based on regular 1 or 2 month injections.

This slide from the most recent investor presentation gives a basic overview of the approach:

ocutx.gcs-web.com/static-files/9cbd8ae8-593e-4091-8d30-fed0534153e4

Phase 1 Trials

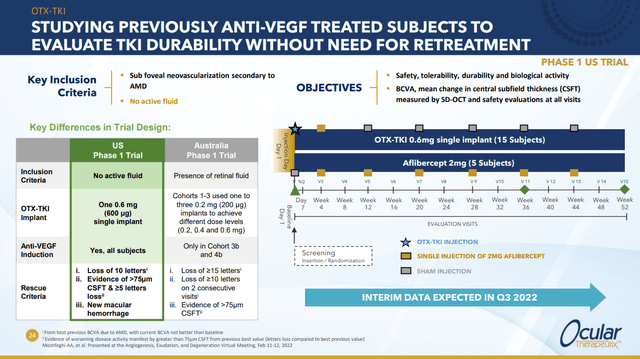

OTX-TKI is currently in two phase 1 trials, the earlier one, which is being conducted in Australia, is intended to see how well the drug can clear fluid from the eye. The more recent trial is being conducted in the US and is intended to answer the question “how long can OTX-TKI keep a dry eye dry without retreatment?”

This slide does a nice job of contrasting the two trials (while also highlighting the design of the US trial):

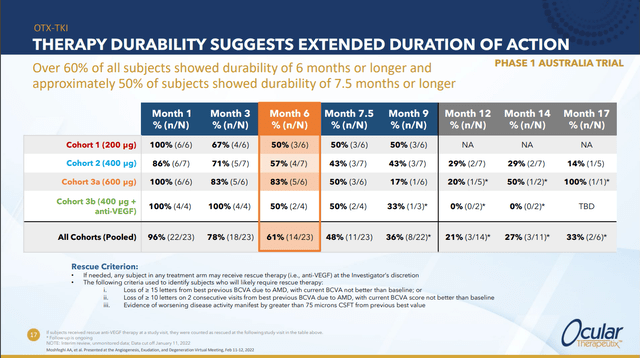

The first trial had several cohorts testing various doses and combinations. Among other things, it showed that across the various treatment regimes, >50% of patients achieved durability of better than 6 months.

This result is part of what gives management (and investors) confidence that the data that will be shared at the late breaking session in September will be interesting/positive. In particular, this optimism is based on the company believing that keeping a dry eye dry is much easier than removing existing fluid from the eye and then keeping it dry. This is the key to the catalyst trade and is probably under-appreciated by the market at large.

The first data from the ongoing trial in the US is part of what OCUL plans to discuss at the aforementioned late breaking session. This is what management had to say about it on the most recent earnings call (with my emphasis):

For those of you following the Ocular story, you’ll know that by far the most anticipated development for the company and for the hope of a more durable treatment for patients with wet AMD is our U.S.-based Phase I clinical trial for OTX-TKI, our existent containing hydrogel implant for treatment of wet AMD and other retinal diseases.

We are developing OTX-TKI to reset the standard of care for durability of a single injection in the treatment of wet AMD from 2 to 3 months to 6 months and beyond. To assess this, we have embarked upon a very important study in the U.S., comparing a single injection of OTX-TKI against Aflibercept dosed every 8 weeks. I’m delighted to announce that all 21 patients in the study have now been on study for 24 weeks or more, and we plan to perform an analysis after 28 weeks. The trial plan dovetails nicely with the American Academy of Ophthalmology meeting in Chicago where we have already been granted a late breaker slot on Friday, September 30.

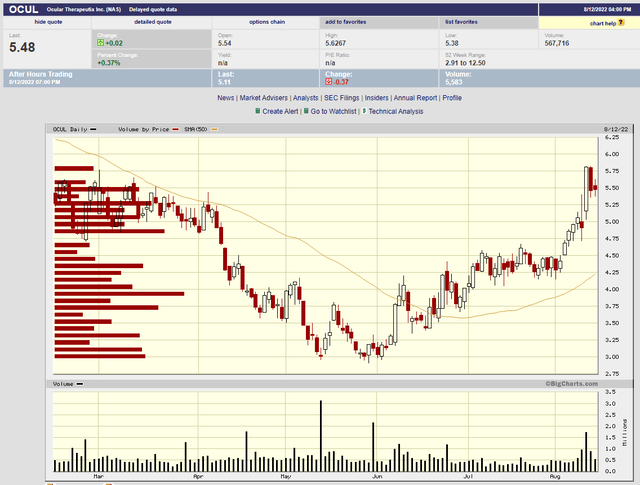

Only time will tell how good or bad the results are, but the market is definitely slowly bidding up the stock in anticipation of the data release.

DEXTENZA

In comparison to the revenue model I established in my last article, OCUL came in light with its DEXTENZA sales over the past two quarters. The company gave this explanation, again from the most recent earnings call, which I accept at face value:

We were seeing both in the market and also with our own field force is that staffing levels continue to be a drag on potential growth. Despite the sluggishness of the current market, we are optimistic about the final quarters of the year and continue our guidance of between $55 million and $60 million of net product revenue for the full year.

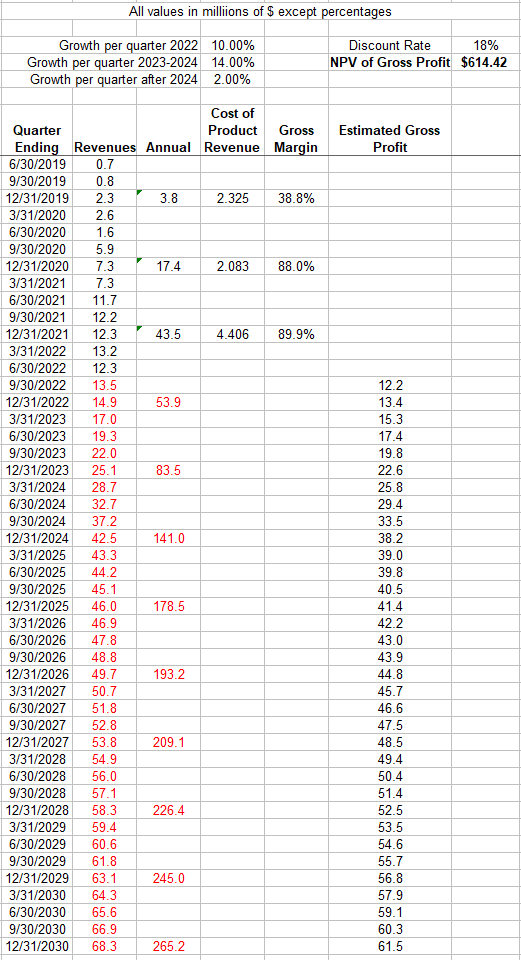

I have updated my model with the latest data. It now shows a NPV of gross profits of $614M, or approximately $8 per share based on 77M shares outstanding.

Author’s Projection and Discounting

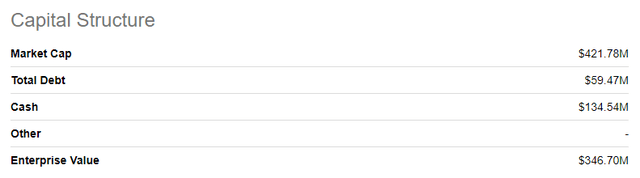

Cash Position & Capital Structure

The company currently has sufficient cash to last through 2023. It will be important for DEXTENZA sales to pick up for this not to be an issue in early 2024. Again from the most recent earnings call:

As of August 5, 2022, the company had 77 million shares outstanding. As of June 30, 2022, the company had $134.5 million in cash and cash equivalents versus $145.4 million at March 31, 2022. Based on current plans and related estimates of anticipated cash inflows from DEXTENZA and anticipated cash outflows from operating expenses, the company believes that its existing cash and cash equivalents are sufficient to enable the company to fund planned operating expenses, debt service obligations and capital expenditure requirements through 2023.

Risks

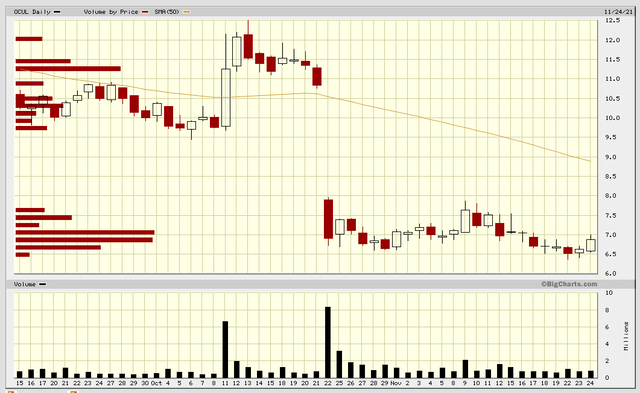

The biggest risk for OCUL is bad OTX-TKI data in September. Here’s a look at what happened when the DED program produced poor data.

I expect the stock could likewise drop 40% on disappointing OTX-TKI data.

The other big risk is slowing DEXTENZA sales, which could necessitate an untimely need for additional financing.

With these risks firmly in mind, I am long a speculative sized position in the company with hopes that the forthcoming catalyst is positive.

Be the first to comment