William_Potter/iStock via Getty Images

Introduction

It can be amazing to see how much changes within a year, such as Occidental Petroleum (NYSE:OXY) which was fighting for their survival during 2020 before subsequently seeing prospects for immense shareholder returns on the horizon during late 2021, as my previous article highlighted. Since their share price has subsequently doubled, it could see some investors looking for the exits but when looking ahead, 2022 offers essentially everything you could want and thus it seems more reasonable to hold, if not actually keep buying despite their otherwise uninspiring very low 0.88% dividend yield.

Executive Summary & Ratings

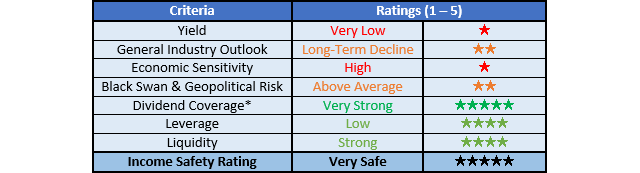

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

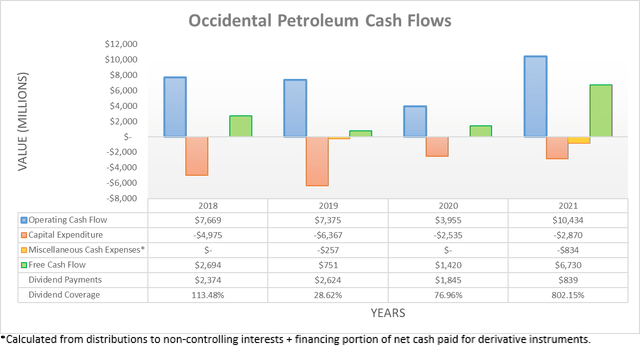

Even though oil and gas prices slid lower during late 2021 due to fears regarding the Omicron COVID-19 wave, thankfully their cash flow performance nevertheless still saw a strong end to the year. This saw their operating cash flow for 2021 end up climbing to a strong $10.434b as they finally started reaping the benefits of their highly controversial and poorly timed Anadarko acquisition, thereby easily surpassing their pre-Covid-19 results of circa $7.5b during 2018-2019 and thus providing their highest result in recent history since at least 2018.

Thanks to their continued restrained capital expenditure their free cash flow surged ahead to a very impressive $6.73b during 2021, which as subsequently discussed, helped immensely to put a serious dent in their net debt and expedite deleveraging. Even more impressively, if not for their $1.426b working capital build this already strong result would have been even stronger and seen massive free cash flow of $8.156b, which would still provide a very high 14.83% free cash flow yield on their current market capitalization of approximately $55b, despite their share price doubling during recent months. Since this was based upon their 2021 results and not the current very strong triple-digit oil prices, this sees minimal downside risk for investors despite their share price doubling because even if oil and gas prices tumble back to their more normal levels from 2021, they would still have ample free cash flow to provide very desirable shareholder returns.

Whilst they are not likely to last forever, the sizeable boost that the widely discussed Russia-Ukraine war has provided to oil and gas prices stands to see their free cash flow surge to new records during 2022 and possibly even beyond into 2023. Since this compounded the already very strong outlook for oil prices, it now seems that oil prices averaging circa $100 per barrel during 2022 are the baseline outlook, which represents a circa $30 per barrel increase versus 2021, as per data from the EIA. Given their high sensitivity to oil prices, they stand to see their operating cash flow increase by $205m for every dollar per barrel that West Texas Intermediate oil prices increase as well as a further $20m for every dollar per barrel that Brent oil prices increase, thereby making for a combined increase of $225m since they normally move in tandem, as per slide twenty-four of their fourth quarter of 2021 results presentation

If these very strong oil prices continue as broadly expected and thus average circa $100 per barrel during 2022, this would see their operating cash flow increase by a very impressive circa $6.75b versus their already strong results during 2021. When combined with their $10.434b of operating cash flow during 2021 and its $1.426b working capital build, it sees their estimated operating cash flow for 2022 at a massive circa $18.6b. They also stand to benefit from higher gas prices but at only $205m per $0.50mmbtu increase, they are far less important than oil prices and thus was excluded to provide a margin of safety. Meanwhile, their capital expenditure is also forecast to jump higher as they ramp up growth investments, as the table included below displays.

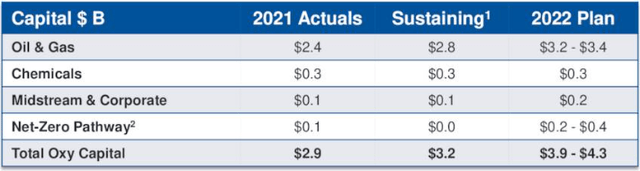

Occidental Petroleum Fourth Quarter Of 2021 Results Presentation

After years of minimal capital expenditure as they focused to help survive the severe downturn, they are now seizing upon these very strong operating conditions to boost their growth investments, which sees 2022 capital expenditure guidance of $4.1b at the midpoint. Meanwhile, their production guidance for 2022 sees full-year production of 1.155mboe/d at the midpoint, which is essentially equal to their 2021 production of 1.19mboe/d, as per slides eight and sixteen of their previously linked fourth quarter of 2021 results presentation. Whilst this may not sound appealing on the surface, it remains positive that they could broadly sustain their production despite two consecutive years of bare minimal investment and accompanying divestitures. Despite this higher capital expenditure, it nevertheless remains dwarfed by their massive estimated operating cash flow and thus sees their estimated free cash flow for 2022 at a massive $14.5b, which provides ample scope to execute their capital allocation strategy, as the slide included below displays.

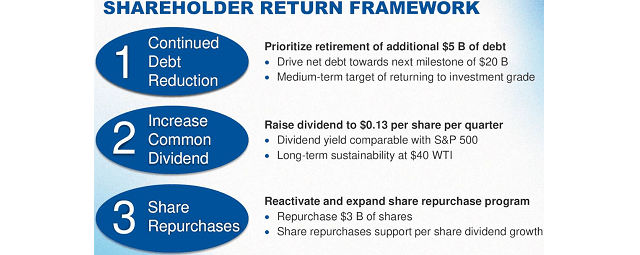

Occidental Petroleum Fourth Quarter Of 2021 Results Presentation

When looking at their refreshed capital allocation strategy for 2022, it shows three priorities with the first being deleveraging, thereby pushing their net debt down to $20b, which as subsequently discussed, they should easily reach even in conjunction with their higher shareholder returns that form the next two priorities. Apart from boosting their dividends, they are also proposing a large $3b of share buybacks that stand to remove upwards of 5%+ of their outstanding shares. Their new quarterly dividends of $0.13 per share should only cost $485.7m per annum given their latest outstanding share count of 934,063,989 and thus even after funding their $800m of preferred dividends and $3b of share buybacks, this still leaves a massive circa $10.2b of free cash flow retained for deleveraging.

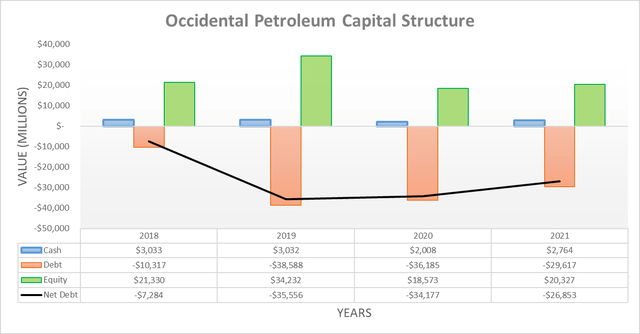

Even though these very strong oil and gas prices may not last forever, thankfully their benefits to their financial position will remain for years to come with their net debt poised to plunge during 2022 after seeing a very impressive improvement throughout 2021. Thanks to their continued strong cash flow performance during the fourth quarter of 2021, their net debt ended the year at $26.853b and thus down materially versus its result of $29.636b at the end of the third quarter when conducting the previous analysis. When looking ahead, their previously estimated $10.2b of retained free cash flow will see them deleverage rapidly and thus should ensure they easily reach their $20b net debt target during 2022, even if oil and gas prices were to soften later in the year. Depending upon the time of payments, this may even eventuate during the first half of 2022 and thus could see their shareholder returns boosted even higher during the coming months.

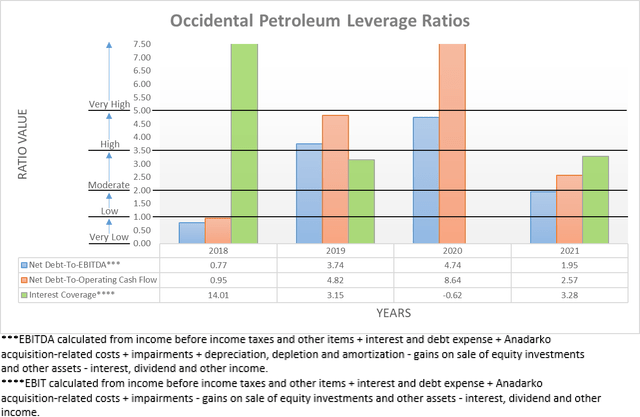

When their materially lower net debt is combined with their continued strong financial performance during the fourth quarter of 2021, it was given that their leverage would have materially decreased in tandem. This now sees their respective net debt-to-EBITDA and net debt-to-operating cash flow sitting at 1.95 and 2.57, which are down versus their respective results of 2.52 and 2.73 when conducting the previous analysis following the third quarter of 2021, although in the case of their net debt-to-operating cash flow, its decrease was limited due to their working capital build.

Whilst the latter saw its result within the moderate territory of between 2.01 and 3.50, given their prospects for significantly higher operating cash flow during 2022 and also lower net debt, it seems reasonable to now judge their leverage as indicated by their net debt-to-EBITDA that was within the low territory of between 1.01 and 2.00. Since their requirement to further deleverage will continue falling as their net debt decreases, the portion of their massive free cash flow directed towards shareholders should increase and thus creates an even brighter outlook for higher shareholder returns that my previously linked article highlighted were on the horizon.

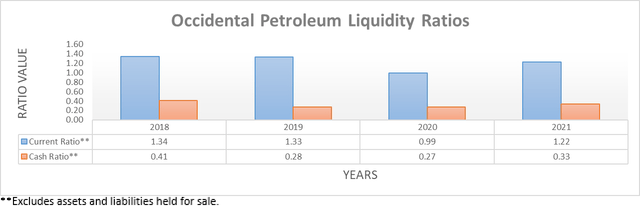

Quite unsurprisingly, their continued strong cash flow performance also ensures that their liquidity remains strong with their respective current and cash ratios ending 2021 at 1.22 and 0.33, which are modestly higher than their respective results of 1.05 and 0.24 when conducting the previous analysis following the third quarter. When looking ahead, rapid deleveraging ensures that their future debt maturities pose no concerns for the foreseeable future, although as a large company they still could have accessed additional liquidity via debt markets if required, even if central banks tighten monetary policy.

Conclusion

Whilst these very strong operating conditions for the oil and gas industry lifts all boats, it remains rare to find a company offering essentially everything; higher dividends and large share buybacks whilst also rapidly deleveraging? Tick. Even brighter outlook for higher shareholder returns as leverage decreases? Tick. Higher capital expenditure to not simply just sustain but actually grow their future production? Tick. Minimal downside risk thanks to a very high free cash flow yield? Tick. Since their free cash flow yield based upon their 2021 performance remains easily within the very high double-digit levels even after their share price doubling in recent months, it should not be surprising that I believe maintaining my buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Occidental Petroleum’s SEC filings, all calculated figures were performed by the author

Be the first to comment