Paul Morigi

Investment Thesis

Despite our original conjectures, it seems that oil prices remain well supported, with crude oil currently at $83.54 at the time of writing, indicating a -15.29% correction since our last analysis at the end of June 2022. On the other hand, Occidental Petroleum Corporation (NYSE:OXY) continued to rally by 9.11% at the same time, or by 118.22% YTD against the S&P 500 Index’s plunge of -22.44%.

The continued upgrades in OXY’s top and bottom-line growth through FY2025 by 23.71% and 203.90%, respectively, remain astounding as well, despite the upgraded recessionary chances to 100% and the Fed’s best efforts thus far. No wonder Buffett continued to load up on OXY at the range of $57.00 to $61.50, despite our now obsolete price target of below $50 or $40. Combined with the massive warrant at the $59.62 strike price, we have to admit our folly then. Ah, hindsight is always perfect indeed.

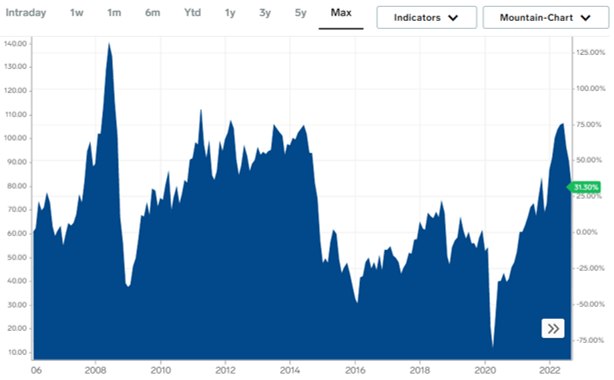

15Y Crude Oil Prices

Market Insider

Going into winter, we expect crude oil prices to persist at these levels, significantly aided by the worsening macroeconomics and geopolitical issues. Nonetheless, the extreme FUD levels of the impending recession have had the critical effect of capping crude oil prices at the previous resistance levels of $105 in July then.

The big question is, will crude oil rise to $100 again? To be honest, we are not certain anymore. One thing is for sure, OXY is at a crossroads now. Assuming that the Feds are not able to tamp down on the rising demand, we may see prices rising again in the short term. Naturally, boosting OXY’s profits and, consequently, stock valuations. Multiple factors are pointing to the resilience of oil prices ahead, due to:

- President Xi Jinping’s “top priority” on economic and GDP growth in China. We already see some hints from the growth in import quota of approximately 104M barrels over the next few months. Thereby, potentially indicating an increase in demand from the world’s most populous country.

- The EU ban on Russian crude and oil products by December at the heights of winter, when electricity bills are expected to be at record highs.

- The OPEC+ output cut by 2M barrels daily, which will “protect” the elevated crude oil prices, despite the recessionary fears.

Though Biden has also pledged another 15M barrels release from the Strategic Petroleum Reserve by December 2022, we do not expect it to anchor the rising prices, especially since winter is coming. A world where energy remains insatiable and renewables struggle to keep up will only point to the strength of conventional energy prices.

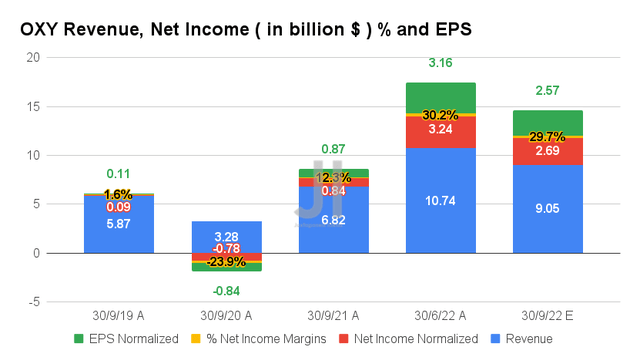

Mr. Market Has Effectively Projected Elevated Prices Through FY2025

For its upcoming FQ3’22 earnings call, OXY is expected to report revenues of $9.05B and net income of $2.69B, indicating a notable decline of -15.73% and -16.97% QoQ, respectively. The declines are obviously attributed to falling crude oil prices, output reduction, and rising costs. Otherwise, these numbers would still represent massive YoY growth of 32.69% and 320.23%, respectively. Thereby, naturally boosting its EPS growth by 295.40% YoY to $2.57 for the next quarter.

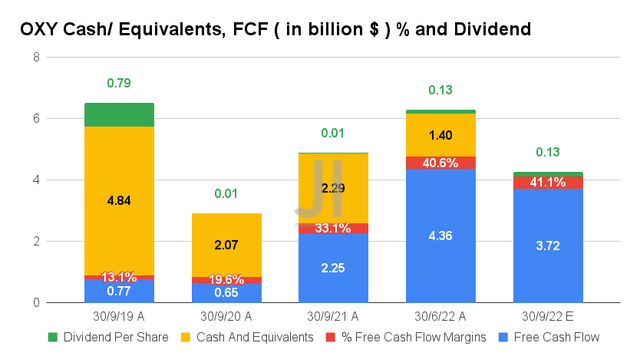

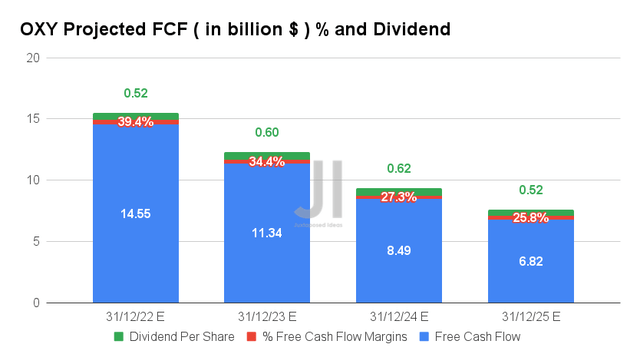

OXY’s Free Cash Flow (FCF) generation would also be improved with $3.72B and an FCF margin of 41.1% projected in FQ3’22, which indicated an increase of 65.33% and 8 percentage points YoY, respectively. Nonetheless, due to its deleveraging efforts, we do not expect to see an increase in its dividends payout, with an in-line $0.13 ahead.

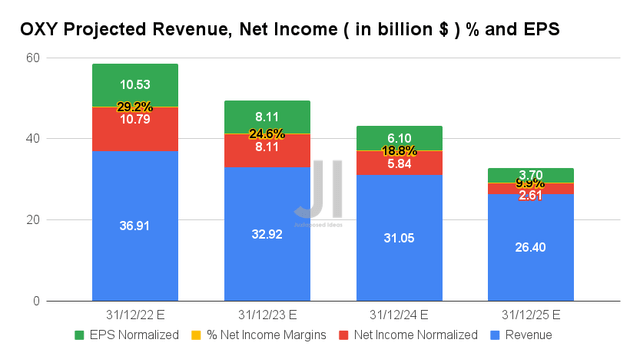

Over the next four years, OXY is expected to report impressive revenue and net income growth compared to FY2019 levels of $21.23B and $1.18B, respectively. The market also continues to gift the company with stellar top and bottom line upgrades by 23.71% and 203.90% through FY2025 since our previous analysis, potentially indicating elevated crude oil prices ahead. Furthermore, its FY2022 estimates indicate an excellent YoY revenue growth of 40.3%, net income growth of 338.9%, and EPS growth of 312.9%, representing another top line upgrade by 6%.

In addition, OXY is expected to report phenomenal FCF generation of $14.55B and FCF margins of 39.4% in FY2022, indicating a massive YoY growth of 97.1% and 11.3 percentage points, respectively. Nonetheless, it is clear that the market does not expect its previously stellar dividends to be reinstated, given the $0.52 expected for the fiscal year compared to the $3.14 paid in FY2019. Pity, since we are fairly confident that OXY would further rally otherwise.

In the meantime, we encourage you to read our previous article on OXY, which would help you better understand its position and market opportunities.

- Occidental Petroleum: No Longer Cheap – Buy Buffett’s Pick At The Next Dip

So, Is OXY Stock A Buy, Sell, or Hold? Your Guess Is As Good As Mine

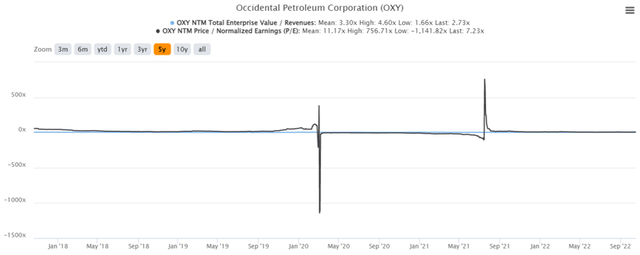

OXY 5Y EV/Revenue and P/E Valuations

OXY is currently trading at an EV/NTM Revenue of 2.73x and NTM P/E of 7.23x, lower than its 5Y mean of 3.30x and 11.17x, respectively. The stock is also trading at $67.78, down -12.12% from its 52 weeks high of $77.13, though at an eye-watering premium of 260.19% from its 52 weeks low of $26.05. Nonetheless, consensus estimates remain bullish about OXY’s prospects, given their price target of $79.17 and a 16.80% upside from current prices. Assuming those top and bottom lines materialized over the next few years, we reckon that the current baked-in premium is well justified.

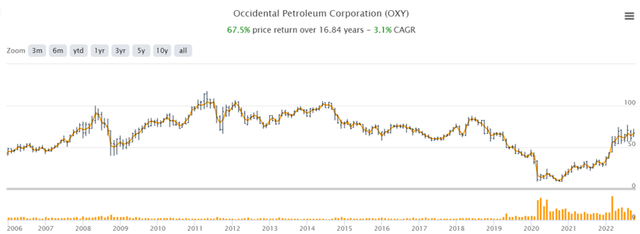

OXY 15Y Stock Price

In addition, if one were to observe OXY’s historical stock price charts & financial performance over the past 15Y, we could very well be at the start of another super cycle of hyper energy growth ahead, as seen between 2010 to 2014. Combined with the simmering geopolitical relations with Saudi Arabia after the endless sanctions with Russia, the pain is unlikely to relent in the short term, indicating a time of elevated energy prices until something or someone relents.

On the other hand, we are starting to see a sequential decline of -2.6% in the energy index through the September CPI, though it remains elevated YoY by 19.8%. Nonetheless, that may not satisfy the Feds, since the US labor market remains surprisingly robust in September, with sticky inflation rates for the September PPI. Thereby, indicating the tremendous consumer spending power ahead. There are already whispers in the market that the Feds may raise its terminal rates to over 5%, beyond the previous projection of 4.6%. 94.7% of analysts are already projecting a 75 basis points hike during the Fed’s next meeting in November and, likely, December as well.

Sadly, we are of the opinion that the recession is already here anyway, with most stocks plummeting catastrophically since their 2021 highs and most global companies on drastic cost-cutting strategies. Therefore, due to mixed signals ahead, we continue to rate OXY stock as a Hold for now. The stock also constantly struggles to break its previous resistance level of $70s, pointing to Mr. Market’s growing pessimism.

In the meantime, investors with higher risk tolerance and a keen investing eye may potentially nibble if OXY falls to the $50s again. Naturally, they should also size their portfolio accordingly, given the massive volatility and minimal dividend yields.

Be the first to comment