ablokhin/iStock Editorial via Getty Images

Investment thesis

We believe market expectations for Ocado’s (OTCPK:OCDDY) shares are low, given poor UK consumer sentiment and a continuing cash burn profile. Our key concern rests with increasing financing costs, as the credit profile of the business is set to degrade in the medium term. We reiterate our sell rating.

Quick primer

Established in 2000 by ex-bankers from Goldman Sachs and listed in 2010, Ocado is a UK-based online grocery retailer operating under its own brand as well as the Morrisons supermarket chain, with a 50:50 venture with Marks and Spencer (OTCQX:MAKSY). There is also the technology business, selling its online retail and distribution platform called OSP (Ocado Smart Platform) to large global grocery chains. Key customer Kroger (KR) in the US now operates 6 automated CFCs (customer fulfillment centers), and there are 11 other international partners signed up which include Groupe Casino (OTCPK:CGUIF), Coles (OTCPK:CLEGY), Aeon (8267) with the latest announcement in November 2022 for Lotte Shopping (023530).

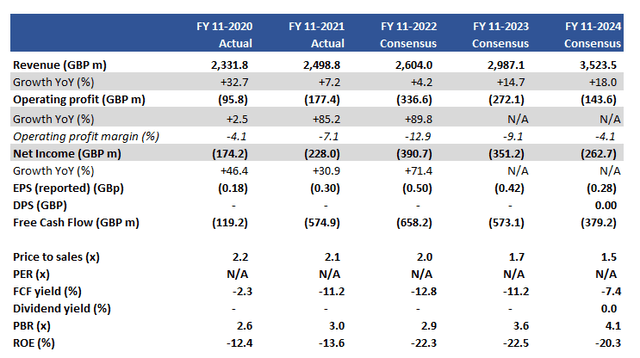

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

Our objectives

We want to update our negative view from July 2021, given the company has continued to acquire new global customers for its OSP technology with the latest addition being increasing exposure in Asia with Korea’s Lotte Shopping. The shares have corrected over 70% since our initial piece, and we want to assess whether this is a buying opportunity.

In the near term

With the core revenue driver being the domestic Retail business in the UK, comments by high street grocer Sainsbury (OTCQX:JSNSF) Chief Executive Simon Roberts in September 2022 talking about “how tough it is for millions of households right now” point to a distinct deterioration of trading conditions since Ocado’s interim results (published in July 2022) which indicated falling shopping basket sizes (down 13% YoY to GBP120/USD135) whilst average selling prices increased by 3% YoY. Tesco (OTCQX:TSCDY) Chief Executive Ken Murphy was more downbeat, saying that “customers are facing a tough time and watching every penny to make ends meet”.

The cost-of-living crisis in the UK is becoming a serious societal problem, and with headline inflation running above 10%, the Bank of England raising base rates to 3.0% and the government set to announce a fiscal tightening program on November 17th, 2022, UK consumers will be under significantly challenging conditions. Consequently, we can only conclude that Ocado will experience the following: 1) an accelerated decline in shopping basket size, 2) a double-digit revenue decline YoY in H2 FY2022 (8% revenue decline in H1 2022), and 3) EBITDA margins fall further as the business sees falling sales volume and inflationary cost pressures.

Under such testing circumstances, Sainsbury has talked about continuing its GBP1.3 billion/USD1.1 billion cost-saving program. Tesco’s strategy includes pushing its own brand range of products in order to make money go further. For Ocado, we believe there is no material opportunity to do either, and hence there is no upside to earnings in H2 FY2022.

The longer-term picture

Ocado’s technology business (called Ocado Technology Solutions) is where investors hold the most expectations for the long term. The idea is to provide grocers with a managed service, providing a suite of solutions that combine end-to-end software systems with physical fulfillment infrastructure. The attractions include what appears to be a large addressable market, together with what the company believes to be a business that can yield an EBITDA margin of around 50% (page 23), versus single-digits for its retail business. There are investors that believe this can be achieved, given Ocado’s ability to raise GBP578 million/USD708 million cash via a follow-on primary offering in June 2022 to fund expansion.

Improving disclosure from Ocado highlighted that in May 2022, the company had commitments from existing customers to generate over GBP900 million/USD1,035 million in revenue from its technology in the ‘mid-term’. The company is growing in scale in the US market with Kroger and continues to win mandates overseas although the latest announcement with Lotte Shopping plans for a client fulfillment center (a CFC) site to go live in 2025.

Whilst Ocado’s technology is seen as leading-edge and reliable (with a large UK market test case), the big negative to date has been the lack of evidence to point to high returns. Rolling out a new CFC involves high capital intensity (with high upfront capex all paid for by Ocado) and ongoing support costs. Construction for a typical ‘5 module’ site takes approximately 2 years to complete and ramping to capacity takes around another 3 years. Although we expect the technology to improve and become most cost-effective over time, the company is expected to continue burning cash for the medium term which is also reflected in consensus forecasts (see table in Key financials above).

We do not believe that Ocado will see no success whatsoever in overseas markets with its technology. However, what seems more certain is continued cash burn for the medium term, and greater difficulties going forwards to raise funds as financing has become more expensive. The risk is that Ocado runs out of cash before it can scale sufficiently to generate any returns on its investments.

Valuation

Consensus forecasts point to continued value destruction with negative free cash flow generation for the medium term. There are no indications that the shares are undervalued from a conventional perspective. Even in a ‘replacement cost’ scenario, we do not think you need GBP5.1 billion/USD5.8 billion to build this business and technology from scratch.

Risks

Upside risk comes from Ocado taking massive market share in the UK grocery space and being seen as the ‘go-to’ grocer. We think this will be challenging given the rising preference for discount grocers such as Aldi and Lidl. Ocado could be seen as a takeover target with its technology – but as the concept remains loss-making, we see limited probability here.

Downside risk comes from continued dilutive equity financing as the company continues to burn cash to fuel investment. The cost-of-living crisis and a global recession may result in customer commitments to Ocado technology adoption being postponed.

Conclusion

We believe the market appreciates Ocado’s poor economics, as well as the current UK environment which will severely pressure its Retail business. Expectations are therefore no longer high for the shares. In more conventional environments we would likely opt to go neutral on the shares. However, as financing is the lifeblood of this business, increasing financing costs will mean this vital source will become much less readily available. With the credit profile of this business set to degrade with continued cash burn, we reiterate our sell rating.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment