David Becker/Getty Images News

Nvidia Corporation’s (NASDAQ:NVDA) dominance in high-end GPU markets for the past half-decade is uncontested, but its golden age appears to pause with Ethereum’s anticipated switch from Proof of Work to Proof of Stake. Proof of Work allows individuals to mine using GPUs and requires massive computing power. The new system is Proof of Stake, which follows a mechanism of processing transactions and creating new blocks inside a blockchain without the need for complex computations. The shift will eliminate the need to buy GPUs for crypto-mining. We believe Nvidia’s management has understated its exposure to GPU sales in the crypto-mining market.

We believe Nvidia is a sell with the firm conviction that the company will not be able to keep up with its high valuation. The recent 2022 Investor Day Presentation outlines a Total Addressable Market (TAM) narrative that forecasts increasing revenues. Our numbers show this TAM narrative is unlikely, at best. We estimate Ethereum’s move to Proof of Stake will likely impact Nvidia a minimum of $500 million and up to $1billion in revenue. So, therefore, we believe Nvidia stock is at the risk of a significant sell-off before the market prices in the new market reality.

Nvidia

What Nvidia’s (not) telling you

The America-based semi giant has maintained leadership in manufacturing and designing computer graphic processors that operate through Graphics Processing Units (“GPU”). Like most semi-products, GPUs form an essential part of our lives, whether through computers, playstation5 graphics, or mining Ethereum in a blockchain. Indeed, Nvidia has a range of end markets it operates through: Gaming (45%), Data Centers (41%), Professional Visualization (8%), Automotive (2%), and Original Equipment Manufacturer (3%).

Innovation and tech in all these sectors have consolidated a name for Nvidia, even more so now with the Omniverse, Hooper Data Center GPU, and Grace ARM-based CPU. However, the company’s expected upcoming stock pullback is not a result technological shortcomings, but rather its lack of transparency with investors about their exposure to crypto-mining demand.

The growth outlined in the GTC 2022 is based on outdated end-market demand and does well to tip-toe around Nvidia’s affair with crypto-mining. Nvidia’s earning presentations from the past 12 quarters fail to mention its exposure to GPU sales related to crypto-mining. We believe investors underestimate Nvidia’s Crypto mining exposure at their peril.

The link between Nvidia and Crypto mining is well established

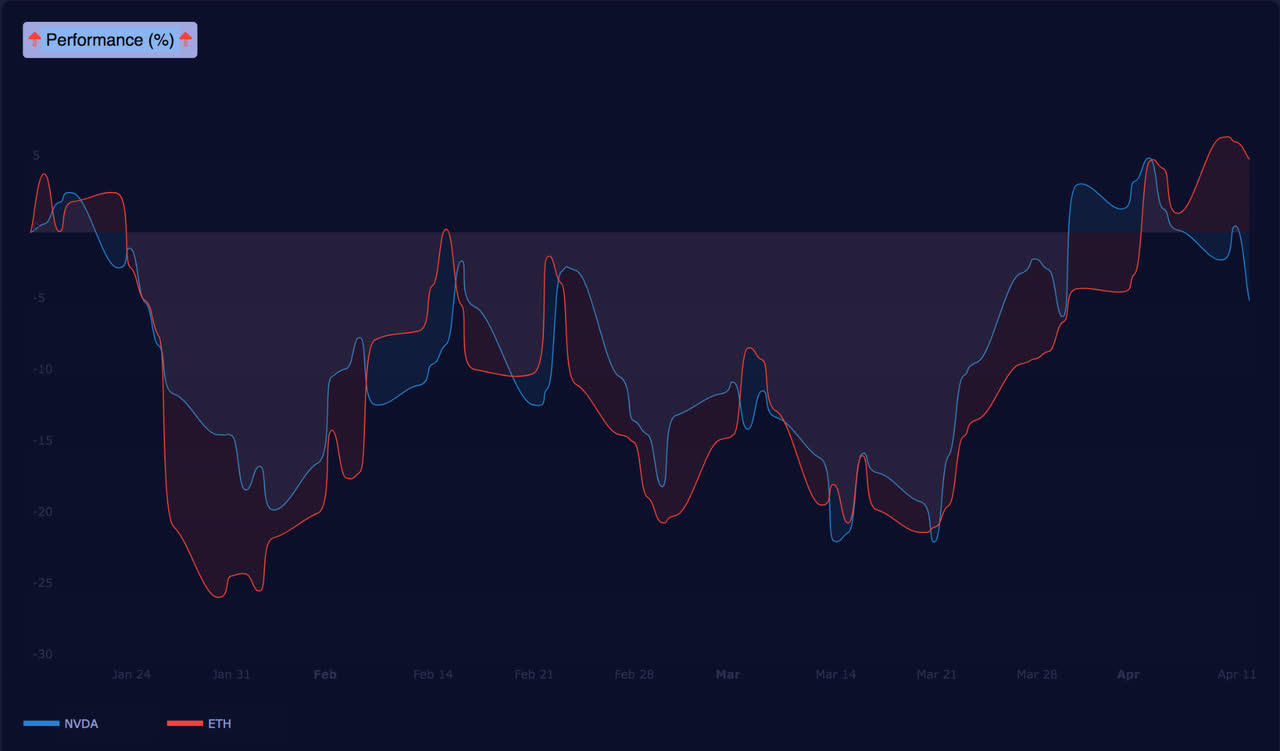

The link between Nvidia and crypto mining is no secret. The only way to mine Ethereum had been through GPUs, and the best GPUs are from Nvidia. The two have been married in their rise and drop since 2017. So much so, that the Ethereum 2018 hash rate dip correlates with a drop in NVDA’s stock for the fiscal year of 2019. We saw this again last year (2021), when the decline in cryptocurrency-related sales impacted Nvidia stock earlier this year, bringing about a 27% decline in January 2022.

Nvidia has again slipped into the same position, and we know the secret of what’s ahead. The following charts illustrate how Nvidia’s stock price correlates to Ethereum’s price.

MacroAxis

Stock performance

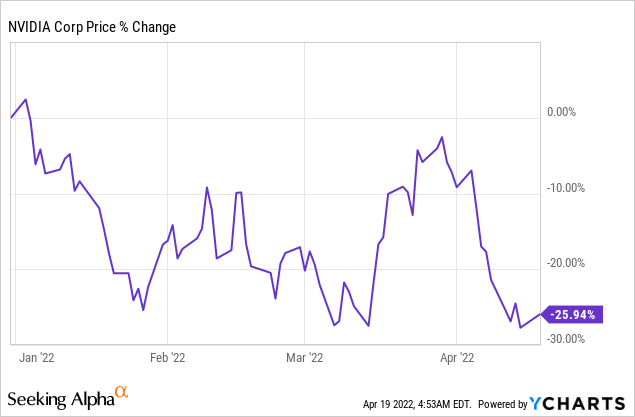

Nvidia’s stock is another pandemic favorite. We witnessed the stock grow 223% since the pandemic’s beginning around March 2020. Specifically, NVDA stock increased 122% in 2020, 125% in 2021, and YTD, the stock is down about 26%. We do not think the stock decline is done yet, since the expected revenue declines due to the waning of Crypto Mining are not priced in. Therefore, we expect another down leg from the current levels on the stock. The following chart illustrates Nvidia’s performance over the last two years.

YCharts Ycharts Ycharts

Valuation

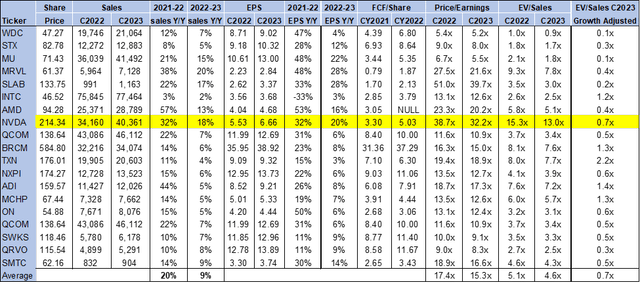

Nvidia is richly valued. The stock is currently trading at around $218 per share. Nvidia is relatively expensive, trading at 15.3x EV/C2022 sales versus the peer group average of 5.1x. On a P/E basis, it is trading at 39.4x C2022 EPS of $5.53, versus the peer group average of 17.4x.

Even adjusting for growth, we believe Nvidia is expensive. On a growth-adjusted basis, Nvidia is trading at 0.7x. We believe revenue and EPS estimates are at risk due to the impending slow-down in the crypto mining market. We believe NVDA’s valuation is too high considering the imminent decline in crypto-mining demand and the negative shift in demand signals from the computer, consumer, and communications OEMs. The following chart illustrates Nvidia’s peer group valuation.

Word on Wall Street

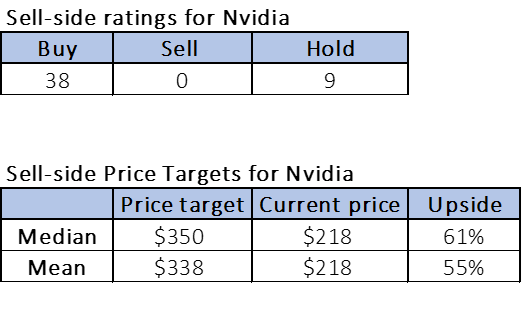

Market consensus pushes for a strong buy on Nvidia stock, making up 81% of the sell-side ratings, with the remaining being neutral/hold rated on the stock. The overwhelming buy consensus is a natural result of investor confidence after Nvidia’s GTC. The average price target on Nvidia is $338, while the median is around $350.

We do not believe the sell-side is pricing in the demand slow-down from the crypto mining business. We think there is more downside on the stock than the market is pricing it in. The following chart illustrates the sell-side ratings, price targets, and upside potential.

Refinitiv

What to do with the stock

We recommend investors sell NVDA at its current levels. Crypto-mining GPU demand and the pandemic did drive up revenues previously, but both are expected to be no longer factors in 2H22. We expect a steep decline, which seems unavoidable, especially since Nvidia is still unwilling to admit its exposure to crypto-mining demand.

Be the first to comment