Justin Sullivan

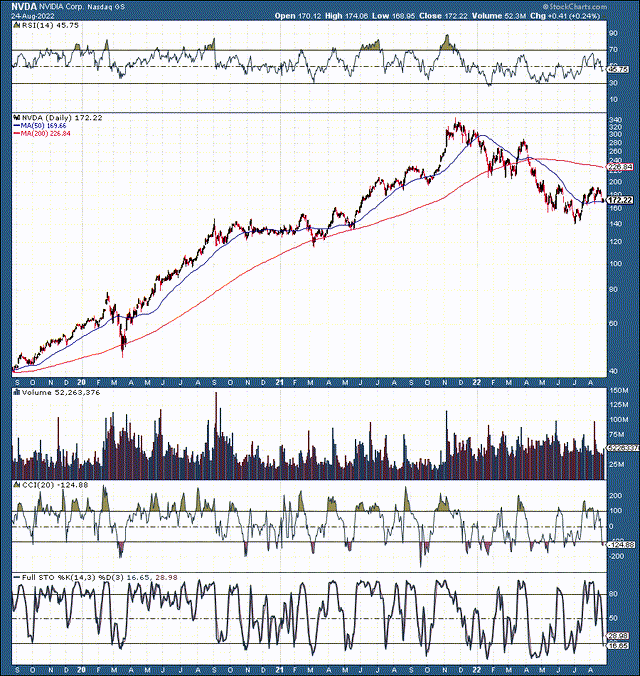

NVIDIA Corporation’s (NASDAQ:NVDA) market cap reached an absurd high of more than $800 billion during the tech-top in November 2021. During this bubble phase, Nvidia’s stock hit an all-time high of around $350, trading at more than 100 times TTM non-GAAP EPS (approximately 40 times TTM sales). Then, the Fed pricked the ultra-high multiple bubble, and many stocks, including Nvidia, crashed.

I warned about the “Epic Drop” in my late-November article, and one of my prime examples of the coming crash was Nvidia. However, despite being one of the most shockingly overvalued stocks of its time, Nvidia’s problems run much deeper than the typical temporary overvalued company.

Nvidia reported earnings in line with its preannounced figures but well below prior guidance and analysts’ estimates. Moreover, the company’s guidance was disappointing. Nvidia is not only suffering from overvaluation problems and a challenging macroeconomic backdrop. The company has entered a severe decline phase, and the market is probably underestimating how serious the situation is for Nvidia.

The company faces several challenging headwinds to its top line, and its bottom line may continue deteriorating in the coming quarters. Therefore, we will probably see earnings estimates and EPS decrease more than anticipated. Meanwhile, the stock should attempt to find a base, but a reasonable entry price may be around $100-120.

The Bubble Days Are Over – More Downside Ahead

This is only a three-year chart of Nvidia. So, we see that before the recent decline phase Nvidia skyrocketed by nearly 10X in just around two years. So, what occurred in this time frame? Why did we see such remarkable demand for Nvidia stock?

We can point to several elements. Nvidia weathered the coronavirus slow down better than many other companies as much of its gaming business is related to gaming. Then, Nvidia received a post-coronavirus recovery boost as well. The company’s revenues surged by 40-60% or more in many quarters in 2020/2021, and investors loved its performance and stock.

The insatiable demand pushed the stock to grossly overbought and ludicrously overvalued levels (roughly 40 times trailing sales). However, what was the true catalyst behind this move? The company claimed that it benefited from surging gaming-related revenues. However, earlier this year, Nvidia settled with the SEC for failing to disclose its cryptocurrency-related sales.

A significant portion of Nvidia’s GPU sales went towards cryptocurrency mining. Unfortunately, we cannot know precisely how much of the GPU sales were cryptocurrency related as the company did not disclose the numbers. However, we know that Nvidia’s GPUs were widely used in Ethereum and other cryptocurrency mining, but sadly for the company, these sales are ending.

The End Of An Era

Nvidia’s revenues benefited greatly from surging Ethereum and other cryptocurrency-related sales. When we look at Nvidia’s surging sales in 2020/2021, this time frame coincides with the significant bull market in Ethereum and other digital assets. However, now the company is reporting sharp drops in sales. Nvidia’s cryptocurrency mining processor (“CMP”) sales were down by 66% YoY to just $140 million last quarter. While the company has a CMP GPU line dedicated to cryptocurrency mining, some of its gaming GPUs also went to cryptocurrency miners.

The massive problem Nvidia faces now is Ethereum’s pivot away from GPU mining. Ethereum has been the driver of cryptocurrency-related mining GPU sales in recent years. However, Ethereum is moving away from intensive GPU mining, and the switch from proof-of-work to the proof-of-stake protocol should be complete soon.

Proof-of-stake is far less intensive and requires nothing near the computing power of proof-of-work. Therefore, the Ethereum network will not need a growing number of GPUs. On the contrary, as we advance, there will probably be a remarkably high number of unneeded GPUs.

Another reason why Nvidia’s revenues spiked so rapidly was the GPU shortage. You’d be lucky to get a quality GPU at MSRP in 2020/2021. Due to the GPU shortage, Nvidia’s graphic cards could sell for two times MSRP or higher in many cases throughout this time frame. Naturally, this phenomenon significantly contributed to the company’s skyrocketing revenues. We can presume that this dynamic occurred partially due to the substantial demand from the cryptocurrency segment.

What We Are Left With Now

Ethereum is moving away from GPU mining. Bitcoin and other digital assets rely more on ASIC miners over GPUs. We see Nvidia’s CMP GPU sales are crashing, and general “gaming” revenues have declined by 33% YoY. Therefore, Nvidia faces a severe problem. A substantial portion of the company’s gains may be gone permanently.

Additionally, Nvidia will no longer benefit from the cryptocurrency segment’s growth. Moreover, the company will no longer benefit from the surging GPU prices it saw in 2020/2021. Instead, Nvidia faces the problem of cheaper GPUs, lower margins, and worsening profitability as the company moves forward.

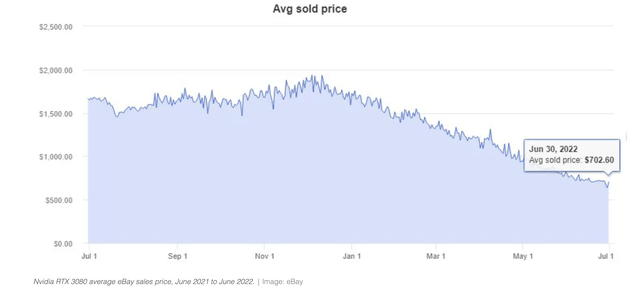

Nvidia RTX 3080 Price Decline

Nvidia RTX 3080 (theverge.com )

We’ve seen a price drop of about 65% for Nvidia’s RTX 3080 GPU since the price peaked last year. This image captures Nvidia’s GPU market and the company’s problem. We will probably see prices stabilize and possibly move up marginally. However, we will not likely see significant price rises any time soon. After years of shortages, the market is oversaturated with Nvidia’s GPUs. We are now seeing the opposite effect and probably have not yet seen the full impact of the oversupply. We must consider that unwanted mining GPUs could further flood the market, exacerbating the supply/demand issue.

We See It In The Results

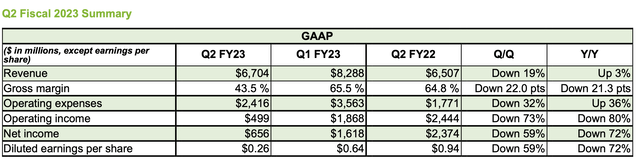

Nvidia 8-K (investor.nvidia.com)

Nvidia’s Q2 results were shockingly poor, and “challenging macroeconomic conditions” do not justify a 19% QoQ revenue drop. Less than one year ago, Nvidia was valued at more than 100 times trailing earnings and now sees YoY growth of just 3% YoY. Moreover, despite only a 3% revenue gain, the company’s operating expenses surged by 36% YoY. Therefore, we see gross margins down substantially, operating income down by 80%, and net income down by 72%.

Now, Let’s Check the Guidance

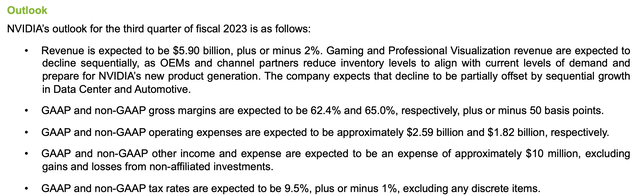

Nvidia Q3 guidance (investor.nvidia.com)

The company guided to just $5.9 billion in revenues for Q3, 15% below the consensus forecast of $6.95 billion. $5.9 billion will be the company’s second consecutive QoQ decline, equating to a YoY drop of 17%. Additionally, the company guided GAAP and non-GAAP gross margins of 62.4% and 65%. However, such a substantial rebound in gross margin will be challenging to achieve, and the company may report gross margins closer to 45-50%, substantially worse than its forecasts. Nvidia’s GPU segment may continue struggling, leading to lower profitability and a worsening long-term image for the company.

Valuation – Still Too High

Nvidia has gone through a severe repricing phase. While the stock is not trading near 100 times TTM earnings, it’s still expensive. Also, we must consider that the market began revising Nvidia’s earnings lower and may not be done.

EPS Revisions

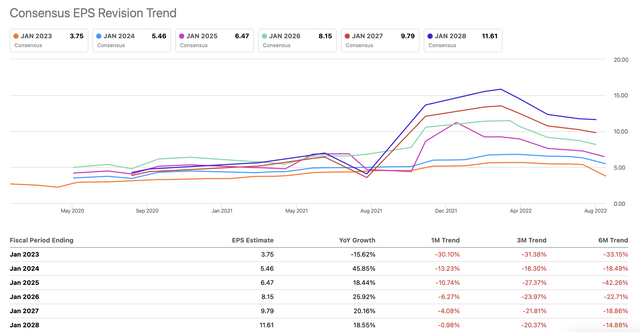

EPS revisions (SeekingAlpha.com )

We see that the EPS forecast trend is lower here. However, considering that Nvidia recently came out with a horrible preannouncement and even more recently provided disappointing guidance, estimates should still go lower. Furthermore, EPS estimates may be too optimistic, as it is unclear whether Nvidia will have such impressive EPS growth in future years.

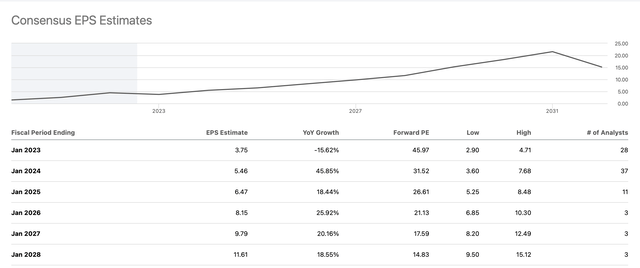

EPS Estimates

EPS estimates (SeekingAlpha.com)

One factor seems clear. The stock is still too expensive here. With an expected EPS of $3.75 this year, Nvidia’s P/E ratio is 45, still very high. EPS projections are for $5.46 next year. However, this figure seems too high, cannot be trusted, and will likely get revised lower. Nevertheless, even if we apply the $5.46 EPS estimates, we still arrive at a P/E of more than 30 for Nvidia. Over thirty times questionable projected earnings is a high price for a company facing significant top and bottom line pressures and will probably see more earnings estimate declines.

I anticipate that Nvidia could earn towards the lower end of current estimates, roughly $4 in EPS in fiscal 2024. Also, Nvidia deserves a lower P/E multiple due to poor performance and uncertainty. I’m comfortable with a forward P/E of 25-30 on a projected EPS of $4 for next year. This dynamic brings us to a buy-in price target of $100-120. In this range, Nvidia becomes a buy, but now at $170, the stock is a sell in my view. I will revisit this stock in the $100-120 range. Until then, there are better stocks to buy.

Be the first to comment