jiefeng jiang

I have posted 3 bearish articles over the last 17 months on NVIDIA (NASDAQ:NVDA), a leading semiconductor growth name, suffering from a mania valuation overshot of any and all reality. Each effort was a bearish valuation call, disregarded by the vast majority of readers during a boom in the semi space, largely caused by transitory COVID-19 shortages. A secondary negative factor was quickly rising inflation and interest rates created a situation where price had to decline in a snapback fashion. Mathematically, the rebalance of earnings and cash flow yields with a completely different investment discount rate backdrop has been a painful process for overexcited bulls.

Seeking Alpha – Paul Franke, May 17th, 2021 Article

Seeking Alpha – Paul Franke, November 8th, 2021 Article

Seeking Alpha – Paul Franke, August 4th, 2022 Article

Then more bad news hit shares this summer, including falling demand from a cryptocurrency mining-related crash, a peak in gaming interest for high-speed graphic chips, U.S. government prohibitions on Chinese sales, and slowing demand (especially from the PC market) in a spreading recession. Today, enthusiasm for NVIDIA by investors is finally shrinking back toward a normal range, as is the valuation on much weaker-than-expected results.

For long-term investors still optimistic on computer graphic chip demand, new artificial intelligence applications, burgeoning robotics in the world, autos and EVs of all types turning into supercomputers, plus all the rest of new-age inventions served by NVIDIA, it is getting late in the downcycle to sell. Consequently, I am upgrading my rating to Hold/Neutral, with an eye focused on purchasing a stake under $100 per share in the coming months.

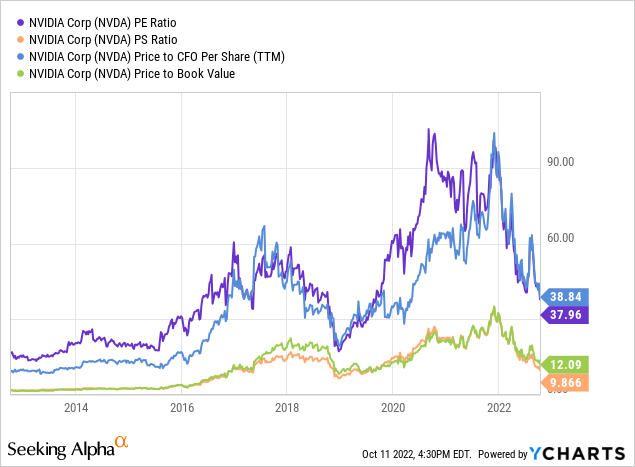

Valuation Improving

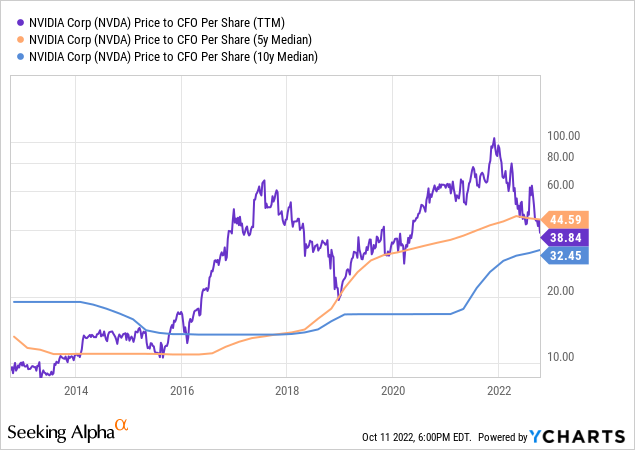

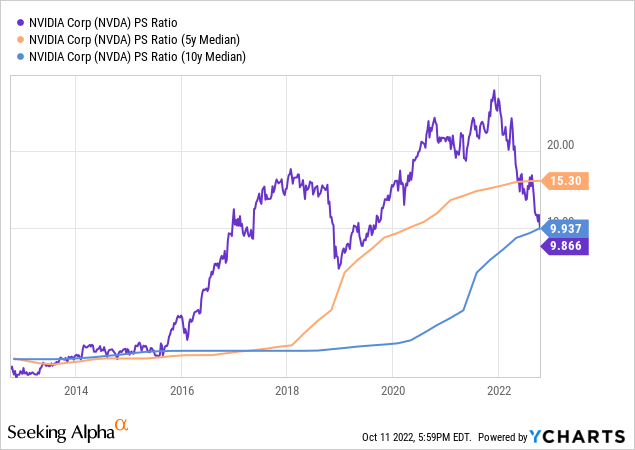

On “trailing” results, basic price to earnings, sales, cash flow, and book value calculations are rebalancing against 10-year normal levels. Below is a graph of all four variables over the last decade, plus a review of 5-year and 10-year median averages of price vs. cash flow and sales.

YCharts – NVIDIA, Basic Fundamental Ratios on Trailing Results, 10 Years YCharts – NVIDIA, Price to Trailing Cash Flow with Median Averages, 10 Years YCharts – NVIDIA, Price to Trailing Sales with Median Averages, 10 Years

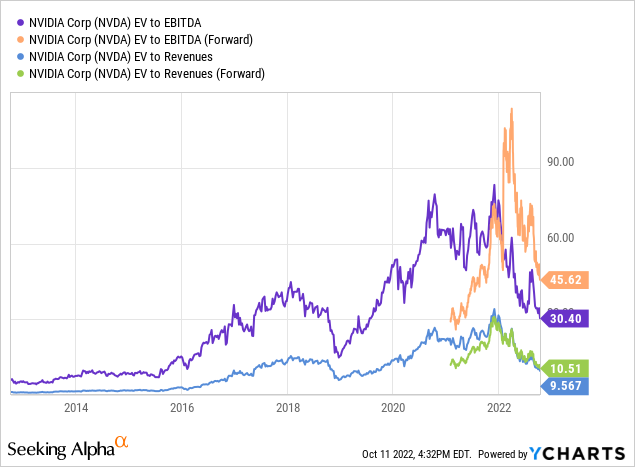

Enterprise value to EBITDA (earnings before interest, taxes, depreciation and amortization) and revenue ratios are still above normal, especially when you start to look at the hiccup in Q2 results and downgraded second half 2022 to early 2023 numbers. The downturn in income is one huge argument that sub-$100 quotes for NVIDIA remain a distinct possibility soon.

YCharts – NVIDIA, EV to EBITDA and Revenues, 10 Years

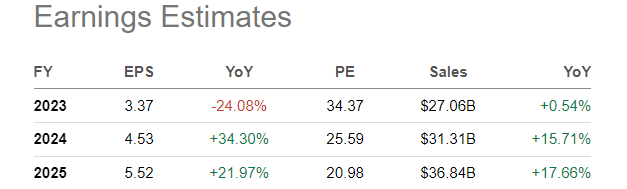

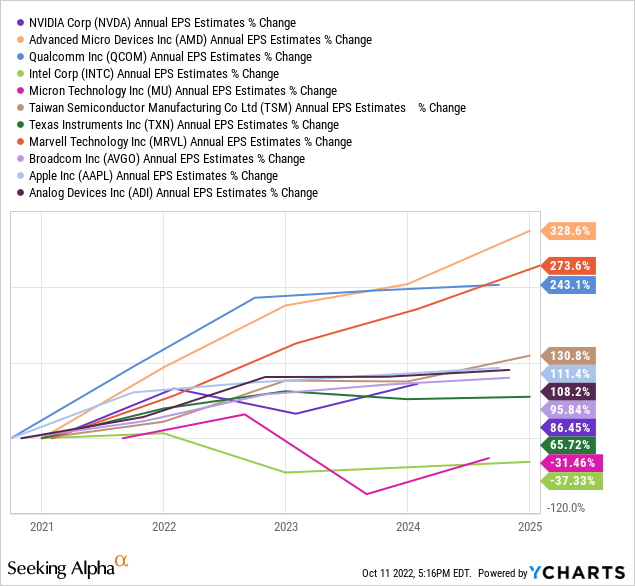

The best shareholder news and foundation for a bullish stock outlook revolves around the projected return to strong income and sales expansion later in 2023, meaning long-term growth trends should remain at least “average” for the Big Tech semiconductor sector and above average vs. the S&P 500.

Seeking Alpha – NVIDIA Analyst Estimates, October 11th, 2022 YCharts – Semiconductor EPS Estimates, October 11th, 2022, Years 2022-24

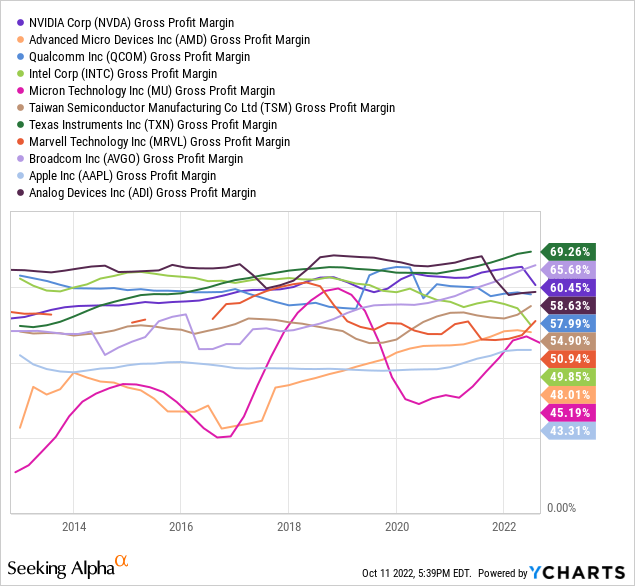

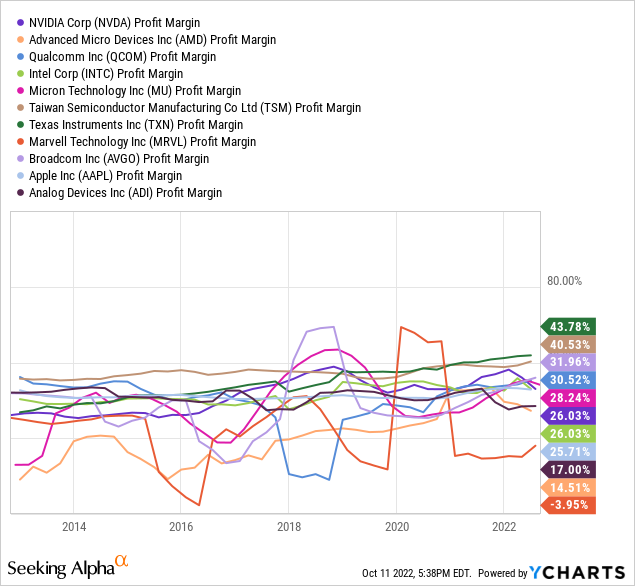

Gross and net income margins are near the top of the technology industry and far stronger than large-cap S&P 500 peers overall. A 10% final margin on sales is better than U.S. company averages, 15% is awesome, and 25%+ is honestly extraordinary for a large enterprise. Cutting-edge tech, protected by thousands of patents, matched against outsized consumer/business demand, makes NVIDIA’s operating future brighter than the vast majority of U.S. equities you can invest your hard-earned capital.

YCharts, Semiconductor Gross Profit Margins, 10 Years YCharts, Semiconductor Net Income Margins, 10 Years

Trading Chart Reversal Coming?

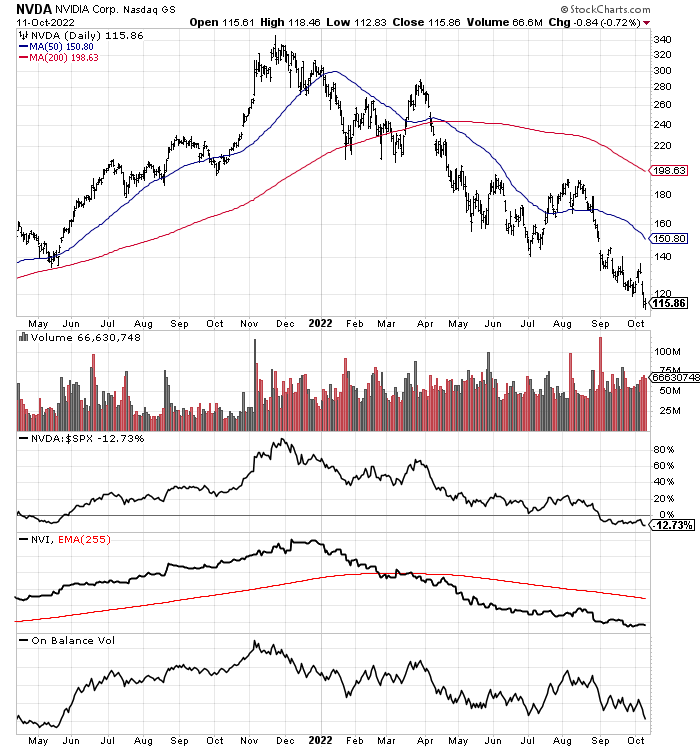

What’s missing for a buy signal (not based in bottom fishing expeditions) is a clear reversal in momentum. My feeling is NVIDIA will not flatline in price for a year or two, but instead reach a crescendo of selling, then pop back up in price to begin a new zigzag higher. At least that’s been the usual pattern during past semiconductor cycle bottoms for the stock.

Below is an 18-month chart of daily trading action, including several momentum indicators I like to track. Basically, technical analysis suggests downside trends will be hard to break until the company is ready to post better-than-expected earnings or Wall Street trading overall witnesses a rebound in pricing. The beginnings of a bottom could be signaled by the Negative Volume Index and On Balance Volume calculations declining only gradually in September-October. These hopeful signs will be worth watching into November.

StockCharts – NVIDIA, 18 Months of Daily Changes

From an investor/analyst sentiment standpoint, one last dip below $100 could cause short-term speculators, frustrated long-term owners, and newbie boom-following investors from 2021 to finally throw in the towel, surrendering shares on the cheap. I am thinking all the pieces for an important low price could be reached before the end of 2022. I would say price does not necessarily need to trade below $100 for a real bottom. At this late stage in the downdraft, a bullish rating is really a function of technical patterns (selling exhaustion or buyers stepping in) and a smarter sentiment setup primed properly for a reversal in supply/demand dynamics.

Final Thoughts

What’s the downside risk past $100? That’s a great question, and one I have been grappling with lately. Assuming EPS and sales come close to current estimates (which may miss in a deep recession), I am estimating $80 is the stock market crash, liquidation panic potential for the rest of 2022. And, a severe recession in 2023 including high inflation and interest rates could push price all the way to $70. However, under any of these super-bearish outcomes, I would categorize quotes under $85 as Strong Buy territory for long-term investors.

If you feel you must buy at $115 today, keep in mind that you might not receive a meaningful profit for years. My view continues to be muted on total return upside, especially without much of a cash dividend distribution (0.2% current yield). An upside target of $125 in 12 months and $150 in 24 months is my baseline case right now, assuming inflation rates moderate, minor GDP growth globally is attainable, and EPS around Wall Street estimates is achieved.

Again, if you hold shares, I would not be inclined to add to the position or sell out either. An interesting buy approach to consider may be the use of a cost-average accumulation plan for new capital. Buying one-third of your position closer to $110, another third either a month down the road or if price under $100 appears, and the final tranche in two months would reduce the immediate risk of further price weakness.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment