Ethan Miller/Getty Images News

It has been a difficult year for equities, even quality growth stocks like Nvidia (NASDAQ:NVDA), as investors brace for what looks like a dampening economy ahead. Inflation continues to run its hottest course in 40 years, while the ongoing Russia-Ukraine crisis and ensuing sanctions threaten to crush already-fragile supply chains and push prices higher. The need to quell inflation is now more urgent than ever, with the Federal Reserve “amping up the hawk” this week. Members of the central bank have unanimously agreed recently that a half-point interest rate increase at the next policy meeting in May is now back on the table. But instead of steep market declines observed earlier this year when the Fed gave a similar hawkish stance, equities actually staged a rebound this week – unprecedented Treasury selling buoyed by the central bank’s signal for further tightening has encouraged investors to rotate back into equities as an “attractive inflation hedge”.

The Nvidia stock has pared its losses to about 6% this year as a result of this week’s rally. Broad-based macro influences aside, Nvidia has also bolstered investors’ confidence on its growth outlook following this week’s GTC 2022 Conference. AI’s growing importance was an obvious theme across the chipmaker’s latest product roadmap, with every new chip and software introduced playing a key role in enabling the nascent technology. From daily interactions with Siri or Alexa, to solving complex problems like climate change, AI computing continues to play an increasingly ubiquitous role in global digital transformation. Paired with Nvidia’s full stack approach in accompanying hardware offerings with complementary software solutions, the company is poised to benefit from sustained acceleration in market share gains ahead.

Nvidia remains in very early innings of renewed growth following its “transition from a PC-leveraged GPU supplier to a diverse parallel computing company” that services a wide range of high-demand end markets, including gaming, data center, professional visualization, and automotive. As a key enabler of critical computing trends in coming years, with expectations for multi-year growth acceleration ahead of a digitization-led upgrade cycle, the stock shows promising potential for sustained upsides over the longer-term.

Nvidia Stock 5 Year Forecast

The key lies in Nvidia’s technology roadmap ahead.

Based on Nvidia’s latest four-day GTC presentation, it is clear that innovation remains at the core of the company’s focus. With the latest introduction of the “Hopper” architecture, and continued expansion of its “Omniverse” ecosystem, the chipmaker is well-poised for further penetration into growing opportunities stemming from the rapid adoption of AI computing. As discussed in one of our recent coverages on Nvidia, much of the accelerated growth prospects observed across its key operating segments – gaming, data center, professional visualization and automotive – are enabled by the increasing integration of AI technology over coming years to keep up with the “exponential surge in data usage”. Here is a closer look at what was unveiled at the latest GTC presentation and what they mean for Nvidia over the longer-term:

1. Nvidia Omniverse Updates

Following the introduction of “NVIDIA Omniverse” just a year ago during GTC 2021, the company has expanded the immersive creativity platform into a multivariate ecosystem. With more than 10x growth in its third-party connections, which streamlines compatibility with workloads from key design tools like Adobe Substance 3D Material Extension (Nasdaq: ADBE) and Epic Games Unreal Engine, NVIDIA Omniverse continues to make it easier for content creators and gaming developers to collaborate, buoying adoption ahead of growing demand for metaverse solutions. The company has also come a long way from its initial introduction of Omniverse apps like “NVIDIA Omniverse Avatar” and “NVIDIA Omniverse Replicator”. New application releases like “Omniverse Nucleus Cloud”, “Omniverse Machinima”, and “Omniverse Audio2Face” as explained in our previous coverage, paired with their significant updates made to date continues to reinforce Nvidia’s penetration into growth opportunities arising from at least 40 million digital designers and creators worldwide as they migrate towards immersive collaborations.

In addition to continuously improving Omniverse offerings, Nvidia has also constructed an attractive software-as-a-service (“SaaS”) business model for the platform to gauge market adoption, while also increasing long-term visibility into the platform’s growth. “Omniverse Enterprise”, the commercial package for Nvidia’s suite of end-to-end virtual collaboration solutions, currently starts at a base price of $9,000 per year plus a subscription fee for each creator license ranging from $100 to $2,000 per user – the best part of this subscription offering is that even users without high-end graphics rendering systems can gain full access to Omniverse applications, an invaluable convenience to creators looking to collaborate on 3D workflows for the first time. Considering the metaverse’s estimated total addressable market value of $800 billion, Nvidia’s well-built Omniverse ecosystem of both software and accompanying hardware offerings is shaping up to become a key benefactor of related opportunities ahead.

2. NVIDIA DRIVE

Drawing on the above developments in Omniverse, the platform’s digital twin application, Omniverse Replicator, has also proven to be a critical tool for autonomous vehicle development in coming years. “NVIDIA DRIVE Sim”, which operates on NVIDIA Omniverse and relies on replicated road data compiled in “NVIDIA DRIVE Map”, enables simulated testing and training of autonomous vehicle technology with real-world road conditions and scenarios. And with the recent introduction of newly-developed AI tools like “virtual reconstruction” and “neural reconstruction”, developers can now easily modify the simulated driving environment by adding/removing objects like cars and pedestrians, and/or changing synthetically generated environments such as the weather to enable testing and training under different environments.

DRIVE Sim and its new software enhancements are the latest validation for Nvidia’s industry-leading expertise in “rendering, graphics and AI”, while also laying the foundation for safe and efficient development and deployment of next-generation autonomous driving technologies. Nvidia’s increasing focus on satisfying automotive technology demands with its AI prowess in recent years comes at an opportune time and is expected pay large dividends in the long-run. The sector is expected to advance at a rapid pace, with demand for autonomous driving software expected to grow at a compounded annual growth rate (“CAGR”) of 36% over the next five years and into a $60 billion opportunity by the next decade, which makes strong tailwinds for Nvidia’s ecosystem of automotive offerings.

In addition to progress in the development of software solutions aimed at hastening the deployment of autonomous driving technology, Nvidia has also started productions of its newest “NVIDIA DRIVE Orin” chip, which is essentially the “AI computer brain” for self-driving cars. NVIDIA DRIVE Orin powers NVIDIA DRIVE software applications like “NVIDIA DRIVE IX“, which enable in-vehicle AI features like “driver and occupant monitoring and advanced visualization of vehicle surroundings”. NVIDIA DRIVE Orin will complement “NVIDIA DRIVE Hyperion 8“, a comprehensive sensor suite built for autonomous driving systems, in delivering comprehensive self-driving solutions for modern vehicle applications. To date, Nvidia’s AI-based automotive hardware and software offerings have already secured a robust pipeline of partnerships. Reputable automakers known for their innovation in building next-generation connected vehicles, including BYD (OTCPK: OTCPK:BYDDF / OTCPK:BYDDY) and Lucid Motors (Nasdaq: LCID), have recently adopted NVIDIA DRIVE as the foundation for their respective self-driving systems.

Although Nvidia’s foray into autonomous driving opportunities is still at very early innings, the chipmaker already sits on an automotive deals pipeline that exceeds $11 billion. The recent achievements are a testament to Nvidia’s critical role in enabling the next generation of “software-defined vehicles” and continues to underpin a massive runway for additional automotive revenue growth over the longer-term. While Nvidia’s automotive segment sales showed a slowdown in 2021, related revenues are expected to ramp up once industry-wide supply chain constraints start to ease and improve in the latter half of the year, as adoption for advanced self-driving technology approaches an inflection point.

3. Hopper Architecture

The “Hopper” architecture, which succeeds “Ampere”, was a highlight of GTC 2022. The “next-generation accelerated computing platform” is designed to address performance requirements for increasingly demanding workloads. The first “Hopper-based GPU”, “NVIDIA H100”, is capable of “advancing gigantic AI language models, deep recommender systems, genomics and complex digital twins”.

Built on TSMC’s newest 4-nanometer process, the H100 is expected to be “the world’s largest and most powerful accelerator” for HPC application. Citing Nvidia CEO Jensen Huang, “twenty H100 GPUs can sustain the equivalent of the entire world’s internet traffic”, underscoring the chipmaker’s powerful influence over AI-computing. The Hopper-based GPU implements Nvidia’s newest “NVIDIA NVLink” technology, which enables “seamless, high-speed communication between every GPU” within a system to facilitate the compute demands of increasingly complex AI and HPC workloads. Building on Nvidia’s leading reputation in AI-computing, the H100 processor is expected to be deployed worldwide by the end of the year, with its presence found across “the world’s leading cloud service providers and computer makers”. This is expected to further bolster its fundamental upsides buoyed by a continued cycle of upgrades ahead.

4. NVIDIA Grace

In the last GTC presentation, Nvidia introduced its first Arm-based CPU processor, “NVIDIA Grace Hopper Superchip”, in a bid to tap into growing HPC opportunities. Fast-forward to a year later, Nvidia introduced “NVIDIA Grace CPU Superchip” at GTC 2022. Built to delivery significant “performance leap for systems training giant AI models”, the Grace CPU Superchip will enable “twice the memory bandwidth and energy-efficiency compared to today’s leading server chips”. The Grace CPU Superchip also implements NVIDIA NVLink technology described above, and comprises of “two CPU chips connected” through “NVLink-C2C” to enable industry-leading performance that is at least 1.5x higher compared to its existing Ampere-based processors shipped today.

Both the Grace Hopper Superchip and Grace CPU Superchip are built to complement Hopper-based GPUs like the H100 described above. Together, the system is expected to catapult Nvidia’s new foray into data center server CPUs and bolster its competition against reputable players in the field, including AMD (Nasdaq: AMD) and Intel (Nasdaq: INTC). Nvidia is already working with “leading HPC, supercomputing, hyperscale and cloud customers” for implementation of the Grace CPU Superchip, which is expected to be deployed in the first half of 2023.

5. Upgraded Ampere-Based RTX GPUs

In addition to the new Hopper-based GPU, Nvidia has also made advancements to its Ampere-based RTX GPUs with the introduction of “RTX A5500”, “RTX A4500”, “RTX A3000 12 GB”, “RTX A2000 8GM”, and “RTX A1000”. In addition to featuring expanded “Deep Learning Super Sampling” (“DLSS”) and ray-tracing capabilities from previous-generation Ampere-based GPUs, the newest RTX A-series GPUs also incorporate Nvidia’s latest RTX technology capable of delivering double the performance to accommodate demanding workflows from anywhere. The newly introduced Ampere-based RTX GPUs also incorporate “Max-Q Technology”, an AI-based system that enables thinner and lighter laptops without compromising on performance.

The upgraded Ampere-based RTX GPUs will be deployed through a new series of “NVIDIA Studio Laptops”, which will be capable of “handling the most challenging 3D and video workloads, with up to double the rendering performance” of its predecessors. Paired with a suite of complementing Studio software, including “Studio Driver”, Omniverse, “Canvas”, and “Broadcast”, the company’s latest development in PC-based GPUs is expected to further propel the current upgrade cycle driving its core gaming segment sales for years to come.

How Much is Nvidia Likely to Grow?

Nvidia’s latest developments in AI-based computing announced at GTC 2022 continues to corroborate our five-year fundamental outlook on the stock. By continuing to refine its AI-based systems and incorporating them into both hardware and software offerings across the board, Nvidia creates an industry-leading technology roadmap that is hard to beat. The chipmaker’s latest GTC presentation communicates one message clearly – it is not a “one and done” but rather a multi-generational enabler of key technologies through continued innovation.

The next five years will mark an inflection point for global digitization with the exponential increase in data generation and usage, creating new growth opportunities ahead for Nvidia. The company has also prioritized the deployment of cash into further expansion of its business as opposed to share buybacks or dividends, which indicates that there is still massive headroom for growth ahead of a booming digitization era, underpinning the creation of additional shareholder value in coming years.

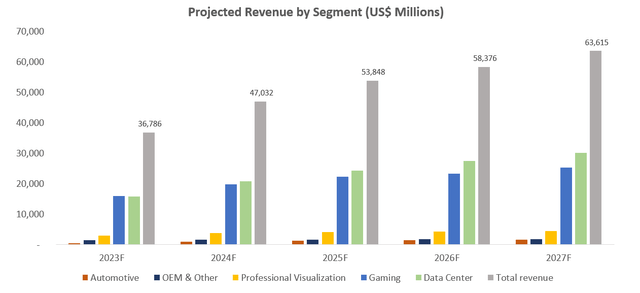

Nvidia Revenue Forecast (Author)

Nvidia_-_Forecasted_Financial_Information.pdf (Please see here for further detail on assumptions applied)

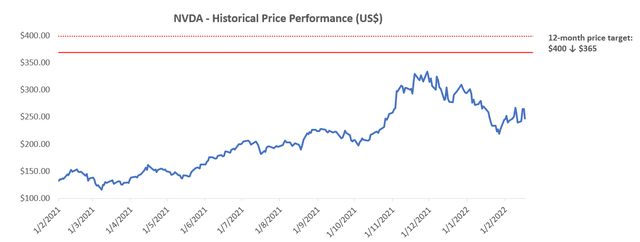

Considering recent market volatility, which has triggered broad-based valuation multiple contractions observed across semiconductor stocks, and mounting macroeconomic headwinds that remain in a fluid, unresolved state, we have revised our 2022 price target from $400 to $365. Specifically, we have made a downward adjustment to the exit multiple used in our previous valuation analysis from 47.8x to 43.5x to reflect anticipated market sentiment for the remainder of the year. All other key assumptions applied in our adjusted valuation analysis (i.e. 12.1% WACC and cash flow streams) remain unchanged from the previous forecast considering there is still reasonable certainty that Nvidia will continue to exhibit fundamental outperformance.

Nvidia Valuation Analysis (Author)

Nvidia_-_Valuation_Analysis.pdf

While global equities remain highly sensitive to evolving macro factors, the Nvidia stock’s latest rally continues to show investors’ care for sustained fundamental growth. Once supply chain constraints start to ease later this year with continued improvements to financial performance, investors’ sentiment for growing chip stocks like Nvidia should return with momentum.

Considering Nvidia’s bullish demand environment, which is expected to buoy a new cycle of yearslong growth considering its “structural importance” in enabling digitization trends ahead, it will only be a matter of time before the stock joins the trillion-dollar-valuation club – likely in the next year when the macro- and geopolitical-risk-ridden market storm clears up. Considering the Nvidia stock’s current market cap of $695 billion, which has come down quite a bit from $800 billion during its November peak, reaching a trillion-dollar valuation would represent upside potential of more than 44%.

Is Nvidia a Good Long-Term Investment?

While current market sentiment may not be favourable for the Nvidia stock, the critical role that it plays in next-generation technology trends make it an attractive long-term investment pick still. However, the stock will likely see further near-term turbulence in response to a macro backdrop that remains “fluid on the geopolitical and economic front”.

Although the majority of the semiconductor industry have unanimously echoed that the ongoing Russia-Ukraine crisis is not expected to cause material impacts on future sales and/or worsen current supply chain constraints, some chipmakers have acknowledged the situation as “clearly not positive”, nonetheless. Paired with increasing potential for multiple half-percentage point rate hikes in upcoming Federal Reserve policy meetings to quell inflation, the stock just might dip again mid-year to the $230-level before any structural momentum resumes in the latter half. While the price pull-back in recent months have created a nice dip-buying opportunity, considering Nvidia’s company-specific growth outlook remains intact, there may be better entry points in the near-term to keep an eye out for in order to maximize long-term gains ahead.

Author’s Note: Thank you for reading my analysis. Please note that I am in the process of planning a subscription service with Seeking Alpha’s Marketplace. The service will allow you to follow my model portfolio, interact with me directly, and participate in chat rooms with other subscribers. I’ll be launching in the near future with a legacy discount for early subscribers and I’ll be sharing more details as we ramp up to launch in the coming months.

Be the first to comment