Justin Sullivan

NVIDIA (NASDAQ:NVDA) has reported a decent quarter and a recovery is likely in the short term, which means that earnings growth should resume in the short term. Long-term investors should continue to buy, as the company’s current valuation is attractive.

Earnings Analysis

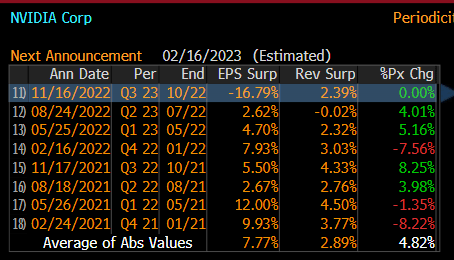

NVIDIA has reported yesterday its earnings related to Q3 of fiscal year (FY) 2023, reporting mixed figures considering that revenue was above expectations, but on the other hand its EPS was below estimates as shown in the next graph. While NVIDIA has a good track record of beating quarterly market estimates, its revenue and earnings surprise has been much more muted in the past couple of quarters, reflecting the weakening operating momentum of the semiconductor industry, namely in consumer electronics and PC sales that has been hurting NVIDIA’s recent growth.

Earnings surprise (Bloomberg)

In the last quarter, NVIDIA’s revenues amounted to $5.93 billion, down 12% compared to the last quarter and lower 17% YoY. This was justified mainly by weak trends in its gaming and pro-visualization segments, which continue to be penalized by inventory corrections as demand declined over the past few months, while on the other hand NVIDIA reported record revenue in data center and automotive segments.

This is the second quarter in a row that NVIDIA reports weak momentum in gaming, which still one of its largest segments, hurt by falling demand following the pandemic-driven boom and lower demand from crypto mining. Investors should note that NVIDIA does not report how much revenue it generates from crypto, but the general market perception is that it’s significant and, therefore, during periods of declining crypto prices NVIDIA’s revenue growth is usually lower. Altogether, NVIDIA’s gaming revenue was $1.57 billion in the quarter, down by 51% YoY and 23% compared to Q2, and represented some 26% of total revenue.

On a more positive note, NVIDIA’s data center revenue was up 1% compared to the previous quarter and 31% YoY to $3.83 billion, representing close to 65% of its total revenue, despite several headwinds including supply chain issues, new export controls to China, and a general economic slowdown. This strong performance was driven by U.S. cloud providers that continue to invest significantly in infrastructure capacity, including Microsoft (MSFT), a customer that also made a multi-year collaboration to build several supercomputing and Artificial Intelligence infrastructure using the company’s GPUs.

Regarding its smaller segments, its operating trends were completely opposite to each other, considering that automotive & embedded reported revenue of $251 billion (+86% YoY), a segment that NVIDIA expects to be its next multi-billion dollar business, while on the other hand its pro-visualization segment reported revenue of $200 million (-65% YoY).

Regarding its business margins, while in the previous quarter the inventory correction and lower GPU prices led to a sharp drop in gross margin, in Q3 NVIDIA’s gross margin recovered to 53.6% (vs. 43.5% in Q2). However, this is still way below the level achieved in Q3 FY 2022 (65.2%), impacted greatly by the gaming segment and inventory charges of $702 million, which were related mainly to lower data center demand in China following new export restrictions. This means that gross margin is likely to maintain its recovery trend next quarter, and be at a level higher than 60%.

Operating expenses were higher in the quarter by 30% YoY to $2.6 billion, due to higher compensation expenses related to headcount growth, salary increase s, and higher expenses in data center infrastructure.

Due to a combination of lower revenue and margins, while costs increased during the past three months, NVIDIA’s net income plunged to $680 million in Q3 FY 2023, a decline of 72% YoY. However, this bottom-line was up 4% QoQ, which means that most likely Q2 was the bottom of the current down cycle, and earnings growth should recover in the coming quarters.

Despite these lower earnings, NVIDIA maintained unchanged its strategy of returning excess capital to shareholders, which amounted to some $3.75 billion in the quarter, both through share repurchases and dividends. In the first three quarters of the year, NVIDIA has returned $9.29 billion to shareholders, and still has more than $8 billion authorized for share buybacks until December 2023.

Regarding its outlook for the next quarter, NVIDIA expects its revenue to be about $6 billion (plus or minus 2%), gross margin to be around 63% as inventory charges should have ended, and operating expenses should be flat on a sequential basis.

This outlook is supported by strong operating momentum both in data center and automotive, that is not expected to change much in the near future, while the gaming segment is expected to recover from a weak period over the past six months and no further inventory drawdown in expected in the coming months.

Medium-term Estimates & Valuation

While NVIDIA has a strong track record over the past few years, its recent financial performance has been much softer, mainly due to weakness in its gaming segment. However, the company’s most recent outlook can be considered positive and a recovery seems likely over the coming quarters. Beyond that, data center and automotive are showing great resilience and have strong structural growth drivers, supporting NVIDIA’s growth for many years.

Indeed, NVIDIA’s data center segment is now generating the vast majority of its total revenue, a much different profile than in recent years, in which gaming was the largest segment. This confirms that the company’s long-term growth prospects were shifting away from gaming to other segments that have good secular growth prospects, such as artificial intelligence or autonomous driving, a move that was faster than expected due to collapsing revenue recently in its gaming segment.

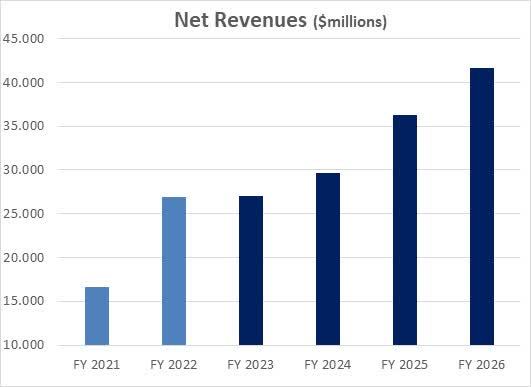

As NVIDIA is increasingly exposed to data center, its medium-term growth prospects are quite solid. Indeed, according to analysts’ estimates, after a flat year related to FY 2023, NVIDIA’s revenues are expected to grow at about 12% per year, over the next four years. This is still a very good growth rate, and NVIDIA is now expected to grow its revenue to about $42 billion by FY 2026, and its bottom-line is expected to reach close to $15 billion (vs. $4.4 billion in FY 2023).

Revenue estimates (Bloomberg)

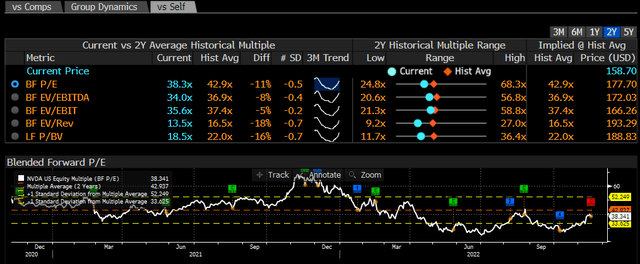

Regarding NVIDIA’s valuation, its shares have de-rated considerable in recent months, like many growth stocks, and is currently trading at some 38x forward earnings. This is below its own historical average over the past couple of years, even though it has already recovered from its bottom of about 25x forward earnings achieved during last October.

Valuation (Bloomberg)

As the company is seeing positive signs of recovery in the gaming segment, while strong has been good in data center and automotive, this valuation seems to be undemanding as the bottom part of the current down trend has likely to have passed.

Regarding major risks, I see increasing competition as the main potential issue for NVIDIA’s growth over the next few years. Indeed, in the discrete GPU market, NVIDIA has a market share above 80% which is a strong advantage, but Advanced Micro Devices (AMD) has become much more competitive in recent years, and may introduce new products that increase the pressure on NVIDIA’s incumbent position. Additionally, Intel (INTC) has also entered this market some months ago, another sign that competition is heating up in the GPU segment.

Another potential issue is NVIDIA’s entry into the CPU segment expected next year, namely in the data center business. While there are strong expectations that a combination of the company’s CPUs and GPUs together will lead to improved performance for data center customers, which could be a positive catalyst for market share gains, there is no certainty in this. NVIDIA’s performance may disappoint and negatively impact its expected growth in this segment.

Conclusion

After a very poor Q2, NVIDIA reported a better quarter and showed encouraging signs of recovery in its gaming segment, boding well for earnings growth in the short term.

NVIDIA remain a great company with a unique profile within the technology industry due to its leadership position in GPUs, which means that its long-term growth prospects remain good supported by several secular growth trends, including data center, AI, and autonomous vehicles. For long-term investors, I still see NVIDIA as a great play in the semiconductor industry, and investors should continue to add as the current valuation remains below its historical average.

Be the first to comment