Yurchello108/iStock via Getty Images

At the end of August, 2022, the U.S. imposed a new license requirement for any future export to China (including Hong Kong) of Nvidia’s (NASDAQ:NVDA) A100 and forthcoming H100 integrated circuits without an export license.

On Sept 1, Nvidia has said that it can continue to ship AI chips from its Hong Kong facility through September 2023. The A100 chips will be able to be bought by Chinese companies until March 2023, while the newer architecture H100 chips can be purchased by Chinese companies until September 2023.

My research shows that these Chinese clients will start stockpiling the A100 chips before the March 2023 ban, followed by the H100 from its Hong Kong facility through September 2023.

It also suggests that Nvidia can ship as many as A100 Ampere GPU processors as TSMC (TSM) it can make until the end of May 2023, since supply-demand dynamics of customers are irrelevant when hoarding. It also means Nvidia can make as many H100 Hopper GPU processors TSMC can make until the end of September 2023.

Impact of Stockpiling

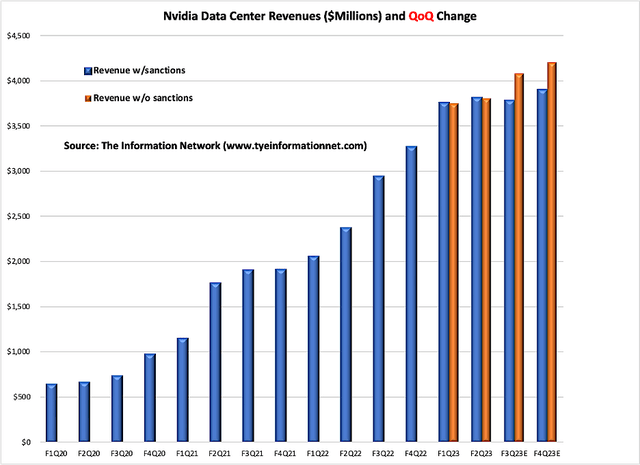

Based on Data Center Revenue generated by Nvidia in Chart 1 I shows revenue with sanctions (blue columns) and without sanctions (orange column).

I expect Data Center revenue to increase 7.3% QoQ in F3Q 2023 without sanctions and because of stockpiling of GPU chips. In other words, the slowdown in Data Center revenues, which I discussed in a my Oct. 3, 2022, Seeking Alpha article entitled “Micron: Slowing Cloud Server Capex Means Equipment Cuts For Applied Materials,” is represented by the blue and shows a -0.8% growth in F3Q 2023.

NVIDIA, The Information Network

Chart 1

China Competition in AI

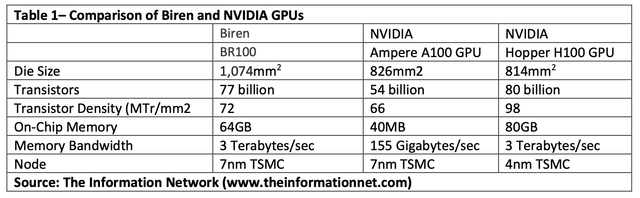

The U.S. restrictions have placed attention China’s GPU industry. Biren Technology and Moore Threads were both started from former Nvidia employees. Biren Technology was founded by a senior Nvidia GPU architect, Lingjie Xu, in 2019. The company has raised $285 million over three rounds. Built on TSMC’s 7nm process, Biren’s initial family of compute GPUs includes two chips. The BR100 promises up to 256 FP32 TFLOPS vs 60 for the H100.

In benchmarking reports, Biren compares its BR100 to Nvidia’s Ampere A100 GPU, with Biren claiming a 2.6x speedup advantage during certain AI inference and training. While the BR100 benchmarks claim a win over A100, Biren’s GPU falls short of Hopper, which significantly outperforms the A100.

Table 1 compares spec information and gen-to-gen comparisons of the three GPUs.

The Information Network

Competition from the Chinese, in their efforts for self-sufficiency and under government programs such as Made in China 2025 are coming on fast and furious.

Nvidia CEO Jensen Huang said in his GTC keynote speech, data centers essentially are becoming “AI factories” with massive computing resources dedicated to AI training models. Remember the U.S. sanctions are about AI, not GPUs. Thus, other types of chips coming from China, which may not be GPUs, are addressing AI.

Shenzhen-based AI chip design start-up Moffett AI revealed a new AI inference accelerator, called S30, which it said has stronger computing power than Nvidia GPUs. It said the computing power of the S30 is twice and 1.2 times stronger than the Nvidia A100 and H100, respectively. The AI chip is made at the 12-nm node.

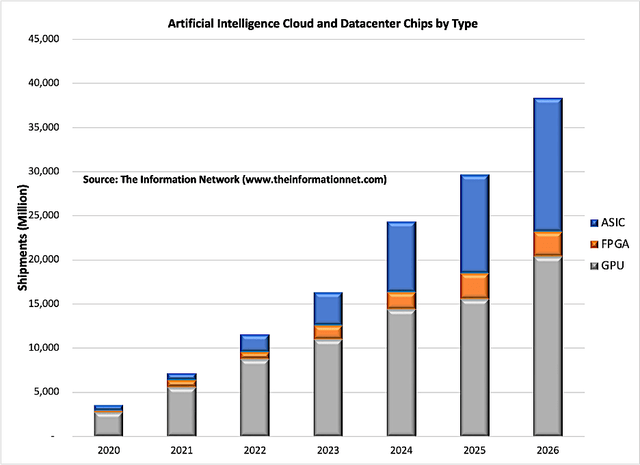

Chart 2 shows that although GPU dominates, ASICs (application specific integrated circuits) and FPGAs (field programmable gate arrays) are utilized at the data center and are growing. But they also can be a customized design, typically called an AI inference accelerator, which also will compete in the data center. There really isn’t a single hardware solution that works well for every use case and the answer depends on your workload parameters.

The Information Network

Chart 2

I estimate the global AI chip market for cloud and data center at $3.6 billion in 2020, and forecast to grow at a 48% CAGR to $39 billion in 2026, as shown above in Chart 2. I estimate GPU dropping from 78% in 2020 to 53% in 2026. I also see the more ASIC market growing at a CAGR of 70% and reaching 40% of the AI chip market in 2026.

Investor Takeaway

These alternative GPUs made in mainland China are 3-5 years behind when compared with Nvidia’s advanced chips. However, Chinese AI firms will have more room for development once the US sales embargo takes effect.

In the meantime, Nvidia will be placing orders with TSMC to make as many chips TSMC can produce until this happens. In other words, stockpiling of these chips will override any supply-demand dynamics as customers will buy as many as they can get.

A major consideration is TSMC’s 7nm capacity, which I estimate at 140,000 wafers per month and should remain constant through 2025 as TSMC expands its smaller 3nm and 2nm node capacity.

Can Samsung Join the Fray?

Ampere is manufactured at 7nm. This raises the question “will Nvidia move back to Samsung Electronics (OTCPK:SSNLF) to crank out Ampere chips before the end of March 2023?”

Nvidia has no manufacturing allegiance, and has a history of switching between manufactures. For example, TSMC made Nvidia data center and consumer PC GPUs until 2019. In 2020, Nvidia selected Samsung for RTX3000 series GPUs to lower production prices and boost product competitiveness by diversifying suppliers, but low production yields forced NVIDIA to move back to TSMC.

Take Your Pick

Both Nvidia and TSMC stand to benefit from the sanctions. Not only will A100 and H100 chip orders be fulfilled, customers will be hoarding additional chips due to sanctions, which will come into effect at the end of March and November 2023, respectively.

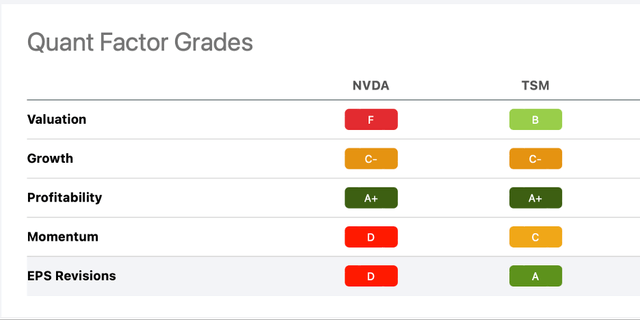

Chart 3 shows Seeking Alpha Quant Factor Grades. TSM has significantly better factor grades, which is a consideration in the overall health of the two companies.

Seeking Alpha

Chart 3

In normal times, I would rate both companies a Hold, as there are too many macro headwinds impacting both companies. However, both companies have a window of opportunity to flood the market with A100 chips through March 2023. The chip is currently in production, and logistically TSMC needs to allocate capacity to meet demand from hoarding by customers.

New sanctions threatened by the U.S. add more uncertainty in supplying China with these Nvidia chips. In the near term NVDA can take advantage of a window of opportunity to “dump” GPU chips in China as sanctions threaten.

Be the first to comment