Evgenii Mitroshin

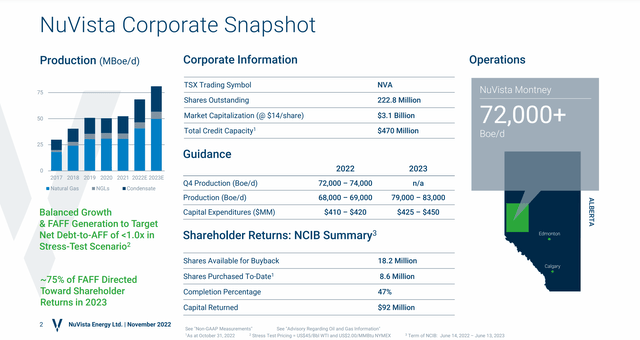

NuVista Energy (OTCPK:NUVSF) or (TSX:NVA:CA) has been one of my favorite companies for years. This company was on the ropes in early 2020 when the Covid Crash hit and sent the stock down to $0.22 per share. Fast forward and this cash flow monster has rebounded to over $14.00 per share. NuVista has handled its business and committed to growing the right way and that is paying off in a big way. The company posted yet another record quarter last week, and they are going to post a record year in 2022 capped off with hitting their debt target and returning 75% of cash flows to shareholders in 2023. While the oil & gas space remains volatile, you can’t go wrong with owning solid companies like NuVista Energy.

Because the company’s primary listing is on the TSX in Canada, this article will be in reference to that share price as well as all $’s are in $CAD.

How Did Q3 Look?

Shocking to no one, it was another record-setting quarter. While commodity prices have been volatile, NuVista has managed to continue to grow cash flows, reduce debt, and maintain a company that is poised for long-term success.

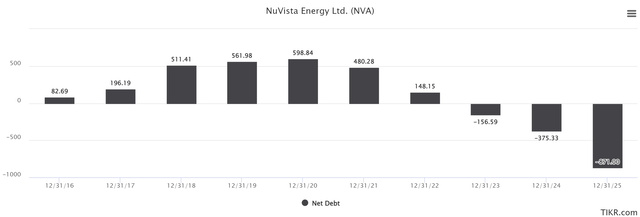

Concerning production in the quarter, we saw them post 68,792 barrels per day. This was the top end of their guidance and 35% higher than this time last year. On the back of that, they achieved a record $246 million of adjusted funds flow. They closed the quarter with only $9 million drawn on their long-term credit facility which has a capacity of $440 million. With respect to net debt, we saw a net debt to annualized third-quarter adjusted funds flow ratio of 0.3x. Which is very good.

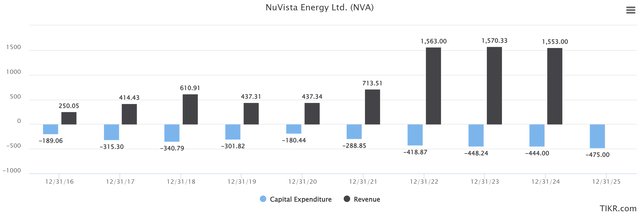

The best part about all of this is that the records are expected to be broken yet again in Q4 and again throughout 2023. As the winter program comes on, we will see another spike in production. In fact, we saw the 75,000 barrels per day mark get taken out in October as they tested the productive capacity of a number of their processing facilities. One of the reasons we are seeing the surge in cash flow is thanks to the cost reductions we have seen. Not only have we seen CapEx stay at a reasonable level while revenues surge (pictured below), but drill costs are coming down as well. In 2022, the average cost to drill, complete, equip, and tie-in a 3000-meter well would cost ~$7.8 million. This is a 16% improvement from 2019. What does this mean at the end of the day? Greater cash flows.

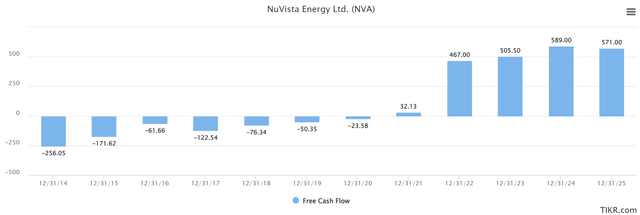

Let’s Talk About Cash Flow

So yes, NuVista is raking in the dough compared to previous years. Looking below we can see the full story. It’s quite impressive to think this stock was really on the ropes in 2020 trading at around $0.20 per share. The question then becomes, what are they going to do with all this excess cash?

We know that they have a buyback program that is already established and will continue. Under their current NCIB, they have 18.2 million shares available for re-purchase. In Q3, we saw 4.28 million repurchased and canceled. Adding the shares repurchased in October takes the total to 8.6 million shares during 2022 so far. This means there’s still plenty of purchasing to take place over the next 8 months as the company plans to max it out by mid-2023.

NuVista is set to hit its net debt target of $200 million by the end of this year. Looking below we can see what that path has looked like, and the good news is that it’s likely to stay well below that for years to come.

Once said target is reached, the board has approved an increase of the return of capital to shareholders to ~75% of free adjusted funds flow. The current ratio is 25-50%, so this is a significant increase. To this point, the company has believed that the best way to return cash to shareholders has been through buybacks, which I don’t disagree with. The question is, will they announce a monthly dividend at year-end? Maybe a special dividend? It’s hard to predict exactly where we will see the cash flows end up, but what I can be sure of is that there will be a shift in how we see the returns.

There was a time I thought someone might buy NuVista, but now I wonder if they will look to acquire assets. The balance sheet is rock solid and the company is poised for continued growth. Shareholders are going to get paid one way or another. Personally, I hope they stick with what they’ve got and continue to buy shares or pay special dividends. Time will tell.

What Does The Price Say?

Diving into the charts, this is a company that drastically outperformed the market performance over the last couple of years. As mentioned, when I last wrote about this company it was May of 2020 and the share price was $0.81 per share. I said then that it could be a multi-bagger, and boy has that paid off. Now it’s just under $14. I would say that qualifies.

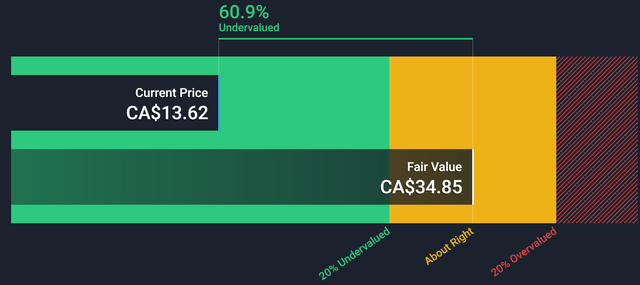

But you’re not here to read about the past, so let’s look at what the price says today and where we could be headed. Looking below, you can get a pretty good idea. Based on fair value, which accounts for future levered cash flows, we can see that the stock is still significantly undervalued. Will it reach full value? I think so. When? Now that’s the million-dollar question. Without the large buy-in from the big funds, it’s hard to say just how quickly the stock will get there.

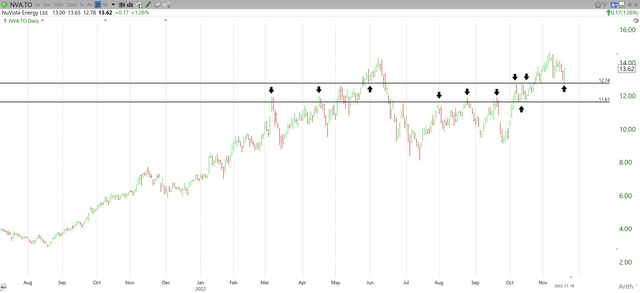

Diving into the charts, you may assume that NuVista is at an all-time high based on what you’ve read so far. But, before the great recession in 2008, the stock was over $20, then crashed to about $5, before rebounding to current levels in 2010. But, the $14.66 mark we hit on November 7th, was the highest the stock had been since 2008.

Where do we go from here? Well, I think we are kind of in no man’s land right now. While the chart still looks fairly bullish to me, a lot of what happens is going to be tied to commodity prices. But, this chart is a stronger-looking one than many others in the space, thanks to the run-up before earnings last week. Looking below, we can see two price levels that I have outlined. These two levels are keys to watch for. If I was a new shareholder, I would have my stop set at $11.61. If I were looking for a sign to buy more or to jump in, I’m waiting to see what happens next week. If we drop below $12.75 then we could be headed for that $11.61 mark. If we bounce, we could be looking to test the recent highs. This can go either way at this point.

As for where we could be headed (positive vibes), I have to use the monthly chart to get points of previous resistance. Looking below we can see that $16.50 and $20.00 are both fair targets to reach for. $20.23 is the official all-time high and I do think we get there in the next year, so long as the commodity prices hold up. But it’s going to be anything but a straight line. While there isn’t much resistance in the last 15 years, previous levels of resistance always seem to act up. It’s no surprise where we topped out last week, and it won’t be one when we see the stock checking itself at $16.50 or $20.00 down the road.

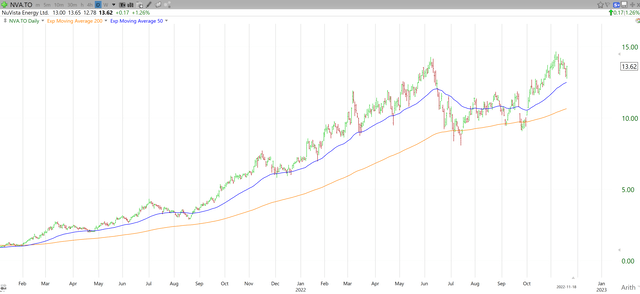

The last chart I want to leave you with that backs up my bullish thesis the most is the one below. This is showing both the 50-day moving average (Blue) and the 200-day moving average (Orange). What this shows is that the current price is above both of these. While you may want to wait for the price to touch the 50-day before buying, you can have full confidence in holding while the stock is above both of these. The chart looks strong and I do believe there is still room to run here. But that doesn’t mean I’m not using stops. Let the math do selling.

Wrap-Up

As you can see, there is a lot to like about NuVista Energy. Is the timing right to buy? Based on the numbers, yes. The chart says to be patient. I trimmed some of my position over $14.00, and I will be looking to add those shares back if we go much lower. I do think this company is set to continue to outperform both the market and the industry as a whole. Not to mention we are going to see the extra allocation to shareholder returns over the next few months and I am very curious to see which way the company decides to go. This of course assumes that commodity prices remain stable, and I think they will. I am long NuVista Energy, and I plan on adding to said position when the opportunity presents itself.

Be the first to comment