Sundry Photography/iStock Editorial via Getty Images

The upside movements we’ve seen in the markets over the past few weeks have all but signaled that a rebound rally is underway, and the stocks that have the most to gain in this rebound are the stocks that had the most to lose since the tech correction began last November. In other words, look to undervalued growth stocks for your best rebound opportunities.

Nutanix (NASDAQ:NTNX), in particular, remains one of my favorite undervalued growth plays in the market. This little-known infrastructure software stock was once the talk of Silicon Valley at the time of its IPO in 2016, but since then, the combination of its very confusing business (it’s much simpler to tout the merits of application software than something infrastructure-related like Nutanix) as well as a business model shift to software-only and subscriptions have made Nutanix difficult to follow.

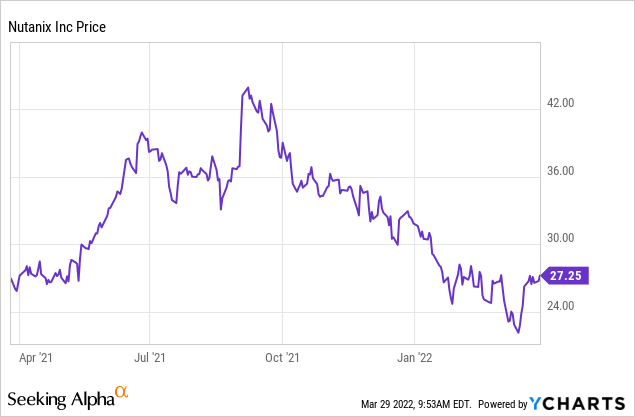

Though investors chased up Nutanix alongside other tech stocks during the immediate aftermath of the pandemic, the stock also sold off sooner than other tech names and is now down ~35% from highs above $40 notched last summer. It’s a fantastic time, in my view, for investors to review the potential in this stock.

Nutanix’s valuation has become severely disconnected with a very positive fundamental story

I remain very bullish on Nutanix, and it remains a core holding in my portfolio, one that I intend to keep both through this rebound and for the long term. Recall that Nutanix is the #1 category leader in “hyperconverged infrastructure,” which is essentially a fancy term for the software that helps different functional areas of a datacenter coordinate in tandem to produce a more seamless and agile computing experience. Longtime tech sector giant VMware (VMW), one of the most well-known names in tech infrastructure, has long been chasing at Nutanix’s heels in the hyperconverged space.

For investors who are newer to this stock, here’s a refresher on what I view to be the key bullish drivers for Nutanix:

- Enabling the hybrid cloud: Not all workloads can be moved to the cloud. These days, IT and computing are all about the cloud. But while the market is chasing after all the hot cloud stocks, the reality is that most companies – especially those in complex or highly regulated industries, or those that simply want more direct control over their data – will never entirely move their systems into the cloud. Nutanix is a champion of the “hybrid cloud” strategy, in which some of a business’s assets are in the cloud and others are in on-prem environments. For the on-prem assets, Nutanix’s hyper-converged technology ensures that customers get the same performance and agility benefits that users receive in the cloud. Most companies today employ some sort of hybrid cloud strategy – meaning Nutanix products are widely applicable to all IT departments.

- Thought leader in hyper-converged infrastructure. VMware has been chasing Nutanix’s tail ever since the company gained prominence. For multiple years in a row, the company has been recognized as the category leader by Gartner, the software industry’s leading analyst and reviewer.

- Software-first. Earlier on in Nutanix’s lifespan, the company sold server devices as its primary business, with its proprietary software overlaid as a “package solution.” Now, Nutanix sells only software. This has dramatically raised its margin profile while also making it more palatable for companies who only want to consume software to run on their own hardware.

- Executing on its new sales strategy. At the beginning of Nutanix’s fiscal 2021, the company made the earth-shaking decision to incentivize its sales staff based on ACV and not TCV. In the past, Nutanix’s account executives sold longer-term contracts and incentivized customers with bigger discounts because they were paid based on the value of the total deal. What’s important for Nutanix and for investors, however, is how much Nutanix can rake in annually and for each customer’s lifetime. So Nutanix shifted its sales compensation in line with this priority and began paying its sales teams based on ACV – and this has yielded very strong results.

Recent news on Nutanix has all been positive, too, especially the company’s most recent quarterly earnings print – which we’ll review in more detail in the next section. But even as Nutanix’s fundamentals have continued to show strength, the company’s valuation has continued to wane. Recall that Nutanix’s low valuation is a legacy symptom of the fact that Nutanix used to sell hardware, and investors de-valued the company accordingly. But even now after its software/recurring revenue transition is complete and the company is generating enviable 80%+ gross margins, the market is still valuing Nutanix like it’s a commodity hardware vendor.

At current share prices near $27, Nutanix trades at a market cap of $6.00 billion. After we net off the $1.29 billion of cash and $1.27 billion of debt on Nutanix’s most recent balance sheet, the company’s resulting enterprise value is $5.98 billion.

For next fiscal year FY23, meanwhile (which for Nutanix is the fiscal year ending in July 2023), Wall Street analysts are expecting Nutanix to generate $1.94 billion in revenue, representing 19% y/y growth (and an acceleration over 17% y/y expected growth in the current fiscal year FY22). Against this revenue estimate, Nutanix trades at just 3.1x EV/FY23 revenue.

To me, this ultra-low valuation makes Nutanix an even more compelling rebound play because valuation is not going to be a near-term ceiling for a Nutanix rally, especially if its fundamentals/billings continue accelerating and the company shows operating margin leverage. I see Nutanix rallying beyond its prior highs of ~$40 within the next 12 months.

Stay long here and take advantage of the disconnect between fundamentals and value to buy.

Q2 download

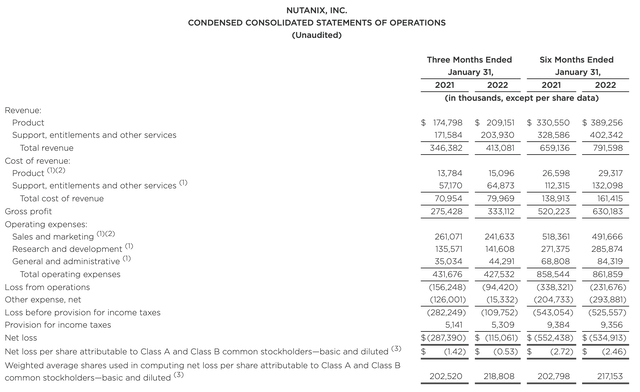

Let’s now review Nutanix’s results for the Q2 (January quarter) period in greater detail. The Q2 earnings summary is shown below:

Nutanix Q2 results (Nutanix Q2 earnings release)

Nutanix’s revenue in the second quarter grew 19% y/y to $413.1 million, beating Wall Street’s expectations of $406.8 million (+17% y/y) by a two-point margin. The company cited strong execution, building on an existing large renewal customer base while also succeeding in landing a raft of new customers.

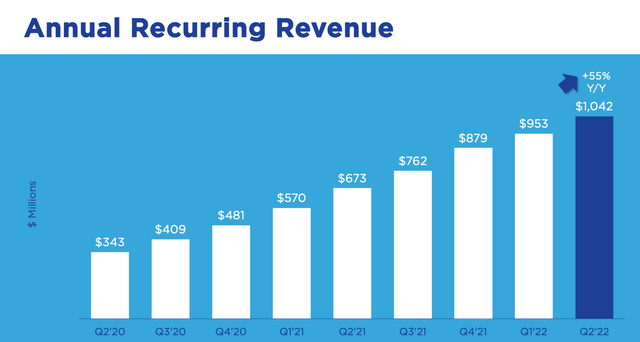

Several key metrics are worth pointing out. As Nutanix has shifted to becoming a recurring software business, we should continue to evaluate Nutanix like we do other SaaS names. In particular, ARR (annual recurring revenue) is one key metric to watch, and for Nutanix, ARR grew 55% y/y to $1.04 billion in the quarter:

Nutanix ARR trends (Nutanix Q2 earnings deck)

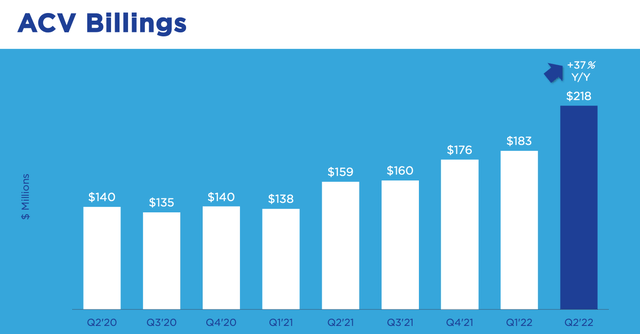

Another metric unique to Nutanix is the concept of “ACV billings,” which represents the sum of ACV (annual contract value) for all the contracts billed within the given quarter, a sum total of both new customer ACV as well as renewal ACV.

In Q2, ACV billings saw accelerated 37% y/y growth to $218 million. This represented four points of acceleration versus 33% y/y growth in Q1:

Nutanix Q2 ACV billings (Nutanix Q2 earnings deck)

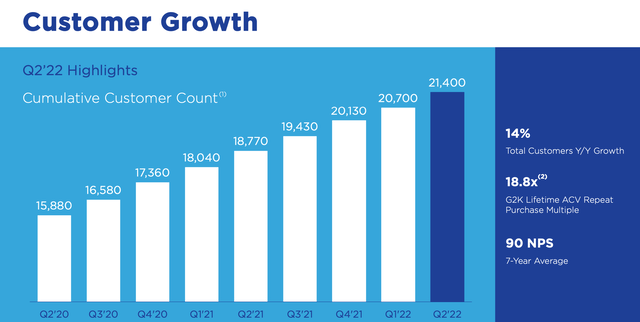

Nutanix also continues to add new customers at a healthy pace. The company added 700 net-new customers to end Q2 with a record high of 21.4k customers, slightly faster than last quarter’s net add of ~570 customers:

Nutanix customer trends (Nutanix Q2 earnings deck)

Duston Williams, Nutanix’s CFO, specifically credited the topline strength in the quarter to much stronger than expected renewal activity. Per his prepared remarks on the Q2 earnings call:

“Our renewals team is starting to hit their stride and the renewals business performed much better than expected, accounting for the ACV billings upside in the quarter. Both LOD support renewals and term-based license renewals exceeded our plans which resulted in a higher mix of renewal business. In any given quarter, our renewals performance is comprised of a certain percentage of late renewals that are executed after the renewal date, on-time renewals and early renewals that are executed before the renewal date. We forecast renewals based on the ATR, or available to renew and apply an estimated retention rate. We also estimate the percentage of renewals that will be transacted as late, on-time and early. In Q2, we processed more early renewals than expected, which led us to exceed our renewals projection.”

Amid topline strength, however, Nutanix also turned in incredible profitability. In particular, the company’s pro forma gross margins in the quarter were a sky-high 83.8% (no one can rightfully claim Nutanix bears any semblance to a hardware company at that high of a gross margin profile, roughly ~10 points higher than most other software companies), higher than the company’s 82-82.5% guidance.

Nutanix also achieved leverage on operating expenses as well. Its pro forma operating loss of -$1.1 million in the quarter clocked in at an essentially breakeven -0.2% margin versus a pro forma operating loss margin of -12.4% in the year-ago quarter. Again, with revenue/billings outmatching expectations plus tremendous margin performance, it’s difficult to not see Nutanix rebounding in the current rally.

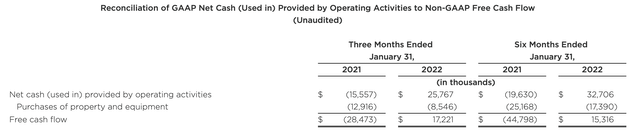

Nutanix’s free cash flow also expanded to a positive $15.3 million in the first six months of FY22, up from a loss of triple that magnitude at -$44.8 million in the year-ago period.

Nutanix FCF (Nutanix Q4 earnings release)

Key takeaways

Nutanix remains a very underrated, undervalued growth stock that is executing admirably on its multi-year shift to becoming a solid recurring revenue software company. With accelerating ACV billings, huge leaps in operating margins and massive expansion in cash flow, the market should recognize and reward the disconnect between fundamentals and value in the coming rebound.

Be the first to comment