Igor Borisenko/iStock via Getty Images

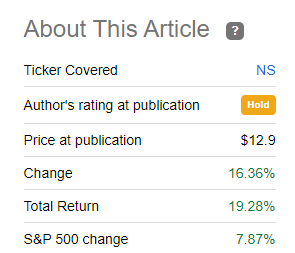

When we last covered NuStar Energy L.P. (NYSE:NS) we decided to bypass the common shares and the preferred shares. The heavy capital structure only made the bonds attractive, and we decided to play it safe by putting our weight behind the 2025 maturities.

The three offer safer prospects relative to the common shares but their value could fall significantly in the next rate cut cycle. We don’t have a position here, but if we did have to choose, we would go with the October 2025 bonds with an 8.735% yield to maturity.

Source: NuStar Preferreds Likely To Cross 12% Yields In 2023

Those bonds have done well since then, but that is hardly a surprise as credit markets have thawed a lot since that date. Even the common shares have delivered a resounding performance and put a smile back on investors’ faces.

Returns Since Last Article

We examine the recently released Q3-2022 numbers and tell you why NS appears to be headed in the right direction.

Q3-2022

Permian is the only real growth story for shale oil, and NuStar showed the benefits of having its pipeline systems leveraged to that.

NuStar’s Permian Crude System’s volumes hit another high in the third quarter of 2022 with a record-breaking average of 580,000 barrels per day (BPD), an increase of 15 percent over third quarter of 2021 volumes and an increase of 11 percent over the second quarter of 2022.

Source: Q3-2022 Press Release

That said, the revenue numbers missed estimates, and the company guided for $700-$730 million in adjusted EBITDA. This was a definite guide down from the $700-$750 million after Q2-2022 results.

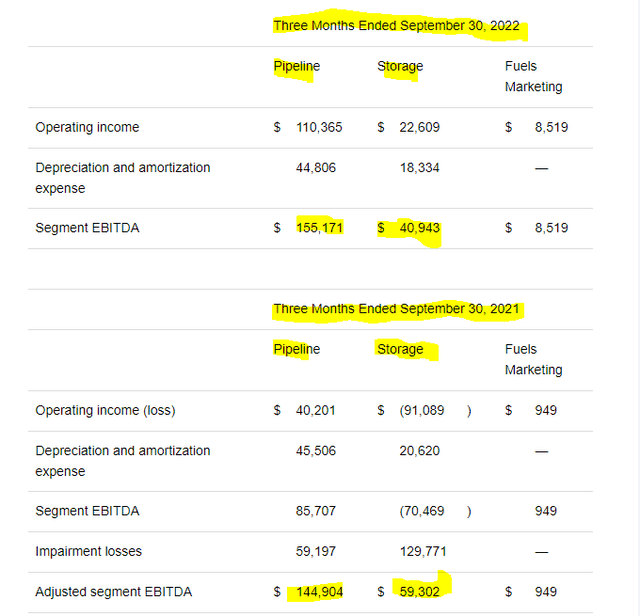

At a segment level, we can see that the pressures on adjusted EBITDA are coming entirely from the storage segment.

These numbers have been adjusted for the Eastern U.S. terminals and Point Tupper terminal, which were sold in October 2021 and April 2022, respectively. So you are looking at an apples-to-apples comparison. This area did get some attention in the conference call as well.

That decrease was due to customer transitions and required tank maintenance at our St. James terminal and an amendment and extension of our customer contract at Corpus Christi North Beach terminal.

Source: Q3-2022 Conference Call Transcript

There are still two positive aspects here, and those may help us catch the EBITDA turn for these assets. The first is that NuStar has dumped a lot of storage assets and its vulnerability is now far lower than it was 12 months back. The second is that the term structure in the futures market has become drastically better. We have a regular contango structure, versus the massive backwardation that we saw over the last nine months.

This likely means that the massive drain in inventories is coming to a close, and there is an incentive to store barrels for sale later.

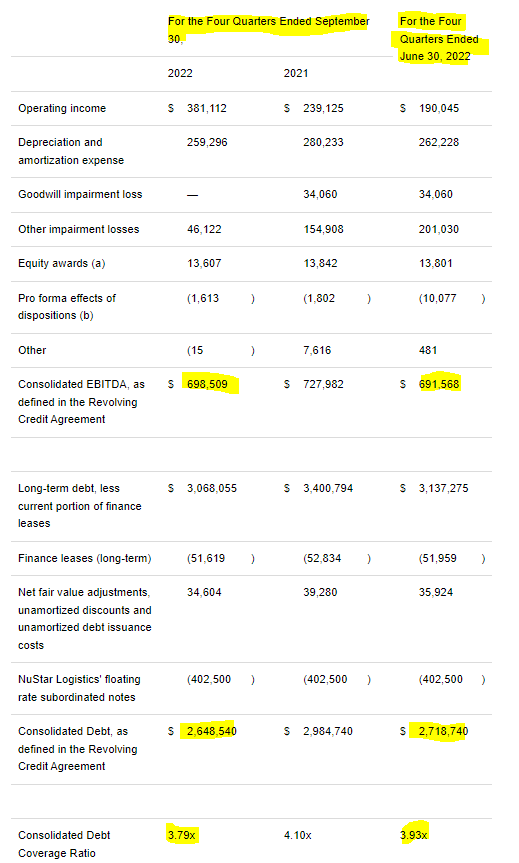

Leverage

NuStar has held an uncomfortable amount of leverage by our standards. This is not readily apparent in the consolidated debt coverage ratio, which is seen in the financial statements. After all, a sub 3.8X number would generally be considered quite good for a midstream company.

Q3-2022 Press Release

That number though comes after the NuStar Logistics Subordinated Notes (NSS) are taken off the count and also ignore the heavy preferred shares ahead of the common. Nonetheless, the 3.79X is an improvement. This improvement has come despite challenges from storage segment woes and high inflation. Looking ahead to 2023, the company should be able to deleverage a little more. With expected EBITDA around $725 million, we could see $200 million of cash left over after, interest, common and preferred distributions and capex.

Series D

The privately placed Series D preferred shares were the biggest thorn in the common equity bull case. NuStar has $590 million of Series D privately placed with EIG Nova Equity Aggregator, L.P. and FS Energy and Power Fund since June 2018, and they have a current coupon of 10.75%. The Series D preferreds become redeemable in July 2023 when the coupon increases to a whopping 13.75%. Any bull case for common shares requires these to be out of the way and that is being addressed.

“Because of the meaningful progress we have made, we are now positioned to accelerate our time frame for addressing the Series D preferred units by completing the redemption in 2024, which is several years ahead of our previously scheduled timeframe. We are currently in discussions with the holders to repurchase approximately one-third of the Series D preferred units by the end of this year. We then plan to redeem approximately another third of them in 2023, and complete the redemption in 2024, while continuing to target our debt metric at about 4 times. This redemption is another important step in our ongoing optimization and will meaningfully increase our cash flow over the next few years.”

Source: Q3-2022 Conference Call Transcript

NS does have a free cash flow run rate after distributions of about $200 million and assuming they can complete this primarily from internal cash flow, things will look a bit improved.

Verdict

NuStar’s preferred shares offer very high yields, thanks to their reset conditions.

1) NuStar Energy L.P., 8.50% Series A Fixed to Float Cumulative Redeemable Perpetual Preferred Units (NYSE:NS.PA)

Yield is floating at LIBOR plus 6.766%.

2) NuStar Energy L.P., 7.625% Series B Fixed to Float Cumulative Redeemable Perpetual Preferred Units (NYSE:NS.PB).

Yield is floating at LIBOR plus 5.643%.

3) NuStar Energy L.P., 9.00% Series C Fixed to Float Cumulative Redeemable Perpetual Preferred Units (NYSE:NS.PC).

Yield floats at LIBOR plus 6.88% starting December 15, 2022.

The three publicly traded preferred shares remain better bets compared to the common. For the common to become attractive, we need to see the Series D taken out and for actual leverage including NSS to go under 4.0X. While the bank debt agreement excludes NSS in calculations, we think that artificially makes the common equity look better. Currently, if we count NSS, leverage is near 4.3X. So moving that down while eliminating the Series D is what is needed to make a longer-term case for the common. The earliest that could happen is the end of 2024. In the interim, we would continue to look up the capital chain for any opportunities and ignore the temptation of the 2X distribution coverage shown on common units.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment