D. Lentz/iStock via Getty Images

Underlying Security Symbol: NUE

It seems I am repeating the first quarter. Nucor, symbol NYSE:NUE, is a stock on which I sold the second most calls during the first quarter of 2022. And, today I am repeating that action.

I added to NUE today. Just Google it, as they say, and you will find numerous articles supporting the need for steel and supporting the fact that NUE is one of the better producers.

Moreover, I like cheap stocks. NUE carries a P/E of 6.6 with a D/E (debt to equity ratio) of .41 and revenue growth of 10.04%. These are good fundamentals. The hair on this baby is the tiny dividend yield. As an income investor, I cannot waste these funds on a stock that does not deliver income even though NUE has been on a nice roll lately.

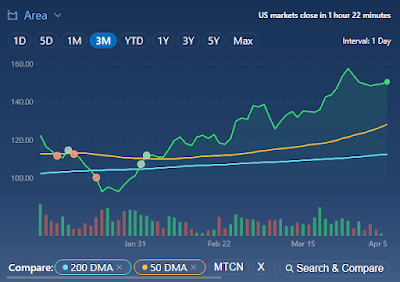

3-Month Chart of NUE price (Source: MSN Money)

3-Month Chart of NUE price (Author)

Therefore, I must be able to create income by selling covered calls. NUE call buyers pay a lot to have the option to buy the stock at a price they think is lower than it will be in May.

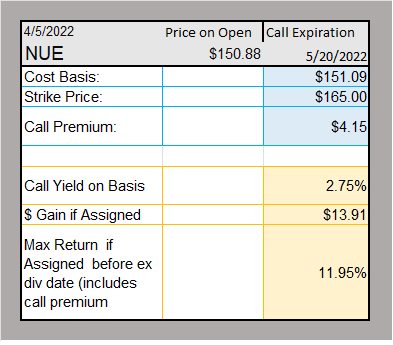

NUE price (Author)

You can see the premium of $4.15 or $450 per contract is a 2.75% yield on my basis. Just think if I sell two calls in a year with this income, I am netting a yield of 5.5%.

Find me a dividend stock with similar fundamentals that yields 5.5% and I would be a happy camper. For now, I live on call premiums until the yield curve on bonds becomes competitive.

MM MoneyMadam

Data from Schwab.com and Marketxls

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment