da-kuk/E+ via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on March 18th, 2022.

As I highlighted previously, PIMCO’s Energy and Tactical Credit Opportunities Fund (NYSE:NRGX) isn’t necessarily your typical energy fund. They take a multi-asset approach and invest with the main tilt towards pipelines and other traditional energy plays. However, they also have a couple of other unique types of positions that you wouldn’t see elsewhere. The most notable was their significant position in Rivian (RIVN). This was a preferred holding that has now converted to an equity position.

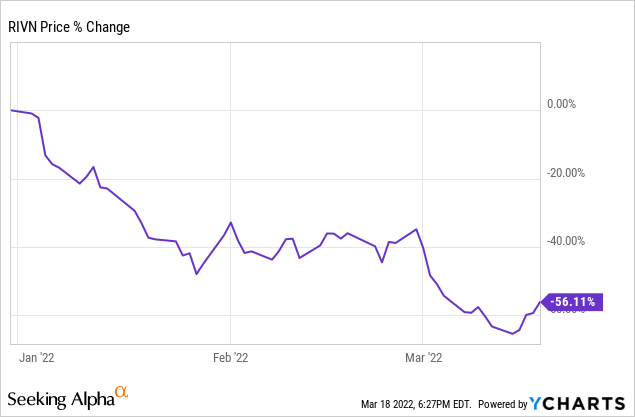

At the end of 2021, it accounted for 9.185% of the fund’s assets, but the position has continued to decline. It is considered restricted security, so chances are they are still holding onto at least some, if not all, of the position and watching it decrease in value. At the same time, NRGX remains fairly attractive, and shareholders recently received a boost to their distribution. The fund’s discount remains quite interesting at these levels.

The Basics

- 1-Year Z-score: -1.26

- Discount: 16.39%

- Distribution Yield: 6.41%

- Expense Ratio: 1.68%

- Leverage: 18.86%

- Managed Assets: $941 million

- Structure: Term (anticipated liquidation date on January 29th, 2031)

NRGX’s investment objective is “to seek total return, with a secondary objective to seek to provide high current income.” They attempt to achieve this through a “flexible strategy by focusing on investments across the full value chain, capital structure and liquidity spectrum of the energy markets.”

They will “invest, under normal circumstances, at least 80% of its assets in investments linked to the energy sector and in investments linked to the credit sectors.” To be structured as a registered investment company [RIC], they will allocate no more than 25% to MLPs in their portfolio. That’s where the futures contracts can help juice that exposure up without breaking the rules.

…derivative instruments that provide economic exposure to these types of investments. To the extent the fund obtains exposure to MLPs through the use of total return swaps (“MLP swaps”), it expects to hold cash and cash equivalents and/or high quality debt instruments in an amount equal to the full notional value of such MLP swaps.

As we will explore in their holdings, they carry significant exposure to U.S. Treasuries, which are as good as cash. This pushes U.S. Treasury Notes exposure to the largest position in the fund. This would often be a bad sign if an actively managed CEF was sitting on this much cash – but in this case, it helps balance out the risks.

The fund’s expense ratio is fairly high at 1.68%. This isn’t that unusual for PIMCO, though. For some reason, energy funds also tend to run higher anyway. When including the leverage expense for the fund, it comes to 1.73%. At this time, PIMCO is enjoying incredibly cheap financing on its reverse repurchase agreements. With higher rates coming and already starting with a recent increase from the Fed, their expenses will likely climb from here. This will be something to be conscious of even if the fund’s income is likely to increase; some of those gains will be offset.

NRGX is also a term fund, which is expected to liquidate at a future date. In this case, around January 29th, 2031 – 12 years after its launch. They can switch to a perpetual fund if they have a tender offer for 100% of the outstanding shares at 100% of NAV. If there are at least $200 million in net assets after the eligible tender offer, they can remove the term structure. This is all outlined in greater detail in their prospectus.

Performance – Heading Higher

I’m sure if PIMCO could, they’d go back and not launch this fund when they did. The fund began trading at the beginning of 2019; it steadily declined since launch, then a massive decline in March 2020. As the price for a barrel of oil on the futures market went negative, the energy sector collapsed, and NRGX wasn’t safe from this. Being a leveraged fund only exacerbated the impact.

However, 2021 and 2022 have been much more kind to the energy sector. This has benefited NRGX, which has sent the fund higher. Unfortunately for them, this is a case where being a “unique” energy fund has meant they’ve underperformed rather spectacularly from other energy CEFs that are more pure-plays. The significant position in RIVN surely hasn’t helped. Still, if an investor has some more reasonable expectations and understands NRGX for what it is, it could be worthwhile to invest in.

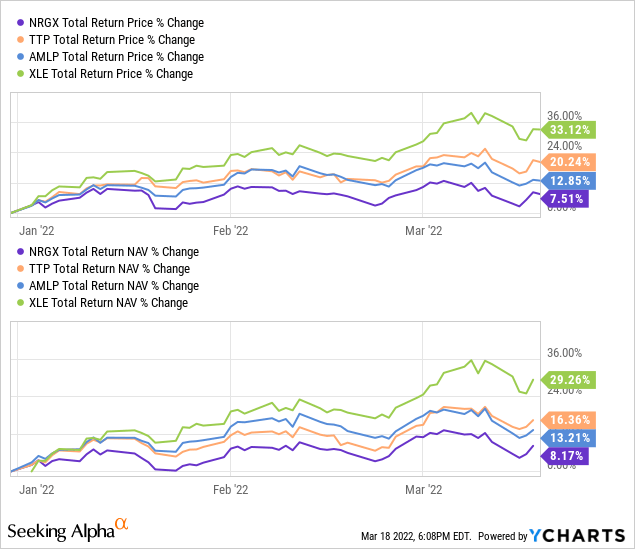

Below is the YTD performance comparing several funds for context with NRGX; Tortoise Pipeline & Energy (TTP), ALPS Alerian MLP ETF (AMLP) and Energy Select Sector SPDR ETF (XLE).

YCharts

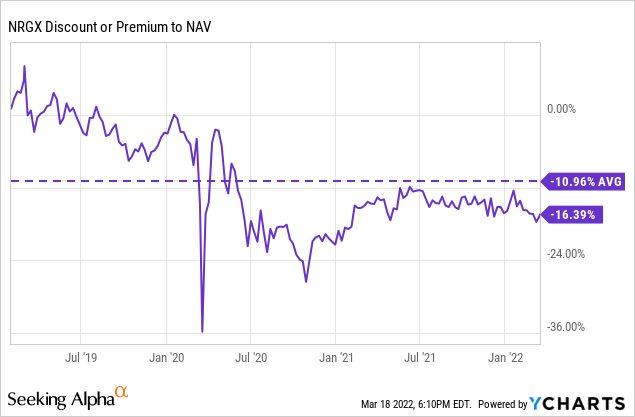

For investors that like discounts, NRGX delivers on that front. The latest discount has even expanded further than where it had been when we first covered the fund. This fund certainly isn’t in the same league as most of the other PIMCO funds that can enjoy premiums rather regularly – though even those have become drastically reduced lately. Since the fund’s launch, it has averaged a discount of nearly 11%. Due to when the fund launched, it is harder to gauge if this is an appropriate level because of the rather unusual circumstances of 2020.

YCharts

Distribution – A Boost For Shareholders

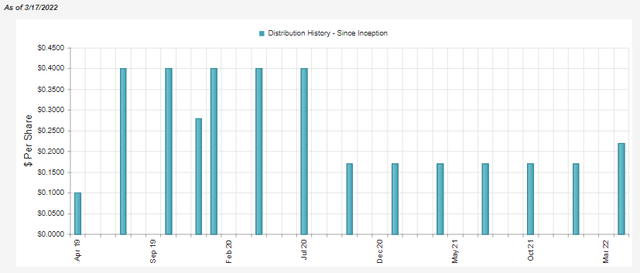

NRGX’s distribution has gone in the right direction with the latest announcement. That is opposed to when they had to slash it in 2020. It still isn’t nearly at that previous level but is still positive for investors.

NRGX Distribution History (CEFConnect)

This puts the fund’s distribution yield at 6.41%; on a NAV basis, it comes to 5.36%. I still believe there is room for even further raises given the current environment, which I mentioned in the fund’s previous update too.

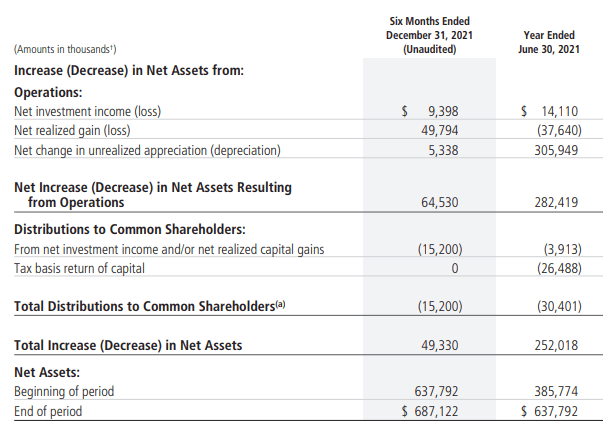

The distribution coverage showed a fairly high coverage coming from net investment income. However, capital gains will still be required to fully payout investors at the current quarterly amount.

NRGX Semi-Annual Report (PIMCO)

If we annualized the NII reported, we also see that the fund has increased fairly considerably from its fiscal year-end 2021. NII coverage came in at 61.83% for this last six-month period, an improvement from the 53.27% previously reported. Given the gains the fund has been experiencing, even through this year, despite the RIVN position, it makes sense that they boosted what they were paying to shareholders.

For tax purposes, the fund had reported that in 2021, $0.314636 of the distributions paid throughout the year were return of capital. They paid a total of $0.68 in distributions for the year.

NRGX’s Portfolio

The turnover rate has come in quite high once again. Last fiscal year, they reported a 118% portfolio turnover rate. In the last six months, they reported a 59% turnover rate. That means their portfolio is changing quite constantly. Yet, their position in RIVN has remained one of the largest after the U.S. Treasury holdings. The main reason for this would be that it was a restricted security where they couldn’t sell the position. I’m not sure if they would have wanted to sell it or not, but that is worth noting.

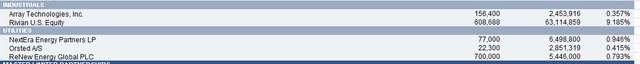

At the end of 2021, we can also see some of the other unusual energy positions with Array Technologies (ARRY) and several utility names. It is important to note that these weightings are based on net assets and not managed assets. At that time, RIVN would have been a 6.99% allocation.

While RIVN has been declining, NRGX has shown an impressive gain so far nonetheless. They reported a cost of the position as $9,429 and a market value of $63,115 at the end of 2021. That massive rise is one of the reasons that the allocation of RIVN has become so large for NRGX in the first place.

YTD RIVN has fallen 56.11%. That would put NRGX’s position at a market value of around $27,701. Still, an impressive gain, as mentioned, but it seems they have a strong momentum of going the wrong way at this time.

YCharts

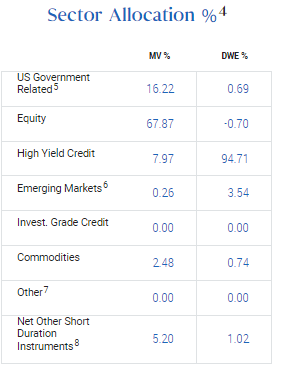

Besides the RIVN position in the fund, a couple of the other metrics are important to look at. The fund’s duration is 0.50 years. That is a measurement of how sensitive the fund is to interest rate changes. With this low figure, it isn’t very much at all. I would have to assume the duration here is so low due to its sizeable weighting to equity securities. It is the largest allocation for the fund, which is followed by the U.S. Government related debt positions.

The weightings were as of the end of February 28th, 2022. These have been little changed from the previous update when we took a look at the fund. One of the main changes here was the slight decrease in high yield credit and a small increase in net other short-duration instruments.

NRGX Asset Allocation (PIMCO)

Similarly unchanged is the fund’s weightings towards sectors. The fund remains overweight to pipeline investments, followed by independent E&P exposure. We see a 3.31% allocation to automotive, which is the RIVN position.

That’s why it was important to note that the above was the weighting on net assets and not managed assets. The below would seem to reflect the amount of decline in the exposure of automotive for the fund. That would include relative to how much RIVN had fallen and factoring in the rest of the portfolio rising in value.

NRGX Sector Weightings (PIMCO)

Conclusion

NRGX is a rather unique energy fund with a bit of exposure that isn’t exactly energy-specific. In particular, it emphasizes U.S. Treasury positions to offset MLP exposure via swaps. After that, the fund’s most significant position has been RIVN – an electric vehicle maker.

It is a rather unique offering for one of PIMCO’s CEFs, too, as it holds a sizeable allocation to equity positions. Though they still have a fairly meaningful allocation to high yield credit. They also have their usual black-box style of investing through various swaps and other derivatives that make it more complex to follow. The latest increase was a welcoming sign for the fund that things are heading in the right direction. The fund’s discount is even attractive at this time, though harder to really get a track record considering the relatively short and unusual period of time that the fund has been trading.

Be the first to comment