sefa ozel

The MicroSectors U.S. Big Oil Index -3X Inverse Leveraged ETN (NYSEARCA:NRGD) gives speculators a leveraged tool to bet on the downside in oil and gas companies. However, I would recommend long-term investors stay away, as the NRGD should not be used as an energy hedge except for very short holding periods. If investors are truly concerned about their energy holdings, they should consider reducing long exposure rather than seek inverse exchange-traded notes (“ETNs”) like the NRGD.

Fund Overview

The MicroSectors U.S. Big Oil Index -3X Inverse Leveraged ETN is an exchange-traded note issued by the Bank of Montreal (BMO) that gives investors exposure to -3x the daily returns of a basket of large U.S. oil and gas companies.

Strategy

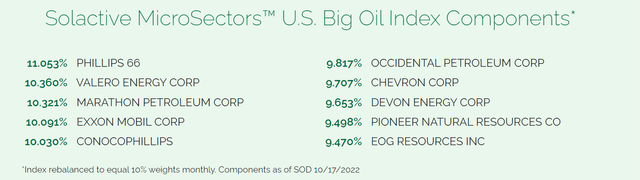

Returns of the NRGD are linked to the Solactive MicroSectors U.S. Big Oil Index (“The Index”). The Index is an equal-weighted index of the 10 largest U.S. energy and oil companies. The current composition of the index is shown in Figure 1.

Figure 1 – MicroSectors U.S. Big Oil Index (microsectors.com)

Investors interested in the NRGD should read the following disclaimer very carefully (note, the text highlight is from the issuer, BMO):

The ETN seeks a return on the underlying index for a single day. The ETNs are not “buy and hold” investments and should not be expected to provide a leveraged return of the underlying index’s cumulative return for periods greater than a day.

The NRGD is designed to provide 3x inverse index returns for a single day. For any longer holding period, the return expectations will differ materially. For example, imagine an investor started with $100 invested in NRGD. If the Index returned -5% on day 1, the NRGD position will grow to $115 (-3x 1-day return of -5%). If the index returns -5% on day 2, the NRGD position will grow to $132.25, which is greater than 3x the 2-day compounded return of 10.25% or $130.75. Conversely, if the daily returns had been 5% and 5% on the Index, the NRGD position will decline to $72.25 (consecutive 15% losses), greater than 3x the 2-day compounded loss of 9.75% or $70.75. Leveraged instruments have “positive convexity” in the direction of the bet.

What happens if the Index returns 5% and -5% in consecutive days? In this example, NRGD will end up at $97.75 (15% gain followed by 15% loss). This is significantly less in value than 3x the 2-day compounded loss of 0.25% or $99.25. This difference is commonly called “volatility decay.” The higher the volatility of the asset, the more the decay.

Returns

Long-term returns of the NRGD ETN are truly abysmal (and probably the reason why they are not tabularized on BMO’s website). Figure 2 is a price chart of the NRGD ETN, after effecting a 1-for-10 reverse split in March 2021, and a 1-for-50 reverse split in April 2022. By my calculation, day 1 investors have lost 99.8% of their capital. The NRGD ETN is definitely not a ‘buy and hold’ product, as per the BMO disclaimers.

Figure 2 – DRND abysmal performance (StockCharts.com)

This is because, since the COVID pandemic, energy stocks have staged an epic rally, with large-cap energy companies represented by the Energy Select Sector SPDR Fund (XLE) generating almost 300% in total returns since the COVID lows (Figure 3).

Figure 3 – Energy stocks have staged an epic rally (Seeking Alpha)

Distribution & Yield

The NRGD ETN does not pay any distribution. In fact, one of the benefits of structuring the product as an ETN instead of the more common exchange-traded fund (“ETF”) structure is because ETNs do not pay distributions or interest income, so there are no taxes due for investors. Investors only pay capital gains taxes when they sell the security.

Fees

NRGD charges a 0.95% expense ratio, accrued daily.

NRGD Only Useful For Speculation

To be clear, I believe the NRGD is only useful for short-term speculation on the downside in oil companies. During the COVID crash, NRGD did rally from $17,300 (split adjusted) in early January 2020 to a high of $152,400 on March 18, 2020. However, as we can see from Figure 2, if investors had not locked in their gains, those spectacular gains would have been gone by the end of April 2020.

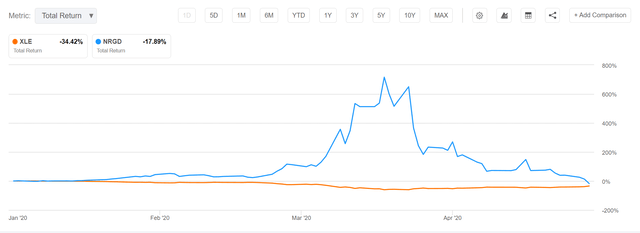

In fact, due to volatility decay, NRGD cannot even be used as a portfolio hedge for long holding periods. For example, Figure 4 compares the returns of the XLE ETF and NGRD from January 1, 2020 to April 30, 2020. Although at one point during the COVID pandemic NGRD had generated over 700% in total returns (when the XLE bottomed at -60% YTD returns), by the end of April, the XLE ETF was down 34% YTD and the NRGD was down 18% YTD.

Figure 4 – NRGD is not a good long-term hedge (Seeking Alpha)

Conclusion

In summary, the NRGD ETN gives speculators a leveraged tool to bet on the downside in oil and gas companies. However, I would recommend long-term investors stay away, as the NRGD should not be used as an energy hedge except for very short holding periods. If investors are truly concerned about their energy holdings, they should consider reducing long exposure rather than seek inverse ETNs like the NRGD as a hedge.

Be the first to comment