Florent Molinier/iStock via Getty Images

Introduction

In May 2021, I wrote a bearish article on SA about Canadian copper and nickel-focused royalty company Nova Royalty (OTCQB:NOVRF) in which I said that its royalty portfolio shouldn’t be worth more than around $50 million at copper prices of $3.00 per pound.

The share price of Nova Royalty has slumped by over 50% since then but I think that the company has improved its royalty portfolio as it now has several projects in an advanced stage of development. It even has a producing asset in its portfolio. However, copper prices have been declining over the past weeks due to growing fears of a global recession and I think that the market valuation of Nova Royalty is likely to continue to decline in the near future. With cash running low, significant stock dilution could be inevitable. Let’s review.

Overview of the recent developments

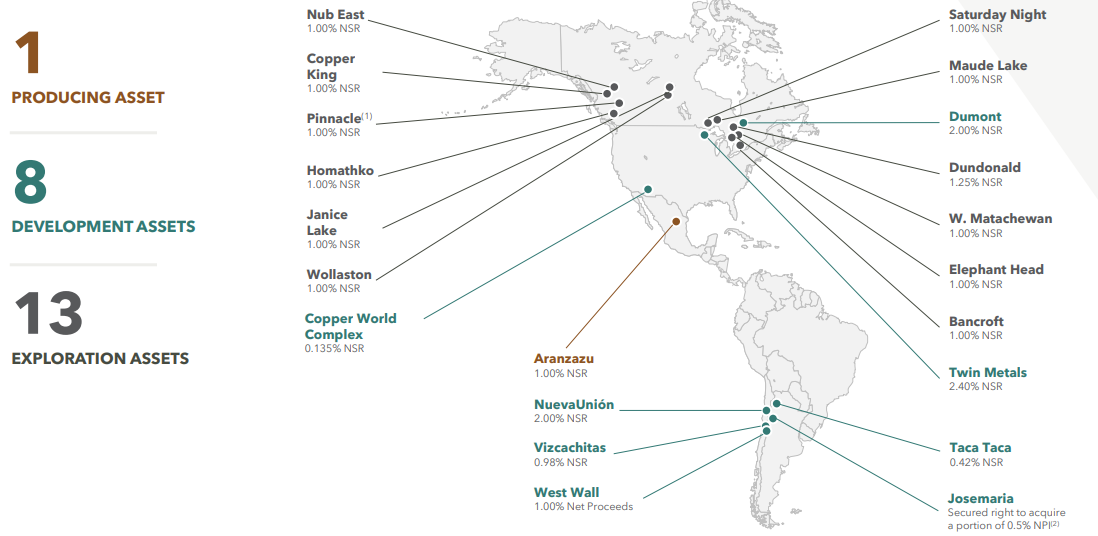

Nova Royalty prefers to invest in net smelter return (‘NSR’) royalties, and back in May 2021 it had a portfolio of royalties on 5 development stage mining projects as well as 13 exploration stage assets. Today, the picture looks much different as the company’s portfolio includes royalties on 1 producing copper mine and 8 development stage projects.

Nova Royalty

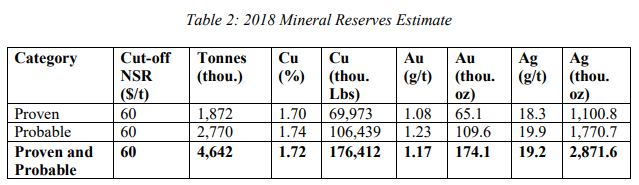

As you can see from the picture above, Nova Royalty now has a 1% NSR on Aranzazu, which is a relatively small underground copper-gold-silver mine in northern Mexico that is owned by Aura Minerals (OTCPK:ARMZF). In Q1 2022, the mine produced a total of 14.1 million pounds of copper equivalent. Nova Royalty bought this royalty in August 2021 for $9 million, with expected annual payments of around $1.5 million. The reason the purchase price was so low is that Aranzazu has a short mine life. According to a feasibility study from 2018, ore was expected to run out in just 5.5 years as copper reserves stood at 176.4 million pounds.

Aura Minerals Aura Minerals

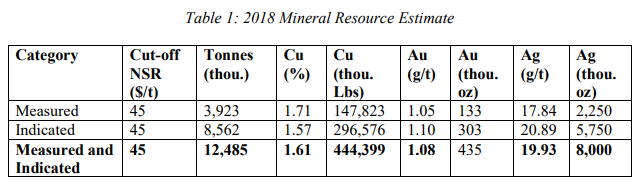

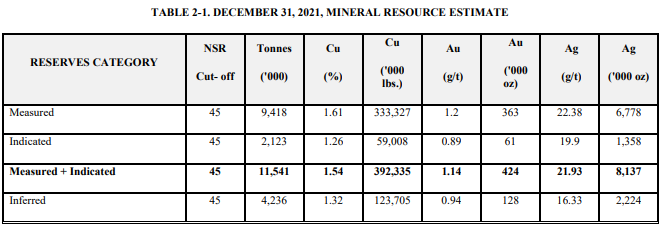

However, Aura Minerals’ drill campaigns have been paying off over the past few years and the reserves and measured and indicated resources of Aranzazu have increased significantly compared to 2018. As of December 2021, copper reserves were almost 195 million pounds and I expect Aranzazu to be in operation for at least a decade. Overall, I view this royalty as a good purchase by Nova Royalty.

Aura Minerals Aura Minerals

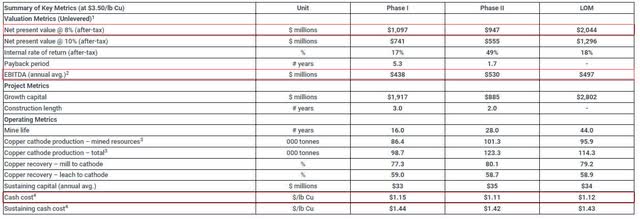

The company made one other notable royalty purchase over the past year – a 0.135% NSR on the Copper World Complex project in Arizona which is being developed by Hudbay Minerals (HBM). In June 2022, Hudbay released the results of a preliminary economic assessment for the project, and I think that the key financial figures look compelling. Copper World Complex has a net present value of just over $2 billion at $3.50 per pound of copper using an 8% discount rate and the cash costs are just $1.12 per pound over the life of mine. The mine could generate annual EBITDA of close to $500 million.

The next step for the Copper World Complex is a feasibility study which should be completed in 2023. This paves the way for a construction decision in 2024. However, construction of Phase 1 of the project alone will take at least 3 years, which means that commercial production is at least 4 years away. And this is bad news for Nova Royalty as copper prices have crashed to a 16-month low due to concerns that aggressive interest rate hikes across the world could send the global economy into a recession and thus put pressure on demand. The way things are going, I wouldn’t be surprised if copper prices fall below $2.50 per pound by the end of 2022.

Trading Economics

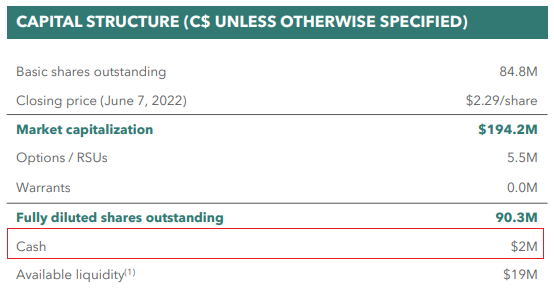

And this is bad for Nova Royalty as the company is tight on cash – it had just C$2 million ($1.5 million) in the bank as of May 24 and there were no warrants that could help it strengthen its balance sheet.

Nova Royalty

One of the key selling points for royalty companies is that they are not exposed to capital or operating cost requirements. However, royalty companies like Nova Royalty that barely have any revenues need to fund their operations with capital increases from time to time even if this pauses the expansion of the royalty portfolio. The reason for this is that G&A expenses add up.

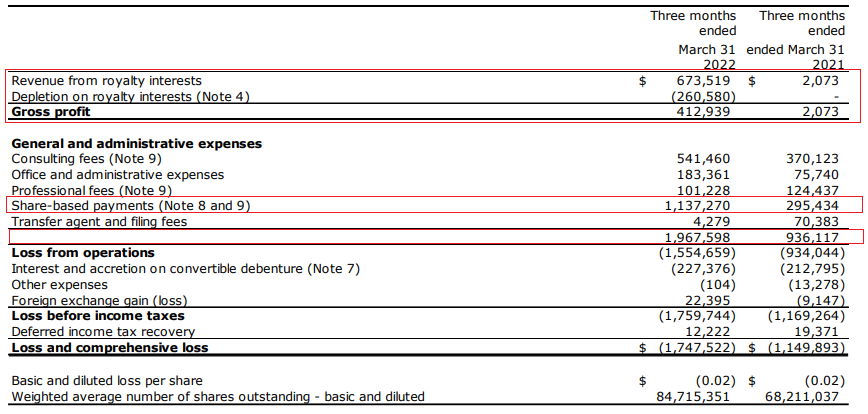

Turning our attention to the financial performance of Nova Royalty, we can see that the revenue from the 1% NSR on Aranzazu came in at C$0.67 million ($0.52 million) in Q1 2022. However, G&A expenses were C$1.97 million ($1.5 million). Yes, C$1.14 million ($0.88 million) of that amount was in the form of share-based payments, but the net cash used in operating activities was still C$0.77 million ($0.59 million).

Nova Royalty

On top of that Nova Royalty had a C$6.84 million ($5 million) convertible debentures as of March, which had an effective interest rate of 9.9%.

Overall, I think that a large capital increase by the end of 2022 seems inevitable. And with copper prices in freefall, significant stock dilution seems likely. So, how do you play this? Well, data from Fintel shows that the short borrow fee rate stands at 4.01% as of the time of writing, which is pretty low. However, short selling stocks in the commodities sector is usually dangerous as this market is notoriously volatile. And unfortunately, there are no call options available to hedge this risk.

Looking at the risks or the bear case, I think that the major one is that central banks around the world decide to stop hiking interest rates and thus ease recession fears. However, I don’t expect this to start happening before 2024 which means that copper prices are unlikely to find support anytime soon.

Investor takeaway

Nova Royalty has added a cash-flowing royalty to its portfolio and increased its exposure to development stage projects. However, G&A expenses are about 3 times higher than revenues which means that the company still has to rely on capital increases to fund its operations. And unfortunately for investors, copper prices are falling rapidly which is having a negative effect on the share price.

With major central banks committed to aggressive rate hikes in the foreseeable future, I think that this is a bad time to invest in companies with exposure to copper. Especially ones with negative cash flow like Nova Royalty.

That being said, I think that short selling the company’s stock could be dangerous as commodities are notoriously volatile and there are no call options available. It could be best for risk-averse investors to avoid Nova Royalty.

Be the first to comment