Tatiana Dyuvbanova

On the backs of the market viewing the Carnival Corp. (CCL) quarterly report in a negative light, Norwegian Cruise Line Holdings (NYSE:NYSE:NCLH) made a crucial announcement to start the week. The market continues to look backwards on the cruise sector while the future is turning far more positive. My investment thesis is ultra-Bullish on the sector with another move by the industry to completely remove any Covid restrictions previously holding back bookings and actual travel.

Eliminating Covid Requirements

On October 3, Norwegian made the final move to remove Covid restrictions. The cruise line announced the removal of all Covid-19 testing, masking and vaccination requirements as of October 4, 2022.

Only back at the start of September, the cruise line sector started rolling back Covid restrictions, including finally allowing unvaccinated guests to board ships with testing. The company is now aligning policies with other travel organizations where the airlines and hotel sectors have already seen revenues soar beyond 2019 peak levels.

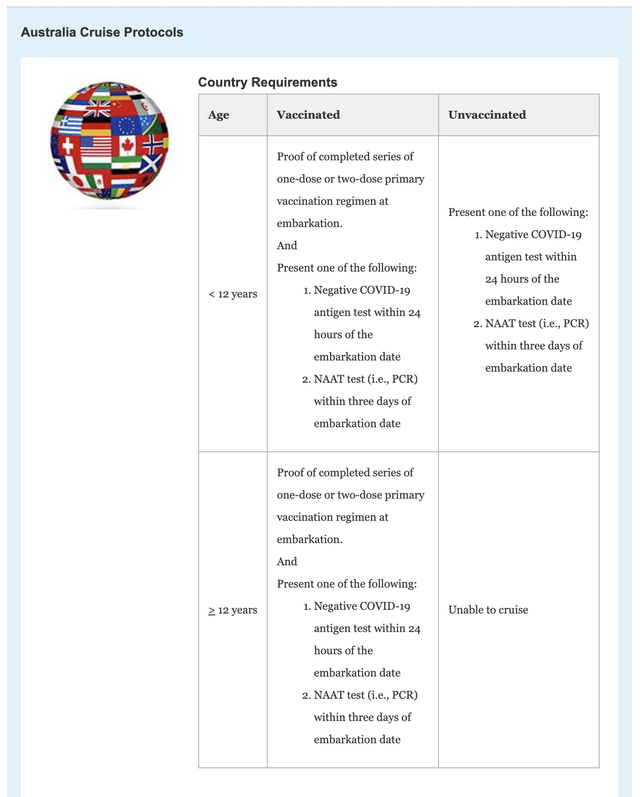

The cruise sector still isn’t free of Covid restrictions being dependent on other regions with more restrictive government policies than the U.S. Norwegian has a long list of destinations with different travel requirements, including Australia as follows:

Source: NCL.com

The good news is that countries like Canada have already removed restrictions setting up generally free travel in North America now. Though, several other countries have restrictions, but the airlines have seen record travel due to travelers willing to spend more money now having the ability to shift trips towards a domestic focus.

The sector had already seen a strong indication of a bookings surge once some Covid restriction were removed at the start of September. Bookings should only increase more now with restrictions removed for unvaccinated passengers.

According to Truist analyst C. Patrick Scholes, Norwegian has already seen a huge boost to bookings. He noted the cruise line saw bookings surge up to 40% during the initial three-week period with luxury seeing the most benefits due to a focus on high-income passengers less affected by a pending global recession. The analyst assigned a $19 price target to the stock.

Carnival Earnings

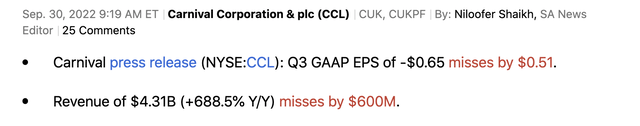

Carnival reported earnings on Friday that disappointed the market. The market though was stuck looking backwards but there was generally positive indication of the future.

The cruise line reported revenues of $4.3 billion that missed revenue estimates by a very wide margin of $600 million.

Source: Seeking Alpha

For those looking for the demise of the cruise line, this was the perfect headline. The stock fell over 20% on Friday in a sign to most that Carnival wasn’t going to survive the Covid period when the Summer quarter failed to meet analyst estimates by a wide margin.

The key here is that people selling the stock weren’t actually paying attention to the details. The reported FQ3’22 was for the period ending August 31 with tough Covid restrictions still in place. Unvaccinated passengers couldn’t even travel and vaccinated passengers needed to still provide a recent negative test to board a ship.

The backward-looking numbers were horrible, but the forward-looking numbers were very positive. Carnival had nearly 2 months of bookings under the relaxed Covid policies when the company reported earnings on September 30. Not surprisingly, the company made the following positive announcements in the earnings release:

Since announcing the relaxation of our protocols last month, we have seen a meaningful improvement in booking volumes and are now running considerably ahead of strong 2019 levels. We expect to further capitalize on this momentum with renewed efforts to generate demand. We are focused on delivering significant revenue growth over the long-term, while taking advantage of near-term tactics to quickly capture price and bookings in the interim.

Cumulative advance bookings for full year 2023 are slightly above the historical average and at considerably higher prices, as compared to 2019 sailings, normalized for FCCs.

During the earnings call, CFO David Bernstein went on to provide these strong bookings details.

So, keep in mind that what we’re talking about here in terms of an acceleration of the book position or the bookings that occurred in mid-August with the relaxed protocols. And the booking patterns, as we indicated, accelerated. In fact, our North American brands were up 30% over 2019 in the last few weeks.

In essence, bookings were struggling due to tough Covid restrictions, but the numbers surged when policies were relaxed in early September. A further removal of all restrictions in the U.S. and Canada should provide another surge in 2023 bookings at prices far above 2019 levels.

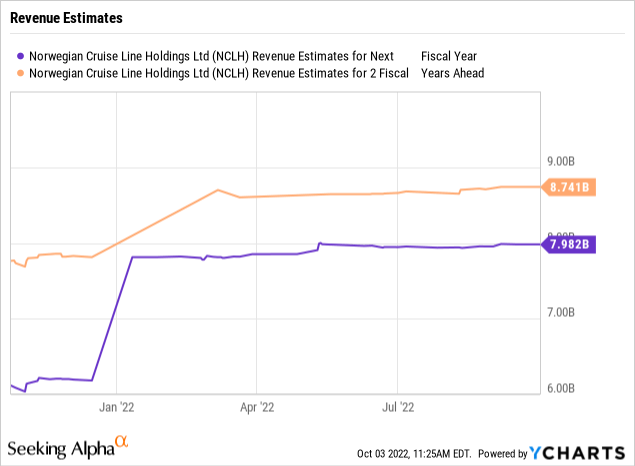

Norwegian produced 2019 revenues of just $6.5 billion. Analysts already forecast 2023 revenues reach $8.0 billion with a further massive jump to $8.7 billion.

The market might have some indigestion on the current results, but the future is clearly bright. In fact, the revenue estimate for 2024 was much closer to just $8.0 billion at the end of last November and the estimates continue to rise.

The stock might trade towards the lows now, but the analysts don’t seem to generally have questions on whether Norwegian will eventually top EPS targets of $1 and $2 in the near term despite higher debt loads now.

Takeaway

The key investor takeaway is that investors looking at the wrong numbers are getting the cruise line sector wrong. Norwegian should provide strong indications of improving results at the investor event on October 4.

Investors should use this weakness to buy shares.

Be the first to comment