Brett_Hondow

On Thursday, August 4, 2022, Pacific Northwest-based natural gas utility Northwest Natural Holding Company (NYSE:NWN) reported its second quarter 2022 earnings results. As was largely expected given the general stability of utility companies, Northwest Natural Holding posted results that were generally better than last year but did not enjoy nearly the same level of growth that companies in some other sectors are able to produce. The company still managed to beat the expectations of its analysts in terms of revenues and earnings, though. As is often the case, this did pop the share price following the announcement but it has generally declined over the past week. Overall, though, these earnings were not at all bad and the company remains on track to deliver the expectations that management has consistently projected over the first half of the year.

As my regular readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article and serve as a framework for the resultant analysis. Therefore, here are the highlights from Northwest Natural Holding’s second quarter 2022 earnings report:

- Northwest Natural Holding brought in total operating revenues of $194.960 million in the second quarter of 2022. This represents a 31.55% increase over the $148.197 million that the company reported in the prior-year quarter.

- The company reported an operating income of $13.539 million in the most recent quarter. This compares quite favorably to the $12.624 million that the company reported in the year-ago quarter.

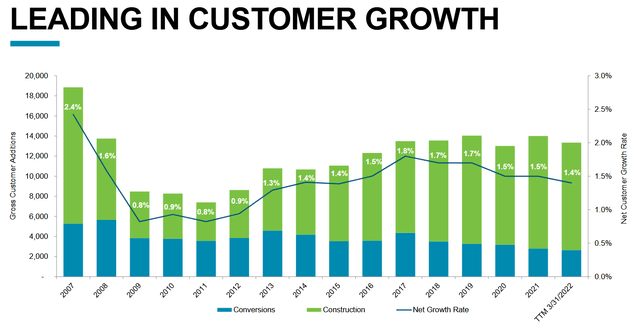

- Northwest Natural Holding added 10,200 natural gas customers over the trailing twelve-month period, which represents a 1.3% growth rate.

- The company began the approval process for a one-megawatt power-to-hydrogen project in Oregon. This is intended to be blended into the company’s natural gas distribution network and reduce the carbon intensity of its consumption.

- Northwest Natural Holding reported a net income of $1.715 million in the second quarter of 2022. This compares very favorably to the $724,000 net loss that the company reported in the second quarter of 2021.

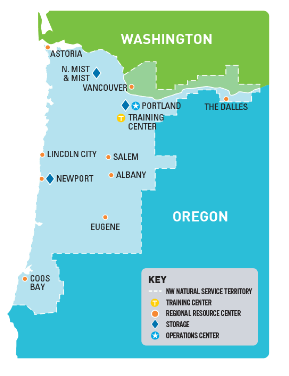

It seems quite certain that one of the first things that anyone reviewing these highlights will notice is that Northwest Natural Holding saw essentially every measure of financial performance improve compared to the year-ago quarter. This is not atypical for a utility as they tend to deliver relatively slow but steady growth. In the case of Northwest Natural Holding, one of the reasons for this is that the company’s service area is growing. As stated in the highlights, the company added 10,200 natural gas customers over the trailing twelve-month period. This is nice because this is one of only two ways for a utility to grow but it is totally out of the company’s control. After all, Northwest Natural Holding is geographically confined to a service area in Oregon and Southwest Washington:

Northwest Natural Holding

This is overall a relatively rapidly-growing area of the country. As we can see, Northwest Natural Holding has generally grown its customer base by more than 1% during any twelve-month period for many years:

It should be fairly obvious why this would result in growth. After all, an increasing population results in the company having more people consuming its natural gas and of course paying their utility bills. As people tend to prioritize paying their utility bills during times when money gets tight, the addition of new customers should effectively guarantee growth. As Northwest Natural Holding has been consistently adding new customers for quite some time, we can be confident that it will likely be able to grow its customer base at a steady rate.

Another reason that Northwest Natural Holding was able to deliver year-over-year growth is that the company was able to increase the prices that it charges its customers. Back in November 2021, regulators in Washington approved a price increase for customers in that state. As these higher rates were not in effect back in the second quarter of last year, the incremental increase resulted in the company receiving more revenue from each of its customers, even if their consumption remained static. Fortunately, the company may be able to generate further growth from this method going forward. This is because the company filed rate reviews with regulators in Oregon requesting rate increases in order to finance some of its planned infrastructure improvements as well as a new renewable natural gas facility. Although the regulators in Oregon have not yet approved this rate increase, Northwest Natural Holding is confident that it will be. Assuming that this is the case, the new rates will take effect on November 1, 2022, so we should see the impact of the higher rates driving the company’s growth as we head into the new year.

As might be expected from a company based in the Pacific Northwest, Northwest Natural Holding is highly committed to green energy and the reduction of carbon emissions. In fact, the company has committed to reducing the carbon emissions of its operations by 30% relative to 2020 levels. This goal applies both to the company’s own operations and the emissions of its customers that are using its natural gas. One of the ways that the company is working to accomplish this is through the use of renewable natural gas, which refers to natural gas produced through the natural decay of organic matter. This is nice because organic matter can be found almost anywhere, but it is especially common in landfills. This is why Northwest Natural Holding is planning to construct one of these plants at a landfill in Oregon. As we already discussed, acquiring the funding to construct this facility is one of the reasons why the company asked the regulators in Oregon to raise its rate. The company intends to blend renewable natural gas into its distribution network in order to use less traditionally-produced natural gas. As extracting natural gas from the ground produces substantial carbon emissions, we can see that this plays a role in achieving Northwest Natural Holding’s sustainability goals.

Another technique that Northwest Natural Holding is attempting to use to reduce its carbon emissions is blending hydrogen in with the natural gas that flows through its distribution network. This reduces the carbon that is emitted when the gas is burned. As stated in the highlights, Northwest Natural Holding began the process to obtain authorization to construct a one-megawatt power-to-hydrogen facility. This is a plant that uses electricity to split the hydrogen and oxygen atoms in the water into their separate parts. The goal of this is to use hydrogen as a store of energy. Northwest Natural Holding expects to mix the hydrogen into its natural gas as a 5% mixture at first and 10% eventually. Overall, this is one project that may prove to appeal to environmentalists and the various environmental, social, and governance funds that have grown substantially in size over the past few years. When we consider the incredible amount of money controlled by these funds this could be a net positive for the stock price but admittedly these funds are not usually interested in natural gas utilities.

One of the biggest reasons why investors purchase shares of Northwest Natural Holding is the dividend that the company boasts. Indeed, the stock has a 3.73% yield as of the time of writing, which is quite a bit more attractive than the 1.43% yield of the S&P 500 index (SPY). In the second quarter of 2022, the company declared a dividend of $0.4825, which is in line with its dividend for the past four quarters. As is always the case though, we want to ensure that the company can actually afford the dividend that it pays out. After all, we do not want to be the victims of a dividend cut since that would both reduce our income and almost certainly cause the stock price to decline.

The usual way that we evaluate a company’s ability to pay its dividend is by looking at its free cash flow. This is the amount of cash that was generated by the company’s ordinary operations that is left over after the company pays all its bills and makes all capital expenditures. In the trailing twelve-month period, Northwest Natural Holding reported a negative levered free cash flow of $174.0 million. This is obviously not enough to pay any dividend, let alone the $58.4 million that the company actually paid out during the same period. However, it is not uncommon for a utility to finance its capital expenditures through the issuance of debt and especially equity. It then uses its operating cash flow to finance the dividend. Northwest Natural Holding had an operating cash flow of $162.6 million over the trailing twelve-month period. This appears to be more than enough to cover the $58.4 million that the company actually pays with a great deal of money left over. Overall, this dividend certainly looks reasonably safe.

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a sure-fire way to earn a suboptimal return on that asset. In the case of a utility like Northwest Natural Holding, one method that we can use to value it is looking at the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes the company’s forward earnings per share growth into account. As a general rule, a price-to-earnings growth ratio of less than 1.0 is a sign that the stock is undervalued relative to its earnings per share growth and vice versa. However, very few companies have a ratio that low, particularly in the slow-growth utility sector. Thus, it is best to compare the company’s ratio to its peers in order to determine which one offers the most attractive relative valuation.

According to Zacks Investment Research, Northwest Natural Holding will grow its earnings per share at a 4.30% rate over the next three to five years. This gives the stock a price-to-earnings growth ratio of 4.78 at the current price. Here is how that compares to a few of the company’s peers:

| Company | PEG Ratio |

| Northwest Natural Holding | 4.78 |

| New Jersey Resources (NJR) | 3.14 |

| South Jersey Industries (SJI) | NA |

| NiSource, Inc. (NI) | 2.93 |

| Atmos Energy (ATO) | 2.80 |

This is certainly somewhat disappointing as Northwest Natural Holding would appear to be the most expensive stock out of this entire growth. Thus, it may make some sense to wait until the price falls to a more reasonable level before actually buying in. As that situation would also cause the company’s yield to increase, such a strategy has that added bonus for income investors.

In conclusion, there appears to be a great deal to like about Northwest Natural Holding’s most recent results. The company showed a fairly significant improvement in both revenue and earnings, which is always nice, as well as a very strong likelihood for more forward growth. The company’s dividend also appears quite sustainable and boasts a reasonably high yield. In fact, the only real concern here is that Northwest Natural Holding appears to be quite expensive relative to several of its peers so it could pay to wait for a better price before acting on the firm’s strong performance.

Be the first to comment