CHUNYIP WONG

Gas and Crude Oil at Historic Highs Since Weeks

Europe was in the midst of a severe energy crisis long before the Russian invasion of Ukraine. Fossil fuel prices skyrocketed during the strong economic recovery from the Covid-19 virus pandemic crisis.

The reopening of production facilities and the resumption of services after weeks of severe restrictions caused energy demand to exceed available quantities and prices to rise very quickly.

Then the war did the rest, as Russia completely halted fossil fuel shipments to Europe in response to Western sanctions against Russia’s invasion of Ukraine. The existence of sufficient supplies raised strong concerns that were overexploited in the spot price markets.

Today, consideration is being given to either linking the price of fossil fuels to benchmark indices of more stable markets or setting a price cap for gas and crude oil. However, these measures are comparable to closing the stable door after the horse has bolted.

As a result, gas and crude oil prices have been trading at historic highs for weeks under strong upward pressure.

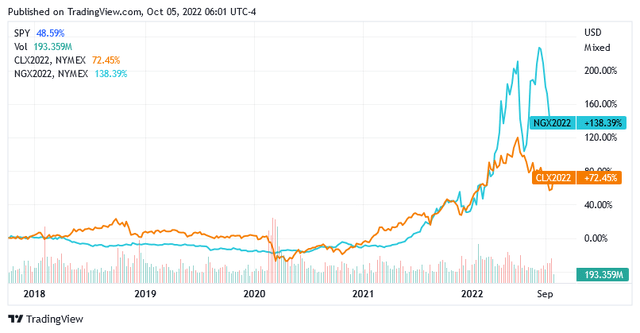

In the last 5 years, gas is up 139% and crude oil is up 72.5%, but most of the growth has occurred in the last 2 years, covering roughly all of the recent global issues.

As a benchmark for natural gas prices, the chart shows natural gas futures expiring November 2022 (NGX2), while as a benchmark for crude oil prices, the chart shows crude oil WTI futures expiring November 2022 (CLX2).

Oil and Gas Prices Outlook

These gas and crude oil prices are likely to remain high for some time as the main trigger is too strong to resolve in the short term. This is the war in Ukraine, which, as long as it lasts, will have a major impact on energy supplies and, consequently, on the price of the commodities.

The threat of Russia using low-yield nuclear weapons and the new eighth package of sanctions by a US-led group of Western countries against the Russian economy, including the oil price cap, point to a further escalation of the hostilities. Further upward pressure will come from OPEC+’s big oil exporters’ decision on Wednesday to cut the daily delivery of barrels of oil to the market by 2 million barrels in a bid to support crude prices.

As a result, economists are forecasting that natural gas futures prices could rise by as much as 30% over the next 12 months to $8.74 per metric million British thermal units [/MMBtu] from the price of $6.726 [at the time of this writing].

As for crude oil futures prices, economists are now forecasting them to rise 8% within a year from the current level of $86.41 to the target price per barrel of $93.32.

North European Oil Royalty Trust is Strongly Positioned to Benefit from Next Natural Gas Market

Hydrocarbon operators should be excited about the prospects in a market that still has plenty to say about growth and where gas prices are on track to quadruple any oil price jump.

To take maximum advantage of higher gas prices, investors may want to consider maintaining their exposure to the commodity through US-listed North European Oil Royalty Trust (NYSE:NRT) shares.

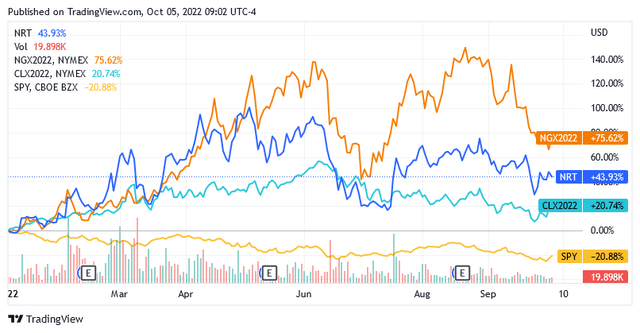

The stock is well tied to changes in the price of natural gas, allowing its shareholders to earn a whopping 44% return so far this year thanks to the rising commodity. And the joy was even greater because this gain was realized when the rest of the market suffered larger declines due to the presence of bearish sentiment.

Given the yield differential between the North European Oil Royalty Trust and the SPDR S&P 500 ETF Trust (SPY), many investors will have to literally jump through hoops to close the gap. The SPDR S&P 500 ETF Trust is the benchmark for the US market.

One way to do that is to take advantage of the upside potential of the royalties of North European Oil Royalty Trust, which are poised to increase if the commodity continues to rise.

If the intention is to add shares to the position, it probably won’t be easy as the stock only has 9.2 million shares outstanding and the average daily volume over the last 3 months has been just over 40,000 shares traded.

About North European Oil Royalty and Its Income

This company makes money from royalties paid quarterly by German subsidiaries of Exxon Mobil Corporation (XOM) and Shell plc (SHEL) to its trust for the sale of gas. The subsidiaries of these oil and gas giants have formed joint venture for this purpose. They produce the commodity from the natural gas fields in northwestern Germany under the royalty agreements inked with North European Oil with Royal Trust.

For the most recent fiscal quarter that ended July 30, 2022, the North European Oil Royalty Trust’s total royalty income of $4.44 million represented an increase of more than 200% year-over-year, due to higher gas prices under license agreements.

Excluding expenses related to trustee fees, the company’s net income was $4.3 million, growing nearly 215% year over year.

The company paid a dividend of $0.46 per share on August 31, 2022, compared to the $0.15 paid a year earlier.

For the first 9 months of the fiscal year [which will end on October 31, 2022], total royalty income increased more than 240% year-over-year to $10.8 million, again driven by higher natural gas prices.

Net income increased 282% year over year to $10.2 million.

The dividend per share increased 230.30% year over year to $1.09.

The Energy Situation in Europe Could Result in Strong Upside Potential

Aside from the expected sharp rise in fossil fuel prices, particularly natural gas, there is another very strong reason why the North European Oil Royalty Trust’s royalty income still has plenty of room for additional growth in the coming period.

Since the Russians are reluctant to send natural gas to Europe and the sabotage activities on the Nord Stream pipeline in the Baltic Sea with the risk of permanent damage were probably no coincidence, the XOM – SHEL joint venture [the largest German producer of natural gas] could now increase production to cover German and European energy needs.

Many EU member states depend on the availability of Russian resources, and Germany would still be heavily dependent if the European experiment in geographic diversification of energy sources failed.

But Europe does not want to lose the battle, so the need to permanently reduce its dependence on Russian hydrocarbons requires greater exploitation of indigenous resources in the North Sea and fossil fuel extraction in north-western Germany as part of its strategic plan to diversify resources from a geographical standpoint.

In addition, thanks to the presence of special equipment at the drilling sites, which allows a constant search for new gas deposits, the activities of the XOM – SHEL joint venture will play a prominent role in the energy plan, as they can ensure a fast and stable supply of gas for Europe’s energy needs.

This can only benefit the royalty income of the North European Oil Royalty Trust, which should lead to strong upside potential for the share price.

Although Not Low, The Stock Price Is a Bargain

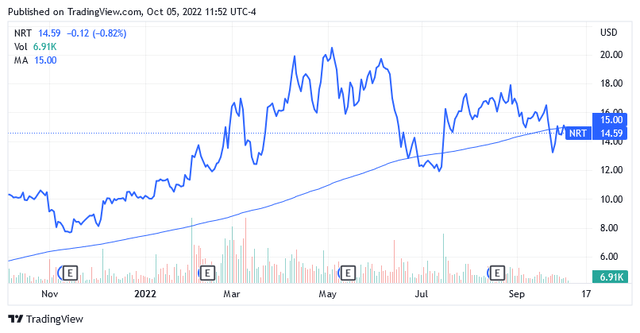

After a significant surge over the past year, the stock isn’t trading low. The stock price of $14.59 [at the time of writing] is almost parallel to its 200-year long-term moving average of $15.

Furthermore, the share price is a little bit above the middle point of $14.165 of the 52-Week Range of $7.61 to $20.72. Also, the P/E GAAP [TTM] of 11.75 is compared to an industry median of 10.08 and the price to sales [TTM] ratio of 11.08 is compared to the industry median of 1.44.

Still, even at these not-low levels, the stock appears to be a strong investment opportunity due to catalysts implying the potential for amazing price gains.

Despite the strong rise, the North European Oil Royalty Trust stock is still far from overbought, as shown by the 14-day relative strength indicator of 45.91.

The stock grants a dividend yield [FWD] of 12.51% as of this writing.

Conclusion – The Stock Benefits from Higher Gas Prices

This is a company that earns royalties from the sale of natural gas from northwestern Germany. The share price is well positioned to benefit from the expected increase in natural gas prices in the spot price markets.

Be the first to comment