phaisarn2517/iStock via Getty Images

Digitization accelerates the penetration of AMT & AT

The truck transmission market in North America is gearing up (no pun intended) for a major shift towards AMT & AT. Over the last decade, advancement in software technology has led to an increase in the adoption of Automated Manual Transmissions (AMT) and Automatic Transmissions (AT). In the coming years, while manual transmissions (MT) may fall further as a share of the total, the market will see inroads from a new technology, reduction transmissions, which will support rising numbers of battery-electric trucks.

It was little over a decade ago that Eaton (ETN) and Volvo (OTCPK:VOLAF) launched UltraShift AMT and I-Shift technologies, respectively, in the region. Since then, there have been several adopters of these technologies, as well as significant improvements in the offerings. Mack started offering its mDrive AMT and Freightliner, and Western Star (OTC:DTRUY) started Detroit DT 12 AMT in 2012. Modern AMTs are lighter, more fuel-efficient, reliable and have longer maintenance intervals than before. The Advanced shift management system makes use of parameters such as vehicle speed, vehicle mass, engine torque etc. to make precise gear shift decisions. Many of the advanced technologies cannot be realized without the control of AMT, and one of them uses GPS to predict road conditions and control optimum driving mode to improve fuel efficiency. The automatic optimum control of vehicle speed, engine speed and auxiliary brake guarantees comfortable and safe eco-operation regardless of the driver’s skill.

OEMs are reporting higher take-rates of AMTs in their new linehaul model than ever before. As one reference, in 2021 about 92% of the new Volvo trucks are equipped with I-Shift AMT compared to 75% in 2014. One of the two reasons for the increase in AMT is the shortage of skilled drivers because the new generation of drivers are more inclined towards AMTs as they have never used stick transmission. The AMT advantage is that it brings the new driver up to the level of an experienced driver because the system is doing the shifting for them. The second reason is vertical integration. In the last couple of years, OEMs are focusing on coupling engines with the in-house automated transmission. Recent is Paccar’s (PCAR) TX-18 automated transmission, a second transmission developed jointly with Eaton and is available in Peterbilt and Kenworth trucks.

AT technology is becoming more intelligent as the year goes on. ATs are becoming more precise in shifting than humans with the advancement in software development. In the last couple of years, we have seen an increase in AT in vocational trucks, which were previously dominated by MT. One of the advantages of AT is that it has a smooth start and stop, which is suitable for vocational trucks. And it is unlike AMT where one must replace a costly clutch on occasion, thus reducing the maintenance cost of AT, which uses a torque converter during the launch. The AT ratio is growing in the urban distribution truck segment which are most used by e-commerce, logistics companies and have a high start/stop cycle in cities.

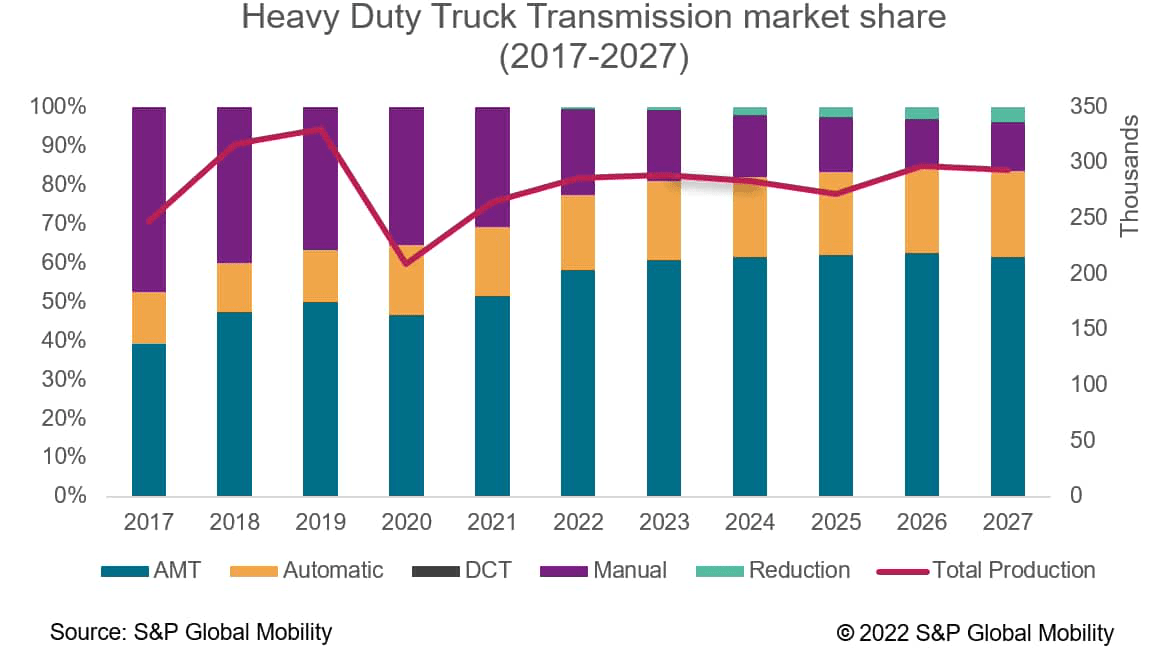

In 2017, AT covered about 91% of the market in the medium duty segment. Share is expected to decline to about 84% by 2027, the primary reason being the increase in battery electric and fuel cell vehicles in the segment, which do not require an AT. In the heavy-duty segment, the shift to AMT and AT is progressing. Some 61% market share will be AMT and 22% will be AT by 2027 whereas MT market share is expected to decline to around 13%.

In the last decade, the trucks’ transmission market in North America was dominated by Eaton, having more than 50% of the market share in 2011, a majority of which was from MTs. In the last couple of years, the heavy-duty truck transmission market has shifted towards AMT and AT in North America, and this has been one of the reasons for the decline in the market share of Eaton to about 38% in 2017. It took a while to catch up but now AMTs are at the forefront of the tractor truck market which replaced MT as the standard option. Although AMTs have seen significant growth, ATs have also made modest gains, mostly in heavy-duty vocational class trucks. Allison Transmission (ALSN) is one of the major manufacturers of AT in North America, having the majority of market share in the medium duty segment. In 2017, Allison had 13% market share in the heavy-duty segment, which is expected to increase to about 19% by 2027. Heavy-duty battery electric and fuel cell trucks are expected to increase from 2025 onwards, leading the market share of Reduction transmission to increase to about 4% by 2027. In 2017, Ford had a share of 43% followed by Allison with 32% in the medium-duty segment. Ford share is expected to decline to about 38% by 2027 owing to the increase in battery electric vehicles in the segment. The number of TMs suitable for battery electric vehicles will increase in the future, and technological trends continue to attract attention as they improve battery electric vehicles performance.

In the coming years, MT will see a significant decrease in market share, but they will remain in the market at least a decade from now. Although the MT share is narrowing down, Manuals may be needed in certain vocational applications where the fleets have trucks which are not used on a regular basis or only if the fleet absolutely need it. It is more like a scrollbar, offering fine control over movements; we cannot say farewell to MTs just by pressing a button.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment