Lisa-Blue

Two months ago, I wrote a bullish article on Nordic American Tankers (NYSE:NAT) highlighting the tightening tanker market. Fast forward to today, Nordic American has rallied over 40%, far outpacing the S&P 500. Will the good times last for NAT?

I believe my bullish thesis from a few months ago is still valid. We could be entering a goldilocks period for oil tankers where rates stay high and generate good margins without the usual supply response from newbuilds. I remain bullish on NAT.

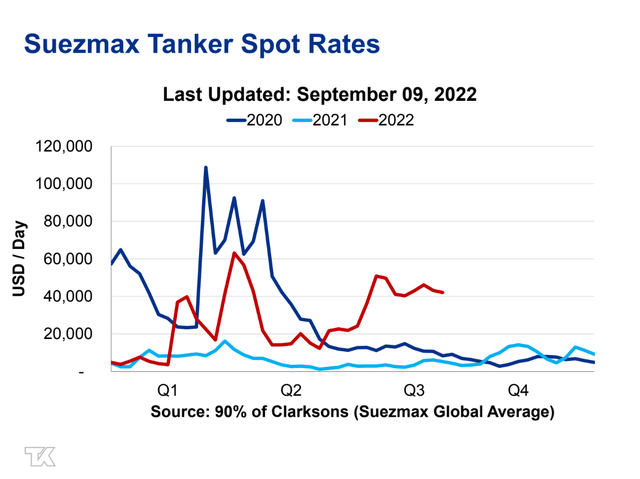

Tanker Spot Rates Update

First, a quick update on tanker rates. From Teekay Tankers website, we can get a snapshot of current tanker rates. The latest report from September 9 is shown in Figure 1. As we can see from the figure, Suezmax spot rates have entered into a plateau between $40k to $50k per day.

Figure 1 – Suezmax Spot Rates (Teekay Tankers Market Insights)

While not as high as the peak rates achieved in 2020, we must remind ourselves that most of China remains in periodic COVID lockdown, with the latest lockdown being the south-western megacity of Chengdu. This has negatively impacted Chinese oil demand, so tanker rates are actually reacting very well, all things considered.

Revisiting Bullish Thesis

A quick refresh for those not familiar with the bullish tanker rate thesis, but essentially, my thesis rests on the redirection of Russia’s oil flows to the Far-East. Russia is the third largest oil producer and largest oil exporter to global markets at over 7.8 million bbl/d of crude oil and products as of December 2021.

Historically, Russian products were sent to ports close by like the Port of Rotterdam in the Netherlands. However, as Russian oil sanctions were enacted, these oil shipments had to be re-routed to faraway destinations like China and India. Furthermore, European refineries have to replace Russia crude with those sourced from farther away like the Middle East and Americas.

Essentially, we are replacing short 5-day voyages between St. Petersburg and Rotterdam with 30-40 day voyages between St. Petersburg and India or Venezuela to Rotterdam. As tankers become committed to these much longer voyages, it is no surprise that the tanker rate market is rapidly tightening.

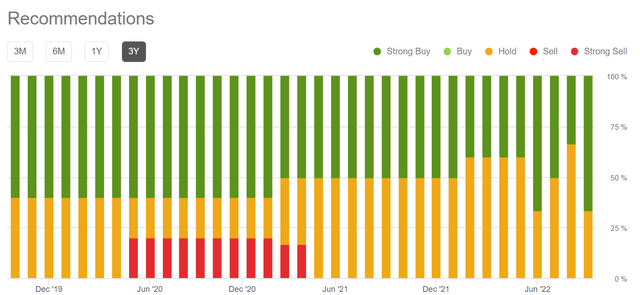

Wall Street Turns Bullish

I’m not sure if any Wall Street analysts read my articles, but the analysts seem to be using the same re-route of Russian oil thesis as the basis for upgrading the sector. For Nordic American specifically, there are now two strong buy ratings and one hold rating (Figure 2).

Figure 2 – NAT Wall Street Recommendation (Seeking Alpha)

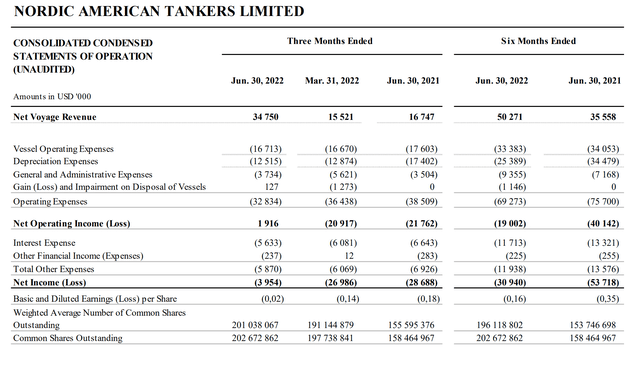

Latest Quarterly Results Show Improvement

Since the time I wrote my last article, Nordic American reported their fiscal second quarter results. NAT reported both a revenue and EPS beat versus consensus, with revenues of $34.8 million and EPS of -$0.02 (Figure 3).

Figure 3 – NAT Condensed Q2 Financials (NAT Q2/2022 Report)

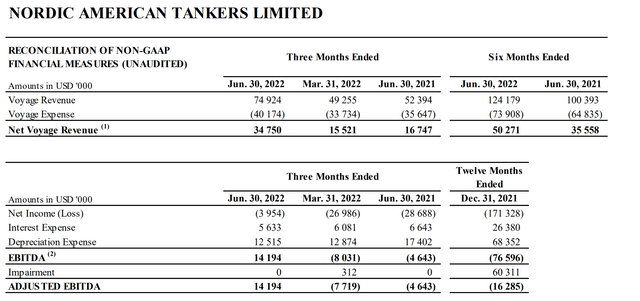

More importantly, The TCE equivalent rate in the second quarter was $20k, a sharp improvement from the $8,900 rate in Q1/2022. Recall, NAT prides itself on having ~$8,000 / day operating costs, so the increase in tanker rates allowed the company to return to positive EBITDA of $14.2 million in Q2/2022 (Figure 4).

Figure 4 – NAT Returns To Positive EBITDA (NAT Q2/2022 Report)

NAT also declared a dividend of $0.03 / share for the second quarter (~4% forward yield), and also indicated that with a better outlook for tanker rates, the company will look to increase the dividend in the coming quarters.

For the upcoming Q3, we know from NAT’s press release that the company has already secured some chunky charters in the $40k to $50k / day range:

12th Aug.: Vessel fixed on subjects to US Oil Major for voyage from Mediterranean to Asia. Time Charter Equivalent (TCE) about USD 60,000 over 35 days

12th Aug.: Vessel fixed on subjects to Asian interests for voyage from AG to Singapore. Time Charter Equivalent (TCE) about USD 19,000 over 36 days

4th Aug.: Vessel fixed to Asian interests for voyage cross Mediterranean. Time Charter Equivalent (TCE) about USD 40,000 over 15 days

This bodes well for the upcoming quarter in terms of revenue and earnings. (Note, in the examples above, TCE rates are quoted on a per day basis.)

Insiders Continue To Buy Shares

In a sign of confidence, board member Alexander Hansson (son of founder and CEO Herbjorn Hansson) continued to accumulate shares, now having 2 million shares net. The Hansson family is the largest private shareholder in Nordic American, a strong show of support and confidence in the company’s prospects.

Outlook For Tanker Rates Muted Short-term

In the short-run, I suspect tanker rates will continue to trade sideways at elevated levels, as Chinese demand remains restricted due to COVID lockdowns. The Chinese situation may improve in the fourth quarter, after President Xi will most likely secure an unprecedented third term as China’s leader in the upcoming plenum scheduled for October.

When Chinese demand returns (I think this is a when, not if, as there are already signs of the Chinese government slowly enacting stimulus measures to support the economy), I think we will see a resumption of the rise in tanker rates.

Higher For Longer Is Good For Business

In fact, we could be entering a goldilocks environment for oil tankers, as rates are sufficiently high to produce good margins, but they are not high enough to attract irrational investments in ships. As I have said in my prior articles, most tanker cycles end when the market is flooded with newbuilds.

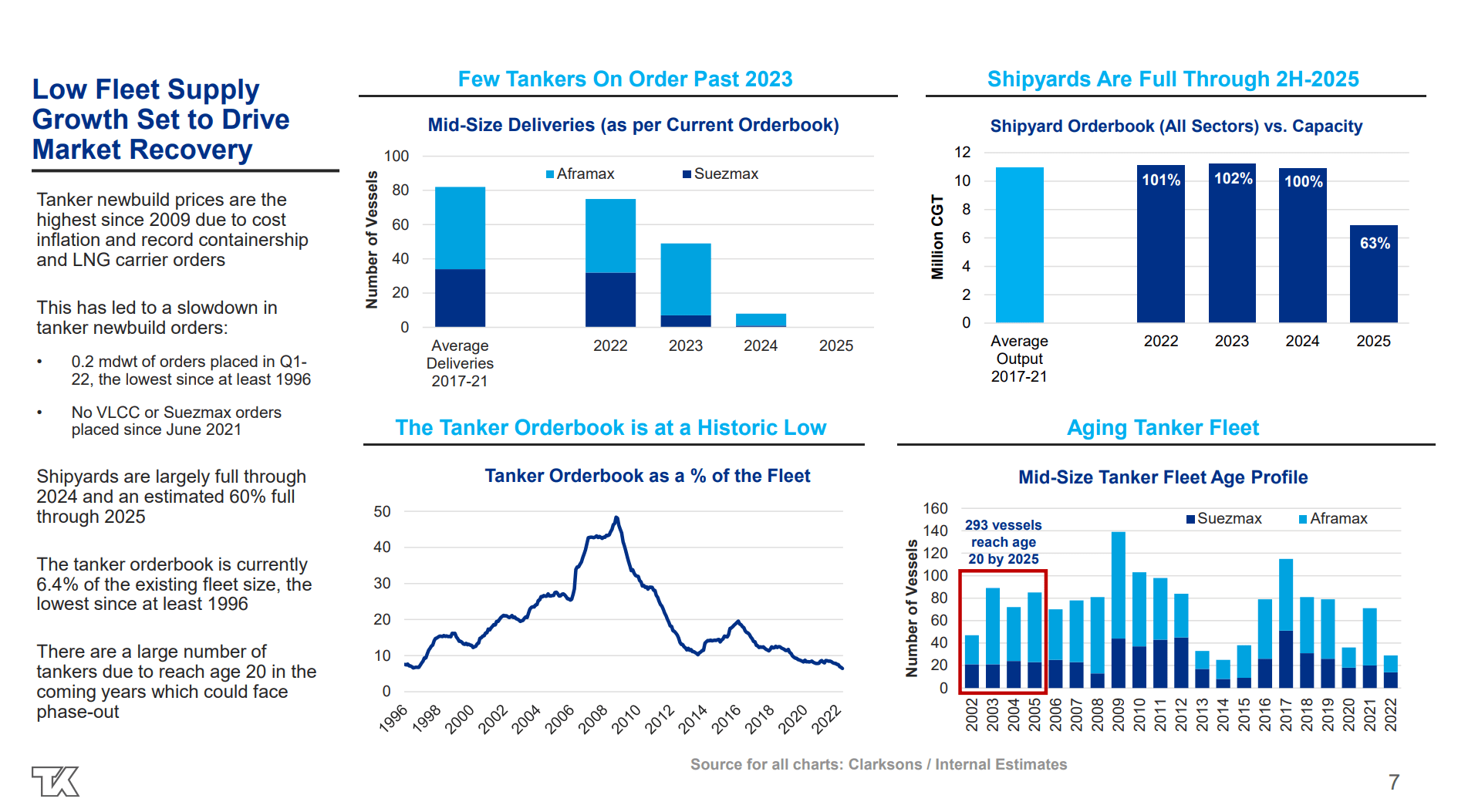

Currently, the newbuild situation is quite different, as the shipyards are busy with building other vehicle types. The order book is currently only at 2% of the Suezmax fleet, and there does not appear to be any available slots to for newbuilds until 2025 (Figure 5).

Figure 5 – Fleet Growth Muted (TNK investor presentation)

Valuing NAT On Spot Rates

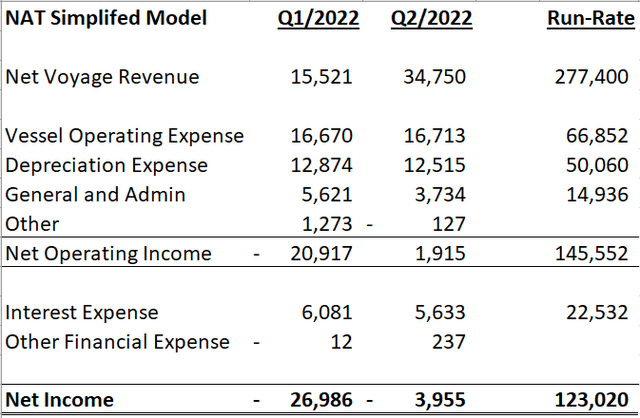

As we can see from Q2’s results, Nordic American is roughly breakeven on a net income level at $20k TCE. If current rates of ~$40k TCE were to last for a year, we can see Operating Income on the order of $145 million or ~$0.70 / share (assuming 202 million shares O/S). This could translate into $0.60 / share in earnings, meaning the stock is currently trading at 5.3x run-rate P/E.

Figure 6 – NAT model (Author created)

Risks To Bullish View

For NAT, I believe the biggest risk remains a global economic slowdown/recession that will reduce demand for oil. In the short-term, this will increase tanker rates, as tankers will be used as temporary storage (a la 2020). However, in the longer-run, a global economic slowdown will prompt OPEC to cut production, which would hurt oil flows.

In fact, OPEC recently announced a symbolic production cut of 100k bbl/d to shore up the oil price.

Investors should also be aware of developments in the Russia/Ukraine conflict. If the war were to end tomorrow, the oil re-route thesis might change depending on how the conflict ends. If the conflict ends with a regime change in Russia, we might see western countries soften their stance on sanctions, which could negative hurt our oil flow thesis.

Conclusion

In conclusion, I believe my bullish thesis from a few months ago is still valid. We could be entering a goldilocks period for oil tankers where rates stay high and generate good margins without the usual supply response from newbuilds. I remain bullish on NAT.

Be the first to comment