1971yes

Introduction

Nordic American Tankers (NYSE:NAT) endured very tough operating conditions during 2021 but as my previous article discussed early in 2022, they saw more green shoots emerge, although this was complicated by war breaking out in Eastern Europe. Despite this geopolitical shock lifting the profits of oil companies, it did not initially help oil tanker operators but this appears set to change heading into 2023. Whilst shareholders would have been excited to see their dividends recently boosted by two-thirds, I feel they should beware of another dividend splurge considering the hidden costs of saving their company the latest downturn, as discussed within this follow-up analysis.

Coverage Summary & Ratings

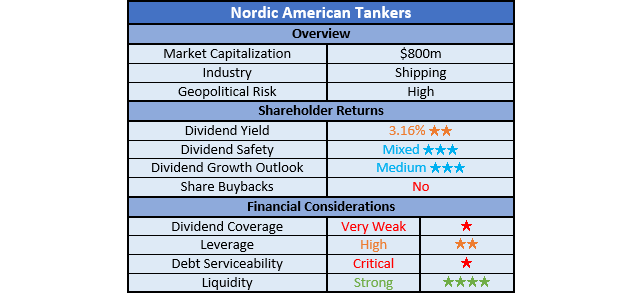

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

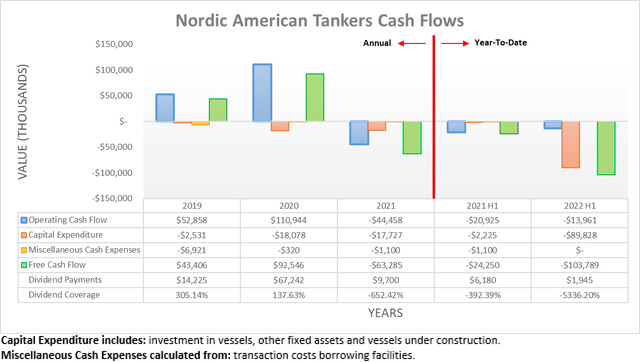

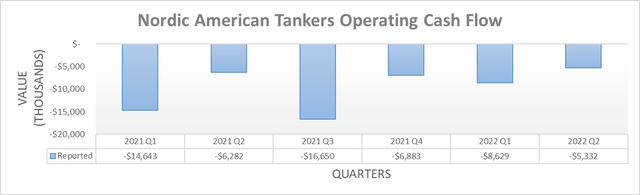

Following a very tough downturn in 2021 that saw their cash bonanza of 2020 evaporate away as their operating cash flow turned to a negative $44.6m, the start of 2022 was not much better with the first half seeing a result of negative $14m. Whilst their result of negative $20.9m during the first half of 2021 was even worse, realistically, this only makes their recent result look ever-so-slightly less bad, as burning cash to merely operate the company remains a severe problem.

At least it appears the worst is over when viewing their operating cash flow on a quarterly basis, as their results appear to be trending better quarter-to-quarter after having bottomed out in the third quarter of 2021 at negative $16.7m. When looking ahead towards the end of 2022, it seems the worst may finally be over when releasing their third-quarter results later in November, especially as they have pre-emptively boosted their dividends by two-thirds. Elsewhere, their competitor, Scorpio Tankers (STNG) who already released their results, saw solid improvements during the third quarter and forecast much stronger than expected charter spot rates for the fourth quarter. If looking ahead into 2023, the upheaval from European sanctions against Russian seaborne oil appears set to increase demand for oil tankers via redirecting trade routes, thereby creating a strong outlook for the next twelve months, possibly even longer. Considering the large dividends they provided during the last up-cycle in 2020, shareholders could be set to receive quite the dividend splurge if these expectations come to fruition.

Whilst positive, there are still very important lessons to learn from the downturn of 2021 and early 2022 that carry significant medium to long-term implications and by extension, influence how I view their shares going forwards into what is seemingly a forthcoming up-cycle. The most important lesson was how they survived consistent negative operating cash flow for over one year straight. When examining their cash flow statements, it shows they issued $80.1m of new shares during 2021, plus a further $34.8m during the first half of 2022. As a result, this lifted their outstanding share count of 151,446,112 at the end of 2020 to 202,672,862 by the end of the second quarter of 2022, thereby representing a one-third increase.

Yes, that is right, an investor holding their shares on December 31st 2020 effectively lost one-third of their ownership via dilution, assuming they still hold the same shares. This is effectively a reverse share buyback whereby instead of removing outstanding shares to boost their value, they issue new shares to boost their cash balance to survive their negative operating cash flow, although it obviously erodes the value of their existing shares.

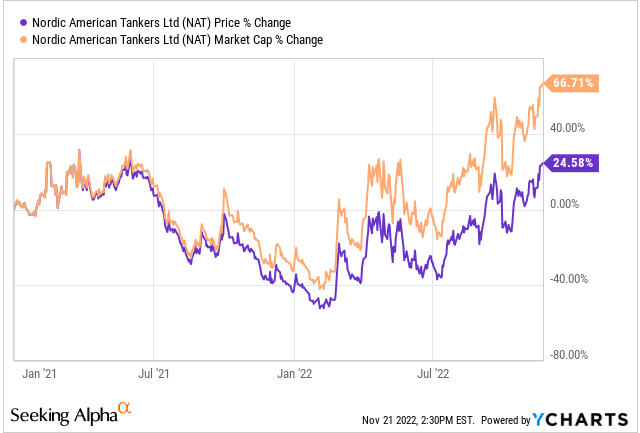

Y-Charts

It should be remembered that whilst investors talk about share prices most frequently, the actual valuation of the company is their market capitalization. When overlaying the relative changes of their share price and market capitalization, the impact of significantly increasing their outstanding share count is abundantly clear. Whilst their share price is now 24.58% higher versus the end of 2020, their market capitalization is far higher at 66.71%, obviously due to their significantly higher outstanding share count, thereby highlighting the hidden costs of saving their company during the latest downturn.

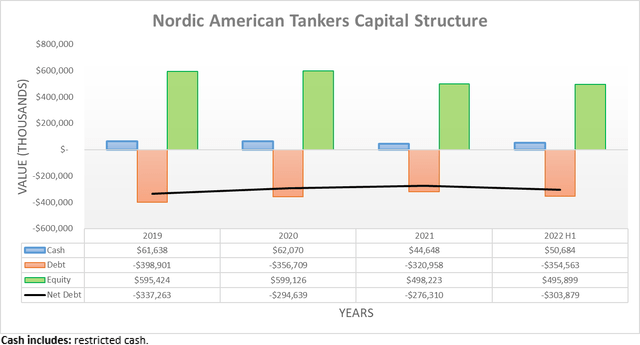

Despite issuing shares, the significant increase was still insufficient to completely extinguish their cash burn as their net debt ended the first half of 2022 at $303.9m and thus above where it ended 2020 and 2021 at $294.6m and $276.3 respectively. When looking ahead, their net debt should stabilize and start trending lower as their cash flow performance improves, although this depends upon the extent of the recovery and equally as important, it depends on their capital allocation strategy.

Even though I am normally a proponent of dividends and to a lesser extent, share buybacks, in light of the hidden cost of saving their company during this latest downturn, I would actually prefer to see a focus on deleveraging before shareholder returns, thereby better preparing their company for future downturns. Whilst it may sound premature to already think about future downturns, the shipping industry is inherently volatile and thus one day or another, they will be faced with tough operating conditions once again.

Since their operating cash flow was still negative during the first half of 2022, it would be pointless to assess their leverage in detail because without positive financial performance, it renders their leverage ratios useless with logically invalid negative results. As a backup measure, their net debt of $303.9m and equity of $495.9m see their gearing ratio at 38.00% that sits within the high territory of between 30.01% and 50.00%. Elsewhere, this same logic also applies to their debt serviceability because negative cash flow performance obviously leaves it critical, as interest expenses required either debt funding or share issuances. Thankfully, if their financial performance improves heading towards the end of 2022 as well as into 2023, both of these considerations should recover.

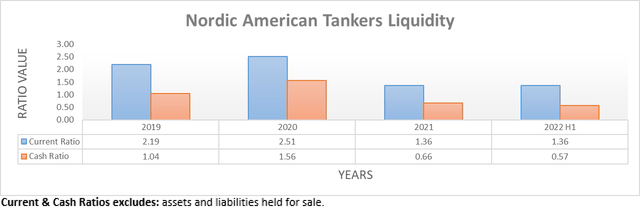

Despite their capital structure continuing to be levied with debt during the first half of 2022, at least their liquidity fared better with their current ratio remaining unchanged at 1.36 versus the end of 2021, whilst their cash ratio only dipped slightly to 0.57 versus 0.66 across these same two points in time. A cash ratio of this size is surprisingly good, although it should be considered that $30m of their $50.7m cash balance is effectively unusable given the covenant of their credit facility, as per the quote included below.

“The agreement contains covenants that require a minimum liquidity of $30.0 million and a loan-to-vessel value ratio of maximum 70%.”

-Nordic American Tankers Q2 2022 6-K.

If not for having raised $114.9m via issuing new shares since the start of 2021, they obviously would have breached their covenant many months ago, thereby ending up in bankruptcy court. Also, if they had retained more of their $92.5m of free cash flow from 2020 instead of funding $67.9m of dividend payments, they would not have needed to issue such a significant amount of shares to avert such a terrible outcome. Alternatively, if they had less leverage, it stands to reason their credit facility would have both carried a less restrictive covenant and also provided more availability. This would have provided another avenue to avoid issuing so many new shares during the downturn and whilst hindsight is fool’s wisdom, these lessons can still be applied going forwards when assessing how they deploy capital during the next up-cycle and by extension, the medium to long-term implications of their choices.

When looking ahead, they should no longer have any issues maintaining this minimum cash balance until the next downturn as their cash flow performance improves in the short-term. This marks an improvement compared to when conducting the previous analysis and thus by extension, their liquidity is now strong instead of only adequate.

Conclusion

Whilst they survived the severe downturn of 2021 and early 2022, it came with a significant hidden cost with their shareholders effectively losing one-third of their company via dilution from new share issuances. The past is the past and cannot be changed, although going forwards, when they release their third-quarter results I would prefer to see a focus towards deleveraging before shareholder returns, thereby better preparing their company to endure future downturns. Since they have already pre-emptively boosted their dividends by two-thirds, I suspect they are once again going to focus on shareholder returns and thus from my medium to long-term perspective, I believe that maintaining a hold rating is appropriate, at least until more data comes to light.

Notes: Unless specified otherwise, all figures in this article were taken from Nordic American Tankers’ SEC filings, all calculated figures were performed by the author.

Be the first to comment