VeselovaElena/iStock via Getty Images

Introduction

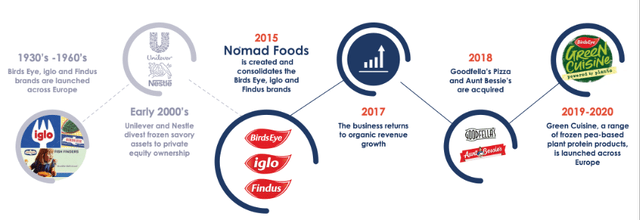

Nomad Foods Limited (NYSE:NOMD) is a growing company specializing in the production and distribution of frozen foods. Nomad Foods originated from the frozen division of Unilever (UL) and Nestle (OTCPK:NSRGF, OTCPK:NSRGY). In the early 2000s, the frozen division of these companies was sold to private equity. In 2015, BirdsEye, iglo and Findus were formed into Nomad Foods and listed on the NYSE.

Company History (Investor Day 2020 Nomad Foods)

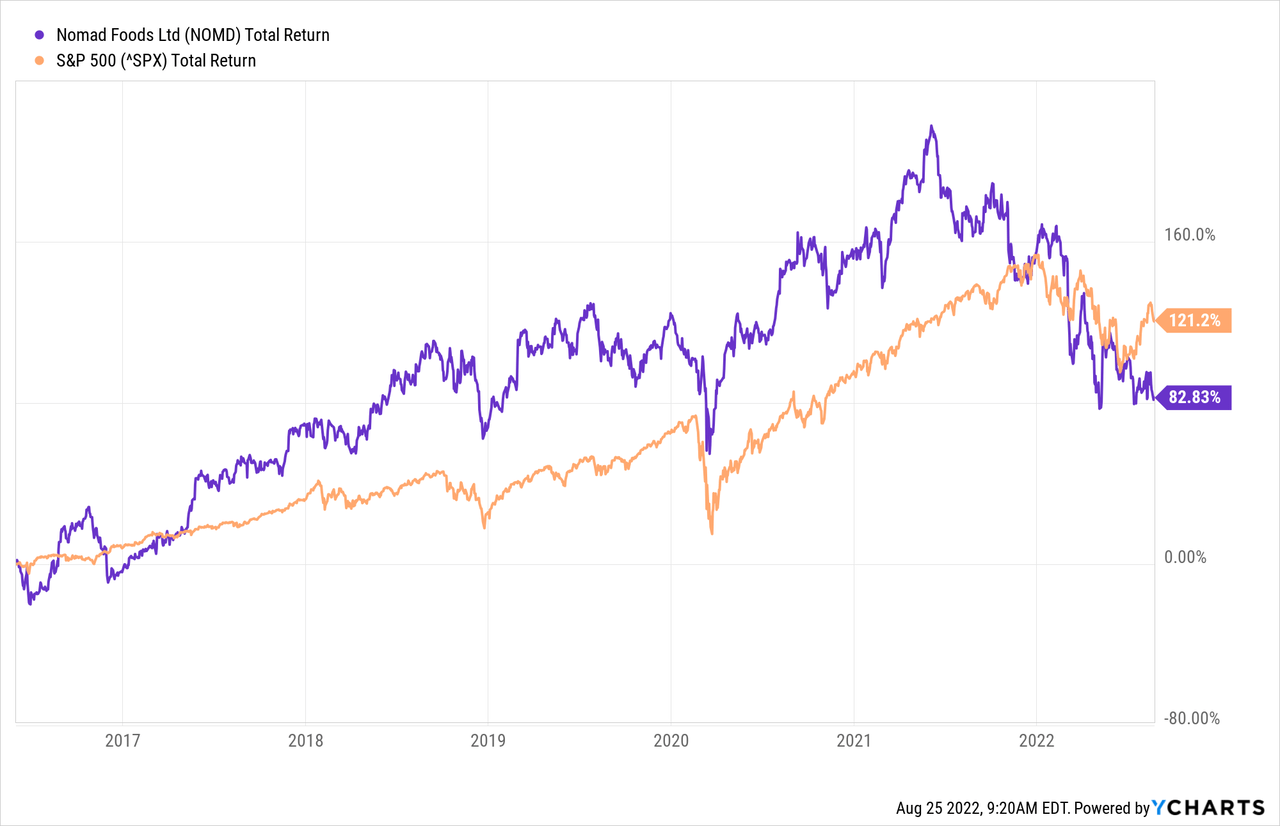

The company rewards its shareholders by repurchasing its own shares. As a result, the share price has risen sharply since the IPO. The stock is currently trading lower than the S&P500, but the stock is also valued cheaper than the S&P500. From June 2021, the dollar appreciated sharply. From June 2021, the dollar appreciated sharply. Nomad Foods only does business in Europe and since then its shares have unjustifiably fallen sharply. In addition, Nomad Foods is on UBS’s highest conviction list.

I have showed the total return chart from the second half of 2016 to now (never buy IPO).

Nomad Foods has strong growth ambitions and is the European market leader in the frozen food market. I therefore do not see that Nomad Foods’ market share is quickly being overtaken by competitors. The share valuation is cheap, and the share buyback program drives a higher share price. However, expectations for this year have been revised downwards, but the company still expects to meet its adjusted EPS target of $2.30 by 2025. The stock is a strong buy.

About The Business

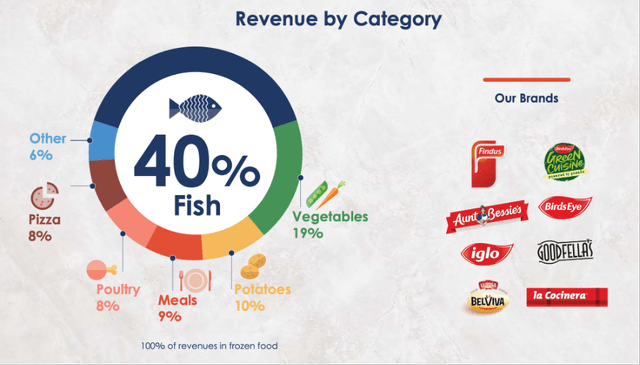

Nomad Foods is a leading company that offers a variety of frozen foods such as fish products, vegetables, poultry and meat products, ready meals and others. The products are offered in supermarkets as well as in food retail chains. Well-known brands include Birds Eye, Iglo, Findus, Goodfella’s, Tante Bessie’s, La Cocinera, Ledo, Frikom and San Marco, which is delicious, high-quality and nutritious food. The company is based in the United Kingdom.

As of 2020 investor day presentation, 40% of sales were made up of fish products sales. Vegetables then make up 19% of sales, as can be seen in the image below. After the recent acquisition of Fortenova’s frozen food business, the allocation may have changed, management needs to update the presentation.

Revenue By Category (Investor Day 2020)

Nomad Foods is growing through organic growth supplemented by acquisitions. In September 2021, it acquired Fortenova’s frozen food business for EUR 615 million (approximately USD 720 million). Fortenova frozen products are active in new markets for Nomad Foods. It is a leading company in its sector in Croatia, Serbia, Bosnia & Herzegovina, Hungary, Slovenia, Kosovo, North Macedonia, and Montenegro. Brands such as Ledo and Frikom offer a wide range of frozen products and have the largest market share in many areas in which they operate. These brands have a strong consumer awareness. With gross margins higher than those of Nomad Foods, Fortenova’s frozen food business is a strong addition to their portfolio. Nomad Foods is currently the number 1 leader in frozen foods in Europe.

Nomad Foods Is Experiencing Strong Growth

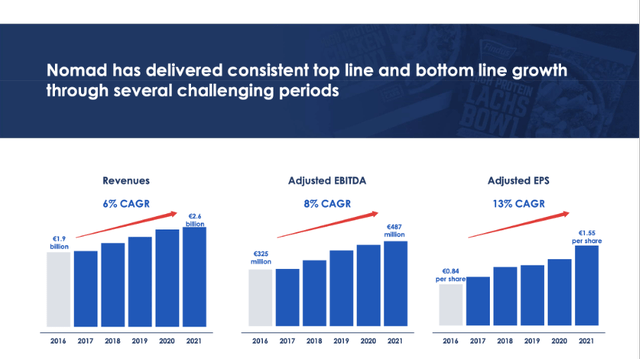

Nomad Foods continues to grow its revenue, Adjusted EBITDA, and EPS year-over-year. As of 2016, a CARG of 6% in revenue growth has been achieved. Adjusted earnings per share grew by 13% CAGR over the same period. The company is growing strongly, both organically and through acquisitions.

Revenue and Earnings Growth Nomad Foods (1Q22 Investor Presentation)

At the 2020 investor day presentation, the company showed strong growth ambitions: Cumulative Adjusted free cash flow from 2020 to 2025 of €1.5B, and Adjusted EPS of €2.30 by 2025. This represents an annual growth in Adjusted EPS of 10%.

Those are high ambitions, especially now as management has slightly lowered Adjusted EPS guidance in 2Q 2022 to a range of $1.65 to $1.71 for 2022. Management expects they are still well on track to hit Adjusted EPS of $2.30 over 2025

Second quarter results were mixed. Consolidated sales grew 17%, but organic sales growth decreased by 3.2% year-over-year. In addition, Adjusted EBITDA increased by 2.9% and Adjusted EPS remained stable at €0.40. (Adjusted EBITDA is EBITDA that excludes the impact of exited markets, purchase price adjustments from acquisitions, exceptional items, goodwill and impairment charges on intangible assets, and others.) Organic sales decline was an improvement from the first quarter, but reflects the impact of COVID lockdown equations and category weakness across Europe.

Nomad Foods was affected by the war in Ukraine and is therefore looking more conservatively to 2022. The war will further increase inflation in Europe and disrupt the global supply chain. Nomad Foods expects the increase in product prices to offset the volume declines. This will lead to low-single digit organic sales growth for 2022. Input costs are higher and Nomad Foods is working with its retail partners on a solution to pass on input costs. Management expects the company to perform better in the second half compared to the first half.

Rising energy prices in Europe could also affect Nomad Foods as they have to cool their products. Fortunately, Nomad has his costs well under control. The energy costs will be covered this year and also for 2023.

What I Don’t Like

Nomad Foods is currently experiencing temporary disruptions due to the war in Ukraine and high inflation. The stock has fallen, and it may be a good opportunity to buy the stock.

What I don’t like is the high debt. Nomad Foods grows partly through acquisitions and finances this with its own money or takes on debt. What I don’t like is the high leverage ratio. Nomad Foods keeps its leverage ratio (net debt/adjusted EBITDA) below 3.75x. Adjusted EBITDA is EBITDA that excludes the impact of market exits, purchase price adjustments from acquisitions, exceptional items, goodwill and impairments on intangible assets and others. Still, I find 3.75x high compared to other companies in the sector and this can pose a risk when the debt needs to be refinanced at a higher interest rate. An upcoming maturity is the Senior US Dollar debt of $916.4 million (€808.6 million), repayable in May 2024.

Dividend, Share Repurchases, And Valuation

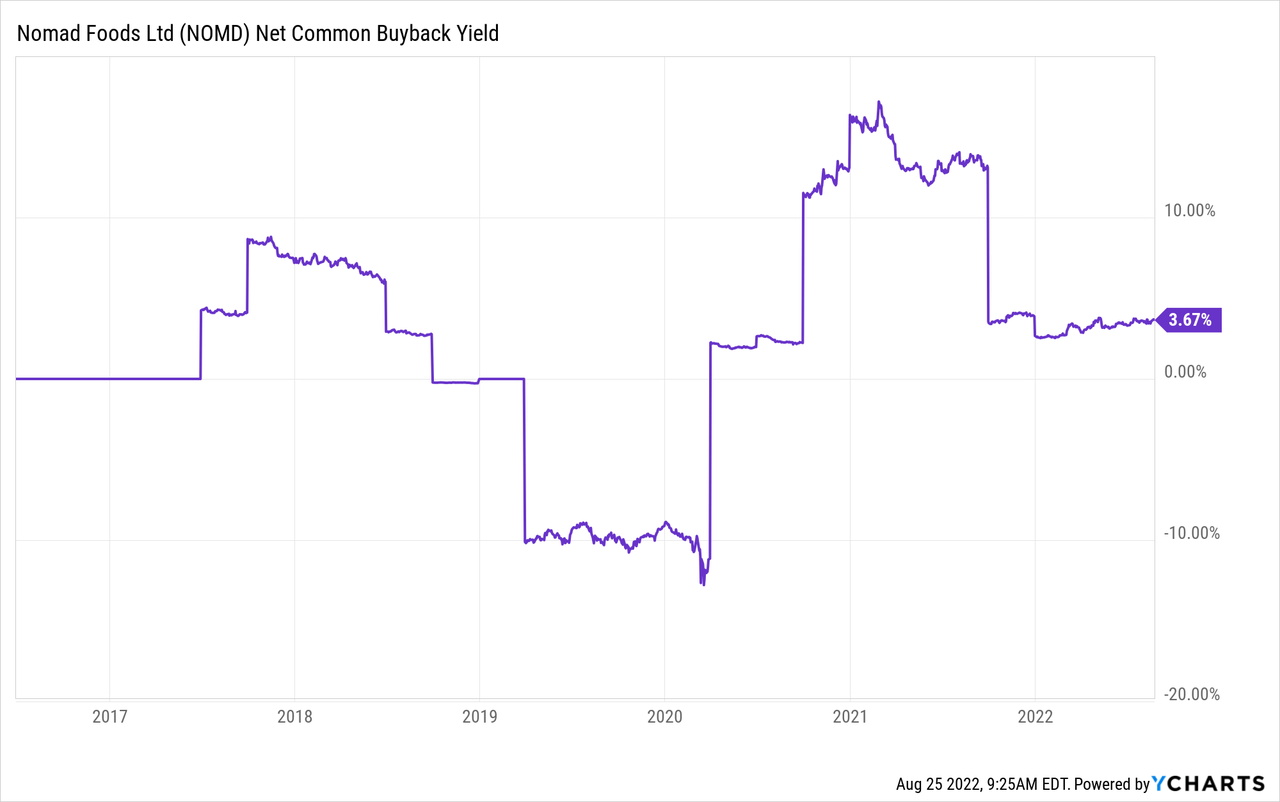

Nomad Foods decides to value shareholders by repurchasing shares instead of paying a tax-inefficient dividend. On August 5, 2021, the company announced its intention to purchase $500 million in shares over a three-year period.

At the end of 2021, there is still $424M left. Over the past six months, it bought up $27 million worth of shares, leaving about $397 million open through 3Q 2024. This equates to $176 million per year, at its current market cap of $3.3 billion, this provides a strong repurchase yield of 5.3%.

I prefer companies that buy back shares because the buyback increases demand while supply decreases. This drives the share price in a tax-friendly way.

Nomad Foods has unjustly fallen sharply since June 2021. The company only conducts business in Europe while listed on the US stock exchange. As of June 2021, the dollar has risen sharply, interest rates have increased, making investors prefer to invest their money in companies doing business in the United States. When the ECB raises interest rates and the euro strengthens, Nomad Foods will resume its upward trend.

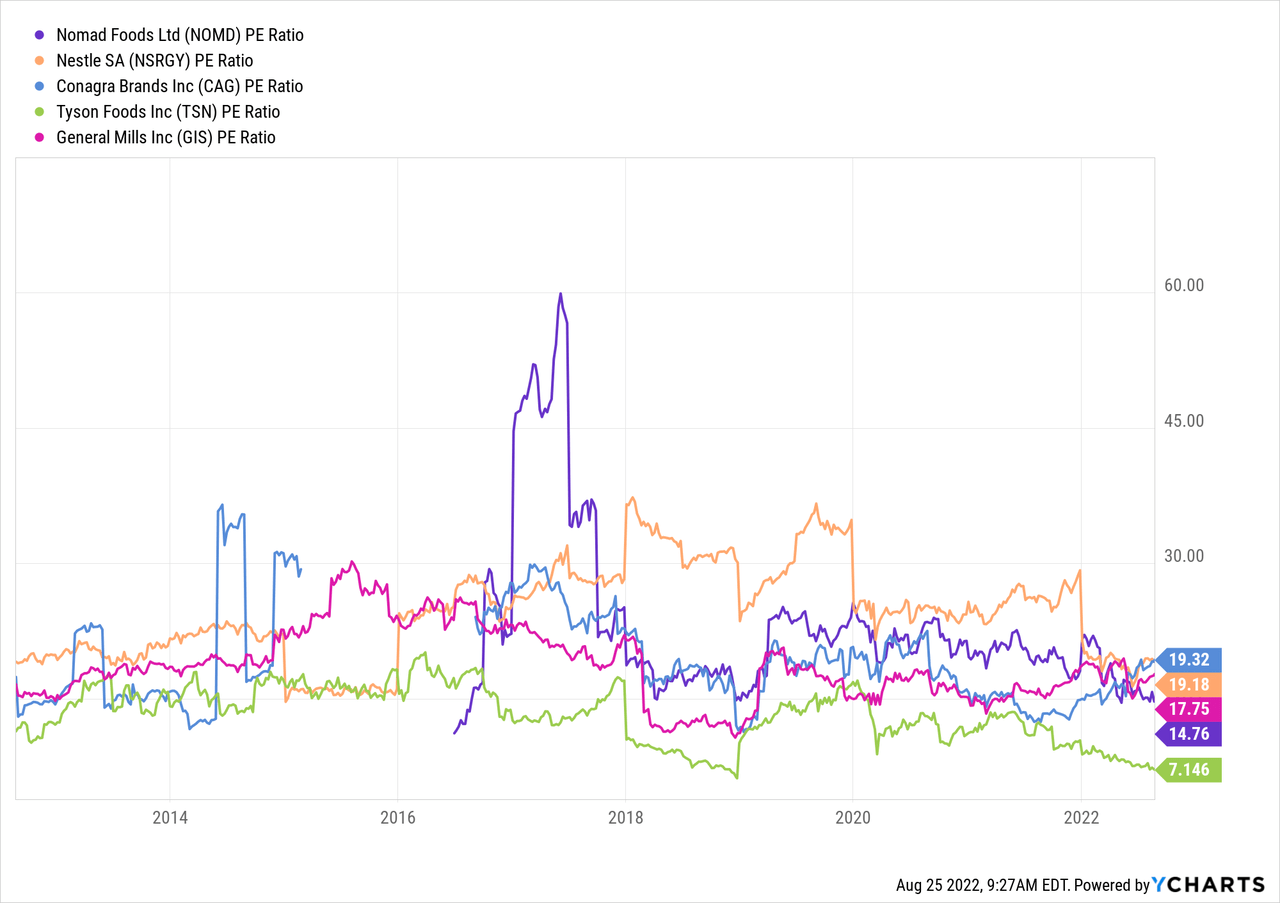

Compared to peers in the industry, Nomad Foods is valued cheaply. Other publicly traded companies in the frozen food sector include Nestle, Conagra (CAG), Tyson (TSN) and General Mills (GIS). These companies are currently all valued below the S&P500 (SP500) P/E ratio. The S&P500 is currently trading at a PE ratio of 21.8. Compared to these companies and the S&P500, Nomad Foods is valued very attractively with a P/E ratio of only 15.6. Nomad Foods’ average P/E ratio since IPO is 20, so the stock is 22% undervalued.

Only Tyson Foods is valued cheaper on a P/E ratio. EPS growth for Nomad Foods for the coming years is positive, while analysts expect Tyson to show negative EPS growth next year.

Nomad Foods expects Adjusted EPS to reach $2.30 in 2025. Calculated with the average P/E ratio of 20, this means an annual return of 30.1% until the end of 2025. At the current P/E ratio, the annual return will be 20.5%. Whether management expectations will be lowered is speculation. Historically, the company is growing strongly and is trading at a huge discount in the market.

Conclusion

Nomad Foods has experienced strong growth in recent years. From 2016 to 2020, revenue grew 6% pa, Adjusted EBITDA grew 8% pa, and Adjusted EPS grew 13% pa over this period.

The strong growth was made possible by organic growth and growth through acquisitions. This makes Nomad Foods the number 1 market leader in frozen products in Europe.

Nomad Foods is currently going through a period of high inflation and supply chain disruption due to the war in Ukraine. They can pass on the higher costs and are negotiating this with retailers. Still, management expects them to deliver $2.30 adjusted earnings per share by 2025. This implies an annual growth of 10+%.

Management announced a $500 million share repurchase program in 2021. Currently, there is approx. $397 million available through 3Q 2024. This equates to a buyback yield of 5.3%. Repurchasing shares creates more demand and lowers supply, allowing the share to rise.

Since June 2021, the dollar has strengthened and appreciated against the euro. Nomad Foods is a company that does business in Europe, but the shares are listed in the United States. Since June 2021, the share has fallen sharply in value. When the ECB raises interest rates in Europe, the value of the euro rises, and the price of Nomad Foods shares rises too.

The stock is valued cheaply. If the company generates $2.30 in adjusted earnings per share in 2025, it will return an annualized return of 20.5% at its current valuation. Due to high expectations, cheap stock valuation and the share repurchase program, the stock is a strong buy.

Be the first to comment