MiguelMalo

Author’s Note: This article was published on the Dividend Kings back on August 31st 2022.

Dear readers,

I don’t often write about smaller businesses like this – except when there is what I view to be a massive opportunity. That’s the case here. It won’t be everyone’s cup of tea – just like some smaller REITs aren’t everyone’s cup of tea. But this is a company close to home for me, and I believe it can offer you some advantages and upside if you give it a chance.

Let me show you what Nolato (OTCPK:NLTBF) is, and why I consider it a solid business.

What is Nolato?

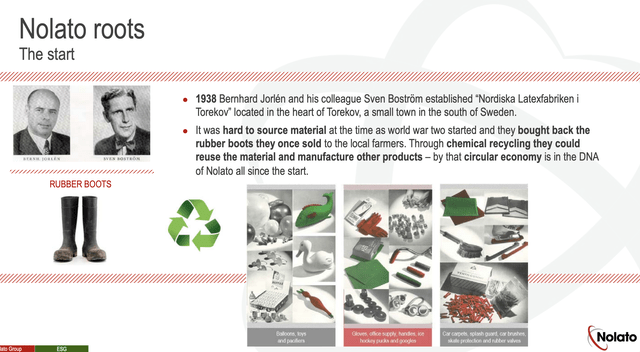

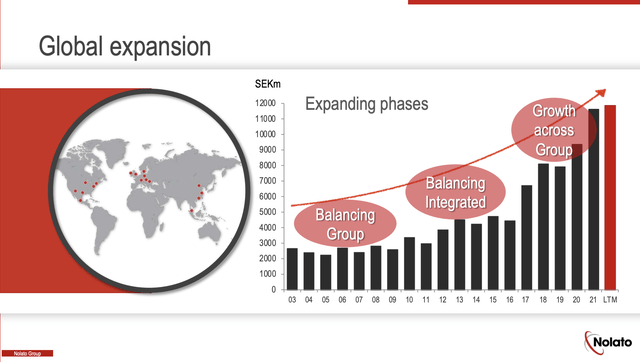

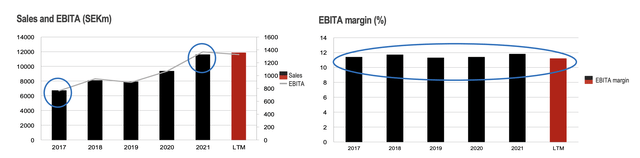

Nolato is an 80+-year-old polymer product company established in the small town of Torekov, in southern Sweden back in 1938. It was listed on the stock market over 36 years ago. The company delivers annual revenues of 11.6BSEK, making an operational profit of 1.3BSEK, or an EBITDA margin of close to 12%. The company employs nearly 8,700 people across the world.

The company started out as a very humble latex factory that worked by taking rubber boots once sold to farmers, and recycling the rubber to produce other products.

Nolato’s ambition is to be the customer’s first choice in polymer products – that is all that they do.

Namely, it’s active in three business areas:

- Medical Solutions, comprising 35% of sales.

- Integrated Solutions, comprising 45% of sales

- Industrial Solutions, comprising 20% of sales.

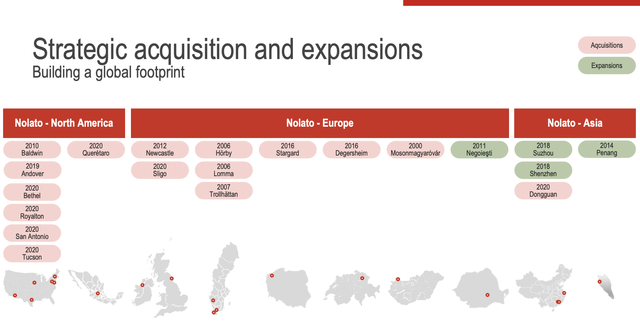

The company has gone through very significant changes in the last 20 years, that have seen it grow from barely $200M in revenues, to well over a billion where it is today.

I hesitate to name Nolato a commodity company, despite its business. The company is active in the manufacturing of polymer product systems, and while this may seem simple when looking at the products, this is a high-expertise business area, and Nolato brings decades of experience to the table. This is crucial because most customers’ demands and requirements are very different.

The company is also an active M&A’er and has been actively consolidating local and national markets as well as international ones for 10 years and more at this point.

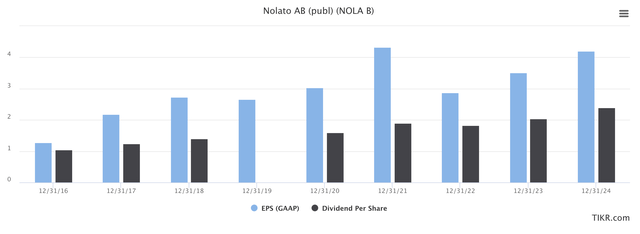

The company’s dividend history isn’t perfect. It’s very good, but it, unfortunately, cut the dividend entirely during COVID in 2020. Aside from that, it’s been in a near-constant growth trajectory since 2003, giving it an 18-19+ year dividend tradition excluding COVID, or 2 years including it. Nolato has a very large share of motivated private ownership split between 3 Swedish families. These families control around 30% of the shares, but over 63% of the voting power.

You will not make decisions for this company – the families Hamrin, Boström, and Jorlén will. The good news is that these families have been in charge for a very long time, and they’re very motivated to see this company succeed.

Large international owners include Vanguard, BlackRock, and other fund companies which own about 1-3% each. It’s not common to see these in a smaller Swedish business like this, which should show you something of what they see in Nolato.

The company was traditionally active in the end markets for mobile phones, industry, and the Medtech industry with a focus on smaller companies. Nolato had a market-leading position in Sweden and Scandinavia, with the EU/International market shares growing. The company has a solid reputation for quality and has established a strong presence in the US, Europe as well as Asia.

Its future target is to be a global end-to-end provider of sustainable solutions for all medical and industrial sectors, as well as integrated solutions with a focus on close, specialized partnerships.

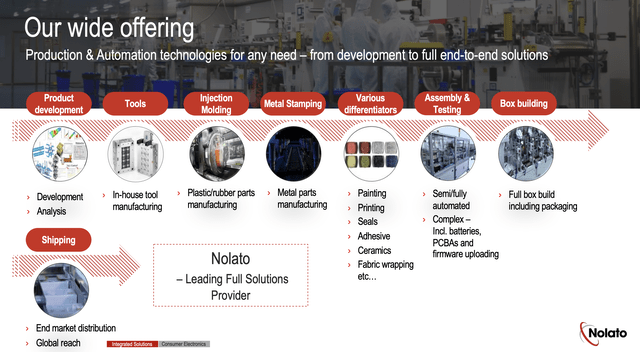

It would take too much space to go through every single thing or product made by the company – so here are some examples that Nolato can do and does in Medtech, based on technologies like injection molding, blow molding, dip molding, and extrusion.

- In-Vitro Diagnostic parts

- Cardiology parts/products

- Continence Care Products

- Endoscopy Products

- Drug Deliver products

- Pharma packaging products

The company has the ability to virtually design, test, and assemble products in their entirety to make sure that they work, with sub-segments like pharma products, diagnostics, and medical devices. Customers are but are not limited to Roche (OTCQX:RHHBY), Siemens (OTCPK:SIEGY), Abbott (ABT), Danaher (DHR), ThermoFisher (TMO), Baxter (BAX), Johnson & Johnson (JNJ), Coloplast (OTCPK:CLPBY), Medtronic (MDT), Pfizer (PFE), Sanofi (SNY), Novo Nordisk (NVO), GlaxoSmithKline (GSK) and Novartis (NVS).

So you see, despite being a small Swedish business with barely a billion bucks in sales, this company delivers high-tech solutions to some of the most significant pharma businesses on the globe.

And the trend is exactly the same in the other segments.

When thinking about Nolato, I want you to consider that has the ability to virtually and physically manufacture any sort of polymer part with a very high degree of technical expertise for any customer on the globe. In integrated solutions, here are some other examples of customers.

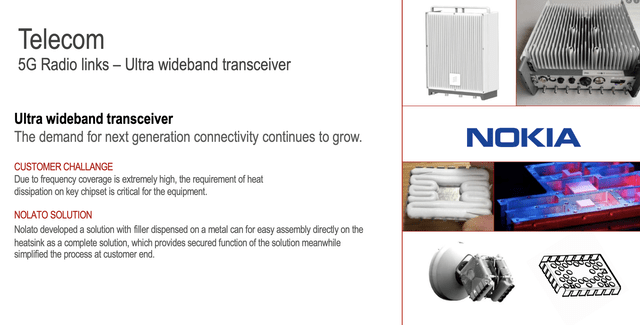

The company is even active in Telcos and 5G communications. Why? Because the company is building and developing cable glands with the ability to protect IP & EMC in the same gasket, as well as assist with 5G radio links.

This is the company building parts of the DC/DC converters for Porsche (OTCPK:POAHY) Taycan EV cars. It’s the company building ADAS parts for NIO (NIO), Aptiv (APTV), and other automotive companies. And the company even develops renewables.

This company has a very strong tradition of in-house sourcing, of developing their own products and solutions. This, in part, isolates them from some of the worst issues with the ongoing supply chain problems. The company’s handbook, which outlines the company’s business culture and principles, has been around for over 40 years. The company is very much “in the now”, based on a bio-based PE cycle and its recycling approach.

The Nolato group is, when all is said and done, an industrial. Despite COVID-19, most fiscal trends in the company have remained absolutely solid.

The area where we see problems is cash flow numbers and ROCE numbers – and problems there are never good. In this case, despite the company’s strategy, it’s not immune from macro. Also, the company has chosen the past years and 2021-2022 specifically, to invest significant amounts both internally and externally, numbers which are currently muddling results somewhat.

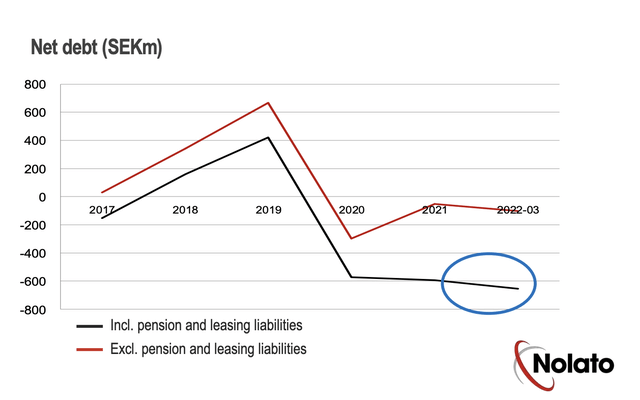

The organization is highly optimized – customers pay Nolato within 10-20 days since 2017, while Nolato pays suppliers usually within 90 days. Despite the recent crash, the company has outperformed the broader Swedish index significantly over time, and debt isn’t at a worrying level.

The company is currently within all of its financial targets. It does not have a credit rating, but it has 2.9BSEK in long-term available credit, with 1.6BSEK available, which is enough to fund both debt and business for a significant time.

Looking at the company’s share price, you might expect company results to have cratered in 2Q22. This is not entirely true – though there are indeed headwinds to consider.

Nolato saw significant sales increase as well as positive currency effects – but at the same time, the company’s EBITA and margins were down due to volume mix, inflation, input costs, and some production efficiency issues. The main culprit was industrial solutions and integrated solutions, which saw an EBITA margin of 5.5% during the quarter – while other margins stayed above 10%. Medical solutions in fact saw YoY sales and EBITA increase – the two other segments saw a mix of sales increase/decrease and EBITA as well as margin declines.

Geopolitics is the main impact on both industrial and integrated solutions. Supply Chain issues, 5G, input costs, and some other issues are hounding Nolato – while the medical solutions segments are doing very well, despite an ongoing pandemic impact. Also – Nolato had not-insignificant operations in Eastern Europe, which are causing some losses due to the situation. The issue is therefore not simply bottlenecks, but the straight loss of demand from certain markets.

The company is still managing to win contracts. It’s, for instance, the manufacturing partner that produces the British American Tobacco (BTI) “Glo” product. Following the initial launch of glo, Nolato experienced rapid growth in its Integrated Solutions segment – but this dropped off due to high inventories. Still, significant growth potential lies in the company’s future.

The high-level case to be made for Nolato is not dissimilar to other industrial companies – once these supply chain and geopolitical issues clear up, the company expects profit normalization. Nolato also isn’t 100% caught up on price increases due to the natures and structures of their contracts – so we’re able to see some growth or offset in the future here as well.

The main thing I want to show you about this company, apart from the basics, which we’ve just been through, is the valuation.

Because that’s where the kicker is.

Nolato – Company Valuation

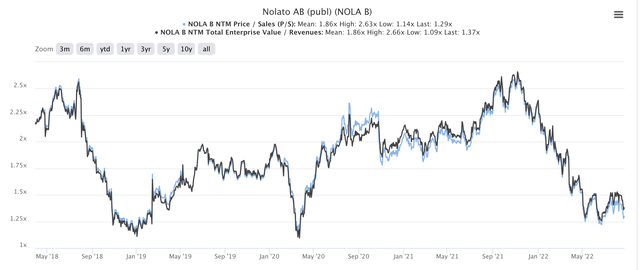

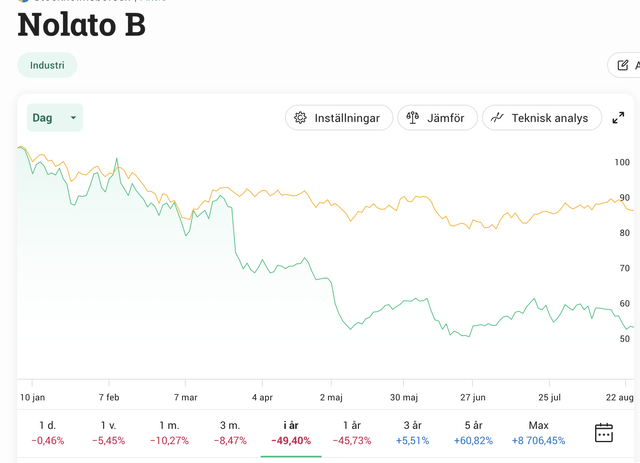

This is what has happened to the company’s valuation in less than a year.

The market would have you believe that because of these issues from geopolitical macro, supply chains, and inflation, Nolato is now worth around half what it was in early 2022. You might ask why, if I believe in this company (which I clearly do), I’ve not yet staked out a claim or stake in the business.

My answer would be that Nolato is usually at a very high premium given its technological expertise and the quality of its portfolio and contracts. Despite its size, this company works with the largest businesses on earth. It’s family-owned by the same family/ies that started the business, and it’s shareholder-aligned with a 50% profit payout.

There is plenty to like here.

However, that usually goes for a 20-30x P/E – which no matter how good the company is, I would never pay for a Swedish mid-sized industrial. There simply is no reason to do so, with plenty of quality on the market available at lower multiples.

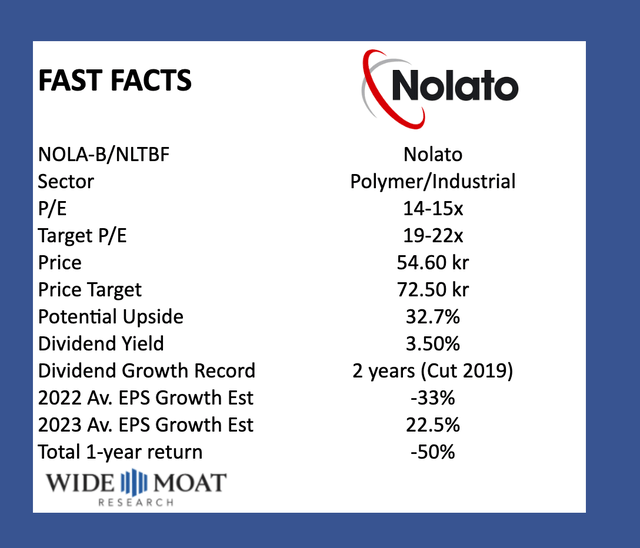

But the situation has changed – at 54 SEK per share, the company’s relative normalized P/E is no more than 14x.

That is an undervaluation not often seen for the company. Even compared to very conservative analyst targets – which currently come in at an average of 72 SEK/share, down from about 113 SEK average in late 2022, the company is still 32.5% undervalued, justifying why most analysts here are either at a “BUY” or “Outperform” (Source: S&P Global), though the company obviously doesn’t have that large a following to fall back on.

Based on conservative DCF, I forecast a modest growth rate of around 10-15%, compared to current expectations of 19-22% GAAP EPS growth in 2023-2024. Even on these conservative assumptions, using a WACC of around 8.5% doesn’t cause the target share price to go below 65 SEK/share. Even the most conservative assumption for Nolato, targeting that 65 SEK/share target (the lowball analyst must keep similar assumptions to mine), gives an upside from today’s share price.

Peers do exist, but they’re typically limited in scope. We have competitors that work in one specific segment, such as Neutroplast, which only works with pharma packaging. Other companies I’ve looked at to the degree that I can are Borouge (private), Wanhua, Tredegar, Gerresheimer (OTCPK:GRRMY), and others – but again, none of these actually share the company’s asset, product, or sales/business profile. S&P Global doesn’t consider peers to exist – not in terms that can be compared to at least. This makes the company somewhat difficult to measure to peers. I can say that the company is valued at around 1.35x to revenues, and around a 9.5x EBITDA multiple. None of that is outlandish – but perhaps a bit high for the market cap. As we’ve mentioned, P/E is around 14-15x depending on how you normalize it.

Expectations are for the full impacts to drive Nolato down this year, but for 2023E to get EPS back up to non-COVID-19 levels (2020A levels), followed by significant growth in the coming years. The dividend, which today yields around 3.5%, is also expected to remain stable.

Nolato EPS/dividend forecasts (TIKR.com/S&P Global)

I will also say that to any relevant multiple – like sales, revenue and earnings, the company is currently trading below any meaningful average. The company’s historical data would suggest a significant upside to be had at this price.

Nolato Valuation (TIKR.com/S&P Global)

The bottom line is, I don’t believe this company deserves the degree of short end of the stick that they’ve been getting this year, a realistic 20-25% EPS decline due to current trends does not justify a 50% drop in fundamental valuation, even if that drop was from heights I would consider overvalued to its overall market cap.

This company, despite some of its lacks, is an absolutely qualitative business with plenty of upside across most areas. While it will continue to have its ups and downs like any industrial, I believe there is a near-generational appeal to Nolato, which has proven over 80 years that it intends to remain with a sharp focus. This is similar to other Swedish companies where I’ve managed to eke out triple-digit profits by buying them at the right price.

I intend for a repeat here.

My official stance is to “BUY” Nolato – but I realize that this company is far from everyone’s cup of tea. There is an ADR, but it’s too thinly traded for me to consider it relevant. The way to invest in Nolato is native, which can be done through IBKR or similar brokers. There’s also dividend taxation and FX to consider – but I believe the realistic, long-term upside to be well beyond low triple digits.

Consider that this company, under the current leadership, and despite being down 50% in less than a year, has still generated returns of over 8,600% since its IPO. The comparative market cap is still incredibly small at under $2B, considering what the company does and the companies they do it with. It’s no longer a small Swedish niche player, but it’s expanding.

At this valuation, I’m very happy to be part of that growth story coupled with very attractive dividends (close to Siemens) in the capable hands of a 3-family structure guiding the company forward.

This is also the sort of company where due to its proximity I could in the future even do a more boots-on-the-ground sort of inquiry and article.

I set my price target at a 20x normalized P/E to begin with, which calls for a 72.5 SEK/share target, which is very close to the analyst average. It should be pointed out that no analyst following the company for S&P Global thinks the company is worth less than 65 SEK/share, and less than 9 months ago, the relative targets were a range of 100 SEK to 124 SEK, with an average of 113 SEK.

I “BUY” Nolato here.

Here are my targets for the company.

Be the first to comment