undefined undefined/iStock via Getty Images

The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.2 percent in March on a seasonally adjusted basis after rising 0.8 percent in February, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 8.5 percent before seasonal adjustment.

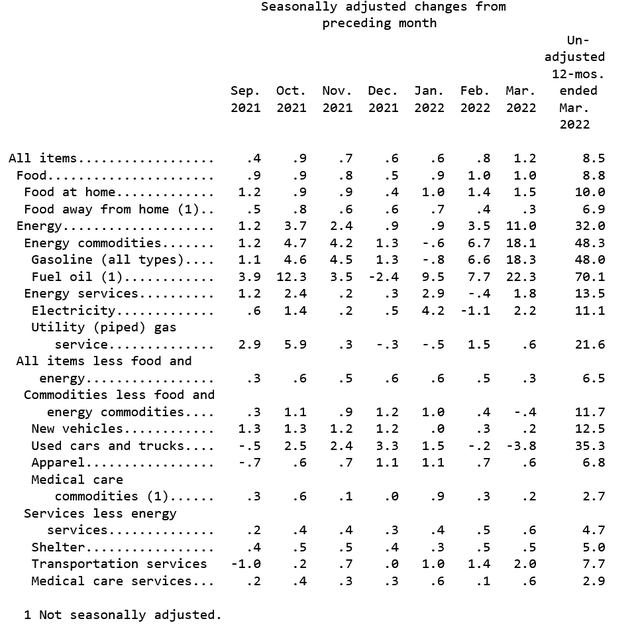

Here’s the table from the report:

CPI components (Bureau of Labor Statistics)

Notice the price pressures are now seeping into all non-energy sectors. Services less energy are up 4.7% Y/Y; shelter increased 5% Y/Y; commodities less food and energy advanced 11.7%. At this point, I think a 50 BP hike at the next meeting is in the cards.

Chicago Fed President Evans is on board with at least one 50 basis point hike this year:

Chicago Federal Reserve Bank President Charles Evans on Monday signaled he would not necessarily oppose getting interest rates up to a neutral setting of 2.25% to 2.5% by the end of the year, a pace that would require a couple of 50 basis-point rate hikes at upcoming Fed meetings.

“Fifty is obviously worthy of consideration; perhaps it’s highly likely even if you want to get to neutral by December,” Evans told the Detroit Economic Club.

But, he added, the Fed should not raise rates so fast that it doesn’t have enough time to assess inflation pressures and adjust policy in response.

The last point is especially important and one that isn’t discussed nearly enough when talking about rate hikes. Fed policy works with a lag of 6-12 months. The last rate hike won’t completely work its way through the economy until this time next year. That places the Fed in an extremely difficult situation regarding inflation. The Fed doesn’t want upward price pressures to run rampant. Neither does the bank want to slam on the brakes so hard that it sends the economy into a recession a la the early 1980s. It’s an incredibly challenging balancing act. As you hear presidents talk about 50 basis point hikes, also remember that the bank needs time to assess the policy impact of that hike, which takes time.

Federal Reserve Governor Lael Brainard said the U.S. central bank will move “expeditiously” to raise interest rates and return surging inflation to its 2% target.

“We are doing that by tightening monetary policy methodically, and it is through a series of interest rate increases as well as beginning that balance sheet runoff,” Brainard said Tuesday in a live-streamed interview at a Wall Street Journal jobs summit. She said a decision on the balance sheet “could be as soon as May, which would lead to reductions in that balance sheet starting in June.”

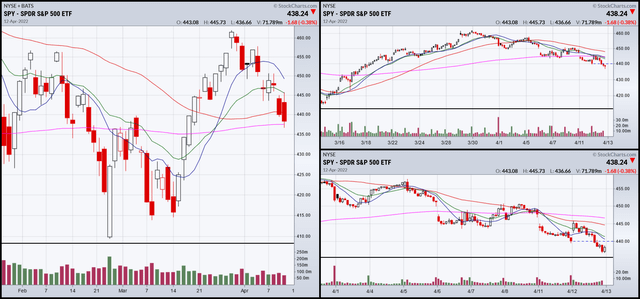

Let’s turn to the charts, looking for bottoming formations indicating the recent sell-off might be over.

SPY 3-month, 1-month, and 2-week (Stockcharts)

The SPY is still clearly heading lower. Prices are just above the 200-day EMA. There are no signs of a bottom on the 1-month (upper right) or 2-week charts.

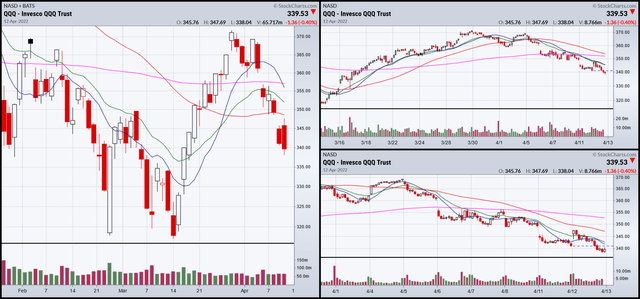

QQQ 3-Month, 1-month, and 2-week charts (Stockcharts)

There are no signs of a bottoming on the QQQ chart, either.

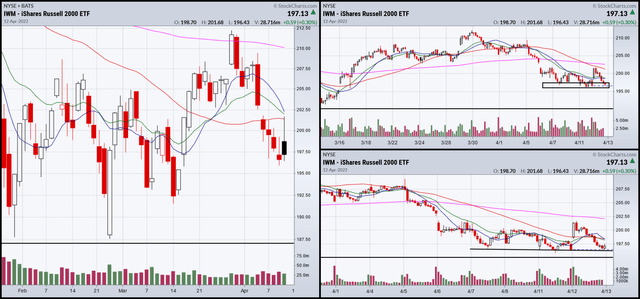

IWM, 3-month, 1-month, and 2-week charts (Stockcharts)

The IWM is finding some support near 196 but there is a clear bottoming formation.

Right now, there are no signs of a bottoming formation. Expect additional downside moves.

Be the first to comment