gguy44

(This article was co-produced with Hoya Capital Real Estate)

Introduction

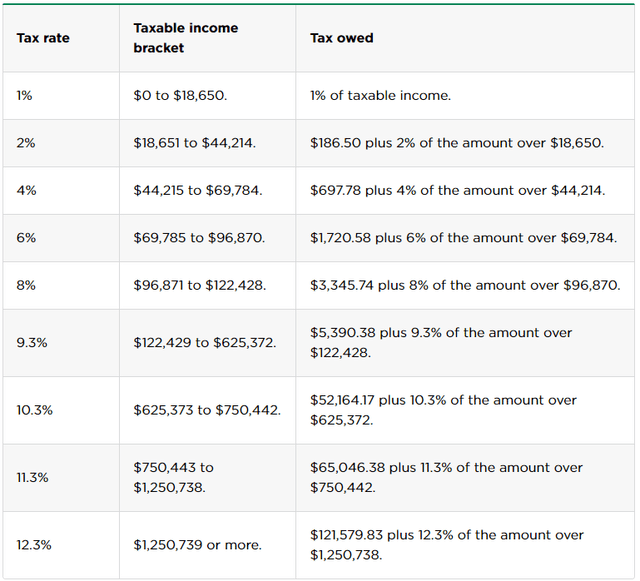

This is the second in a series focused on comparing two Closed-End-Funds that invest specifically for high earners in one state. This one reviews two CEFs that only invest in California tax-free bonds: the Nuveen California AMT-Free Quality Municipal Income Fund (NYSE:NKX) and the PIMCO California Municipal Income Fund (NYSE:PCQ). Along with full and part-time residents, people who received income from a California source (like professional athletes with CA road games) fall under the income tax laws of the state. The current tax tables for married-joint and widow(ers):

NerdWallet CA state tax rates

For singles and married filing separately returns, the income levels are cut in half. Regardless of filing status, an additional 1% tax applies to income exceeding $1 million. The revenues from this tax support mental health services. For filers in the top state and Federal brackets, income that escapes Federal and California income taxes equates to a possible taxable yield that is double what these CEFs yield. I just read that a fall ballot initiative called the Clean Cars and Clean Air Act would raise the top income-tax rate on earners making more than $2 million by 1.75 percentage points to 15.05%!

Nuveen California AMT-Free Quality Municipal Income Fund review

Seeking Alpha describes this CEF as:

The Fund will invest at least 80% of its Assets in municipal securities and other related investments the income from which is exempt from federal and California income taxes. The Fund will invest 100% of its Managed Assets in municipal securities and other related investments the income from which is exempt from the federal alternative minimum tax applicable to individuals at the time of purchase. The Fund generally invests in California municipal securities with intermediate or long-term maturities in order to maintain an average effective maturity of 15 to 30 years. The fund primarily invests in undervalued municipal securities and other related investments the income which are exempt from regular federal and California income taxes and are rated Baa, BBB or higher with an average maturity of 20.17 years. NKX started in 2002.

Source: seekingalpha.com NKX

NKX has $587m in assets and shows a Forward yield of 5.5%. Nuveen charges 155bps in fees; broken down as:

- Management fees: 89bps

- Other expenses: 14bps

- Leverage costs: 55bps: leverage is currently 41%.

NKX holdings review

Nuveen adds this information related to permissible assets:

The Fund may invest up to 20% of its managed assets in municipal securities rated below investment quality or judged by the manager to be of comparable quality, of which up to 10% of its managed assets may be rated below B-/B3 or of comparable quality. The Fund uses leverage.

Source: nuveen.com NKX

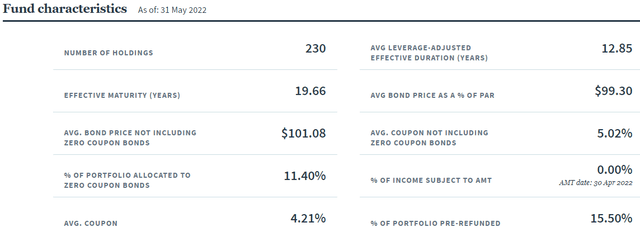

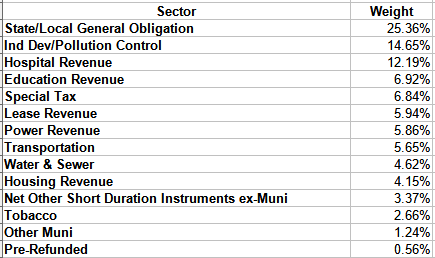

They also provide the following data on the portfolio:

Nuveen

As of the end of May, the average non-Zero-coupon bond was selling above Par and none of the income generated was subject to the AMT process. As like most Muni funds, the duration (12.85) and maturity (19.66) are on the long-side, which hurts NKX as rates go up.

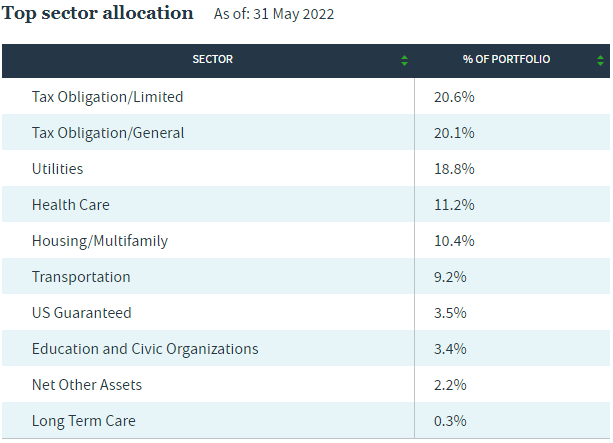

Nuveen

Taxing entities account for over 40% of the bond weight in the portfolio, with Utilities another 18%. With the recently announced huge state surplus, those state bonds should be safe. The next list shows the largest Issuers.

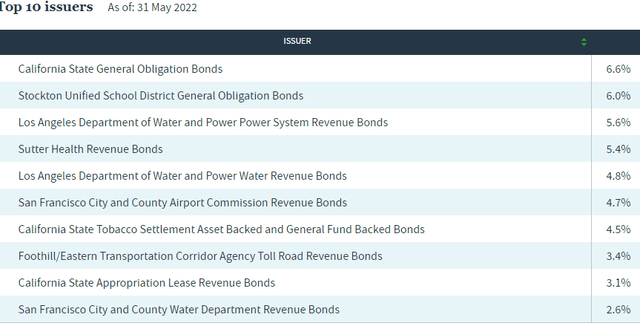

Nuveen

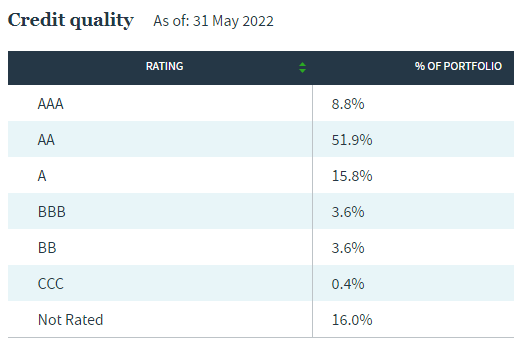

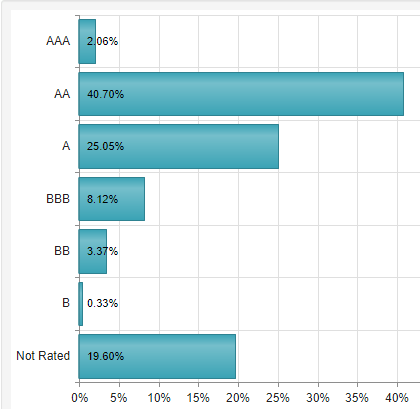

These Issuers account for 47% of the portfolio; California state obligations come to 9.7%, with Los Angeles utilities amounting to 10.4%. The Credit Quality of the portfolio is very good, with almost all of the rated bonds being of investment-grade.

Nuveen

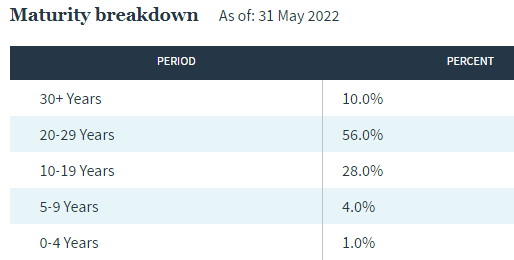

The most telling information from the next chart is how little of the portfolio matures over the next four years: 1%!

Nuveen

While over 40% of the portfolio can be called during that time, this becomes less likely when rates are climbing.

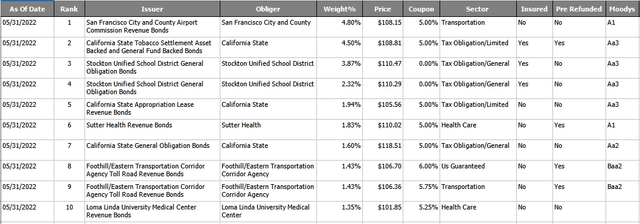

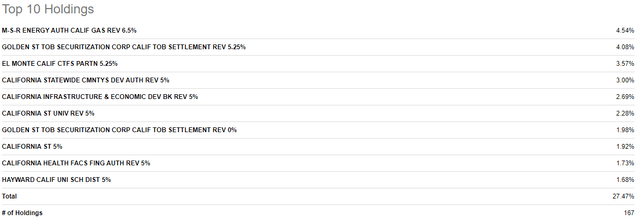

Top 10 holdings

Nuveen; compiled by Author

Even with 230 bonds, the Top 10 represent 25% of the portfolio weight. About 19% of the portfolio is Insured, some of which is also pre-funded.

NKX distribution review

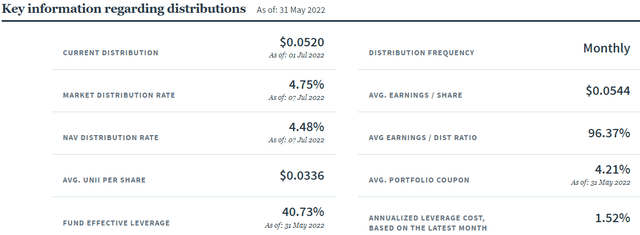

Nuveen provides data points related to NKX’s distribution too.

Nuveen

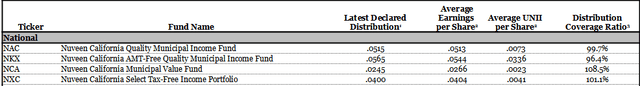

The next table compares the UNII data for all four Nuveen California CEFs; NKX is in the worst shape.

Nuveen UNII data

The above probably accounts for the last monthly payment being cut from $.565 to $.520. Each summer over the past few years has seen the payout changed.

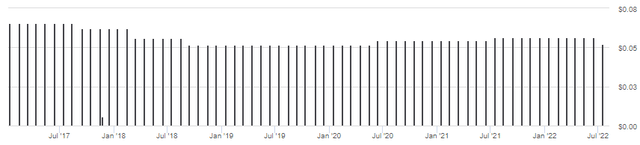

Seeking Alpha NKX DVDs

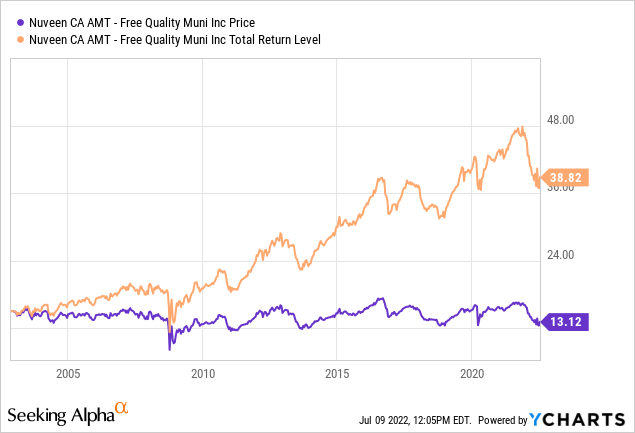

NKX price and NAV review

The price is down since inception and has mostly traded between $12-16 since that time. Investors who reinvested their payouts have a 4.95% ROI, others only 3.3%. The next chart shows how the price and NAV have moved.

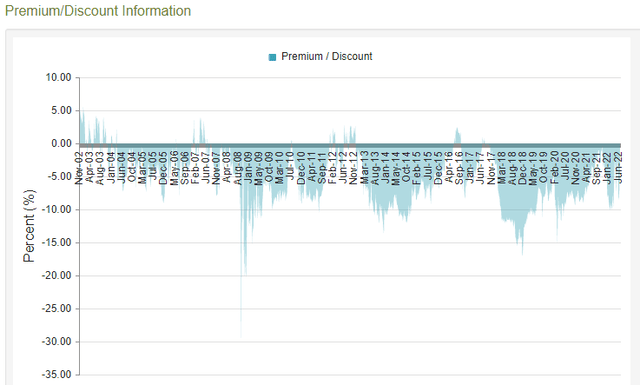

CEFConnect

NKX has seldom traded at a premium, a fact important for investors who play the discount-shrinkage strategy. The current 5.68% discount appears to me to be well within its normal fluctuation zone.

PIMCO California Municipal Income Fund review

Seeking Alpha describes this CEF as:

Primary investments (at least 90%) are municipal fixed-income securities, the interest from which is exempt from federal and California State income tax. At least 80% of the bonds are investment grade. The Fund will seek to avoid bonds generating interest potentially subjecting individuals to the alternative minimum tax. Up to 20% of the net assets may be invested in municipal bonds that are rated Ba/BB or B. PCQ started in 2001.

Source: seekingalpha.com PCQ

PCQ has $289m in assets and shows a Forward yield of 5.1%. PIMCO charges 141bps in fees; broken down as:

- Management fees: 71bps

- Other expenses: 49bps

- Leverage costs: 24bps: leverage is currently 49%

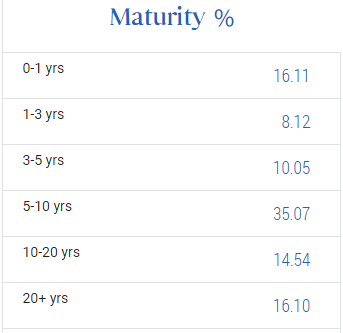

PCQ holdings review

Managers of PCQ use proprietary analytical models to test and evaluate the sensitivity of its holdings to changes in interest rates, something of importance currently. PIMCO has not posted new data since the end of the first quarter.

PIMCO; compiled by Author

PCQ has much lower allocation to tax obligations bonds (25%) and more to revenue dependent ones (appx 19%) than NKX. The maturity allocation results in a WAM of 10.09 years.

PIMCO

The duration is 12.4 years. About 40% is callable with the next five years. The Credit quality closely matches NKX’s.

CEFConnect

Seeking Alpha PCQ

The Top 10 bonds equal 27% of the portfolio weight, about the same as NKX even with less assets held. One odd thing for a single-state fund is the fact that 25% of the bonds are not California issued. It could be the others have reciprocal agreements to be state tax-free. NKX is 17% invested outside the state.

PCQ distribution review

I could not find any documentation that told what percent of the recent income was exempt from the AMT process; only that the limit is 20% of the assets owned.

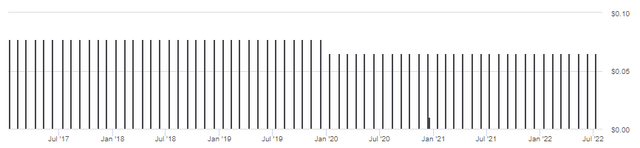

Seeking Alpha PCQ DVDs

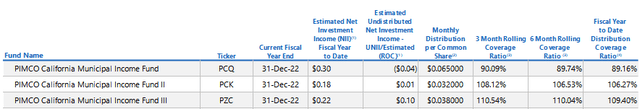

PCQ has paid at a monthly rate of $.065 since 2019. Prior to that, it paid $.077 monthly. Like Nuveen, PIMCO offers multiple California CEFs: UNII wise, PCQ is in the worst condition to maintain its current payout.

PIMCO

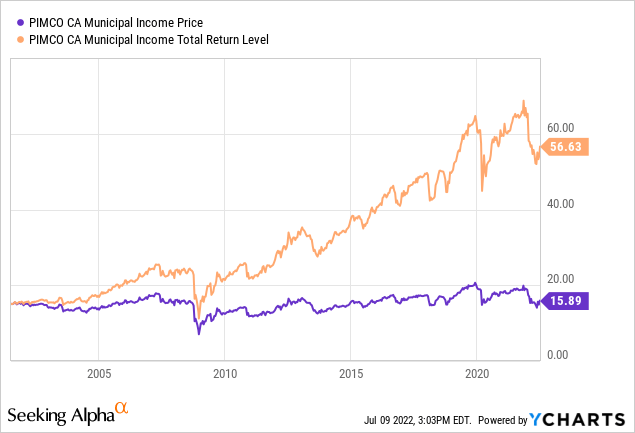

PCQ price and NAV review

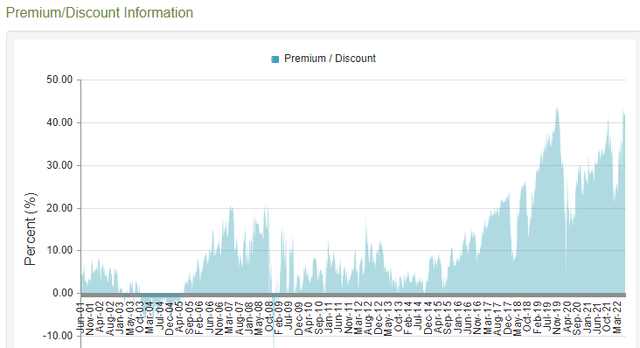

Unlike NKX, PCQ has a price above its initial one. Since inception, PCQ has a 6.4% return (reinvested) or 4.03% (payouts taken). Also, unlike NKX, PCQ seldom trades at a discount, hitting premium peaks over 40%. The current premium is over 42%.

CEFConnect

Fund comparison

| Factor | NKX | PCQ |

| Size | $587m | $289m |

| Asset count | 230 | 167 |

| Fees | 155bps | 141bps |

| Leverage | 41% | 49% |

| Premium/Discount | -5.7% | +42.1% |

| Yield | 5.5% | 5.1% |

| Average Coupon | 5.12% | 5.64% |

| Average Bond Price | $108.93 | $107.39 |

| Average Duration/Maturity | 12.9/19.7 | 12.4/10.1 |

For most investors, I suspect the premium/discount difference would be the deciding factor. Like many PIMCO funds, PCQ constantly trades at a premium, though 40+% is large even for PIMCO funds. That said, PCQ has provided the better return, which could be a function of the premium size.

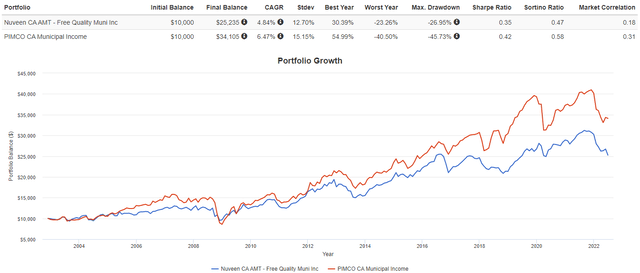

Portfolio Visualizer

Portfolio strategy

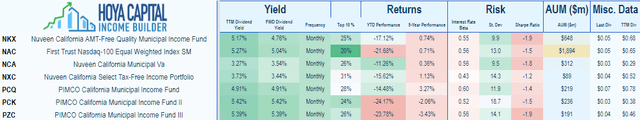

Despite having a $100b surplus, California is thinking of adding another tax bracket for those making over $2m. One option is packing your bags and moving out-of-state. Almost 700,000 chose that path in 2021! For those staying, avoiding state taxes is an option. Both managers have better funds based on UNII coverage and returns than those covered this time. Here is basic data on all the Nuveen and PIMCO California funds.

Hoya Capital Income Builder

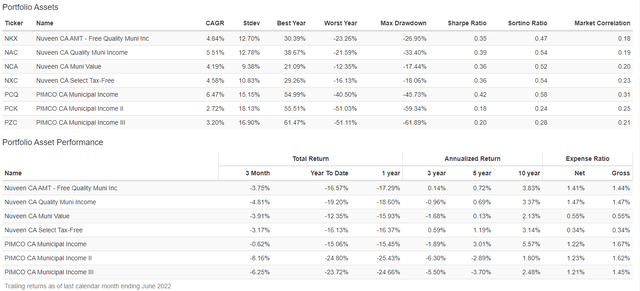

PortfolioVisualizer data provides more CAGR and risk data for these CEFs.

Portfolio Visualizer

This is where the preferences of each investor comes in as they review all the data. Based on most of the return data, NKX and PCQ are the best funds for each manager; but based on UNII data, the most likely to experience a payout reduction for each manager. The risk ratios favor PCQ over all the rest, but its 40% premium is a “no go” for some investors.

Another option to review

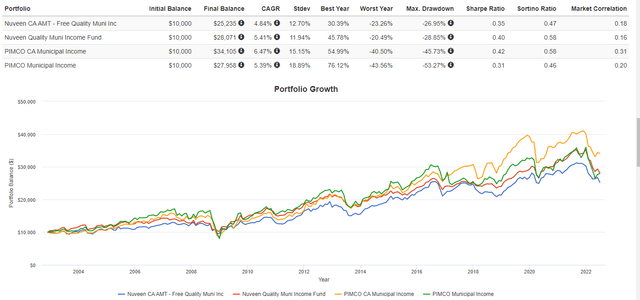

I wondered if California investors would do better using National, CA-focused funds. To that end, I picked a popular National Muni CEF from each manager and ran a comparison. The two CEFs are:

The results seem to say stay “home”.

Portfolio Visualizer

While the PIMCO CA-only fund has outperformed the PIMCO National fund, the opposite was true for the Nuveen set, but probably by too little after adjusting for the higher California taxes that would be owed.

Be the first to comment