Kevin Frayer/Getty Images News

Until recently, NIO Inc. (NYSE:NIO) has been the only stock of the Chinese-based firm in my portfolio. Unlike Alibaba Group Holding Limited (BABA), the automotive company hasn’t been as big as its tech counterpart to pose any threat to Beijing. That’s why when the Chinese-based tech companies faced a government crackdown that wiped billions of dollars in shareholder value in the last couple of years, NIO has been able to thrive and expand its position in the growing Chinese electric vehicle (“EV”) market without worrying too much about politics. However, it seems that that period is coming to an end.

The recent reelection of Xi Jinping for an unprecedented third term as the general secretary of the CCP during the 20th National Congress last week gives me reasons to believe that it’s no longer worth it to hold even stocks of Chinese-based firms that haven’t been affected by the latest crackdowns much. In addition to the economic policies, which hurt NIO’s financials earlier this year and are likely to continue to be implemented in the future, there’s also a risk that the business wouldn’t be able to overcome the upcoming political and geopolitical challenges simply due to the fact that they would be outside of its control. Therefore, even though NIO’s stock has significantly depreciated recently along with the stocks of other Chinese-based firms, I don’t think that the company trades at a bargain, and now could be a good time to double down and increase the portfolio’s exposure to it as there are reasons to believe that Xi Jinping’s China has become uninvestable.

Welcome To The New Reality

One of the upsides of owning NIO is the exposure to the growing Chinese EV market. As Beijing aims for China to become a carbon-neutral nation by 2060, one of the ways to achieve such a goal is to accelerate the production and deployment of electric vehicles, which don’t emit greenhouse gases in comparison to traditional ICE vehicles.

Even though NIO has certain disadvantages, such as the lack of its own manufacturing facility as it outsources the production to third parties, which is something that I’ve covered in my articles on the company in the past, the firm nevertheless managed to become one of the most popular EV brands in China. Until recently, NIO was on a path to even more aggressively expand its footprint in China and abroad, and that was one of my main reasons for purchasing its stock. However, there’s a risk now that the NIO’s growth wouldn’t be as aggressive as previously forecasted, which makes it important to reevaluate the position in the company.

There are several reasons to be cautious going forward. First of all, during the opening of the 20th National Congress on October 16, Xi Jinping gave a speech in which he praised China’s response to the Covid-19 pandemic and doubled down on the zero-Covid policy, which has negatively affected NIO’s financials and growth prospects earlier this year. Back in April, NIO’s deliveries were down almost in half Q/Q due to Covid-19-related lockdowns, while in May the rebound of the deliveries due to the reopening of China’s major cities was still below the initial delivery targets. Considering that Beijing’s policy in regards to lockdowns won’t change and there are already reports of new lockdowns taking place right now, there’s constantly a risk that the city in which NIO’s production partner JAC operates could be quarantined, once again creating a scenario under which NIO fails to meet its deliveries targets and disappoints its shareholders.

At the same time, despite unveiling various fiscal stimulus packages by Beijing, it seems that the Chinese economy is not growing as aggressively as expected, mostly due to the fact that Covid-19 lockdowns continue to negatively affect the growth rates. While in Q3, China claims that its GDP has increased by 3.9% Y/Y, there are signs that its economy nevertheless weakens as home prices have declined for the 13th consecutive month, retail sales slowed down, and the budget deficit already nears a record $1 trillion.

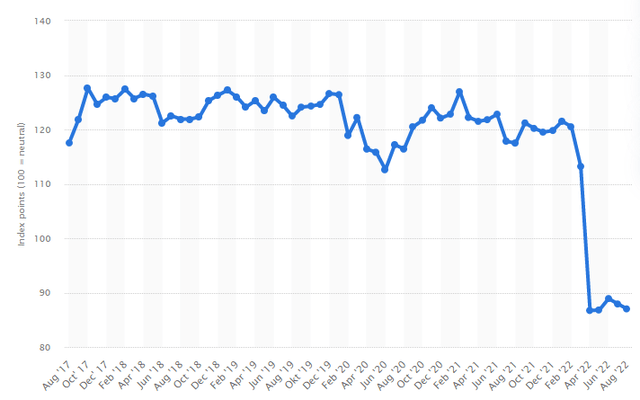

With slower retail sales and a falling housing market, questions are being raised about how long can China’s electric vehicle market continue to grow at an aggressive rate in the current environment. While the latest data shows that the penetration of electric vehicles in China increases at an impressive rate, companies like Tesla (TSLA) already began to drop prices there. Elon Musk even believes that China is in a recession of sorts, and as a result, his company likely wouldn’t be able to meet deliveries target this year. Elon could be right in the end, considering that China’s consumer confidence index is currently at its historical lows and, as a result, there’s a risk that, in the following months, other automakers would also face additional economic challenges. This could also negatively affect NIO’s ability to meet its own annual deliveries target.

China’s Consumer Confidence Index (Statista)

What’s Next For NIO?

One of the biggest red flags from the latest National Congress is the fact that in addition to the reelection of Xi Jinping for an unprecedented third term, the reshuffling of the Politburo Standing Committee from which pro-market reformists were sacked and replaced with party loyalists also gives more reasons for concern. I have already noted in my latest article on Alibaba that Xi Jinping’s constant reiteration of Marxism along with the desire to achieve common prosperity, which includes the redistribution of wealth and already is about to cost Alibaba ~22% of its liquidity, signals that the political interests will prevail over the economic reasoning going forward.

As a result of this, it’s safe to assume that the cost of exposing your portfolio to the Chinese EV market via a long position in NIO now is significantly greater than before due to the political aspect. Considering that the risks of state intervention are high, it won’t surprise me that somewhere down the road Beijing starts to strengthen its grip over the automotive industry the same way that it did over the tech industry via various economic and political means.

On top of the internal challenges that NIO is facing, there are also geopolitical risks, which for some might outweigh all the potential growth opportunities that the company offers. First of all, even though Beijing decided to allow the U.S. inspectors to audit the books of the Chinese-based firms, there’s still no guarantee that the inspection would be successful. There’s always a possibility that the Chinese side wouldn’t honor their part of the deal, since they had already done so in the past when they decided not to cooperate after signing a Memorandum of Understanding back in 2013.

Secondly, even if the latest audit would be successful, NIO would continue to offer its shares on the public exchanges only in the form of a variable interest entity (VIE), which gives investors no voting rights and no share in the Chinese-based company itself, as ownership is granted only to the shell subsidiary on the Cayman Islands. At the same time, it gives the Chinese regulators the ability at their own discretion to prohibit their companies from using the VIE structure in case of a further confrontation with the West, as VIEs themselves are neither recognized nor denied by the Chinese regulators.

Thirdly, while NIO primarily operates in China, its business is dependent on the imports of American-designed chips that are used in its AI projects. NIO has been actively using Nvidia’s (NVDA) A100 chips to build data centers that power the software that’s used in its vehicles. After the Biden administration’s decision to ban the export of A100 chips to China, there’s a possibility that NIO wouldn’t be able to fully realize its AI ambitions and fully automate its fleet of vehicles, which in the end could make its car offering less attractive to consumers.

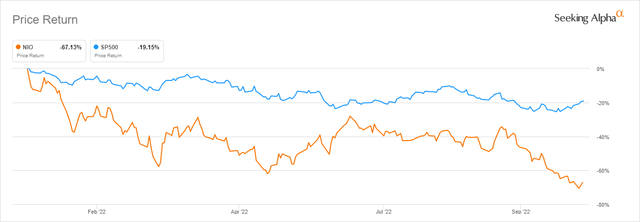

Last but not least, the current sentiment regarding the stocks of Chinese-based companies is extremely bearish. After the end of the National Congress on Sunday, the stocks of the Chinese-based firms continued to depreciate and trade significantly lower in comparison to the rest of the market, as could be seen in the chart below where a YTD performance of NIO’s shares are compared with the YTD performance of the S&P 500 index.

NIO’s Price Return Against S&P 500 (Seeking Alpha)

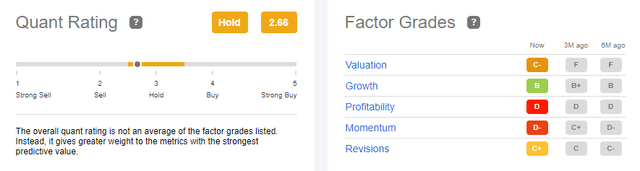

With all of that in mind, it becomes obvious that NIO is now facing multiple internal and external challenges that it’s unlikely to overcome due to them being outside of its control. As a result, Seeking Alpha’s Quant rating system gives the company’s stock a HOLD rating but leans close to sell since the business is losing its momentum while at the same time losses are mounting.

NIO’s Quant Rating (Seeking Alpha)

The Bottom Line

The latest developments in China suggest that no stock of any Chinese-based firm is safe from the political, economic, and geopolitical challenges that the whole country is facing or is about to face. Even though NIO offers decent exposure for the Chinese EV market for investors, I believe that as the risks of confrontation between China and the collective West are rising with each year, while the zero-Covid policy would likely continue to wreak havoc on the Chinese economy, the downsides of owning Chinese-based companies outweigh all potential growth opportunities. Therefore, I recently closed my long position in NIO and have no plans to expose the portfolio to any other stock of a Chinese firm in the foreseeable future.

Be the first to comment